FORM 8-K THE DIXIE GROUP, INC.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant To Section 13 OR 15(d) Of The Securities Exchange Act Of 1934

Date of Report (Date of earliest event reported): August 21, 2009

THE DIXIE GROUP, INC.

(Exact name of Registrant as specified in its charter)

Tennessee

0-2585

(State or other jurisdiction of incorporation)

(Commission File Number)

62-0183370

(I.R.S. Employer Identification No.)

104 Nowlin Lane - Suite 101, Chattanooga, Tennessee

37421

(Address of principal executive offices)

(zip code)

(423) 510-7000

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of

the registrant under any of the following provisions (see General Instruction A.2. below):

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e4(c))

Item 2.03.

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance

Sheet Arrangement of a Registrant.

On August 21, 2009, the Dixie Group, Inc., (the “Company”) entered into a financing

arrangement with General Electric Capital Corporation (“GE”), structured as a sale

lease-back, to provide approximately $4,600,000.00 of financing for the purchase of

three items of tufting equipment. Net of deposits and a required letter of credit, the

Company will receive approximately $2,440,000.00 of funds. Pursuant to the

arrangement, a wholly-owned subsidiary of the Company sold three items of tufting

equipment to GE; simultaneously, the subsidiary (Masland Carpets, LLC), leased the

equipment back from GE (the “Lease”). One item of equipment had been purchased by

the Company last year, and the other two items were purchased contemporaneously

with the sale lease-back transaction.

The Lease has a 5 year term, and provides the Company the right to purchase the

underlying equipment at the end of 3 and 4 years at a percentage of the purchase price

of the equipment specified in the schedule to the Lease, and at the end of the term at

the fair market value of the equipment. The monthly lease payments that the Company

(through its subsidiary) is obligated to pay under the terms of the lease is approximately

$72,000.00. The Company has guaranteed prompt payment in full of its subsidiary’s

obligations under the lease pursuant to a guarantee agreement (“the Guarantee”). In

the event of default by the subsidiary, and in the event of other circumstances

amounting to a default and described more fully in the Lease and Guarantee, the

Company could become liable for a “stipulated loss value” and related expenses,

customary in these types of transactions.

Item 9.01(d)

Financial Statements and Exhibits

10.01

Master Lease Agreement by and between General Electric Capital

Corporation and Masland Carpets, LLC, dated August 21, 2009.

10.02

Schedule to Master Equipment Lease, dated August 21, 2009.

10.03

Corporate Guaranty, as executed by The Dixie Group, Inc., dated August

21, 2009.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this

report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: August 25, 2009

THE DIXIE GROUP, INC.

/s/ Gary A. Harmon

Gary A. Harmon

Chief Financial Officer

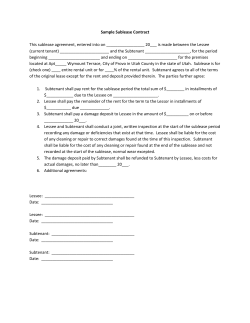

Exhibit 10.1

MASTER LEASE AGREEMENT

dated as of

THIS MASTER LEASE AGREEMENT

August 21, 2009

(as amended, supplemented or otherwise modified from time to time, this "Agreement") is

between General Electric Capital Corporation (together with its successors and assigns, if any, "Lessor") and Masland Carpets, LLC ("Lessee"). Lessor

has an office at 10 Riverview Drive, Danbury, CT 06810-6268. Lessee is a Limited Liability Company organized and existing under the laws of the state of

Georgia. Lessee's mailing address and chief executive office is 2208 S. Hamilton Street, Dalton, GA 30721. This Agreement contains the general terms that

apply to the leasing of certain equipment and personal property (the "Equipment") from Lessor to Lessee. Additional terms that apply to the Equipment and

financial terms in relation to the lease of the Equipment (term, rent, options, etc.) shall be contained on an equipment schedule (each a "Schedule", and

collectively the "Schedules"). This Agreement together with any Schedule shall constitute the "Lease" for any Equipment. Capitalized terms used but not

defined in this Agreement shall have the meanings assigned to such terms set forth in the applicable Schedule(s).

1. LEASING:

(a) Subject to the terms and conditions set forth below, Lessor agrees to lease to Lessee, and Lessee agrees to lease from Lessor, the Equipment described in

any Schedule signed by both parties.

(b) Lessor shall purchase Equipment from the manufacturer or supplier ("Supplier") and lease it to Lessee if on or before the Last Delivery Date Lessor

receives (i) a Schedule for the Equipment, (ii) evidence of insurance which complies with the requirements of Section 9, and (iii) such other documents as Lessor

may reasonably request. Each of the documents required above must be in form and substance satisfactory to Lessor. Lessor hereby appoints Lessee its agent

for inspection and acceptance of the Equipment from Supplier. Once the Schedule is signed, Lessee may not cancel the Schedule.

2. TERM, RENT AND PAYMENT:

(a) The rent ("Rent") payable for the Equipment and Lessee's right to use the Equipment shall begin on the earlier of (i) the date when Lessee signs the

Schedule and accepts the Equipment or (ii) when Lessee has accepted the Equipment under a Certificate of Acceptance ("Lease Commencement Date"). The

term of the Lease for any Equipment shall commence on the Basic Lease Commencement Date and shall continue, unless earlier cancelled or terminated

pursuant to the provisions of the applicable Schedule (the "Term"). If any term is extended or renewed, the word "Term" shall be deemed to refer to all

extended or renewal terms, and all provisions of this Agreement shall apply during any such extension or renewal terms, except as may be otherwise specifically

provided in writing.

(b) Lessee shall pay rent to Lessor at its address stated above, unless otherwise directed by Lessor. Each payment of Rent (each a "Rent Payment") shall

be in the amount set forth in, payable at such intervals and due in accordance with the provisions of the applicable Schedule. If any Interim Rent and/or any

Advance Rent is payable in respect of any Equipment, such Interim Rent and/or Advance Rent shall be set forth in the applicable Schedule and shall be due and

payable in accordance with the terms of the Schedule. Upon Lessor's receipt of the Interim Rent and the Advance Rent, (i) the Interim Rent shall be applied to

the Rent Payment due for the Interim Period, if any, set forth in the Schedule, and (ii) the Advance Rent shall be applied to the first Rent Payment due for the

Basic Term, and (iii) the remaining balance, if any, shall be applied to the next scheduled Rent Payment under such Schedule. In no event shall any Interim

Rent, Advance Rent or any other Rent Payments be refunded to Lessee. If Lessor does not receive from Lessee payment in full of any scheduled Rent Payment

or any other sum due under any Lease within ten (10) days after its due date, Lessee agrees to pay, a late fee equal to five percent (5%) on such unpaid Rent

Payment or other sum, but not exceeding any lawful maximum. Such late fee will be immediately due and payable, and is in addition to any other costs, fees and

expenses that Lessee may owe as a result of such late payment.

3. RENT ADJUSTMENT:

(a) If, solely as a result of Congressional enactment of any law (including, without limitation, any modification of, or amendment or addition to, the Internal

Revenue Code of 1986, as amended, ("Code")), the maximum effective corporate income tax rate (exclusive of any minimum tax rate) for calendar-year

taxpayers ("Effective Rate") is higher than thirty-five percent (35%) for any year during the Term for any Lease, then Lessor shall have the right to increase

such rent payments by requiring payment of a single additional sum. The additional sum shall be equal to the product of (i) the Effective Rate (expressed as a

decimal) for such year less 0.35 (or, in the event that any adjustment has been made hereunder for any previous year, the Effective Rate (expressed as a decimal)

used in calculating the next previous adjustment) times (ii) the adjusted Termination Value (defined below), divided by (iii) the difference between the new

Effective Rate (expressed as a decimal) and one (1). The adjusted Termination Value shall be the Termination Value (calculated as of the first rental due in the

year for which such adjustment is being made) minus the Tax Benefits that would be allowable under Section 168 of the Code (as of the first day of the year for

which such adjustment is being made and all future years of the Term for any Lease). The Termination Values and Tax Benefits are defined on the Schedule.

Lessee shall pay to Lessor the full amount of the additional rent payment on the later of (i) receipt of notice or (ii) the first day of the year for which such

adjustment is being made.

(b) Lessee's obligations under this Section 3 shall survive any expiration, cancellation or termination of any Lease.

