Morning Notes seall14 21gpgppivg

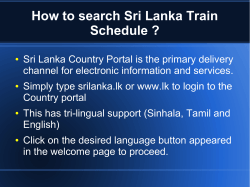

seall14 21gpgppivg Morning Notes 10 November 2014 Market Diary ASI Outlook (based on charts) Today: Anilana Hotels & Properties - Right Issue – Provision of Allotment Richard Pieris Exports - XD Date (LKR 6.40 per share) Tomorrow: Namunukula Plantations - XD Date (LKR 2.00 per share) Anilana Hotels & Properties - Right Issue – XR Date Renuka Holdings – voting & non-voting - Right Issue – Provision of Allotment Corporate Announcements Interim Financial Statements 30-09-2014 - Amana Bank (ABL), C T Land Development (CTLD), Lanka Tiles (TILE), Lanka Walltiles LWL), Swisstek (Ceylon) (PARQ) & Horana Plantations (HOPL). Comments (short term trend): ASI is trading near a moderate resistance level. Several other technical indicators suggest a possible consolidation in the near term. Cautions approach is advised. Royal Ceramics Lanka – Interim Dividend of LKR 1.00 per share: XD – 18th Nov 2014 Payment date – 21st Nov 2014 ASI - Pivot Points Previous day’s close Pivot Point R1 R2 Lanka Tile – Interim Dividend of LKR 2.00 per share: XD – 18th Nov 2014 Payment date – 25th Nov 2014 ASI - Moving Averages 07 day 14 day 21 day Lanka Walltiles – Interim Dividend of LKR 2.00 per share: XD – 18th Nov 2014 Payment date – 27th Nov 2014 Vallibel Power Erathna – Dr.T.Senthilverl has increased his stake to 14.4%: Dr.T.Senthilverl has purchased approx. 106mn shares on 04 th November 2014. Subsequent to the above transaction, the total no. of shares held by Dr.T.Senthilverl in VPEL has increased to approx. 108mn shares constituting 14.432% of the shares in issue. 50 day 100 day 200 day 7,210.99 6,940.26 6,530.03 100% allotment A minimum 20,000 debentures plus 20.133% of the balance Orient Garments – Winding up court case: The winding up case (HC/CIVIL/34/2014/CO) came up for hearing on 31st October 2014, and was extended until 11th November 2014. BRAC Lanka Finance – Mandatory offer made by Commercial Leasing & Finance: The mandatory offer made by Commercial Leasing & Finance was expired on 05 th November 2014. Total no. of shares for which acceptances of the offer have been received – 37,033,733 ordinary shares of NIFL (35.02% of issued shares of NIFL) Total no. of shares held by Commercial Leasing & Finance before the offer period – 62,745,908 ordinary shares of NIFL (59.33% of issued shares of NIFL) Royal Ceramic Lanka – Proposed investment in Australia: Rocell Pty Ltd has been incorporated under the laws of Australia, as a fully owned subsidiary of RCL, to engage in the wholesale and retail business of floor and walltiles and bath ware, in Australia. The proposed initial investment in the said subsidiary is AUD 525,000 (equivalent to LKR 61.5mn). Quantity S&P 500 (USA) FTSE 100 (UK) NIKKEI 225 (Japan) Shanghai Comp (China) BSE Sensex (India) KSE All (Pakistan) MSCI frontier markets MSCI emerging markets Index 2,031.92 6,567.24 16,756.36 2,441.20 27,868.63 30,930.04 646.04 991.32 Change +0.71 +16.09 -124.02 +23.03 -47.25 +266.26 -10.15 -7.12 % Change +0.03 +0.25 -0.73 +0.95 -0.17 +0.87 -1.55 -0.71 Global Business News Mercantile Investments & Finance – Debenture issue – Basis of Allotment: No. of debentures applied Basis of allotment Dealings by Directors Company Purchase Citizen Development 30 Business Finance Dipped Products Sale 7,383.25 7,350.35 Global Equity Indices Ceylon Tobacco Company – Third Interim Dividend of LKR 11.10 per share: XD – 18th Nov 2014 Payment date – 26th Nov 2014 Dividends declared during the FY14 – LKR 35.10 Dividends declared during the FY13 – LKR 48.75 Above 20,000 debentures 7,333.68 7,271.15 7,277.84 S1 S2 Short-term Technical Indicators RSI 67 MACD The MACD line has crossed the signal line from below. Printcare – Interim Dividend of LKR 0.45 per share: XD – 18th Nov 2014 Payment date – 26th Nov 2014 Up to 20,000 debentures 7,416.15 7,399.70 7,432.60 7,449.05 Director Date Price (LKR) K.M.Weerasuriya 03 Nov 8,500 94.30 S.P.Peiris 05 Nov 4,800 140.00 Gold Declines After Biggest Gain Since June as SPDR Assets Fall: Gold fell from the highest level in a week on expectations that U.S. borrowing costs will increase, and as assets in the largest exchange-traded product backed by the metal extended declines. Silver and platinum dropped. Gold for immediate delivery lost as much as 0.7 percent to $1,170.09 an ounce, and was at $1,170.91 at 8:01 a.m. in Singapore, according to Bloomberg generic pricing. On Nov. 7, the metal surged to $1,178.82, rallying from a more than four-year low of $1,132.16, after U.S. jobs data trailed estimates, weakening the dollar. (Bloomberg) Brent Gains as China Exports Rise More Than Estimated; WTI Holds: Brent crude rose for