NEW EMPLOYEE PERSONAL DATA SHEET Name: ____________________________________________ SS # ______________________

NEW EMPLOYEE

PERSONAL DATA SHEET

Name: ____________________________________________ SS # ______________________

Address: _____________________________________________________________________

Town: _____________________________ State: _____________ Zip Code: ______________

Home Phone: __________________________ Date of Birth: ___________________________

PERSON TO NOTIFY IN CASE OF AN EMERGENCY:

Name: ______________________________________ Relationship: _____________________

Address: _____________________________________________________________________

Town: _____________________________ State: _____________ Zip Code: ______________

PHONE NUMBERS:

Day: __________________________________ Evening: ______________________________

RACIAL IDENTIFICATION (for federally required reporting)

____ Caucasian

____ Asian

____ Black

____ American Indian

____ Hispanic

____ Cape Verdean

MARITAL STATUS

____ Single

____ Married

If you would be willing to serve as a translator for the hospital, please indicate the languages

you are fluent in below.

LANGUAGES: ______________________________________________________________

Form W-4 (2014)

Purpose. Complete Form W-4 so that your employer

can withhold the correct federal income tax from your

pay. Consider completing a new Form W-4 each year

and when your personal or financial situation changes.

Exemption from withholding. If you are exempt,

complete only lines 1, 2, 3, 4, and 7 and sign the form

to validate it. Your exemption for 2014 expires

February 17, 2015. See Pub. 505, Tax Withholding

and Estimated Tax.

Note. If another person can claim you as a dependent

on his or her tax return, you cannot claim exemption

from withholding if your income exceeds $1,000 and

includes more than $350 of unearned income (for

example, interest and dividends).

Exceptions. An employee may be able to claim

exemption from withholding even if the employee is a

dependent, if the employee:

• Is age 65 or older,

• Is blind, or

• Will claim adjustments to income; tax credits; or

itemized deductions, on his or her tax return.

The exceptions do not apply to supplemental wages

greater than $1,000,000.

Basic instructions. If you are not exempt, complete

the Personal Allowances Worksheet below. The

worksheets on page 2 further adjust your

withholding allowances based on itemized

deductions, certain credits, adjustments to income,

or two-earners/multiple jobs situations.

Complete all worksheets that apply. However, you

may claim fewer (or zero) allowances. For regular

wages, withholding must be based on allowances

you claimed and may not be a flat amount or

percentage of wages.

Head of household. Generally, you can claim head

of household filing status on your tax return only if

you are unmarried and pay more than 50% of the

costs of keeping up a home for yourself and your

dependent(s) or other qualifying individuals. See

Pub. 501, Exemptions, Standard Deduction, and

Filing Information, for information.

Tax credits. You can take projected tax credits into account

in figuring your allowable number of withholding allowances.

Credits for child or dependent care expenses and the child

tax credit may be claimed using the Personal Allowances

Worksheet below. See Pub. 505 for information on

converting your other credits into withholding allowances.

Nonwage income. If you have a large amount of

nonwage income, such as interest or dividends,

consider making estimated tax payments using Form

1040-ES, Estimated Tax for Individuals. Otherwise, you

may owe additional tax. If you have pension or annuity

iincome, see Pub. 505 to find out if you should adjust

your withholding on Form W-4 or W-4P.

Two earners or multiple jobs. If you have a

working spouse or more than one job, figure the

total number of allowances you are entitled to claim

on all jobs using worksheets from only one Form

W-4. Your withholding usually will be most accurate

when all allowances are claimed on the Form W-4

for the highest paying job and zero allowances are

claimed on the others. See Pub. 505 for details.

Nonresident alien. If you are a nonresident alien,

see Notice 1392, Supplemental Form W-4

Instructions for Nonresident Aliens, before

completing this form.

Check your withholding. After your Form W-4 takes

effect, use Pub. 505 to see how the amount you are

having withheld compares to your projected total tax

for 2014. See Pub. 505, especially if your earnings

exceed $130,000 (Single) or $180,000 (Married).

Future developments. Information about any future

developments affecting Form W-4 (such as legislation

enacted after we release it) will be posted at www.irs.gov/w4.

