Real Estate Law In this issue To Enforce or Forbear:

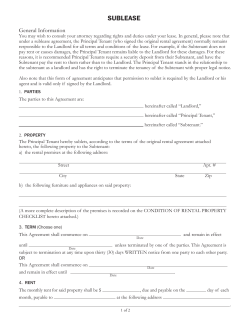

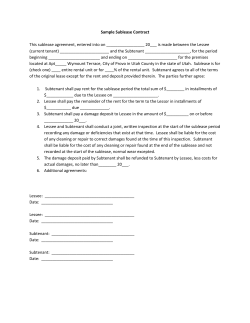

Real Estate Law To Enforce or Forbear: A Lesson in Keeping Your Powder Dry In this issue 1. To Enforce or Forbear: A Lesson in Keeping Your Powder Dry 3. Introducing Ron Fairbloom 4. Subleasing: A Potentially Risky Proposition By Norman Kahn 6. Landlord Financial Hardship - The Experience of American Tenants: Do the Same Rules Apply Here? Introduction Following and sometimes in anticipation of a default by a borrower, the mortgage lender must decide whether to 7. Done Deals proceed to enforce its rights under its security as soon as its right to do so has crystallized, or whether to work with the borrower to attempt to resolve the pending or actual crisis in their relationship. Unless the lender is prepared to waive the default entirely, some positive action is almost always recommended to the lender by its legal counsel. Such action may be simply to demand payment of the amount in default (together with interest and costs incurred by the lender) or, where contemplated by the loan or security documents, repayment of the entire loan (including interest and costs). However, it may also include putting the borrower on notice of the default and providing an opportunity to the borrower to cure such default within a strict time period, especially if the borrower had bargained for and obtained such time before the lender is entitled to call in the loan or enforce its security. Finally, the lender may have a real interest in entering into an arrangement with the borrower by which it would agree not to enforce its remedies for a limited time, and, in return, the borrower agrees to remedy the unsatisfactory situation in a specified manner. This arrangement may also vary the terms of the existing loan and security documents and deal with any other issues related to the lender/ borrower relationship. This arrangement once finalized is often referred to as a “forbearance agreement.” How Does a Forbearance Agreement Work? A forbearance agreement is not a court document, but rather a private contract that binds its signatories in the same way as the loan and security document binds them. It typically describes the unsatisfactory situation in place between the lender and debtor and requires the debtor to acknowledge and correct the situation on specified terms. It will often preserve the rights of the lender arising from the debtor’s defaults during the “forbearance period” set out the agreement. Parties to a forbearance agreement should include in the agreement those additional parties who have some type of relationship with the lender arising out of the primary debt, such as guarantors. The Canadian Mortgage and Housing Corporation and various regulatory authorities may have to be notified of or involved in the forbearance agreement depending on the nature of the loan or the debtor’s business. A forbearance agreement can be employed both before and after a borrower has gone into default. What is Contained in a “Forbearance Agreement”? While “forbearance agreements” take different forms, and may contain as many provisions as the parties feel are MARCH 2010 PAGE 1 REAL ESTATE LAW Aird & Berlis LLP necessary to deal with the situation (so long as they are otherwise lawful), they typically contain the following: (a)introductory recitals describing (i) the loan transaction and briefly describing the documentation relating to the loan and the security; (ii) the events of default which have occurred and (iii) the purpose of the agreement; (b) acknowledgements by the lender and borrower, as is appropriate, confirming the accuracy of all recitals; (c)the terms and conditions which the debtor must fulfill in order to have the lender agree not to enforce its remedies under the loan agreement and security, such as, but not limited to: (i)amendments to the terms of the loan such as a temporary reduction in interest rates, delay in the frequency and timing of periodic loan payments and maturity date, requirements for additional security and/or credit enhancements and more detailed and more frequent reporting requirements; (ii) amendments to existing security where some flaw or defect has been discovered in them; (iii)increased control by the lender to be exercised over the security and the revenue and expenses relating thereto, such as placing a “monitor” or “soft receiver” over the prescribed assets; controls over bank accounts and expenditures; and “lock box” type arrangements; (iv) time period for expiry forbearance period; and (v) payment of all costs of the forbearance arrangements. When Would a Lender Consider Entering into a Forbearance Agreement? The circumstances in which a lender may consider entering into a forbearance agreement or similar arrangement include the following: (a)the borrower has made a good case that with some flexibility in amending the terms of the loan to reflect current market conditions and some period of time to “turn things around,” the borrower will likely be able to put the loan into good standing; (b)the loan and security originally provided by the borrower to the lender contain sufficient flaws, gaps or issues which would make it impossible or very time consuming and difficult for the lender to exercise its remedies; (c) there is a general reluctance on the lender’s part to enforce its remedies; (d)if the lender wishes to better oversee the operations of the debtor, a forbearance agreement may address the