the third time in four days as Chinese export data signaled that foreign demand may help sustain the economy in the world’s second-biggest oil consumer. WTI was steady in New York. Futures gained as much as 0.6 percent in London. Overseas shipments increased 11.6 percent from a year earlier, according to Chinese customs data on Nov. 8, exceeding the 10.6 percent median estimate in a Bloomberg News survey. The number of rigs drilling for oil in the U.S. last week shrank to the lowest since August, Baker Hughes Inc. said Nov. 7. (Bloomberg) Libya’s Biggest Oil Field to Resume Pumping by Tomorrow: Libya, holder of Africa’s largest oil reserves, plans to restart production by tomorrow at its biggest field at Sharara while an export terminal in the country’s east remains closed. The Sharara and Elephant fields in southwestern Libya will resume output after gunmen returned equipment they had stolen from the sites, staterun National Oil Corp. spokesman Mohamed Elharari said by telephone from Tripoli. Crude shipments from the Hariga terminal remain halted, said Ihab Said, an inspector at the facility. (Bloomberg) Morning Notes Local Business News Exports lose steam in Sept. as imports take off: As the growth of imports weighed on the export earnings, the country’s trade deficit in September widened to $ 764 million compared to $ 587 million in September 2013. However, on a cumulative basis, the trade deficit during the first nine months of 2014 narrowed by 3.6% compared to the corresponding period in 2013. The Central Bank said earnings from exports increased by 0.5%, year-on-year, in September 2014 to $ 903 million while the cumulative earnings increased by 13.0% to $ 8,288 million during the first nine months of 2014. The largest contribution to the export growth in September 2014 was from textiles and garments followed by coconut and printing industry products. Export earnings of textiles and garments grew by 4.4% in September 2014 supported by a substantial improvement in exports of outerwear. Expenditure on imports increased by 12.2%, year-on-year, to $ 1,667 million in September 2014, while on a cumulative basis, imports grew by 5.4% to $ 14,222 million during the first nine months of 2014. The increase in import expenditure in September 2014 was mainly due to the significant increase in imports of transport equipment, particularly a dredger vessel followed by imports of vehicles such as motorcycles and motorcars for personal use. (DFT) Tourist arrivals up by 13.6%: Sri Lanka’s tourist arrivals had shown an increase of 13.6% to 121,576 in October 2014 with tourist arrivals being boosted from countries such as India, China and the United Kingdom. For the past nine months of this year, arrivals were up by 21.5% to 1,228,754 when compared to the same time period last year. South Asian tourists were down 10.7% to 35,718 when compared to the same month last year with arrivals from India, Sri Lanka’s top market, up 19.8% to 26,148. Maldivian tourists were down 0.04% to 6,460 and Pakistan was down 33% to 1,725. Arrivals from the United Kingdom, the second biggest market for Sri Lanka was up 2.7% to 10,112 when compared to the same month last year. (DN) CBSL's reserves dip due to commitments: With Central Bank of Sri Lanka (CBSL) continuing to exercise moral suasion (MS) on the 'spot' on importer (buyer) banks for the fourth consecutive week according to records maintained by Ceylon FT, trading continued to revolve round 'spot next' and 'spot next next,' at Friday's trading, market sources told Ceylon FT. MS was maintained on the 'spot' at Rs 130.85 to the US dollar in interbank trading, with 'spot next' and 'spot next next' therefore being traded at Rs 131 and Rs 131.05 to the dollar respectively, however, on thin volumes. 'Spot' trades are settled two market days after the date of transaction, 'spot next' after three and 'spot next next' after four. "Import demand is building, but there is no visible trading on forwards," they further said. In the unfolding developments, statistics further showed that a minimum of US$ 132.31 million exited from CBSL's foreign exchange (FX) reserves, either to sell certain selected banks, dollars at the discounted price of Rs 130.85 to the dollar from its reserves, or to meet Government of Sri Lanka's (GoSL's) foreign debt servicing commitments, or due to a mix of both. (CFT) Commercial banks seek CB relief on 12 per cent interest move: The Sri Lanka Banks’ Association is urging the Central Bank (CB) and the Treasury to extend a scheme applicable to state banks to cover losses in paying high interest rates to senior citizens, to all banks. The association has made the request in writing to the CB. In the 