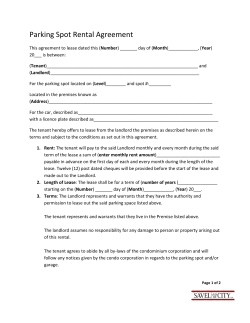

9 Landlord and Tenant