2nd QUARTER FY 2015 EARNINGS PRESENTATION November 6, 2014

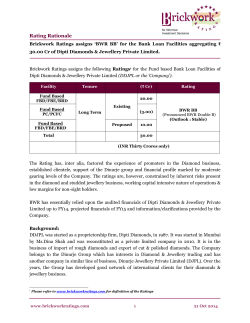

2nd QUARTER FY 2015 EARNINGS PRESENTATION November 6, 2014 Forward-Looking Statements All written or oral statements made by CSC at this meeting or in these presentation materials that do not directly and exclusively relate to historical facts constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements represent CSC’s expectations and beliefs, and no assurance can be given that the results described in such statements will be achieved. These statements are subject to risks, uncertainties, and other factors, many outside of CSC’s control, that could cause actual results to differ materially from the results described in such statements. For a description of these factors, please see CSC’s most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. 2nd Quarter FY 2015 Earnings Presentation November 6, 2014 2 Non-GAAP Reconciliations This presentation includes certain non-GAAP financial measures, such as operating income, operating margin, earnings before interest and taxes (EBIT), EBIT margin, free cash flow, and capital expenditures. These non-GAAP financial measures are not meant to be considered in isolation or as a substitute for results prepared in accordance with accounting principles generally accepted in the United States (GAAP). A reconciliation of non-GAAP financial measures included in this presentation to the most directly comparable financial measures calculated and presented in accordance with GAAP accompanies this presentation and is on our website at www.csc.com. CSC management believes that these non-GAAP financial measures provide useful information to investors regarding the Company’s financial condition and results of operations as they provide another measure of the Company’s profitability and ability to service its debt, and are considered important measures by financial analysts covering CSC and its peers. 2nd Quarter FY 2015 Earnings Presentation November 6, 2014 3 Basis of Presentation During the first quarter of fiscal year 2015, CSC changed its pension accounting policy. Under the new policy, actuarial gains and losses and changes in fair value of plan assets are recorded in the year in which they occur. Also during the quarter, CSC changed its inter-company accounting policy. Previously, inter-company transactions between segments were generally reflected as inter-company revenue. Under the new policy, inter-company transactions are now generally treated as cost transfers. The company has recast its financial statements for the year-ago periods to reflect both these accounting policy changes. 2nd Quarter FY 2015 Earnings Presentation November 6, 2014 4 2nd QUARTER FY 2015 EARNINGS PRESENTATION Mike Lawrie Chief Executive Officer Key Messages EPS* of $1.18 driven by cost takeout and lower tax rate Growth from next-generation offerings and partnerships; headwinds in infrastructure NPS performing better than expected Total revenue target flat to slightly down for FY15 Increasing EPS* target to $4.45 – $4.65 Continuing to return capital to shareholders *EPS from Continuing Operations 2nd Quarter FY 2015 Earnings Presentation November 6, 2014 6 2nd QUARTER FY 2015 EARNINGS PRESENTATION Paul Saleh Chief Financial Officer 2nd Quarter Results Q2 YTD FY15 Revenue ($M) $ FY14 3,080 $ FY15 3,187 $ FY14 6,317 YoY Growth – GAAP (3.4%) (1.9%) YoY Growth – cc (4.3%) (3.1%) Operating Income ($M) Operating Margin (%) EBIT ($M) EBIT Margin Income from Continuing Operations ($M) $ 6,441 349 361 653 693 11.3% 11.3% 10.3% 10.8% 276 271 524 540 9.0% 8.5% 8.3% 8.4% 177 162* 336 323* 1.01* $ 2.22 2.05* 4.2 $ 5.7 EPS from Continuing Operations $ 1.18 Bookings ($B) $ 3.0 $ $ 7.0 *Prior to the change in the pension accounting policy, Q2 FY14 and Q2 FY14 YTD Income from Continuing Operations was $146 million and $291 million, respectively, and Q2 FY14 and Q2 FY14 YTD EPS from Continuing Operations was $0.93 and $1.86, respectively 2nd Quarter FY 2015 Earnings Presentation November 6, 2014 8 Global Business Services (GBS) Q2 FY15 GBS 32% GIS 34% Revenue ($M) $ 1,003 YoY Growth – GAAP YoY Growth – cc Year to Date Operating