4. TAXES AND FEES:

(a) If permitted by law, Lessee shall report and pay promptly all taxes, fees and assessments due, imposed, assessed or levied against any Equipment (or

purchase, ownership, delivery, leasing, possession, use or operation thereof), this Agreement (or any rents or receipts hereunder), any Schedule, Lessor or

Lessee, by any domestic or foreign governmental entity or taxing authority during or related to the Term of any Lease, including, without limitation, all license

and registration fees, and all sales, use, personal property, excise, gross receipts, franchise, stamp or other taxes, imposts, duties and charges, together with any

penalties, fines or interest thereon (collectively "Taxes"). Lessee shall have no liability for Taxes imposed by the United States of America or any state or

political subdivision thereof which are on or measured by the net income of Lessor except as provided in Sections 3 and 14(c). Lessee shall promptly reimburse

(on an after tax basis) Lessor for any Taxes charged to or assessed against Lessor. Lessee shall show Lessor as the owner of the Equipment on all tax reports or

returns, and send Lessor a copy of each report or return and evidence of Lessee's payment of Taxes upon request.

(b) Lessee's obligations, and Lessor's rights, privileges and indemnities, contained in this Section 4 shall survive the expiration or other cancellation or

termination of this Agreement.

5. REPORTS:

(a) If any tax or other lien shall attach to any Equipment, Lessee will notify Lessor in writing, within ten (10) days after Lessee becomes aware of the tax or

lien. The notice shall include the full particulars of the tax or lien and the location of such Equipment on the date of the notice.

(b) Lessee will deliver or make available to Lessor, Lessee's and any Guarantor's, if applicable, complete financial statements prepared in accordance with

generally accepted accounting principles, consistently applied, certified by a recognized firm of certified public accountants within ninety (90) days of the close

of each fiscal year of Lessee, together with a certificate of an authorized officer of Lessee stating that such officer has reviewed the activities of Lessee and that

to the best of such officer's knowledge, there exists no Event of Default or event which with notice or lapse of time (or both) would become an Event of Default.

In addition, Lessee will deliver to Lessor copies of Lessee's and any Guarantor's, if applicable, quarterly financial report certified by the chief financial officer of

Lessee, within ninety (90) days of the close of each fiscal quarter of Lessee. Lessee will deliver or make available to Lessor all Forms 10-K and 10-Q, if any,

filed with the Securities and Exchange Commission within thirty (30) days after the date on which they are filed. As long as: i) Lessee remains a wholly-owned

subsidiary of The Dixie Group, Inc.; and ii) The Dixie Group, Inc. remains publicly traded and is a corporate guarantor of Lessee’s payment and performance

obligations under this Agreement; then copies of Form 10-K and Form 10-Q for The Dixie Group, Inc. will satisfy the financial statement delivery requirements

set forth in this section 5(b), if provided within the time periods specified in this section for the delivery of quarterly and annual financial reports.

(c) Lessor may inspect any Equipment during normal business hours after giving Lessee reasonable prior notice.

(d) Lessee will keep the Equipment under any Lease at the Equipment Location specified in the applicable Schedule and will give Lessor at least five (5)

business days prior written notice of any relocation of such Equipment. If Lessor asks, Lessee will promptly notify Lessor in writing of the location of any

Equipment.

(e) If any Equipment is lost or damaged (where the estimated repair costs would exceed the greater of ten percent (10%) of the original Equipment cost or

fifty thousand and 00/100 dollars ($50,000)), or is otherwise involved in an accident causing personal injury requiring hospital admission and/or (as the case

may be) requiring federal, state or local government reporting (including without limitation to the Occupational Safety and Health Administration) and/or (as the

case may be) causing third party property damage in excess of fifty thousand dollars ($50,000), Lessee will promptly and fully report the event to Lessor in

writing within ten (10) days of the occurrence of any such incident.

(f) Upon Lessor’s request, Lessee will provide within ten (10) days of such request, copies of the insurance policies or other evidence required by the terms

hereof.

(g) Upon reasonable request by Lessor, Lessee will furnish a certificate of an authorized officer of Lessee stating that he has reviewed the activities of

Lessee and that, to the best of his knowledge, no Event of Default or event which with notice or lapse of time (or both) would become an Event of Default within

thirty (30) days of Lessor's request.

(h) Lessee will promptly notify Lessor of any change in Lessee's state of incorporation or organization, in any case within thirty (30) days of such change.

(i) Upon reasonable request by Lessor, Lessee will provide Lessor such other reports or information in relation to the Equipment and the maintenance

thereof.

6. DELIVERY, USE AND OPERATION:

(a) All Equipment shall be shipped directly from Supplier to Lessee (unless the Equipment is being leased pursuant to a sale-leaseback transaction in which

case Lessee represents and warrants that it is in possession of the Equipment as of the Lease Commencement Date).

(b) Lessee agrees that the Equipment will be used by Lessee solely in the conduct of its business, and in a manner complying with all applicable laws,

regulations and insurance policies, and in compliance with manufacturer’s recommendations. Lessee further agrees that it shall not discontinue use of any

Equipment for more than one hundred twenty (120) consecutive days unless otherwise permitted under the terms of the corresponding Schedule. .

(c) Lessee will not (i) move any Equipment from the location specified on the Schedule, without the prior written consent of Lessor, or (ii) part with

possession of any of the Equipment (except to Lessor or for maintenance or repair). The foregoing notwithstanding, provided Lessee is not subject to an Event

of Default under this Agreement, Lessee may relocate the Equipment to other facilities operated by it or by its parent company (The Dixie Group, Inc.), or

wholly-owned subsidiaries of its parent company within the continental United States; provided, Lessee (i) provides Lessor with at least five (5) business days

prior written notice of such proposed relocation, including the address and operator of such facility, (ii) delivers to Lessor prior to relocation any information,

instruments or documents reasonably required to protect the interest of Lessor in the Equipment, including without limitation, UCC filings, sublease consents

and landlord or mortgagee waivers with respect to the new location, and (iii) indemnifies and holds harmless Lessor from any additional tax, fees or other

charges resulting from the relocation of the Equipment. Upon the written request of Lessor, Lessee will notify Lessor forthwith in writing of the location of any

Equipment as of the date of such notification.

(d) Lessee will keep the Equipment free and clear of all liens, claims and encumbrances other than those which result from acts of Lessor.

(e) Lessor shall not disturb Lessee's quiet enjoyment of the Equipment during the term of the Agreement unless an Event of Default has occurred and is

continuing under this Agreement.

7. MAINTENANCE:

(a) Lessee will, at its sole expense, maintain each unit of Equipment in good operating order and repair, normal wear and tear excepted. Lessee shall also

maintain the Equipment in accordance with manufacturer's recommendations. Lessee shall make all alterations or modifications required to comply with any

applicable law, rule or regulation during the Term of any Lease. If Lessor requests, Lessee shall affix plates, tags or other identifying labels showing ownership

thereof by Lessor. The tags or labels shall be placed in a prominent position on each unit of Equipment.

(b) Lessee will not attach or install anything on any Equipment that will impair the originally intended function or use of such Equipment without the prior

written consent of Lessor. All additions, parts, supplies, accessories, and equipment ("Additions") furnished or attached to any Equipment that are not readily

removable shall become the property of Lessor. All Additions shall be made only in compliance with applicable law. Lessee will not attach or install any

Equipment to or in any other personal or real property without the prior written consent of Lessor.

8. STIPULATED LOSS VALUE: If for any reason any unit of Equipment becomes worn out, lost, stolen, destroyed, irreparably damaged or unusable

("Casualty Occurrences") Lessee shall promptly and fully notify Lessor in writing. Lessee shall pay Lessor the sum of (i) the Stipulated Loss Value (see

Schedule) of the affected unit determined as of the rent payment date prior to the Casualty Occurrence; and (ii) all rent and other amounts which are then due

under this Agreement on the Payment Date (defined below) for the affected unit. The "Payment Date" for purposes of this Section 8 shall be the next

scheduled Rent Payment date after the Casualty Occurrence. Upon payment of all sums due hereunder, the term of the Lease as to such unit shall terminate.

9. INSURANCE:

(a) Lessee shall bear the entire risk of any loss, theft, damage to, or destruction of, any unit of Equipment from any cause whatsoever from the time the

Equipment is shipped to Lessee.