2015 budget, state banks have been instructed to offer a 12 per cent annual interest rate for deposits of pensioners and elders. To cover any deficit between lending and borrowing rates, the Treasury is to float a $30 billion bond issue at 12 per cent interest in which state banks can invest. (ST) Sri Lanka to harness benefits from AIIB, moving away from WB, ADB : Sri Lanka is drawing up ambitious development project plans to harness maximum benefits from the newly launched Asian Infrastructure Investment Bank (AIIB), moving away from its dependence on the World Bank (WB), International Monetary Fund (IMF) and the Asian Development Bank(ADB), government officials said. Deputy Secretary to the Treasury, Dr. B.M.S Batagoda told the Business Times that the new lender would fund the construction of roads, power plants and telecommunications networks in the country at concessionary terms and conditions without attaching strings which will keep the country’s economy buzzing. (ST) Good time to mull consolidating the insurance sector, CB Governor says: With Sri Lanka’s Non Bank Financial Institutions (NBFI) sector consolidation nearing completion, the time has come to consider a similar move in the insurance sector, Nivard Cabraal, Governor Central Bank (CB) says. “Now that we have a good body of knowledge built with the experience in consolidating the NBFI sector, it’s a good time to consider consolidation in the insurance sector,” he told the Business Times in a recent interview. He said mandating the splitting of composite insurance companies separately to that of general insurance and life insurance firms by next year makes a strong case for this move. (ST) Restricted land ownership laws for foreigners impact on all SL businesses, says JKH chief: The Land (Restrictions on Alienation) Act recently passed by Parliament poses several challenges to Sri Lanka’s business community, John Keells Holdings (JKH) Chairman Susantha Ratnayake has said. Commenting in the latest report on the group results for the second quarter of 2014-15, he said, “impact to the Group, if any will be assessed once the specifics in the Act are interpreted and understood”. (ST) Britannia explores Sri Lankan re-entry: Britannia Industries Ltd, an Indian food-products corporation based in Kolkata is aiming to return to the Sri Lankan market, officials said. “We had a presence in Sri Lanka some years ago and now we are planning a re-entry. The fundamentals of the economy are great. That’s what attracts us,” Manjunath Desai, company Vice President Strategy and Business Development told the Business Times in a telephone interview from India. (ST) 10 November 2014 Global Business News China to establish $ 40 b Silk Road infrastructure fund: China will contribute $ 40 billion to set up a Silk Road infrastructure fund to boost connectivity across Asia, President Xi Jinping announced on Saturday, the latest Chinese project to spread the largesse of its own economic growth. China has dangled financial and trade incentives before, mostly to Central Asia but also to countries in South Asia, backing efforts to resurrect the old Silk Road trading route that once carried treasures between China and the Mediterranean. The fund will be for investing in infrastructure, resources and industrial and financial cooperation, among other projects, Xi said, according to Xinhua. (DFT) Russia, China Add to $400 Billion Gas Deal With Accord: Russia and China signed a second initial natural-gas supply agreement, following a $400 billion deal earlier this year, as President Vladimir Putin broadens links with the world’s secondbiggest economy. OAO Gazprom is discussing the supply of as much as 30 billion cubic meters of gas annually from West Siberia over 30 years, the company said yesterday. Russia may start selling gas to China within four to six years as part of an agreement with state-owned China National Petroleum Corp., Gazprom Chief Executive Officer Alexey Miller told reporters in Beijing. (Bloomberg) Morning Notes Local Business News Pelwatte Dairy to commission Rs 700m milk powder plant: The second Rs. 700 million state-of-the-art milk powder manufacturing facility at Pelawatte will be commissioned by the end of this year, said Pelwatte Dairy, Chairman Ariyaseela Wickramanayake. He said that the foundation for the ultra-modern facility was laid last week and work on the plant will be launched this month. "We hope to produce an additional 3,500 tonnes per annum and save the huge drain of foreign exchange on imports of dairy products. We completed the preliminary work of the project within a short time due to the procurement of machinery early this year from Europe," Wickramanayake said. Sri