Personal Allowances Worksheet (Keep for your records.)

Enter “1” for yourself if no one else can claim you as a dependent . . . . . . . . . . . . . . . . . .

A

• You are single and have only one job; or

Enter “1” if:

B

• You are married, have only one job, and your spouse does not work; or

. . .

• Your wages from a second job or your spouse’s wages (or the total of both) are $1,500 or less.

Enter “1” for your spouse. But, you may choose to enter “-0-” if you are married and have either a working spouse or more

than one job. (Entering “-0-” may help you avoid having too little tax withheld.) . . . . . . . . . . . . . .

C

Enter number of dependents (other than your spouse or yourself) you will claim on your tax return . . . . . . . .

D

Enter “1” if you will file as head of household on your tax return (see conditions under Head of household above) . .

E

Enter “1” if you have at least $2,000 of child or dependent care expenses for which you plan to claim a credit

. . .

F

(Note. Do not include child support payments. See Pub. 503, Child and Dependent Care Expenses, for details.)

Child Tax Credit (including additional child tax credit). See Pub. 972, Child Tax Credit, for more information.

• If your total income will be less than $65,000 ($95,000 if married), enter “2” for each eligible child; then less “1” if you

have three to six eligible children or less “2” if you have seven or more eligible children.

G

• If your total income will be between $65,000 and $84,000 ($95,000 and $119,000 if married), enter “1” for each eligible child . . .

a

Add lines A through G and enter total here. (Note. This may be different from the number of exemptions you claim on your tax return.)

H

A

{

B

C

D

E

F

G

H

For accuracy,

complete all

worksheets

that apply.

}

{

• If you plan to itemize or claim adjustments to income and want to reduce your withholding, see the Deductions

and Adjustments Worksheet on page 2.

• If you are single and have more than one job or are married and you and your spouse both work and the combined

earnings from all jobs exceed $50,000 ($20,000 if married), see the Two-Earners/Multiple Jobs Worksheet on page 2 to

avoid having too little tax withheld.

• If neither of the above situations applies, stop here and enter the number from line H on line 5 of Form W-4 below.

Separate here and give Form W-4 to your employer. Keep the top part for your records.

Form

W-4

Department of the Treasury

Internal Revenue Service

1

Employee's Withholding Allowance Certificate

OMB No. 1545-0074

a Whether you are entitled to claim a certain number of allowances or exemption from withholding is

subject to review by the IRS. Your employer may be required to send a copy of this form to the IRS.

Your first name and middle initial

Last name

Home address (number and street or rural route)

2

3

Single

Married

2014

Your social security number

Married, but withhold at higher Single rate.

Note. If married, but legally separated, or spouse is a nonresident alien, check the “Single” box.

City or town, state, and ZIP code

4 If your last name differs from that shown on your social security card,

check here. You must call 1-800-772-1213 for a replacement card. a

5

6

7

Total number of allowances you are claiming (from line H above or from the applicable worksheet on page 2)

5

Additional amount, if any, you want withheld from each paycheck . . . . . . . . . . . . . .

6 $

I claim exemption from withholding for 2014, and I certify that I meet both of the following conditions for exemption.

• Last year I had a right to a refund of all federal income tax withheld because I had no tax liability, and

• This year I expect a refund of all federal income tax withheld because I expect to have no tax liability.

If you meet both conditions, write “Exempt” here . . . . . . . . . . . . . . . a 7

Under penalties of perjury, I declare that I have examined this certificate and, to the best of my knowledge and belief, it is true, correct, and complete.

Employee’s signature

(This form is not valid unless you sign it.)

8

Date a

a

Employer’s name and address (Employer: Complete lines 8 and 10 only if sending to the IRS.)

For Privacy Act and Paperwork Reduction Act Notice, see page 2.

9 Office code (optional)

Cat. No. 10220Q

10

Employer identification number (EIN)

Form W-4 (2014)

Employee:

State . . . . . . . . . . . . . . .

M

O V I E TE M

EN U E

AT E

RT

BE

AM

EN

L

SV

I

B

T OF

EV

ID

M

T

City. . . . . . . . . . . . . . . . . . . . . . .