(b) Lessee shall secure and maintain in effect at its own expense throughout the Term of any Lease of the Equipment, insurance for such amounts and

against such hazards as Lessor may reasonably require. All such policies shall be with companies, and on terms, reasonably satisfactory to Lessor. The

insurance shall include coverage for damage to or loss of the Equipment, liability for personal injuries, death or property damage. Lessor shall be named as

additional insured with a loss payable clause in favor of Lessor, as its interest may appear, irrespective of any breach of warranty or other act or omission of

Lessee. The insurance shall provide for liability coverage in an amount equal to at least ONE MILLION U.S. DOLLARS ($1,000,000.00) total liability per

occurrence, unless otherwise stated in any Schedule. The casualty/property damage coverage shall be in an amount equal to the full replacement cost of the

Equipment and shall have deductible amounts acceptable to Lessor. Notwithstanding anything in this Section 9(b) to the contrary, as long as Lessee is not subject

to an Event of Default under this Agreement, Lessee may assume a deductible exposure of up to TWO HUNDRED FIFTY THOUSAND DOLLARS ($250,000)

in the aggregate per occurrence under the physical damage insurance coverages required to be maintained under the Agreement. No insurance shall be subject to

any co-insurance clause. The insurance policies shall provide that the insurance may not be altered or canceled by the insurer until after thirty (30) days written

notice to Lessor. Lessee agrees to deliver to Lessor evidence of insurance reasonably satisfactory to Lessor.

(c) Lessee hereby appoints Lessor as Lessee's attorney-in-fact to make proof of loss and claim for insurance, and to make adjustments with insurers and to

receive payment of and execute or endorse all documents, checks or drafts in connection with insurance payments. Lessor shall not act as Lessee's attorney-infact unless Lessee is in default. Lessee shall pay any reasonable expenses of Lessor in adjusting or collecting insurance. Lessee will not make adjustments with

insurers except (provided Lessee is not subject to an Event of Default under this Agreement) with respect to claims for damage to any unit of Equipment where

the repair costs for such unit of Equipment are less than ten percent (10%) of the original Equipment cost (as stipulated in the applicable Schedule for such

Equipment). Lessee may, at its option (unless Lessee is subject to an Event of Default, in which case Lessor may, at its option) apply proceeds of insurance, in

whole or in part, to (i) repair or replace Equipment or any portion thereof, or (ii) satisfy any obligation of Lessee to Lessor under this Agreement.

10. RETURN OF EQUIPMENT:

(a) Upon the expiration, cancellation or termination of this Agreement or any Lease (including any cancellation or termination pursuant to Section 17 hereof

or any cancellation or termination occurring after or in connection with an Event of Default hereunder), Lessee shall perform any testing and repairs required to

place the units of Equipment in the same condition and appearance as when received by Lessee (reasonable wear and tear excepted) and in good working order

for the original intended purpose of the Equipment. If required the units of Equipment shall be deinstalled, disassembled and crated by an authorized

manufacturer's representative or such other service person as is reasonably satisfactory to Lessor. Lessee shall remove installed markings that are not necessary

for the operation, maintenance or repair of the Equipment. All Equipment will be cleaned, cosmetically acceptable, and in such condition as to be immediately

installed into use in a similar environment for which the Equipment was originally intended to be used. All waste material and fluid must be removed from the

Equipment and disposed of in accordance with then current waste disposal laws. Lessee shall return the units of Equipment to a location within the continental

United States as Lessor shall direct. Lessee shall obtain and pay for a policy of transit insurance for the redelivery period in an amount equal to the replacement

value of the Equipment. The transit insurance must name Lessor as the loss payee. Lessee shall pay for all costs to comply with this Section 10.

(b) Until Lessee has fully complied with the requirements of Section 10(a) above, Lessee's rent payment obligation and all other obligations under this

Agreement shall continue from month to month notwithstanding any expiration, cancellation or termination of the lease term. Lessor may terminate Lessee's

right to use the Equipment upon ten (10) days notice to Lessee.

(c) Lessee shall provide to Lessor a detailed inventory of all components of the Equipment including model and serial numbers. Lessee shall also provide an

up-to-date copy of all other documentation pertaining to the Equipment. All service manuals, blue prints, process flow diagrams, operating manuals, inventory

and maintenance records shall be given to Lessor at least ninety (90) days and not more than one hundred twenty (120) days prior to lease cancellation or

termination.

(d) Lessee shall make the Equipment available for on-site operational inspections by potential purchasers at least one hundred twenty (120) days prior to

and continuing up to lease cancellation or termination. Lessor shall provide Lessee with reasonable notice prior to any inspection. Lessee shall provide

personnel, power and other requirements necessary to demonstrate electrical, hydraulic and mechanical systems for each item of Equipment.

11. DEFAULT AND REMEDIES:

(a) Lessee shall be in default under this Agreement and under any Lease upon the occurrence of any of the following (each an "Event of Default", and

collectively, the "Events of Default"):

(i)

Lessee fails to pay within ten (10) days after its due date, any Rent or any other amount due under this Agreement or any Lease;

(ii)

Lessee breaches any of its insurance obligations under this Agreement or any other Document (as defined in Section 16 hereof);

(iii) Lessee breaches any of its other obligations under any Lease (other than those described in Section 11(a)(i) and (ii) above), and fails to cure that

breach within thirty (30) days after written notice from Lessor;

(iv) any representation, warranty or covenant made by Lessee or any guarantor or surety for the obligations under any Lease (each a "Guarantor", and

collectively, the "Guarantors") in connection with this Agreement or under any Lease shall be materially false or materially misleading;

(v)

any Equipment is illegally used;

(vi) Lessee or any Guarantor becomes insolvent or ceases to do business as a going concern;

(vii) if Lessee or any Guarantor is a natural person, any death or incompetency of Lessee or such Guarantor;

(viii) a receiver is appointed for all or of any part of the property of Lessee or any Guarantor, or Lessee or any Guarantor makes any assignment for the

benefit of its creditors;

(ix) Lessee or any Guarantor files a petition under any bankruptcy, insolvency or similar law, or in the event an involuntary petition is filed against

Lessee or any Guarantor under any bankruptcy or insolvency laws and in the event of an involuntary petition, such petition is not dismissed within fortyfive (45) days of the filing date;

(x)

Lessee or any Guarantor breaches or is in default under any other agreement by and between Lessor (or any of its affiliates or parent entities) on

the one hand, and Lessee or such Guarantor (or any of their respective parent or affiliates) on the other hand; provided however that any such default

under this Section 11(a)(x) is not solely related to a material adverse change in Lessee’s financial condition;

(xi) any Guarantor revokes or attempts to revoke its obligations under its guaranty or any related document to which it is a party, or fails to observe or

perform any covenant, condition or agreement to be performed under such guaranty or other related document to which it is a party;

(xii) Lessee or any Guarantor defaults under any other agreement, document or instrument to which Lessee or any Guarantor is a party or by which

Lessee or any Guarantor or any of their respective properties is bound, creating or relating to any obligations owed to a party other than Lessor (or any

of Lessor’s affiliates or parent companies) (each a “Third Party Obligation” and collectively the “Third Party Obligations”) (i) in excess of

$3,000,000 if the payment or maturity of such Third Party Obligation(s) may be accelerated in consequence of such event of default or demand for

payment of such Third Party Obligation(s) may be made; or (ii) an acceleration occurs of the payment or maturity of any Third Party Obligation(s) in

excess of $1,500,000; provided however that any such default under this Section 11(a)(xii) is not solely related to a material adverse change in Lessee’s

or any Guarantor's financial condition;

(xiii) there is any dissolution or termination of existence of Lessee or any Guarantor; or

(xiv) there is any merger, consolidation or change in controlling ownership of Lessee or any Guarantor, or either Lessee or any Guarantor sells or leases

all, or substantially all, of its assets.

The default declaration shall apply to all Schedules unless specifically excepted by Lessor.