Lanka spends around US $ 15 million per annum on the import of milk powder. The present facility produces around 3,500 tonnes. (SO) Coconut industry targets Rs 100b by 2015: The coconut industry is turning out to be one of the main modes of income for the country and US$ 1 billion is targeted from coconut product exports by 2020. The Rs. 100 billion target can be achieved by next year, Coconut Development Authority Chairman Aruna Gunawardane told the Sunday Observer. Sri Lanka also plans to capture markets in Europe, Russia, the USA, Australia, the Chairman said. “Minister Jagath Pushpakumara launched a program in 2011 to plant 32 million coconut trees. Already 19 million plants have been cultivated. We hope to reap the benefits of the program between 2016-2018 and coconut production will increase from 600 to 700 million nuts,” Gunawardane said.“Before a separate Ministry was set up, Rs. 20 billion was earned from the coconut industry. Following the setting up of a separate Ministry it increased to Rs. 30 billion in 2011. (SO) Fonterra to build chilling centre in Gampaha: A chilling centre will be built by Fonterra Brands Sri Lanka in Gampaha as part of its commitment to develop the local dairy industry. The chilling centre will enable Fonterra to begin milk collection and support 200 local milk farmers, Fonterra Brands Sri Lanka, Managing Director Leon Clement said. “We are focused on improving the local dairy industry. We see Sri Lanka as a profitable market. We hope to improve milk quality, increase collection and accessibility in Gampaha,” he said. It is necessary to introduce modern technology to the dairy industry while farmer education and model farms could also support the growth of the industry. The chilling centre will also help bring expertise on sustainability to the area. (SO) Off-budget funding escalates: Off-budget funding of State-owned enterprises continues to expand at a rapid pace, new data showed.The Treasury has issued off-budget guarantees amounting to Rs 503.7 billion as at end September 2014, the Fiscal Management Report 2015 of the Ministry of Finance and Planning showed. Such guarantees amounted to Rs 492 billion as at end May 2014, up sharply from Rs 302.7 billion a year earlier. Issuing such off-budget guarantees helps the government spend without troubling the budget deficit or debt to GDP ratios. The International Monetary Fund (IMF) has already cautioned the government on overly relying on such as guarantees as it understates the overall budget deficit. It has also cautioned against the practice as it could impact financial sector stability. (CFT) Singer appointed distributor for Sony products: To strengthen and expand sales, marketing and distribution of the Sony brand of consumer electronics products including mobile phones in Sri Lanka, Sony has appointed Singer Sri Lanka PLC as the authorised distributor of the Japanese consumer electronics brand in Sri Lanka. With this appointment, Singer, with the present distributor Siedles (Pvt) Ltd, will handle product distribution, sales and marketing activities of the Sony range of consumer electronic products such as Bravia televisions, Cyber-shot and a range of digital cameras and Walkman audio products. Besides this range of products, Singer will also continue their status as distributor for the Xperia range of mobile phones and tablet devices. “The decision to appoint Singer Sri Lanka PLC was an easy one to make,” said General Manager, Sony Electronics Singapore, Masaki Matsumae. (SO) Bill passed to merge three banks: Further progress was made last month by banks and finance and leasing companies (NBFIs) on the financial sector consolidation process. The Bill to facilitate the proposed merger of three banks, viz., DFCC Bank, National Development Bank PLC and the DFCC Vardhana Bank PLC, was passed in Parliament. The joint internal committees worked closely to ensure that the integration of operations was smooth to form a strong bank with a focus on development, as envisaged in Budget 2014. The proposed amalgamation of the Merchant Bank of Sri Lanka PLC, MCSL Financial Services Ltd and MBSL Savings Bank Ltd has reached the final stage of completion. (SO) SL targets becoming a US$ 10B rubber industry: Considering the significant value addition as well as the vast potential for future investment; rubber industry in Sri Lanka can be a US$ 10 billion business, an industry expert said.The rubber industry in Sri Lanka has the potential to grow bigger than the garment industry. Unfortunately, foreign investors have not seen the possibility of this factor. Thus, the country needs to attract large foreign manufacturers to invest in the tyre trade, as well as