appointment of a consultant or monitor of the lender’s choosing; (e) the lender wishes to apply pressure on the debtor’s search to find replacement financing; (f)the lender feels that “take out” financing for the debtor is imminent and the lender wishes to keep the debtor on a tight leash during the intervening period; and (g) the lender wishes to take “fresh security” for the reasons described above.1 When Would a Borrower Consider Entering into a Forbearance Agreement? The circumstances in which a borrower may consider entering into a forbearance agreement or similar arrangement include the following: (a)the borrower wishes to continue managing and operating its real estate project, maintaining its cash flow, without having to satisfy all of its obligations under the initial loan agreement immediately; (b)the borrower believes that when existing dire market conditions pass, it will be able to repay the loan, and does not want the lender exercising its remedies under the loan agreement (i.e. taking possession of the borrower’s real estate project); and (c)the borrower wishes to avoid acrimony with the lender, and to maintain the commercial relationship between the parties.2 See Conclusion, page 3. PAGE 2 MARCH 2010 REAL ESTATE LAW Aird & Berlis LLP Introducing Ron Fairbloom We are pleased to announce that Ron Fairbloom has joined the Aird & Berlis LLP Real Estate Group as an associate. Ron brings a wealth of experience in acting on behalf of a number of the GTA’s and southern Ontario’s most prominent condominium and freehold developers. Ron has been involved in and has assisted his clients with all aspects of condominium development, from the acquisition of the future development lands, drafting condominium disclosure documents on some of the most complex, high-profile projects in the GTA, assisting with construction financing and excess condominium deposit insurance, consulting on various development issues, registering plans of condominium, completing the final closings and turning over control of the condominium to the individual unit owners. In his practice as a real estate lawyer, Ron has brought to market and registered dozens of high and low rise standard condominiums, including residential, mixeduse, commercial and industrial condominium projects, phased condominiums and common elements condominiums. Ron has also acted on behalf of a number of homebuilders in the acquisition of building lots, the sale of newly built homes to third party homebuyers, the acquisition and disposition of raw land and the acquisition and disposition of multi-residential, commercial and industrial buildings. To Enforce or Forbear (continued from page 2) Conclusion Often, though a borrower is about to default on a loan, it would be disadvantageous for the lender to enforce its remedies immediately. Such situations include the situation where the default results primarily from a down market, when the project is otherwise solid and viable, and when the lender is reluctant to assume all the obligations of becoming the owner of the property of the debtor. In lieu of immediate remedial action, a lender would be wise in such circumstances to approach the borrower with the possibility of entering into a forbearance agreement. This arrangement enables the lender to acquire an additional modicum of control over the borrower’s operations, while simultaneously allowing the borrower to continue on its path to solvency, wherein it can satisfy the full amount of the original debt. This strategy also enables the parties, before the lender employs the drastic and often irreparably damaging step of utilizing a remedy, to maintain their commercial relationship. 1 In this circumstance, lenders should be wary of taking new security from a debtor who is on the eve of insolvency, considering that sections 95(1) and 96 of the Bankruptcy and Insolvency Act allow a trustee to review transactions made, even between arm’s length parties, in the three months prior to the date of bankruptcy and to potentially void those transactions. 2 Exercising a remedy may have irreversible consequences on the lender/borrower relationship. It can solidify a sense of mistrust, and once a lender has taken control of the property he has assumed the risks inherent in it and therefore there is no benefit for him to re-establish the original dynamic between the parties. MARCH 2010 PAGE 3 REAL ESTATE LAW Aird & Berlis LLP Subleasing: A Potentially Risky Proposition By Lloyd Cornett and David Himmel (Articling Student) Many commercial tenants, hit hard by the economic downturn, especially those locked into long-term leases, are seeking to sublet a portion of their unused rented space to defray rent and operating costs. From an occupant’s perspective, subleases can be a financially attractive arrangement. Tenants interested in subletting their space are often highly motivated or even desperate, meaning the prospective subtenant should be able to negotiate a sublease at a deep discount from the rent payable under the tenant’s head lease. For instance, at the end of July 2009, sublet space in the GTA was discounted on average by 27% compared to direct space.1 However, these favourable rent rates are tempered by the risks associated with being a subtenant; most notably, the fact that the subtenancy is dependent upon the continuing existence of the head lease and will be automatically terminated if the head lease is dissolved. A subtenant has several statutory rights that may enable it to maintain some aspects of its