(b) Upon the occurrence of any Event of Default and so long as the same shall be continuing, Lessor may, at its option, at any time thereafter, exercise one

or more of the following remedies set forth in this Section 11, as Lessor in its sole discretion shall lawfully elect. (i) Upon the request of Lessor, Lessee shall

immediately comply with the provisions of Section 10(a), (ii) Lessee shall authorize Lessor to peacefully enter any premises where any Equipment may be and

take possession of the Equipment, (iii) Lessee shall immediately pay to Lessor without further demand as liquidated damages, for loss of a bargain and not as a

penalty, an amount equal to (x) the Stipulated Loss Value of the Equipment (calculated as of the Rent Payment date prior to the declaration of default), plus (y)

all Rents and other sums then due under this Agreement, any Lease and all Schedules, (iv) Lessor may cancel or terminate the Lease as to any or all of the

Equipment, and any cancellation or termination of Leases shall occur only upon written notice by Lessor to Lessee and only as to the units of Equipment

specified in any such notice, (v) Lessor may, but shall not be required to, sell Equipment at private or public sale, in bulk or in parcels, with or without notice,

and without having the Equipment present at the place of sale, (vi) Lessor may also, but shall not be required to, lease, otherwise dispose of or keep idle all or

part of the Equipment, (vii) Lessor may use Lessee's premises for a reasonable period of time for any or all of the purposes stated above without liability for rent,

costs, damages or otherwise, (viii) Lessor shall have the right to apply the proceeds of any sale, lease or other disposition, if any, in the following order of

priorities: (1) to pay all of Lessor's costs, charges and expenses incurred in taking, removing, holding, repairing and selling, leasing or otherwise disposing of

Equipment; then, (2) to the extent not previously paid by Lessee, to pay Lessor all sums due from Lessee under this Agreement; then (3) to reimburse to Lessee

any sums previously paid by Lessee as liquidated damages; and (4) any surplus shall be retained by Lessor. Lessee shall immediately pay any deficiency in (1)

and (2) above, to the extent any exists, (ix) Lessor shall be entitled to collect from Lessee all costs, charges, and expenses, including actual legal fees and

disbursements, incurred by Lessor by reason of any Event of Default under the terms of this Agreement or under any other agreement between Lessor (or any of

its affiliates or parent entities), on the one hand, and Lessee or any Guarantor (or any of their respective affiliates or parent entities), on the other hand, (x) Lessor

may proceed by appropriate court action, either by law or in equity, to enforce the performance by Lessee of the applicable covenants of this Agreement and any

Lease or to recover damages for breach hereof, and (xi) Lessor may exercise any rights it may have against any security deposit or other collateral pledged to it

by Lessee, any Guarantor or any of their respective affiliates or parent entities.

(c) In addition to Lessor’s remedies set forth above, any rent or other amount not paid when due shall bear interest, from the due date until paid, at a per

annum rate equal to the lesser of twelve percent (12%) or the maximum rate not prohibited by applicable law (the "Per Diem Interest Rate"). The application

of such Per Diem Interest Rate shall not be interpreted or deemed to extend any cure period set forth herein, cure any default or otherwise limit Lessor's rights or

remedies hereunder. Notwithstanding anything to the contrary contained in this Agreement or any Schedule, in no event shall this Agreement or any Schedule

require the payment or permit the collection of amounts in excess of the maximum permitted by applicable law.

(d) The foregoing remedies are cumulative, and any or all thereof may be exercised instead of or in addition to each other or any remedies at law, in equity,

or under any applicable statute, or international treaty, convention or protocol. Lessee waives notice of sale or other disposition (and the time and place thereof),

and the manner and place of any advertising. Lessee shall pay Lessor's actual attorney's fees incurred in connection with the enforcement, assertion, defense or

preservation of Lessor's rights and remedies under this Agreement, or if prohibited by law, such lesser sum as may be permitted. Waiver of any default shall not

be deemed to be a waiver of any other or subsequent default.

(e) Any Event of Default under the terms of this Agreement, any Lease or any other agreement between Lessor and Lessee may be declared by Lessor a

default under this Agreement, any Lease and any such other agreement between Lessor and Lessee.

12. ASSIGNMENT: LESSEE SHALL NOT SELL, TRANSFER, ASSIGN, ENCUMBER OR SUBLET ANY EQUIPMENT OR THE INTEREST OF

LESSEE IN THE EQUIPMENT WITHOUT THE PRIOR WRITTEN CONSENT OF LESSOR, WHICH CONSENT WILL NOT BE

UNREASONABLY WITHHELD. However, Lessor shall not be deemed to have unreasonably withheld its consent if: (A) in Lessor’s opinion, there is

expected to be any adverse affect on Lessor’s interest in the Lease, the Equipment, or any related Tax Benefits, (B) at the time of Lessee’s request, Lessee is

subject to an Event of Default or an event that with the giving of notice or passage of time or both would constitute an Event of Default, (C) any proposed

assignee or (as the case may be) sublessee fails to meet Lessor’s compliance screening standards then in effect (e.g., “Patriot Act”), or (D) Lessor fails to

receive, in form and substance satisfactory to Lessor, any transfer and assumption agreement, consents to sublease, new or amended financing statements, or

other documents and instruments that may be required by Lessor in connection with such request.. Lessor may, without the consent of Lessee, assign this

Agreement, any Schedule or the right to enter into a Schedule. Lessee agrees that if Lessee receives written notice of an assignment from Lessor, Lessee will

pay all rent and all other amounts payable under any assigned Schedule to such assignee or as instructed by Lessor. Lessee also agrees to confirm in writing

receipt of the notice of assignment as may be reasonably requested by assignee. Lessee hereby waives and agrees not to assert against any such assignee any

defense, set-off, recoupment claim or counterclaim which Lessee has or may at any time have against Lessor for any reason whatsoever.

13. NET LEASE: Any Lease entered into pursuant to the terms and provisions of this Agreement is a net lease. Lessee acknowledges and agrees that its

obligations to pay Rent and any and all amounts due and owing in accordance with the terms hereof and under any Schedule shall be absolute and unconditional,

and such obligations shall not be released, discharged, waived, reduced, set-off or affected by any circumstances whatsoever, including, without limitation, any

damage to or destruction of any Equipment, defects in the Equipment or Lessee no longer can use such Equipment. Lessee further acknowledges that Lessee is

not entitled to reduce or set-off against Rent or any other amounts due to Lessor or to any assignee under Section 12, whether or not Lessee’s claim arises out of

this Agreement, any Lease, any statement by Lessor, Lessor’s liability or any Supplier’s liability, strict liability, negligence or otherwise. Lessor shall have no

obligation, liability or responsibility to Lessee or any other person with respect to the operation, maintenance, repairs, alternations, modifications, correction of

faults or defects (whether or not required by applicable law) or insurance with respect to any Equipment, all such matters shall be, as between Lessee and Lessor,

the sole responsibility of Lessee, regardless upon whom such responsibilities may fall under applicable law or otherwise, and the Rent payable hereunder has

been set in reliance of Lessee’s sole responsibility for such aforementioned matters.

14. INDEMNIFICATION:

(a) Lessee hereby agrees to indemnify and save, on a net after-tax basis, Lessor and its affiliates, and all of Lessor’s and such affiliates’ respective directors,

shareholders, officers, employees, agents, employees, predecessors, attorneys-in-fact, lawyers, successors and assigns (each an "Indemnitee") harmless from

and against any and all losses, damages, penalties, injuries, claims, actions and suits, including reasonable attorneys’ fees and legal expenses, of whatsoever kind

and nature and other costs of investigation or defense, including those incurred upon any appeal arising out of or relating to the Equipment, this Agreement or

any Lease or any other Document (as defined in Section 16 hereof) (collectively, "Claims") whether in law or equity, or in contract, tort or otherwise.

This indemnity shall include, but is not limited to, Lessor's strict liability in tort or otherwise, including Claims that may be imposed on, incurred by or asserted

against an Indemnitee in any way arising out of (i) the selection, manufacture, purchase, acceptance or rejection of Equipment, the ownership of Equipment

during the term of this Agreement, and the delivery, lease, sublease, chartering, possession, maintenance, use, non-use, financing, mortgaging, control, insurance,

testing, condition, return, sale (including all costs, incurred in making the Equipment ready for sale after the exercise of remedies as a result of an Event of

Default), operation or design of the Equipment (including, without limitation, latent and other defects, whether or not discoverable by Lessor or Lessee and any

claim for patent, trademark or copyright infringement or environmental damage), any interchanging or pooling of any parts of the Equipment, if applicable; (ii)

the condition of Equipment sold or disposed of after use by Lessee, any sublessee or employees of Lessee; (iii) any breach of Lessee's or any Guarantor's

representations or obligations under any Lease or any other Document or any guaranty, or the failure by Lessee to comply with any term, provision or covenant

contained in any Lease or any other Document or the Equipment or with any applicable law, rule or regulation with respect to the Equipment, or the

nonconformity of the Equipment or its operation with any applicable law; (iv) any actions brought against any Indemnitee that arise out of Lessee's or any

Guarantor's actions or omissions (or actions or omissions of Lessee's or Guarantor's agents); or (v) reliance by any Indemnitee on any representation or warranty

made or deemed made by Lessee or any Guarantor (or any of their officers) under or in connection with any Lease or any other Document, or any report or other

information delivered by Lessee or Guarantor pursuant hereto which shall have been incorrect in any material respect when made or deemed made or delivered;

provided, that Lessee shall not be obligated to pay and shall have no indemnity liability for any Claims (x) imposed on or against an Indemnitee to the extent that

such Claims are caused by the gross negligence or willful misconduct of such Indemnitee, or (y) to the extent imposed with respect to any Claim solely based on

events occurring after the earlier of (A) the expiration or other cancellation or termination of the Term of any Lease in circumstances not requiring the return of

the Equipment and payment in full of all amounts due from Lessee under such Lease and any other Document, and (B) the satisfaction in full by Lessee of all its

obligations under Section 10 "Return of Equipment" hereof in respect of any Lease, and the payment in full of all amounts due from Lessee under any Lease and

related Documents, except in each case to the extent such Claims result from an exercise of remedies under this Agreement and any Lease following the

occurrence of an Event of Default. Lessee shall pay on demand to each Indemnitee any and all amounts necessary to indemnify such Indemnitee from and

against any Claims. Lessee shall, upon request, defend any actions based on, or arising out of, any of the foregoing.