to look at other businesses which are parallel to solid tyre business, Global Rubber Industries (Pvt) Ltd Managing Director, Prabhash Subasinghe said. (CFT) Govt’s vision is to enhance ICT literacy to 75%: The vision and key objective of the government is to enhance the ICT literacy rate to 75% by the year 2016 through the meaningful development of this vital segment in Sri Lanka, says Telecommunications and Information Technology Minister, Ranjith Siyambalapitiya. “IT-related exhibitions of the caliber of INFOTEL has played a pivotal role in widening the horizon of knowledge in the industry and giving an impetus to our sustained effort to achieve the goal of a significantly high ICT literacy ratio in the country”, the Minister noted. (DN) 10 November 2014 Morning Notes 10 November 2014 Local Business News Fairway project to open in Galle: Fairway Holdings launches Fairway Galle, its latest vertical living development project in the heritage city of Galle. Fairway Holdings, a leader in the field of luxury high-rise development, having introduced many 'firsts' in luxury vertical living solutions, has embarked on its latest venture - Fairway Galle. Set in the historic city of Galle, boasting of a heritage spanning over three centuries, Fairway Galle is located on the exit road to Galle from the Southern Expressway in close proximity to the city itself and a myriad of significant historical attractions as well as a wide array of other recreational activities. (DN) President hailed for proposals relating to gem industry: The President’s proposals relating to the gem industry during the 2015 budget speech have been welcomed by local businessmen and foreign investors alike, with the initiatives seen as potentially adding a new dimension to the industry. “Proposed reduction in service fee imposed by the Gem and Jewellery Authority to 0.25% of FOB value, the proposed establishment of a gem and jewellery processing zone and gem trading centre in Ratnapura to further the Magampura Ruhuna Development Plan and increased focus and support of the Government to the gem industry would have far reaching benefits to the industry and country,” said Ratnapura Lanka Gemstones Private Limited (“RLGPL”), a subsidiary of Gemfields plc (LSE: AIM. GEM), a global leader in the coloured gemstone industry with a proven track-record of lifting growth and transparency in the gemstone sectors of several countries. (DN) Softlogic launches Dell Latitude 12 and 14 Rugged Extreme notebooks: Softlogic Information Technologies, one of the premier ICT companies in Sri Lanka and a pioneering subsidiary of Softlogic Holdings, launched the new Latitude 14 Rugged Extreme notebook and the Latitude 12 Rugged Extreme convertible notebooks for customers who require powerful solutions that will survive tough environments. Dell recently introduced a family of ruggedized laptop solutions from the most durable military grade options to flexible business ready-solutions designed to resist spills and drops and to handle almost any situation. The new introduction is the perfect answer by Dell for mission critical tasks in challenging conditions. (DFT) Trillium Property Management to invest Rs 1 b on two projects: Trillium Property Management and Services is planning to invest over Rs. 1 billion to launch two mixed development properties in Colombo 7 and Nugegoda. Trillium Colombo 7, a super luxury apartment complex under the Trillium brand, will be developed in a very prestigious location in Torrington Avenue Colombo 7. The complex will consist of 18 stylish super luxury 3bedroom apartments ranging from 1500 sq ft to 1800 sq ft and two 3000 sq ft penthouses with an infinity swimming pool and a state-of-the-art gymnasium on the rooftop, the developers said. Signature features of popular Trillium Brand will be incorporated into this up-market project. The Trillium Melder Place Luxury Villas Nugegoda project will consist of eight exclusive single villa houses with modern luxury. (DFT) The information contained in this report, researched and compiled for purposes of information do not purport to be complete description of the subject matter referred to herein. In preparing this report care has been exercised to collect information from sources which we believe to be reliable although we do not guarantee the accuracy and completeness thereof. Lanka Securities (Pvt) Ltd. and/or its affiliates and/or its directors, officers and employees shall not in any way be responsible or liable for loss or damage which any person or party may sustain or incur by relying on the contents of this report and acting directly or in directly in any manner whatsoever. Lanka Securities Research

© Copyright 2026