tenure in spite of the extinguishment of the head lease, but head landlords often require the waiver of those rights in exchange for consenting to the proposed sublease. It is important for a prospective subtenant, before taking advantage of a subleasing opportunity, to have a clear understanding of its rights, in order to fully appreciate the effect relinquishing those rights will have on the security of its sub-tenure. Surrender of Head Lease Section 17 of the Commercial Tenancies Act (the “Act”) grants a subtenant just such a right. In the event of the surrender of the head lease by the tenant, this section provides that the head landlord becomes an assignee of the interest of the tenant in any valid underlease granted by the tenant. In other words, a subtenant’s rights and obligations will not be disturbed when the head lease is surrendered, as section 17 transforms the head landlord into the direct landlord of the subtenant on the terms of the sublease. Section 17 does not apply, however, in instances where the head landlord exercises either a right of re-entry and termination or a contractual option to terminate, both of which will result in an automatic termination of the sublease. Forfeiture of Head Lease In the event of forfeiture or a right of re-entry being exercised by the head landlord under the head lease due to a default by the tenant, section 21 of the Act affords a subtenant the ability to maintain its subtenancy. In these circumstances, section 21 allows a subtenant to apply to Court for an order permitting it to retain its leased premises as a direct tenant of the head landlord, a similar outcome to the application of section 17. However, if such an order is granted, the Court has discretion to impose such terms as to the tenancy as the Court deems just, including the amount of rent payable, costs, expenses, and giving of security, though the term of the new lease cannot exceed the term granted to the subtenant under the sublease. In considering what terms to impose, the Courts have been concerned with not being unfairly prejudicial to the head landlord. This will often lead to the terms of the head lease, rather than the sublease, being imposed (including the higher rent amount normally payable under the head lease). Where the subtenant subleased from the tenant less than all of the space under the head lease, it should also be aware that the Court may require the subtenant to lease the whole premises. The combination of having to pay the higher rent and being required to lease all of the tenant’s premises may render an order obtained under section 21 of little value to the subtenant. Bankruptcy of Head Tenant Section 39(2) of the Act provides that in the event of the bankruptcy or winding up of the head tenant, and provided the sublease was approved or consented to by the head landlord, the subtenant can elect, within three months of the bankruptcy filing or issuance of the winding up order, to take over the head lease on the same terms and conditions, except as to rent. If the subtenant elects to exercise such rights, it must also assume the entire term of the head lease, and the rent payable will become the greater of the rent due under the head lease and that due under the sublease. However, the subtenant is not required to pay any rent arrears. This arrangement allows the subtenant to “trump” the rights of the bankrupt tenant’s trustee to affirm, assign or disclaim the lease within three months after the bankruptcy. Where a subtenant of a part of the leased premises exercises its rights under section 39(2), it is unclear whether (like section 21) the court can require the subtenant to assume the lease for all of the leased premises or only for the portion sublet. PAGE 4 MARCH 2010 REAL ESTATE LAW Aird & Berlis LLP Distress Even if the head lease continues, a subtenant’s inventory, furnishings, equipment and other personal property could be exposed to loss if the tenant fails to pay its rent. If rent for the leased premises is not paid by the tenant and the head landlord exercises its right of distress, (i.e. the right to seize assets on the premises and to sell them to satisfy the rent) the subtenant may use section 32 of the Act to protect its own assets from the distress, provided it has paid the sublease rent to the tenant. Many head landlords will want a prospective subtenant to waive its protection under section 32 prior to consenting to a sublease, because the head landlord’s right of distress may be its only form of security. Mitigating the Risks Outside of the statutory protections described above, which the subtenant may be compelled by the head landlord to relinquish, there are several other means by which a subtenant can minimize the risks occasioned by the uncertainty inherent in a sublease. The subtenant can seek an agreement from the head landlord which would allow the subtenant continued occupation of its premises on the same terms and conditions as in the sublease in the event the head lease is terminated. However, this will rarely be available as the head landlord is unlikely to be interested in continuing to rent out a portion of its premises at the discounted rate that is probably in place under the sublease. In lieu of this, head landlords may be willing to agree to other accommodations, if asked. For example, a head landlord may agree to a provision whereby the subtenant will be permitted a reasonable period during which it may remain in occupancy of the subleased premises after the termination of the