(b) Lessee hereby represents, warrants and covenants that (i) on the Lease Commencement Date for any unit of Equipment, such unit will qualify for all of

the items of deduction and credit specified in Section C of the applicable Schedule ("Tax Benefits") in the hands of Lessor, and (ii) at no time during the term of

this Agreement will Lessee take or omit to take, nor will it permit any sublessee or assignee to take or omit to take, any action (whether or not such act or

omission is otherwise permitted by Lessor or by this Agreement), which will result in the disqualification of any Equipment for, or recapture of, all or any

portion of such Tax Benefits.

(c) If as a result of a breach of any representation, warranty or covenant of Lessee contained in this Agreement or any Schedule (i) tax counsel of Lessor

shall determine that Lessor is not entitled to claim on its Federal income tax return all or any portion of the Tax Benefits with respect to any Equipment, or (ii)

any Tax Benefit claimed on the Federal income tax return of Lessor is disallowed or adjusted by the Internal Revenue Service, or (iii) any Tax Benefit is

recalculated or recaptured (any determination, disallowance, adjustment, recalculation or recapture being a "Loss"), then Lessee shall pay to Lessor, as an

indemnity and as additional rent, an amount that shall, in the reasonable opinion of Lessor, cause Lessor's after-tax economic yields and cash flows to equal the

Net Economic Return that would have been realized by Lessor if such Loss had not occurred. Such amount shall be payable upon demand accompanied by a

statement describing in reasonable detail such Loss and the computation of such amount. The economic yields and cash flows shall be computed on the same

assumptions, including tax rates as were used by Lessor in originally evaluating the transaction ("Net Economic Return"). If an adjustment has been made

under Section 3 then the Effective Rate used in the next preceding adjustment shall be substituted.

(d) All references to Lessor in this Section 14 include Lessor and the consolidated taxpayer group of which Lessor is a member. All of Lessor's rights,

privileges and indemnities contained in this Section 14 shall survive the expiration or other cancellation or termination of this Agreement. The rights, privileges

and indemnities contained in this Agreement are expressly made for the benefit of, and shall be enforceable by Lessor, its successors and assigns.

15. DISCLAIMER: LESSEE ACKNOWLEDGES THAT IT HAS SELECTED THE EQUIPMENT WITHOUT ANY ASSISTANCE FROM LESSOR, ITS

AGENTS OR EMPLOYEES. LESSOR DOES NOT MAKE, HAS NOT MADE, NOR SHALL BE DEEMED TO MAKE OR HAVE MADE, ANY

WARRANTY OR REPRESENTATION, EITHER EXPRESS OR IMPLIED, WRITTEN OR ORAL, WITH RESPECT TO THE EQUIPMENT LEASED

UNDER THIS AGREEMENT OR ANY COMPONENT THEREOF, INCLUDING, WITHOUT LIMITATION, ANY WARRANTY AS TO DESIGN,

COMPLIANCE WITH SPECIFICATIONS, QUALITY OF MATERIALS OR WORKMANSHIP, MERCHANTABILITY, FITNESS FOR ANY PURPOSE,

USE OR OPERATION, SAFETY, PATENT, TRADEMARK OR COPYRIGHT INFRINGEMENT, OR TITLE. All such risks, as between Lessor and Lessee,

are to be borne by Lessee. Without limiting the foregoing, Lessor shall have no responsibility or liability to Lessee or any other person with respect to any of the

following; (i) any liability, loss or damage caused or alleged to be caused directly or indirectly by any Equipment, any inadequacy thereof, any deficiency or

defect (latent or otherwise) of the Equipment, or any other circumstance in connection with the Equipment; (ii) the use, operation or performance of any

Equipment or any risks relating to it; (iii) any interruption of service, loss of business or anticipated profits or consequential damages; or (iv) the delivery,

operation, servicing, maintenance, repair, improvement or replacement of any Equipment. If, and so long as, no default exists under this Agreement, Lessee

shall be, and hereby is, authorized during the Term of any Lease to assert and enforce whatever claims and rights Lessor may have against any Supplier of the

Equipment leased hereunder at Lessee's sole cost and expense, in the name of and for the account of Lessor and/or Lessee, as their interests may appear.

16. REPRESENTATIONS, WARRANTIES AND COVENANTS OF LESSEE:

(a) Lessee makes each of the following representations and warranties to Lessor on the date hereof and on the Lease Commencement Date.

(i) Lessee has adequate power and capacity to enter into, and perform under, this Agreement and all related documents (together, the "Documents").

Lessee is duly qualified to do business wherever necessary to carry on its present business and operations, including the jurisdiction(s) where the Equipment is or

is to be located.

(ii) The Documents have been duly authorized, executed and delivered by Lessee and constitute valid, legal and binding agreements, enforceable in

accordance with their terms, except to the extent that the enforcement of remedies may be limited under applicable bankruptcy and insolvency laws.

(iii) No approval, consent or withholding of objections is required from any governmental authority or entity with respect to the entry into or performance by

Lessee of the Documents except such as have already been obtained.

(iv) The entry into and performance by Lessee of the Documents do not, and will not: (i) violate any judgment, order, law or regulation applicable to Lessee

or any provision of Lessee's organizational documents; or (ii) result in any breach of, constitute a default under or result in the creation of any lien, charge,

security interest or other encumbrance upon any Equipment pursuant to any indenture, mortgage, deed of trust, bank loan or credit agreement or other instrument

(other than this Agreement) to which Lessee is a party.

(v) There are no suits or proceedings pending or threatened in court or before any commission, board or other administrative agency against or affecting

Lessee, which if decided against Lessee will have a material adverse effect on the ability of Lessee to fulfill its obligations under this Agreement.

(vi) Each financial statement delivered to Lessor has been prepared in accordance with generally accepted accounting principles consistently applied. Since

the date of the most recent financial statement, there has been no material adverse change.

(vii)

Lessee's exact legal name is as set forth in the first sentence of this Agreement.

(b) Lessee hereby covenants to Lessor that at all times during the Term of any Lease:

(i) The Equipment accepted under any Certificate of Acceptance is and will remain tangible personal property.

(ii) Lessee is and will be at all times validly existing and in good standing under the laws of its state of incorporation or organization (specified in the first

sentence of this Agreement).

(iii) The Equipment will at all time be used for commercial or business purposes.

(iv) Lessee shall not consolidate or reorganize (other than any internal reorganization or consolidation that does not change the legal entity status of the

Lessee) or merge with any other corporation or entity, or sell, convey, transfer or lease all or substantially all of its property during the Term of any Lease,

without the prior written consent of Lessor, which shall not be unreasonably withheld. Lessee acknowledges that with respect to the prior written consent of

Lessor referred to in this Section 16(b)(iv), Lessor shall not be deemed to have unreasonably withheld its consent if: (A) in Lessor’s reasonable opinion, there is

expected to be any adverse change in the creditworthiness of Lessee or any Guarantor or (as the case may be) any proposed successor lessee or successor

guarantor, (B) in Lessor’s reasonable opinion, there is expected to be any adverse affect on the Equipment, Lessor’s interest therein or any related Tax Benefits,

(C) at the time of Lessee’s request, Lessee is subject to an Event of Default or an event that with the giving of notice or passage of time or both would

constitute an Event of Default, (D) any such proposed successor entity or new controlling entity fails to meet Lessor’s compliance screening standards then in

effect (e.g., “Patriot Act”), or (E) Lessor fails to receive, in form and substance satisfactory to Lessor, any transfer and assumption agreement, new or amended

financing statements, or other documents and instruments that may be required by Lessor in connection with such request.

(v) Lessee shall maintain all books and records (including any computerized maintenance records) pertaining to the Equipment during the Term of any

Lease in accordance with applicable rules and regulations.