Margin (%) Bookings ($B) Revenue ($M) OI Margin % $ 1,022 (1.9%) (3.2%) Operating Income ($M) NPS 34% Q2 FY14 130 120 13.0% 11.7% $ 1.2 $ 1.3 Bookings ($B) Decline in cc of 1.2% $2,076 $2,091 11.2% 11.4% $2.5 $2.4 YTD FY14 YTD FY15 YTD FY14 YTD FY15 YTD FY14 YTD FY15 2nd Quarter FY 2015 Earnings Presentation November 6, 2014 9 Global Infrastructure Services (GIS) Q2 FY15 GIS 34% GBS 32% Revenue ($M) $ 1,036 YoY Growth – GAAP YoY Growth – cc Year to Date Operating Margin (%) Bookings ($B) Revenue ($M) $ 1,113 (6.9%) (8.4%) Operating Income ($M) NPS 34% Q2 FY14 68 107 6.6% 9.6% $ OI Margin % 0.6 $ 0.8 Bookings ($B) Decline in cc 5.8% $2 $2,260 $2,167 8.8% 6.4% YTD FY14 YTD FY15 2nd Quarter FY 2015 Earnings Presentation YTD FY14 YTD FY15 $1 $0 $1.7 $1.8 YTD FY14 YTD FY15 November 6, 2014 10 North American Public Sector (NPS) Q2 FY15 Revenue ($M) GIS 34% GBS 32% $ 1,041 YoY Growth – GAAP Year to Date Operating Margin (%) DoD Civil Other Revenue ($M) $2,105 YTD FY14 $2,059 YTD FY15 53% 38% 9% Bookings ($B) OI Margin % 13.8% YTD FY14 15.1% YTD FY15 $ 1,052 (1.0%) Operating Income ($M) NPS 34% Q2 FY14 160 163 15.4% 15.5% $ $4 $4 $3 $3 $2 $2 $1 $1 $0 1.1 $ 2.1 Bookings ($B) $2.8 Large Renewal $1.8* YTD FY14 $1.4 YTD FY15 *Adjusted for one large NPS renewal 2nd Quarter FY 2015 Earnings Presentation November 6, 2014 11 Financial Highlights Effective Tax Rate Q2 tax rate of 27.8% Targeting 32% for Q3 and Q4 Continuing with tax planning strategies Cash Flow Performance Q2 FY15 Free Cash Flow Cap Ex — Including Capital Leases Cap Ex as a % of Revenue 2nd Quarter FY 2015 Earnings Presentation YTD FY15 $31M $101M $199M $402M 6.5% 6.4% November 6, 2014 12 Financial Highlights (Cont’d) Capital to Shareholders Capital Structure Q2 FY15 Q2 FY14 $32M $30M Share Repurchases 4.6M shares $278M 2.0M shares $102M Accelerated Stock Repurchases 1.3M shares $75M Dividends Q2 FY15 Q2 FY14 Cash and Equivalents $1.9B $2.1B Net Debt to Capital Ratio 13.2% 10.1% 2nd Quarter FY 2015 Earnings Presentation November 6, 2014 13 Cost Takeout and Reinvestment Update Q2 FY15 YTD FY15 FY15 Targets ~$85M ~$195M $450M – $500M ~$65M ~$170M $350M – $400M COST TAKEOUT • Continued G&A efficiency • Shift to low-cost delivery centers • Productivity gains • Supply chain management REINVESTMENTS • Next-generation offerings • Strategic partnerships • Sales • Finance and HR systems • Customer-committed savings 2nd Quarter FY 2015 Earnings Presentation November 6, 2014 14 FY 2015 Targets Revenue Flat to slightly down • Commercial • NPS EPS from Continuing Operations $4.45 – $4.65 Free Cash Flow $700 million 2nd Quarter FY 2015 Earnings Presentation November 6, 2014 15 2nd QUARTER FY 2015 EARNINGS PRESENTATION Supplemental Information Bookings* $B FY14 GBS Global Business Services GIS FY15 Global Infrastructure Services NPS North American Public Sector *Segment bookings may not add to total due to rounding 2nd Quarter FY 2015 Earnings Presentation November 6, 2014 17 Non-GAAP Reconciliations Operating Income ($M) Operating Income Corporate G&A Interest Expense Interest Income Other Income (Expense), Net Income from Continuing Operations Before Taxes Q2 FY15 $ 349 (67) (36) 5 (6) $ 361 (68) (35) 3 (22) $ 245 $ 239 Earnings Before Interest and Taxes ($M) Earnings Before Interest and Taxes Interest Expense Interest Income Taxes on Income Income from Continuing Operations Q2 FY15 $ $ Margin % Revenue ($M) Pre-tax Margin % Operating Income Margin % EBIT Margin % Q2 FY14 276 (36) 5 (68) 177 Q2 FY14 $ $ Q2 FY15 $ 3,080 8.0% 11.3% 9.0% 271 (35) 3 (77) 162 Q2 FY14 $ 3,187 7.5% 11.3% 8.5% Q2 FY14 As Previously Reported* $ 338 (68) (35) 3 (22) $ 216 Q2 FY14 As Previously Reported* $ $ 248 (35) 3 (70) 146 Q2 FY14 As Previously Reported* $ 3,187 6.8% 10.6% 7.8% *Before the change in the pension accounting policy 2nd Quarter FY 2015 Earnings Presentation November 6, 2014 18 Q2 FY14 Select P&L Items $M except EPS Revenue Cost of Services SG&A Income from Continuing Operations, Before Taxes Taxes on Income Income from Continuing Operations Income from Discontinued Operations, Net of Taxes Net Income Net Income Attributable to Noncontrolling Interest, Net of Taxes Net Income Attributable