AC

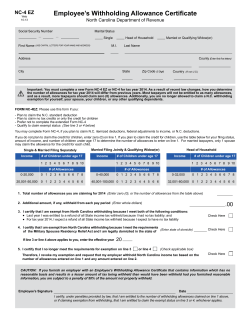

Print home address . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

PL

Social Security no. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

PE TI T

Print full name . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

SACHUSET

AS

TS

Rev. 1/12

EN SE

MASSACHUSETTS EMPLOYEE’S WITHHOLDING EXEMPTION CERTIFICATE

D E PA R

FORM

M-4

R

Zip . . . . . . . . . . . . . . . .

HOW TO CLAIM YOUR WITHHOLDING EXEMPTIONS

File this form or Form W-4 with

your employer. Otherwise,

Massachusetts Income Taxes

will be withheld from your

wages without exemptions.

2. If married and if exemption for spouse is allowed, write the figure “4.” If your spouse is age 65 or over or will

be before next year and if otherwise qualified, write “5.” See Instruction C. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

........

Employer:

3. Write the number of your qualified dependents. See Instruction D. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

........

Keep this certificate with your

records. If the employee is

believed to have claimed

excessive exemptions, the

Massachusetts Department

of Revenue should be so

advised.

1. Your personal exemption. Write the figure “1.” If you are age 65 or over or will be before next year, write “2” . . . . . . .

........

4. Add the number of exemptions which you have claimed above and write the total. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5. Additional withholding per pay period under agreement with employer $ _____________________

A.

Check if you will file as head of household on your tax return.

B.

Check if you are blind.

D.

Check if you are a full-time student engaged in seasonal, part-time or temporary employment whose estimated annual income

will not exceed $8,000.

C.

Check if spouse is blind and not subject to withholding.

EMPLOYER: DO NOT withhold if Box D is checked.

I certify that the number of withholding exemptions claimed on this certificate does not exceed the number to which I am entitled.

Date. . . . . . . . . . . . . . . . . . . . . . . . . . . Signed . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

THIS FORM MAY BE REPRODUCED

THE COMMONWEALTH OF MASSACHUSETTS, DEPARTMENT OF REVENUE

A. Number. If you claim more than the correct number of exemptions, civil

and criminal penalties may be imposed. You may claim a smaller number of

exemptions. If you do not file a certificate, your employer must withhold on

the basis of no exemptions.

If you expect to owe more income tax than will be withheld, you may either

claim a smaller number of exemptions or enter into an agreement with your

employer to have additional amounts withheld.

You should claim the total number of exemptions to which you are entitled to

prevent excessive overwithholding, unless you have a significant amount of

other income.

If you work for more than one employer at the same time, you must

not claim any exemptions with employers other than your principal

employer.

If you are married and if your spouse is subject to withholding, each may

claim a personal exemption.

B. Changes. You may file a new certificate at any time if the number of

exemptions increases. You must file a new certificate within 10 days if the

number of exemptions previously claimed by you decreases. For example,

if during the year your dependent son’s income indicates that you will not

provide over half of his support for the year, you must file a new certificate.

C. Spouse. If your spouse is not working or if she or he is working but not

claiming the personal exemption or the age 65 or over exemption, generally you may claim those exemptions in line 2. However, if you are planning to

file separate annual tax returns, you should not claim withholding exemptions for your spouse or for any dependents that will not be claimed on your

annual tax return.

If claiming a wife or husband, write “4” in line 2. Using “4” is the withholding

system adjustment for the $4,400 exemption for a spouse.

D. Dependent(s). You may claim an exemption in line 3 for each individual

who qualifies as a dependent under the Federal Income Tax Law. In addition,

if one or more of your dependents will be under age 12 at year end, add “1”

to your dependents total for line 3.

You are not allowed to claim “federal withholding deductions and

adjustments” under the Massachusetts withholding system.

If you have income not subject to withholding, you are urged to have

additional amounts withheld to cover your tax liability on such income.

See line 5.

IF THE ALLOWABLE MASSACHUSETTS WITHHOLDING EXEMPTIONS ARE THE SAME

AS YOU ARE CLAIMING FOR U.S. INCOME TAXES, COMPLETE U.S. FORM W-4 ONLY.