head lease. In addition (or alternatively), the head landlord may agree that written notice will be given to the subtenant of any default by the tenant under the head lease, and that the subtenant will have a right to cure such default. While not ideal, these two provisions would give the subtenant some time to either cure the default (or get the tenant to do so), negotiate a new lease directly with the landlord or find other premises. Another option would be for the subtenant to make arrangements with the tenant and the head landlord to have the sublease rent paid directly to the head landlord, eliminating the risk that the subtenant’s funds could be diverted and not passed upstream to the head landlord, while also establishing goodwill between the subtenant and the head landlord. Finally, the subtenant should request, as a condition of the sublease transaction, that the tenant post financial security to be resorted to by the subtenant if the head lease is terminated due to a tenant default or bankruptcy. While such security would offer no protection against the loss of the sublease, if the security was for a sufficiently large amount it might afford protection against the costs and losses which the subtenant would be exposed to if it was forced to suddenly relocate to new premises. A prospective subtenant should be sure to perform the necessary due diligence before entering into a sublease arrangement. Such due diligence should include analyzing all the agreement that make up the head lease, (i.e. the head lease, any amendments to it, estoppels certificates, etc.) ensuring that the tenant has sufficient financial strength to perform its obligations under the head lease and ensuring that a non-disturbance agreement has been granted to the tenant by the head landlord’s mortgagee, so that if the head landlord defaults under its mortgage the tenant’s lease will be protected from termination by the mortgagee, thereby avoiding a consequent termination of the sublease. In considering the financial opportunity to obtain leased premises at a reduced cost, which a sublease may offer, a prospective subtenant should keep in mind the legal and practical risks inherent in the complex, tri-party relationship which a sublease entails. While there are statutory protections which can mitigate such risks to some degree, those protections may have to be foregone in order to obtain the consent of the head landlord to the sublease. There may be other ways to partially reduce these risks, but a sublease will inevitably always represent a riskier proposition than a direct lease. 1 Colliers International GTA Sublease Report, July 2009. MARCH 2010 PAGE 5 REAL ESTATE LAW Aird & Berlis LLP Landlord Financial Hardship - The Experience of American Tenants: Do the Same Rules Apply Here? By Derek McCallum As a result of financial challenges facing a number of American landlords including, most notably, General Growth Properties (the owner of over 220 malls across the United States), much has been written about the impact of landlord bankruptcy on the rights of tenants. Most distressing for American tenants is that a Chapter 11 bankruptcy allows the bankrupt landlord (or its bankruptcy trustee) to elect to terminate existing leases. In such situations, the bankruptcy trustee is also permitted to sell the property of a bankrupt landlord free and clear of any tenant interests in the property, subject to certain conditions. As a result, American tenants are counselled to be very versed on the impacts of landlord bankruptcies and to be prepared to go to court to assert their rights. Fear has risen among tenants operating businesses in Canada that bankruptcies of Canadian landlords could result in similar outcomes. Before exploring the Canadian legislative framework, a brief refresher of the lexicon of financial impecuniosity is helpful. Although the words “bankruptcy” and “insolvency” are synonymous to non-lawyers, they have different meanings in law. Insolvency is a financial condition, whereas bankruptcy is a legal status. Insolvency, as defined in the Canadian Bankruptcy and Insolvency Act (the “BIA”), is the condition used to characterize a debtor that is unable to meet its obligations as they fall due, that has ceased paying its current obligations, or whose property value is insufficient to pay its debts. Bankruptcy, on the other hand, is the legal status of an insolvent debtor that has become “bankrupt” pursuant to a formal proceeding under the BIA. A bankrupt person is always insolvent, but an insolvent person is not necessarily bankrupt. A debtor may also be “in receivership,” meaning that a person has been appointed, either under a security agreement or by a court order, to take possession or control of the business property of an insolvent or bankrupt person. Often times, a bankruptcy will operate contemporaneously with or near the same time as a receivership proceeding and, therefore, a tenant may have to deal with a receiver. The nature of a receiver’s obligations and powers will depend on whether the receiver was judicially or privately appointed and the content of the receivership order. Section 30(1)(k) of the BIA provides that in a bankruptcy, the trustee in bankruptcy may “elect to retain ... assign, surrender, disclaim or resiliate any lease.” As such, it would appear that the legislative authority for a trustee of a bankrupt landlord to terminate a lease exists in Canada. However, case law has held that this section only applies in the case where the tenant is the