(vi) Lessee is and will remain in full compliance with all laws and regulations applicable to it including, without limitation, (i) ensuring that no person who

owns a controlling interest in or otherwise controls Lessee is or shall be (Y) listed on the Specially Designated Nationals and Blocked Person List maintained by

the Office of Foreign Assets Control ("OFAC"), Department of the Treasury, and/or any other similar lists maintained by OFAC pursuant to any authorizing

statute, Executive Order or regulation or (Z) a person designated under Section 1(b), (c) or (d) of Executive Order No. 13224 (September 23, 2001), any related

enabling legislation or any other similar Executive Orders, and (ii) compliance with all applicable Bank Secrecy Act ("BSA") laws, regulations and government

guidance on BSA compliance and on the prevention and detection of money laundering violations.

17. EARLY TERMINATION:

(a) On or after the First Termination Date (specified in the applicable Schedule), Lessee may, so long as no Event of Default (or event or circumstance

which with the giving of notice or passage of time or both, would result in an Event of Default) exists and no Casualty Occurrence has occurred, terminate this

Agreement as to all (but not less than all) of the Equipment on such Schedule as of a rent payment date ("Termination Date"). Lessee must give Lessor at least

ninety (90) days', but no more than one hundred eighty (180) days' prior written notice of the termination.

(b) Lessee shall, and Lessor shall have the right to, solicit cash bids for the Equipment on an AS IS, WHERE IS BASIS without recourse to or warranty

from Lessor, express or implied ("AS IS BASIS"). Prior to the Termination Date, Lessee shall (i) certify to Lessor any bids received by Lessee and (ii) pay to

Lessor (1) the Termination Value (calculated as of the Rent due on the Termination Date) for the Equipment, and (2) all Rent and other sums due and unpaid as

of the Termination Date.

(c) If all amounts due hereunder have been paid on the Termination Date, Lessor shall (i) sell the Equipment on an AS IS BASIS for cash to the highest

bidder and (ii) refund the proceeds of such sale (net of any related expenses) to Lessee up to the amount of the Termination Value. If such sale is not

consummated, no termination shall occur and Lessor shall refund the Termination Value (less any expenses incurred by Lessor) to Lessee.

(d) Notwithstanding the foregoing, Lessor shall have the right to elect by written notice, at any time prior to the Termination Date, not to sell the Equipment.

In that event, on the Termination Date Lessee shall (i) return the Equipment (in accordance with Section 10) and (ii) pay to Lessor an amount equal to the sum of

(x) the Termination Value (calculated as of the Termination Date) for the Equipment as required under Section 17(b)(ii)(1) above less the amount of the highest

bid certified by Lessee to Lessor, plus (y) all Rent and other amounts due and unpaid as of the Termination Date as required under Section 17(b)(ii)(2) above.

18. END OF LEASE PURCHASE OPTION:

(a) On the expiration of any Lease, Lessee may, so long as no Event of Default (or event or circumstance which with the giving of notice or passage of time

or both, would result in an Event of Default) exists thereunder, and such Lease has not been earlier cancelled or terminated, purchase all (but not less than all) of

the Equipment set forth in any Schedule on an AS IS BASIS for cash equal to its then Fair Market Value (plus all applicable sales taxes). Lessee must notify

Lessor of its intent to purchase the Equipment in writing at least one hundred eighty (180) days prior to the expiration date of such Lease. If Lessee is in default,

or if the Lease or this Agreement has already been cancelled or terminated, Lessee may not purchase the Equipment.

(b) "Fair Market Value" shall mean the price that a willing buyer (who is neither a lessee in possession nor a used equipment dealer) would pay for the

Equipment in an arm's-length transaction to a willing seller under no compulsion to sell. In determining the Fair Market Value, (i) the Equipment shall be

assumed to be in the condition in which it is required to be maintained and returned under the Lease, (ii) if the Equipment is installed it shall be valued on an

installed basis, and (iii) the costs of removal of the Equipment from current location shall not be a deduction from the value of the Equipment. If Lessor and

Lessee are unable to agree on the Fair Market Value at least one hundred thirty-five (135) days prior to the expiration of the Lease, Lessor shall appoint an

independent appraiser (reasonably acceptable to Lessee) to determine Fair Market Value, at Lessee's sole cost, and such independent appraiser's determination

shall be final, binding and conclusive.

(c) Lessee shall be deemed to have waived this option unless it provides Lessor with written notice of its irrevocable election to exercise the same within

fifteen (15) days after Fair Market Value is told to Lessee.

19. MISCELLANEOUS:

(a) LESSEE AND LESSOR UNCONDITIONALLY WAIVE THEIR RIGHTS TO A JURY TRIAL OF ANY CLAIM OR CAUSE OF ACTION BASED

UPON OR ARISING OUT OF THIS AGREEMENT, ANY OF THE RELATED DOCUMENTS, ANY DEALINGS BETWEEN LESSEE AND LESSOR

RELATING TO THE SUBJECT MATTER OF THIS TRANSACTION OR ANY RELATED TRANSACTIONS, AND/OR THE RELATIONSHIP THAT IS

BEING ESTABLISHED BETWEEN LESSEE AND LESSOR. THE SCOPE OF THIS WAIVER IS INTENDED TO BE ALL ENCOMPASSING OF ANY

AND ALL DISPUTES THAT MAY BE FILED IN ANY COURT. THIS WAIVER IS IRREVOCABLE. THIS WAIVER MAY NOT BE MODIFIED

EITHER ORALLY OR IN WRITING. THE WAIVER ALSO SHALL APPLY TO ANY SUBSEQUENT AMENDMENTS, RENEWALS, SUPPLEMENTS

OR MODIFICATIONS TO THIS AGREEMENT, ANY RELATED DOCUMENTS, OR TO ANY OTHER DOCUMENTS OR AGREEMENTS RELATING

TO THIS TRANSACTION OR ANY RELATED TRANSACTION. THIS AGREEMENT MAY BE FILED AS A WRITTEN CONSENT TO A TRIAL BY

THE COURT.

(b) The Equipment shall remain Lessor's property unless Lessee purchases the Equipment from Lessor in accordance with the terms hereof, and until such

time Lessee shall only have the right to use the Equipment as a lessee. Any cancellation or termination by Lessor of this Agreement, any Schedule, supplement

or amendment hereto, or the lease of any Equipment hereunder shall not release Lessee from any then outstanding obligations to Lessor hereunder. All

Equipment shall at all times remain personal property of Lessor even though it may be attached to real property. The Equipment shall not become part of any

other property by reason of any installation in, or attachment to, other real or personal property.

(c) Time is of the essence of this Agreement. Lessor's failure at any time to require strict performance by Lessee of any of the provisions hereof shall not

waive or diminish Lessor's right at any other time to demand strict compliance with this Agreement and any Lease. Lessor may correct patent errors and fill in

all blanks in the Documents consistent with the agreement of the parties. Lessee will promptly, upon Lessor's request and at Lessee's sole cost and expense,

execute, or otherwise authenticate, any document, record or instrument necessary or expedient for filing, recording or perfecting the interest of Lessor or to carry

out the intent of this Agreement and any Lease (including filings to evidence amendments to this Agreement and any Lease, and acknowledgments of

assignments), and will take such further action as Lessor may reasonably request in order to carry out more effectively the intent and purposes of this Agreement

and any Lease and to establish Lessor's rights and remedies under this Lease, or otherwise with respect to the Equipment. In addition, Lessee hereby authorizes

Lessor to file a financing statement and amendments thereto describing the Equipment described in any and all Schedules now and hereafter executed pursuant

hereto and adding any other collateral described therein and containing any other information required by the applicable Uniform Commercial Code. Lessee

irrevocably grants to Lessor the power to sign Lessee's name and generally to act on behalf of Lessee to execute and file financing statements and other

documents pertaining to any or all of the Equipment. Lessee hereby ratifies its prior authorization for Lessor to file financing statements and amendments

thereto describing the Equipment and containing any other information required by any applicable law (including without limitation the Uniform Commercial

Code) if filed prior to the date hereof. If and to the extent that this Agreement or a Schedule is deemed a security agreement, Lessee hereby grants to Lessor a

first priority security interest in the Equipment, together with all additions, attachments, accessories and accessions thereto whether or not furnished by Supplier

of the Equipment and any and all substitutions, upgrades, replacements or exchanges therefor, and any and all insurance and/or other proceeds of the property in

and against which a security interest is granted hereunder. This security interest is given to secure the payment and performance of all debts, obligations and

liabilities of any kind whatsoever of Lessee to Lessor, now existing or arising in the future under this Agreement or any Schedules hereto, and any renewals,

extensions and modifications of such debts, obligations and liabilities. All notices required to be given hereunder shall be deemed adequately given if delivered

by hand, or sent by registered or certified mail to the addressee at its address stated herein, or at such other place as such addressee may have designated in

writing. This Agreement and any Schedules and Annexes thereto constitute the entire agreement of the parties with respect to the subject matter hereof. NO

VARIATION OR MODIFICATION OF THIS AGREEMENT OR ANY WAIVER OF ANY OF ITS PROVISIONS OR CONDITIONS, SHALL BE VALID

UNLESS IN WRITING AND SIGNED BY AN AUTHORIZED REPRESENTATIVE OF THE PARTIES HERETO.