CONFIDENTIALITY STATEMENT

In keeping with Emerson Hospital policies it is the responsibility of all Emerson personnel, included but not limited to,

employees, medical staff and other health care professionals, volunteers, agency, temporary and registry personnel;

trainees, students and interns, and Emerson Practice Associates employees, to preserve and protect confidential patient,

employee and business information whether in hard copy, file, oral or computerized form. HIPAA and Massachusetts Law

establish protections to preserve the confidentiality of various medical and personal information and specify that such

information may not be disclosed except as authorized by law or the patient or individual.

Protected Health Information (PHI) is defined as any individually identifiable information in possession or derived from a

provider of health care regarding a patient’s medical history, mental or physical condition or treatment, as well as the

patients and/or their family members’ records, test results, conversations, research records and financial information.

I understand and acknowledge that:

1.

Unauthorized access, use or disclosure is strictly prohibited. Access to all patient, employee, financial and

proprietary information without specific written authorization, is permitted only when required for patient care or to

perform regular duties for the Hospital and only in accordance with this Agreement.

2.

Access to patient information by physician office staff is restricted to patients directly under the care of the

physician or physician group in which they are employed.

3.

All of Emerson Hospital’s information technology resources (including computers, telephones, telecopiers, email, Internet access and all other electronic devices and systems) are property of Emerson Hospital.

4.

Emerson’s Information Technology Resources contain various types of activity-monitoring capabilities that

document and monitor user activities, and that periodic audits are performed.

5.

It is my legal and ethical responsibility to protect the privacy, confidentiality and security of all medical records,

proprietary information and other confidential information relating to Emerson Hospital.

6.

I will discuss confidential information only in the work place as appropriate, and only for job related purposes,

and to refrain from discussing this information outside of the work place or within the hearing of other people who

do not have a need to know this information.

7.

I will only access or disseminate patient care information in the performance of my assigned duties and where

required by or permitted by law, and in a manner which is consistent with Emerson Hospital policies.

8.

Each time I access protected health information I will only use the minimum necessary required to do that

function of my job.

9.

All non-Emerson owned systems used in accessing PHI remotely must meet Emerson’s minimum IS security

recommendations and standards. No PHI will be download to portable media unless encrypted.

10. I will access information/documents needed to perform my job only through Citrix; no paper documents of any

kind shall be removed from the hospital.

11. I will avoid using personal telephones to contact patients unless approved by IS Security.

12. Unauthorized release of confidential information may make me subject to legal action and/or disciplinary action.

13. The law specially protects psychiatric and substance abuse records, any and all references to HIV testing,

positive or negative, and that unauthorized release of such information may make me subject to disciplinary

and/or legal action.

14. I am not to share my log-in user ID and/or password with anyone, and that any access to Emerson systems

made under my log-in/user ID and password is my responsibility.

All individuals must read and sign this form prior to the beginning of their assignment, issuance of a password(s), and

yearly thereafter.

Acknowledgment: I have read and understand the above Confidentiality Statement and I agree to comply with it. I understand that a

violation of any part of the Confidentiality Statement may result in disciplinary action up to and including termination of employment or, for

individuals who are not employed by the Hospital, termination of access to the Hospital’s information systems and/or facilities.

______________________________________

Print Name

___________________

Date of Hire/Transfer

_________________________________________

Mother’s Maiden Name (for security verification purposes)

_________________________

Position/Title

______________________________________

Signature

__________________________________

Department/Physician Practice

__________________________________________

Date

Agreement Form Approved: 05/2006; revised 01/2012; 05/2012; 12/2012; 07/2013; 09/2013; 11/2013; 01/2014;

05/2014

Page 1 of 2

erson Hospital

PrRm urn C?re,,

..'5.:774.):rtal

Touch,

SUBSTANCE-ABUSE-PREVENTION POLICY

I.

Basis of the Policy

Emerson Hospital ("the Company") is committed to protecting the safety, health, and

well-being of its employees, clients, and all people who come into contact with its employees,

workplaces, and property, and/or use its services. The Company recognizes that drug and alcohol

abuse pose a direct and significant threat to this goal, and to the goal of a productive and efficient

working environment in which all employees have an opportunity to reach their full potential.