to CSC Common Stakeholders EPS - Continuing Operations EPS - Discontinued Operations As Previously Reported $ 3,187 2,338 316 216 70 146 63 209 6 203 $ 0.93 $ 0.41 Impact of MtM* As Reported $ $ $ 3,187 2,317 314 239 77 162 80 242 10 232 1.01 0.53 $ $ $ (21) (2) 23 7 16 17 33 4 29 0.08 0.12 *Adoption of Mark-to-Market pension accounting policy 2nd Quarter FY 2015 Earnings Presentation November 6, 2014 19 Selected Cash Flow Items and Non-GAAP Reconciliations $M Net Income Depreciation and Amortization Change in Assets and Liabilities Loss (Gain) on Dispositions Other Operating Cash Flow Q2 FY15 $ 156 252 (218) 7 20 217 Q2 FY14 $ 242 247 (167) (73) 21 270 YTD FY15 $ 307 524 (372) (13) 44 490 YTD FY14 $ 419 502 (367) (98) 27 483 (144) (18) (35) 13 (184) (145) 176 (27) 21 25 (263) (13) (35) 13 (298) (305) 232 (27) 24 (76) 18 35 (55) 31 (176) 27 (60) $ 86 13 35 (139) 101 (232) 27 (5) (120) 77 Capital Expenditures Business Dispositions Acquisitions Other Investing Cash Flow Business Dispositions Acquisitions Other Capital Leases and Other Financing Free Cash Flow $ $ $ Capital lease payments, repayments of obligations related to assets acquired under long-term financing arrangements, and proceeds from the sale of assets (included in investing activities) are included in the calculation of Free Cash Flow 2nd Quarter FY 2015 Earnings Presentation November 6, 2014 20 Recast FY14 and FY13 Quarterly Revenues by Segment Quarterly revenues have been recast to reflect the change in CSC’s inter-company accounting policy $M GBS GIS NPS Total Revenues Q1 FY14 $ 1,054 1,147 1,053 $ 3,254 Q2 FY14 $ 1,022 1,113 1,052 $ 3,187 Q3 FY14 $ 1,093 1,145 990 $ 3,228 Q4 FY14 $ 1,152 1,173 1,004 $ 3,329 FY14 $ 4,321 4,578 4,099 $ 12,998 $M GBS GIS NPS Total Revenues Q1 FY13 $ 1,257 1,188 1,183 $ 3,628 Q2 FY13 $ 1,185 1,153 1,190 $ 3,528 Q3 FY13 $ 1,201 1,178 1,157 $ 3,536 Q4 FY13 $ 1,201 1,170 1,132 $ 3,503 FY13 $ 4,844 4,689 4,662 $ 14,195 2nd Quarter FY 2015 Earnings Presentation November 6, 2014 21 Recast FY14 and FY13 Quarterly OI by Segment Quarterly operating income (loss) has been recast to reflect the change in CSC’s pension accounting policy and change in CSC’s inter-company accounting policy $M GBS GIS NPS Corporate & Eliminations Total OI Q1 FY14 $ 113 92 127 $ 332 Q2 FY14 $ 120 107 163 (29) $ 361 Q3 FY14 $ 140 91 122 (15) $ 338 Q4 FY14 $ 201 92 112 (20) $ 385 FY14 $ 574 382 524 (64) $ 1,416 $M GBS GIS NPS Corporate & Eliminations Total OI Q1 FY13 $ 75 23 99 (28) $ 169 Q2 FY13 $ 89 52 147 (4) $ 284 Q3 FY13 $ 106 67 136 (28) $ 281 Q4 FY13 $ 133 26 129 (53) $ 235 FY13 $ 403 168 511 (113) $ 969 2nd Quarter FY 2015 Earnings Presentation November 6, 2014 22 Non-GAAP and Other Definitions • Operating Cost: Equal to the sum of (1) cost of services, (2) segment SG&A, excluding Corporate G&A, (3) depreciation and amortization, and (4) restructuring costs • Operating Income: Revenue minus Operating Cost • Operating Income Margin: Operating Income as a percentage of Revenue • Earnings Before Interest and Taxes: Revenue minus cost of services, selling, general and administrative expenses, depreciation and amortization, restructuring costs, and other income (expense) • Earnings Before Interest and Taxes Margin: Earnings Before Interest and Taxes as a percentage of Revenue • Pre-tax Margin: Income from Continuing Operations Before Taxes as a percentage of Revenue • Free Cash Flow: Equal to the sum of (1) operating cash flows, (2) investing cash flows, excluding business acquisitions and dispositions, and investments (including short-term investments and purchase or sale of available-for-sale securities), and (3) payments on capital leases and other long-term asset financings • Capital Expenditures: Equal to sum of purchases of property, equipment, and software, and payments on outsourcing contracts, less proceeds from sales of assets • Net Debt: Calculated as the sum of long-term and short-term debt, less cash and cash equivalents • Net Debt to Capital: Calculated as the ratio of net debt to capital (total debt plus equity) 2nd Quarter FY 2015 Earnings Presentation November 6, 2014 23 2nd QUARTER FY 2015 EARNINGS PRESENTATION Thank You

© Copyright 2026