(d) If Lessee does not comply with any provision of this Agreement, Lessor shall have the right, but shall not be obligated, to effect such compliance, in

whole or in part. All reasonable amounts spent and obligations incurred or assumed by Lessor in effecting such compliance shall constitute additional rent due to

Lessor. Lessee shall pay the additional rent within five (5) days after the date Lessor sends notice to Lessee requesting payment. Lessor's effecting such

compliance shall not be a waiver of Lessee's default.

(e) Any provisions in this Agreement and any Schedule that are in conflict with any statute, law or applicable rule shall be deemed omitted, modified or

altered to conform thereto.

(f) Lessee hereby irrevocably authorizes Lessor to adjust the Capitalized Lessor's Cost up or down by no more than ten percent (10%) within each Schedule

to account for equipment change orders, equipment returns, invoicing errors, and similar matters. Lessee acknowledges and agrees that the rent shall be adjusted

as a result of the change in the Capitalized Lessor's Cost. Lessor shall send Lessee a written notice stating the final Capitalized Lessor's Cost, if it has changed.

(g) THIS AGREEMENT AND THE RIGHTS AND OBLIGATIONS OF THE PARTIES HEREUNDER SHALL IN ALL RESPECTS BE GOVERNED

BY AND CONSTRUED IN ACCORDANCE WITH, THE INTERNAL LAWS OF THE STATE OF CONNECTICUT (WITHOUT REGARD TO THE

CONFLICT OF LAWS PRINCIPLES OF SUCH STATE), INCLUDING ALL MATTERS OF CONSTRUCTION, VALIDITY AND PERFORMANCE,

REGARDLESS OF THE LOCATION OF THE EQUIPMENT. LESSEE IRREVOCABLY SUBMITS TO THE EXCLUSIVE JURISDICTION OF THE

STATE AND FEDERAL COURTS LOCATED IN THE STATE OF CONNECTICUT TO HEAR AND DETERMINE ANY SUIT,

ACTION OR

PROCEEDING AND TO SETTLE ANY DISPUTES, WHICH MAY ARISE OUT OF OR IN CONNECTION HEREWITH (COLLECTIVELY, THE

"PROCEEDINGS"), AND LESSEE FURTHER IRREVOCABLY WAIVES ANY RIGHT IT MAY HAVE TO REMOVE ANY SUCH PROCEEDINGS

FROM ANY SUCH COURT (EVEN IF REMOVAL IS SOUGHT TO ANOTHER OF THE ABOVE-NAMED COURTS). LESSEE IRREVOCABLY

WAIVES ANY OBJECTION WHICH IT MIGHT NOW OR HEREAFTER HAVE TO THE ABOVE-NAMED COURTS BEING NOMINATED AS THE

EXCLUSIVE FORUM TO HEAR AND DETERMINE ANY SUCH PROCEEDINGS AND AGREES NOT TO CLAIM THAT IT IS NOT PERSONALLY

SUBJECT TO THE JURISDICTION OF THE ABOVE-NAMED COURTS FOR ANY REASON WHATSOEVER, THAT IT OR ITS PROPERTY IS

IMMUNE FROM LEGAL PROCESS FOR ANY REASON WHATSOEVER, THAT ANY SUCH COURT IS NOT A CONVENIENT OR APPROPRIATE

FORUM IN EACH CASE WHETHER ON THE GROUNDS OF VENUE OR FORUM NON-CONVENIENS OR OTHERWISE.

LESSEE

ACKNOWLEDGES THAT BRINGING ANY SUCH SUIT, ACTION OR PROCEEDING IN ANY COURT OTHER THAN THE COURTS SET FORTH

ABOVE WILL CAUSE IRREPARABLE HARM TO LESSOR WHICH COULD NOT ADEQUATELY BE COMPENSATED BY MONETARY DAMAGES,

AND, AS SUCH, LESSEE AGREES THAT, IN ADDITION TO ANY OF THE REMEDIES TO WHICH LESSOR MAY BE ENTITLED AT LAW OR IN

EQUITY, LESSOR WILL BE ENTITLED TO AN INJUNCTION OR INJUNCTIONS (WITHOUT THE POSTING OF ANY BOND AND WITHOUT

PROOF OF ACTUAL DAMAGES) TO ENJOIN THE PROSECUTION OF ANY SUCH PROCEEDINGS IN ANY OTHER COURT. Notwithstanding the

foregoing, each of Lessee and Lessor shall have the right to apply to a court of competent jurisdiction in the United States or abroad for equitable relief as is

necessary to preserve, protect and enforce their rights under this Agreement and any Lease, including but not limited to orders of attachment or injunction

necessary to maintain the status quo pending litigation or to enforce judgments against Lessee, any Guarantor or the Equipment or to gain possession of the

Equipment.

(h) Any cancellation or termination by Lessor, pursuant to the provisions of this Agreement, any Schedule, supplement or amendment hereto, of the lease of

any Equipment hereunder, shall not release Lessee from any then outstanding obligations to Lessor hereunder.

(i) To the extent that any Schedule would constitute chattel paper, as such term is defined in the Uniform Commercial Code as in effect in any applicable

jurisdiction, no security interest therein may be created through the transfer or possession of this Agreement in and of itself without the transfer or possession of

the original of a Schedule executed pursuant to this Agreement and incorporating this Agreement by reference; and no security interest in this Agreement and a

Schedule may be created by the transfer or possession of any counterpart of the Schedule other than the original thereof, which shall be identified as the

document marked "Original" and all other counterparts shall be marked "Duplicate".

(j) This Agreement and any amendments, waivers, consents or supplements hereto or in connection herewith may be executed in any number of

counterparts and by different parties hereto in separate counterparts, each of which when so executed and delivered shall be deemed an original, but all such

counterparts together shall constitute but one and the same instrument; signature pages may be detached from multiple separate counterparts and attached to a

single counterpart so that all signature pages are physically attached to the same document. Delivery of an executed signature page of this Agreement or any

delivery contemplated hereby by facsimile or electronic transmission shall be as effective as delivery of a manually executed counterpart thereof.

(k) Each party hereto agrees to keep confidential, the terms and provisions of the Documents and the transactions contemplated hereby and thereby

(collectively, the "Transactions"); provided that either party may disclose the terms and provisions of the Documents and transactions contemplated hereby and

thereby (collectively, "Confidential Information") (i) to its or its controlling entities' employees, officers, directors, agents, consultants, auditors, attorneys and

accountants, (ii) if it is reasonably believed by it to be compelled by any court decree, subpoena or other legal or administrative order or process, (iii) on the

advice of its counsel, otherwise required by law or necessary or appropriate in connection with any litigation or other proceeding to which it or its affiliates is a

party, or (iv) which becomes available to such party from a third party on a non-confidential basis. Notwithstanding the foregoing, the obligations of

confidentiality contained herein, as they relate to the Transactions, shall not apply to the federal tax structure or federal tax treatment of the Transactions, and

each party hereto (and any employee, representative, or agent of any party hereto) may disclose to any and all persons, without limitation of any kind, the federal

tax structure and federal tax treatment of the Transactions. The preceding sentence is intended to cause each Transaction to be treated as not having been offered

under conditions of confidentiality for purposes of Section 1.6011-4(b)(3) (or any successor provision) of the Treasury Regulations promulgated under Section

6011 of the Internal Revenue Code of 1986, as amended, and shall be construed in a manner consistent with such purpose. In addition, each party hereto

acknowledges that it has no proprietary or exclusive rights to the federal tax structure of the Transactions or any federal tax matter or federal tax idea related to

the Transactions.

(l) Lessee hereby acknowledges and agrees that Lessor reserves the right to impose fees or charges for returned checks and certain optional services that

Lessor may offer or provide to Lessee during the term of this Agreement. Lessor will notify Lessee the amount of the applicable fee or charge if Lessee requests

such optional services. In addition, Lessor may make available to Lessee a schedule of fees or charges for such optional services from time to time or upon

demand, provided, however, that such fees and charges are subject to change in Lessor's sole discretion without notice to Lessee.

(m)

Lessee hereby acknowledges that it has not received or relied on any legal, tax, financial or accounting advice from Lessor and that Lessee has had

the opportunity to seek advice from its own advisors and professionals in that regard.