The Company therefore is committed to ensuring a substance-abuse-free working environment

for all of its employees, and underscores that commitment through implementation and

enforcement of this Substance-Abuse-Prevention Policy ("Policy").

II.

Scope and Applicability

This Policy applies to all employees, including all management employees, and — as

appropriate and relevant — to all job applicants.

III.

Drug and Alcohol Prohibitions

(A)

Drug Abuse

Emerson strictly prohibits the possession, use, sale, attempted sale, purchase,

attempted purchase, conveyance, distribution, transfer, dispensation, cultivation, and/or

manufacture of illicit drugs or other intoxicants at any time, and in any amount or any

manner — as well as the abuse/misuse of alcohol and prescription drugs.

"Illicit drugs" includes all drugs, narcotics, and intoxicants for which possession or

misuse is illegal under federal law, and includes prescription medications for which the

individual does not have a valid prescription. The deliberate use of prescription medications

and/or over-the-counter drugs in a manner inconsistent with dosing directions, and in a manner

which may result in impairment, is considered illicit drug use. In addition, the use of chemical

intoxicants for other than a legitimate and therapeutic purpose is considered illicit drug use.

(B)

Alcohol Abuse and Misuse

Emerson recognizes the enormity and severity of the alcohol-abuse problem in American

society and in American workplaces. The Company therefore prohibits the abuse, misuse, or

possession of alcohol while working, present on the Company's premises (defined as all

buildings, facilities, and property — including parking areas — owned or leased by the Company,

and all places where the Company conducts business, including client facilities), or representing

the Company at any time and in any way.

-2-

The Company also prohibits the use of alcohol, or the possession of opened containers of

alcohol, by employees operating Company-provided vehicles, or operating any other vehicle

while on Company business. Moreover, the use or abuse of alcohol off-the-job which could

impair, to any extent, performance on-the-job, will be considered a violation of this Policy.

Notwithstanding the foregoing, the Company's executives may occasionally authorize

alcoholic beverages at approved Company functions at designated sites. In those situations, an

employee may consume a moderate amount of alcohol, provided that the employee's conduct

and demeanor remain business-like and professional at all times, and provided further that the

employee does not thereafter drive or otherwise engage in any activity which could be hazardous

if the alcohol consumed impaired or affected the employee's ability to perform those activities,

and does not otherwise engage in conduct which would reflect detrimentally on the Company.

(C)

Use of Prescription Medications

Employees who use prescription and/or over-the-counter medications — that the employee

or his or her health-care provider believes may impair the employee's ability to perform his or

her job responsibilities safely — are responsible for notifying their immediate supervisor or the

Human Resources Department so that steps can be taken to minimize the safety risks posed by

such use. Employees may be asked to obtain a doctor's certification that the employee can

safely perform the responsibilities of his or her position. Any information the Company may

learn about an employee's health or medicines will be treated as confidential, and will be shared

with Company personnel only on a need-to-know basis.

IV.

Discipline

Employees in violation of this Policy will be subject to disciplinary action, up to and

including termination, including for a first offense. Employees who are drug tested, and

whose drug tests are confirmed positive, will have their employment with the Company

terminated. Job applicants who test positive will be denied employment. In circumstances

which warrant it, the Company also will notify law enforcement, and will fully cooperate

with any resulting investigation and prosecution.

V.

Employee Assistance

The Company strongly encourages employees who believe that they have a problem with

alcohol or drugs — legal or illegal — to seek assistance before a violation of this Policy is found.

For those employees who self-identify a substance-abuse problem to the Company, sources of

help may be provided. The employee would be referred for a medical assessment, possible

counseling and rehabilitation, and possible re-testing during and after rehabilitation, and would —

at the Company's sole discretion -- be subject to continued employment.

-3VI.

Drug and Alcohol Testing

(A)

Job Applicants

All job applicants must take and pass a mandatory drug test as soon as practical following

their acceptance of a conditional offer of employment, and prior to the actual time they

commence employment with the Company. A confirmed positive test will result in the

withdrawal of an offer of employment. A job applicant's refusal to submit to testing, failure to

fully cooperate in the testing process, and/or attempt to tamper with, substitute for, adulterate,

dilute, or otherwise falsify a test sample will be considered a withdrawal from the application

process, and will result in denial of employment.

(B)

Employees

Employees may be subject to drug and/or alcohol testing as a condition of continued

employment as directed by the Company, at its sole discretion. This includes, but is not limited

to, drug and/or alcohol testing: (1) on a for-cause basis; (2) as part of a post-incident

investigation; (3) during and post-rehabilitation, including return-to-duty testing; (4) as

contractually required by the government or clients and/or (5) as otherwise deemed necessary

and appropriate by the Company.

An employee's refusal to submit to testing; failure to fully cooperate in the testing

process; attempt to tamper with, substitute for, adulterate, dilute, or otherwise falsify a test

sample; and/or any other conduct which would intentionally prevent or compromise a valid test

result will be considered insubordination and will result in termination of employment.

VII.

Consequences of a Positive Test

Any employee whose drug test is positive will be considered to be in violation of this

Policy, and will have his or her employment terminated.

VIII. Notification of Conviction

Consistent with the requirements of the Drug-Free Workplace Act of 1988, the

Company's employees working on federal government contracts must notify the Human

Resources Department of any criminal drug statute conviction for a violation occurring in the

workplace no later than five days after such conviction.

IX.

Searches

When Emerson has any reason to believe that an employee is violating any aspect of this

Policy, he or she may be asked by the Company to submit immediately to a search or inspection.

Such a search or inspection can be required at any time (including during breaks and meal

periods) while on Company premises, representing the Company, or at worksites where the

Company conducts operations.

-4This includes a search of an employee's person and/or the requirement that the employee

make his or her desk, work station, storage locker, briefcase, purse, pockets, wallet, personal

belongings, vehicles, accommodations, and/or any other property that he or she uses, has access

to, and/or has control of, available for inspection.

Any property provided by the Company, or its customers, to an employee is provided

with only a temporary license of use and/or access, and then only relative to the appropriate

performance of the employee's work responsibilities. Such license is specifically subject to the

condition that the employee must, on request, grant access to the property for inspection and

search. The Company reserves and retains the right to remove any lock or other devise securing

the property, as necessary and/or appropriate.

Entry on to the Company's premises or worksites constitutes a consent to searches and

inspections.

An employee's refusal to consent to a search or inspection when requested by Emerson

constitutes a violation of this Policy and — as with other violations of this Policy — is grounds for

adverse employment action, up to and including termination of employment.

X.

General Responsibility

Substance-abuse prevention is everyone's responsibility. The Company expects all of its

employees to recognize and accept this responsibility, and to do their part in assuring that —

working together — we can achieve and maintain a substance-abuse-free working environment

for all Emerson employees.

Attachment: Attachment A — Emerson Hospital Employee Acknowledgement Form

Attachment A

Emerson Hospital

Premium Care. Pelsorm

7.

Employee Acknowledgement Form

I hereby certify that Emerson Hospital has provided me with a copy of its SubstanceAbuse-Prevention Policy; that I have read and do understand the Policy; and that I agree to fully

comply with the terms and conditions of the Policy.

Date

Employee Signature

Employee Printed Name

Date

Witness Signature

Witness Printed Name

4816-7779-9185, v. 1

This Employer

Participates in E-Verify

This employer will provide the Social Security Administration

In order to determine whether Form I-9 documentation is valid,

(SSA) and, if necessary, the Department of Homeland Security

this employer uses E-Verify’s photo screening tool to match

(DHS), with information from each new

employee’s Form I-9 to confirm work

authorization.

IMPORTANT: If the Government cannot

confirm that you are authorized to work,

this employer is required to provide you

written instructions and an opportunity

to contact SSA and/or DHS before taking

adverse action against you, including

the photograph appearing on some

N O T I C E:

permanent resident and employment

Federal law requires

all employers

to verify the identity and

employment eligibility

of all persons hired to work

in the United States.