IN WITNESS WHEREOF,

Lessee and Lessor have caused this Agreement to be executed by their duly authorized

representatives as of the date first above written.

LESSOR:

LESSEE:

General Electric Capital Corporation

Masland Carpets, LLC

By:

/s/ Mark E. Frankel

By:

Name:

Mark E. Frankel

Name:

Title:

Operations Analyst

Title:

/s/ Gary A. Harmon

Gary A. Harmon

President and Chief Manager

*LEAS8760*

Exhibit 10.02

MACHINE TOOLS EQUIPMENT SCHEDULE

SCHEDULE NO. 001

DATED THIS August 21, 2009

TO MASTER LEASE AGREEMENT

DATED AS OF August 21, 2009

Lessor & Mailing Address:

Lessee & Mailing Address:

General Electric Capital Corporation

Masland Carpets, LLC

10 Riverview Drive

2208 S. Hamilton Street

Danbury, CT 06810-6268

Dalton, GA 30721

This Schedule is executed pursuant to, and incorporates by reference the terms and conditions of, and capitalized terms not defined herein shall have the meanings

assigned to them in, the Master Lease Agreement identified above ("Agreement" said Agreement and this Schedule being collectively referred to as "Lease"). This

Schedule, incorporating by reference the Agreement, constitutes a separate instrument of lease.

A.

Equipment:

Subject to the terms and conditions of the Lease, Lessor agrees to lease to Lessee the Equipment described below (the "Equipment").

Number

Capitalized

of Units

Lessor's Cost

1

$1,479,206.00

Manufacturer

Serial Number

Tuftco

674702339-LLC

Model and Type of Equipment

2009 165 Velva Loop/Level Loop Cut

Tufting Machine

1

$1,473,879.49

Tuftco

665972329-LLC

2008 165 Split Cam, 1/10 Guage,

Staggered Needle, Level Loop Cut

Tufting Machine

Equipment immediately listed above is located at: 209 Carpet Drive, Atmore, Escambia County, AL 36502

1

$1,627,468.00

Tuftco

674982358-A

2009 175 Colortron Cut Pile Tufting

Machine

Equipment immediately listed above is located at: 3641 Highway 411 North, Chatsworth, Murray County, GA 30705

and including all Purchase Orders, additions, attachments, accessories and accessions thereto, and any and all substitutions, upgrades, replacements or

exchanges therefor, and all insurance and/or other proceeds thereof.

B.

Financial Terms

1.

Advance Rent (if any): Not Applicable

5.

Basic Term Commencement Date: 9/1/09

2.

Capitalized Lessor's Cost: $ 4,580,553.49

6.

Lessee Federal Tax ID No.: 020739755

3.

Basic Term (No. of Months): 60 Months.

7.

Last Delivery Date: August 21, 2009**

4.

Basic Term Lease Rate Factor: 0.01563922

8.

Daily Lease Rate Factor: 0.00025000

** Conditions Precedent to Leasing/Funding: All of the terms and conditions set forth in this Lease are subject to the satisfaction of all the following

conditions precedent no later than the Last Delivery Date, each in form and substance satisfactory to Lessor at its sole discretion: (i) all of the conditions

precedent set forth in the Agreement (including Section 1 thereof), this Schedule and the other Documents relating to this Schedule; (ii) no Event of Default

or event which with the passage of time or the giving of notice would become an Event of Default has occurred under the Agreement; (iii) as of the Last

Delivery Date, there will have been, since the date that this Schedule is delivered to the Lessee for execution, no adverse change (as determined by Lessor in

its sole discretion) in the business prospects or projections, operations, management, financial or other conditions of the Lessee, any affiliate of Lessee, any

Guarantor, or any other party to whom Lessor may have recourse in regard to this Lease, or in the industry in which Lessee or Guarantor or such other party

operates, or a change in control of any one of the aforesaid parties; and (iv) the absence, during the period from the date that this Schedule is delivered to the

Lessee for execution to the Last Delivery Date, of any disruption of, or adverse change in, the leasing or lending market, leasing or loan syndication, or

financial, banking or capital markets conditions. If any such condition precedent is not so satisfied by the Last Delivery Date, Lessor shall have no

obligation to proceed with the transactions contemplated under this Schedule or any other Documents related to this Schedule.

9.

First Termination Date: Thirty-six (36) months after the Basic Term Commencement Date.

10.

Interim Rent: For the period from and including the Lease Commencement Date to but not including the Basic Term Commencement Date ("Interim

Period"), Lessee shall pay as rent ("Interim Rent") for each unit of Equipment, the product of the Daily Lease Rate Factor times the Capitalized Lessor's

Cost of such unit times the number of days in the Interim Period. Interim Rent shall be due on 8/31/09 .

11.

Basic Term Rent. Commencing on 10/1/09 and on the same day of each month thereafter (each, a "Rent Payment Date") during the Basic Term,

Lessee shall pay as rent ("Basic Term Rent") the product of the Basic Term Lease Rate Factor times the Capitalized Lessor's Cost of all Equipment on this

Schedule.

12.

Tax Administration Fee. As compensation for Lessor’s internal and external costs in the administration of Taxes related to each unit of Equipment, Lessee

agrees to pay Lessor a tax administrative fee equal to $12 per unit of Equipment per year during the Lease Term of such unit of Equipment, not to exceed the

maximum permitted by applicable law ("Tax Administration Fee"). The Tax Administrative Fee (at Lessor’s sole discretion) may be increased by an amount

not exceeding 10% thereof for each subsequent year of the Lease Term to reflect Lessor’s increased cost of administration and Lessor will notify Lessee of

any such increase by indicating such increased amount in the relevant invoice or in such other manner as Lessor deems appropriate.

C.

Tax Benefits

1.

Depreciation Deductions:

Depreciation method is the 200% declining balance method, switching to straight line method for the 1st taxable year for which using the straight line

method with respect to the adjusted basis as of the beginning of such year will yield a larger allowance.

D.

2.

Recovery Period: 5 years.

3.

Basis: 100 % of the Capitalized Lessor's Cost.

Property Tax

APPLICABLE TO EQUIPMENT LOCATED IN ALABAMA AND GEORGIA: Lessee agrees that it will not list any of such Equipment for property tax purposes

or report any property tax assessed against such Equipment until otherwise directed in writing by Lessor. Upon receipt of any property tax bill pertaining to

such Equipment from the appropriate taxing authority, Lessor will pay such tax and will invoice Lessee for the expense. Upon receipt of such invoice, Lessee

will promptly reimburse Lessor for such expense.

Lessor may notify Lessee (and Lessee agrees to follow such notification) regarding any changes in property tax reporting and payment responsibilities.

E.

Article 2A Notice

IN ACCORDANCE WITH THE REQUIREMENTS OF ARTICLE 2A OF THE UNIFORM COMMERCIAL CODE AS ADOPTED IN THE APPLICABLE

STATE, LESSOR HEREBY MAKES THE FOLLOWING DISCLOSURES TO LESSEE PRIOR TO EXECUTION OF THE LEASE, (A) THE PERSON(S)

SUPPLYING THE EQUIPMENT IS MASLAND CARPETS, LLC (THE "SUPPLIER(S)"), (B) LESSEE IS ENTITLED TO THE PROMISES AND

WARRANTIES, INCLUDING THOSE OF ANY THIRD PARTY, PROVIDED TO THE LESSOR BY SUPPLIER(S), WHICH IS SUPPLYING THE

EQUIPMENT IN CONNECTION WITH OR AS PART OF THE CONTRACT BY WHICH LESSOR ACQUIRED THE EQUIPMENT AND (C) WITH

RESPECT TO SUCH EQUIPMENT, LESSEE MAY COMMUNICATE WITH SUPPLIER(S) AND RECEIVE AN ACCURATE AND COMPLETE

STATEMENT OF SUCH PROMISES AND WARRANTIES, INCLUDING ANY DISCLAIMERS AND LIMITATIONS OF THEM OR OF REMEDIES.

TO THE EXTENT PERMITTED BY APPLICABLE LAW, LESSEE HEREBY WAIVES ANY AND ALL RIGHTS AND REMEDIES CONFERRED

UPON A LESSEE IN ARTICLE 2A AND ANY RIGHTS NOW OR HEREAFTER CONFERRED BY STATUTE OR OTHERWISE WHICH MAY LIMIT

OR MODIFY ANY OF LESSOR'S RIGHTS OR REMEDIES UNDER THE DEFAULT AND REMEDIES SECTION OF THE AGREEMENT.

F.

Stipulated Loss and Termination Value Table*

Rental

Termination