Citizenship and Immigration Services’

terminating your employment.

authorization cards with the official U.S.

(USCIS) photograph.

If you believe that your employer has

violated its responsibilities under this

program or has discriminated against

you

during

the

verification

process

based upon your national origin or

citizenship status, please call the Office of Special Counsel at

Employers may not use E-Verify to pre-screen job applicants or

to re-verify current employees and may not limit or influence the

choice of documents presented for use on the Form I-9.

For more information on E-Verify,

please contact DHS at:

1-888-464-4218

1-800-255-7688 (TDD: 1-800-237-2515).

If you have a legal right to

work in the United States,

there are laws to protect

you against discrimination

in the workplace.

In most cases employers

cannot require you to be a

U.S. citizen or permanent

resident or refuse any

legally acceptable

documents.

No employer can deny you

a job or fire you because

of your national origin or

citizenship status.

You should know that –

If any of these things have

happened to you, you may

have a valid charge of

discrimination that can be

filed with the OSC. Contact

the OSC for assistance in

your own language.

Or write to:

U.S. Department of Justice

Office of Special Counsel - NYA

950 Pennsylvania Ave., N.W.

Washington, DC 20530

In the Washington, D.C.,

area, please call

202-616-5594, TDD

202-616-5525

Call 1-800-255-7688. TDD

for the hearing impaired is

1-800-237-2515.

Office of Special Counsel for

Immigration-Related Unfair

Employment Practices

U.S. Department of Justice

Civil Rights Division

IF YOU HAVE THE RIGHT TO WORK,

Don’t let anyone take it away.

Emerson Hosp

Acknowledgement of Receipt of

E-verify Informational Posters:

English & Spanish

Notice of E-Verify Participation

Right to Work Poster

IPXOtillAVOIPE.RUMITIO WORK";

Donttafailioner . tiate *away . '

I hereby acknowledge that I have received a copy of the posters

shown above.

Employee Signature

Date:

Parking Form

Application Type:

Access Card

Today’s Date:

Access Badge #:

(6 digit number on the back of the card)

PERMIT HOLDER CONTACT INFORMATION

First name:

Last name:

Department:

Position:

Mr.

Mrs.

Ms.

Dr.

Contact Phone #:

Email Address:

Status:

Full Time

Part Time

Daily Physician

Other: ____________________

Work Schedule:

(Please circle

am or pm)

MON ________am/pm to________ am/pm

SAT________ am/pm to ________am/pm

TUES________am/pm to ________ am/pm

SUN________am/pm to________ am/pm

WED________am/pm to________ am/pm

*Variable _______am/pm to______am/pm

THU________am/pm to________ am/pm

*Describe Variable Here:

FRI_________am/pm to________ am/pm

VEHICLE INFORMATION

Vehicle:

Make

Model

Color

Plate #

Reg. State

#1:

#2:

Desired

Location:

Garage ($15 per month)*

Garage Lower Level ($25 per month)*

* Once Garage or Garage Lower Level access has been granted, you will receive notice by email. The parking cost will be deducted

directly from payroll. This cost is $3.47/week for Garage and $5.78/week for Garage Lower Level. By signing below I understand

and authorize payroll to process the transactions.

Signature:__________________________________

Date:____________________

I certify that the statements made on this application are true and I will notify the parking department whenever a change occurs in

the information given in this application. I also am aware that any falsification could result in the loss of all parking privileges,

individual or carpool. I also understand that any parking permit issued to me is a license to park my vehicle in the designated lot at my

own risk. That my use of the parking permit will not constitute Emerson Hospital or Curbside, Inc. as bailee of my vehicle or its

contents and that neither Emerson Hospital nor Curbside, Inc. nor any of its employees will be responsible for theft or damage to my

vehicle or its contents while in any Emerson Hospital and Curbside, Inc. parking facility. I understand that while Emerson Hospital may

provide some supervision and surveillance of some of the lots there will be times when any lot or portions thereof are not supervised.

Signature:__________________________________

Date: ____________________

Please email this completed form to [email protected] or submit to parking office.

Emerson Hospital

133 Old Road to Nine Acre Corner

Concord, MA 01742

(978) 369-1400

www. emersonhospital.org

Dear New Employee:

The attached policies reflect information that we are responsible for providing to new employees.

The information is important for you to read and, as your employment with us proceeds, you will

be asked to learn other policies and procedures that relate to your employment with Emerson

Hospital.

As mandated by the Massachusetts Board of Registration in Medicine, health care facilities are

required to give written instructions on their incident reporting system and their Patient's Rights

Policy to all new employees involved in patient care.

We are providing you these written instructions, as they must be received within five days of

employment. You will then receive an education and training session during your orientation

program that will assist you in understanding these policies and your responsibilities.

Feel free to contact Patient Care Assessment, extension 3095, if you have any questions

regarding the attached policies 1-4.

In addition, we are providing you with a copy of our Harassment/Sexual Harassment policy and

our Code of Organizational Behavior and Ethics policy which can also be found on the hospital

intranet. You will also receive an overview of Human Resources policies in your orientation

packet. Anytime you have questions regarding Human Resources, please call us at extension

3070.

Please sign below that you have received the policies and information listed. This

acknowledgement will be placed in your personnel file.

I have received copies of the following policies:

1. Code Of Conduct

2. Report of Occurrence/Report of Medication Related Occurrences.

3. Patient and Family Complaints.

4, Patient's Rights and Responsibilities and written notice given to all patients.

5. Devise-Related Incidents: Compliance with the Safe Medical Device Act.

6. Harassment/Sexual Harassment

7. Ethical Concerns

8. Code of Organizational Behavior and Ethics

Employee Signature

Date

AUTHORIZATION FOR DIRECT DEPOSIT OF PAY

NAME:______________________________________________EMPLOYEE ID# ________________EXT:___________

FUNDS MAY BE DIRECTLY DEPOSITED INTO MORE THAN ONE ACCOUNT

ONLY FILL OUT THE SECTION(S) THAT APPLY

EMPLOYEES WHO CHOOSE DIRECT DEPOSIT WILL NOT RECEIVE A PAPER COPY

THEY WILL RECEIVE A COPY ELECTRONICALLY THROUGH THEIR EMERSON OUTLOOK EMAIL ACCOUNT

****YOU MUST ATTACH A VOIDED CHECK IN ORDER TO PROCESS THIS FORM****

BANK NAME

BANK NAME

BANK NAME

TRANSIT

NUMBER

NEW DIRECT DEPOSIT:

ACCOUNT

NUMBER

ACCOUNT TYPE

DEPOSIT AMOUNT

(CHECKING OR SAVINGS)

(FIXED AMT OR NET PAY)

CHANGE EXISTING DIRECT DEPOSIT TO THE FOLLOWING:

TRANSIT

ACCOUNT

ACCOUNT TYPE

NUMBER

NUMBER

(CHECKING OR SAVINGS)

(FIXED AMT OR NET PAY)

CANCEL THE FOLLOWING DIRECT DEPOSIT:

TRANSIT

ACCOUNT

ACCOUNT TYPE

NUMBER

NUMBER

(CHECKING OR SAVINGS)

(FIXED AMT OR NET PAY)

DEPOSIT AMOUNT

DEPOSIT AMOUNT

ALL CHANGES, EXCEPT FOR DOLLAR AMOUNTS WILL GENERATE A LIVE CHECK (RED) FOR TWO WEEKS.

Direct deposits are processed through the New England Automated Clearing House (NEACH) System. The deposits are normally

processed by the NEACH system on Wednesdays. Credits to your accounts will appear 24 to 48 hours after the deposit is processed.

DURING HOLIDAY WEEKS, DEPOSITS MAY BE DELAYED.

IF YOUR DIRECT DEPOSIT REJECTS DUE TO INACCURATE INFORMATION ON THIS FORM, IT WILL

AUTOMATICALLY BE CANCELLED AND YOU WILL CONTINUE TO RECEIVE A LIVE CHECK UNTIL THE

CORRECT INFORMATION IS RECEIVED.

I hereby authorize my employer to have my pay directly deposited according to the above information.

EMPLOYEE SIGNATURE:________________________________________________ DATE:__________________

© Copyright 2026