bankrupt, not where the landlord is the bankrupt. Prior to recent amendments to the Companies’ Creditors Arrangement Act (the “CCAA”), the ability of a debtor seeking CCAA protection to terminate a contract, including a real property lease, was determined by judicial precedent. This judicial precedent permitted a debtor company, subject to certain restrictions, to terminate almost any form of contractual obligation. However, similar to case law under the BIA, the courts did not extend this termination right to real property leases where the landlord was the debtor company. Recent amendments to the BIA and the CCAA (the majority of which were proclaimed in force on September 18, 2009) have sought to clarify the distinction between tenant and landlord bankruptcy. Specifically, section 65.11(10) of the BIA specifies that a lease of real property may not be unilaterally disclaimed or resiliated by a debtor landlord. Section 32(9) of the CCAA contains a similar provision. A tenant dealing with a receiver of a bankrupt or insolvent landlord can take some comfort in the fact that a receiver, whether judicially or privately appointed, will not possess any power greater than that of the landlord to terminate an existing lease. Therefore, provided the lease is not terminable as a result of tenant default, the tenant’s leasehold interest is not threatened by the appointment of a receiver. PAGE 6 MARCH 2010 REAL ESTATE LAW Aird & Berlis LLP Accordingly, for a Canadian tenant, the risk is not that its leasehold interest in a property is terminable as a result of landlord financial hardship, but rather remains in ensuring that the terms of its lease are enforceable against subsequent purchasers and that the priority of such lease is maintained vis-a-vis the landlord’s secured creditors. As such, the traditional safeguards of registering notice of a tenant’s leasehold interest in the Land Registry Office and requiring non-disturbance agreements from any mortgagees holding a prior registered interest in the property remain the proper prudent steps for protecting a tenant’s rights. The author would like to acknowledge the assistance of Steven Graff and Ian Aversa in preparing this article and strongly recommends the more thorough review of these issues which can be found at the following link. Done Deals Represented Canadian Real Estate Investment Trust (CREIT) in its acquisition of a 50% undivided interest in a part of the South Edmonton Common Shopping Centre (SEC), in Alberta. SEC is one of the largest and most successful unenclosed regional power centres in Canada and currently comprises approximately 2.1 million square feet of retail space with retailer-owned anchors including IKEA, Walmart, The Home Depot and Loblaw Real Canadian Superstore. (Hayden Solomons, Mike Smith and David Himmel) Acted for Allied Properties Real Estate Investment Trust in the purchase from Northam Realty Advisors of 151 Front Street West and 20 York Street, Toronto, Ontario, for $192 million. This acquisition was the second largest commercial real estate transaction by dollar value in 2009. (Mike Smith and Steve Pavlides) Acted on behalf of Soave Hydroponics Company and Great Northern Hydroponics, a subsidiary of Soave Enterprises, to help them attain commercial operation of their combined heat and power (CHP) facility under a CHP contract with the Ontario Power Authority. A&B advised on the application and negotiation of the CHP contract, the facility’s financing arrangements, energy and environmental issues and leasing arrangements. (Randy Hooke) Acted as Canadian Counsel to Talon Merchant Capital on its acquisition of a significant equity stake in Liquidation World Inc. (Norman Kahn and Derek McCallum) Acted for Canadian Real Estate Investment Trust (CREIT) with respect to the sale to The Bayfield CT Limited Partnership of a 50 per cent undivided interest in the office complex situated at 110 Yonge Street, Toronto, Ontario. The sale price was $21.75 million. (Hayden Solomons and Christie McNeill) Acted for CREIT with respect to the sale to Canfirst Industrial Properties Fund Inc. of the mixed used commercial complexes situated at 45A and 45B West Wilmot Street, Richmond Hill, Ontario and 90 Nolan Court, Markham, Ontario. The sale price was $24 million. (Hayden Solomons and Christie McNeill) Acted for Anthem 415 Yonge Street Ltd. with respect to the sale of 415 Yonge Street, Toronto, Ontario. The sale price was $32.1 million. (S. Michael Brooks, Hayden Solomons and Sandra Dos Santos) Acted for Concord Adex with respect to the registration and completion of financial closings for Cityplace, Block 24, Neo and Montage projects, comprised of 883 residential condominium units. (Andrew Webster) MARCH 2010 PAGE 7 REAL ESTATE LAW Aird & Berlis LLP If you have questions regarding any aspect of real estate law, please contact any member of the Aird & Berlis LLP Real Estate Group: Lawyers: S. Michael Brooks 416.865.3422 [email protected] Lloyd F. Cornett 416.865.7757 [email protected] Sandra Dos Santos 416.865.3084 [email protected] Ron Fairbloom 416.865.4143 [email protected] Randy T. Hooke 416.865.7784 Norman I. Kahn 416.865.3420 [email protected] Derek J. McCallum 416.865.7728 [email protected] Christie McNeill 416.865.7772 [email protected] Steven Pavlides 416.865.3065 [email protected] [email protected] Edmund C. D. Smith 416.865.7730 [email protected] Michael D. Smith 416.865.7731 [email protected] Hayden Solomons 416.865.3960 [email protected] Andrew Webster 416.865.7777 [email protected] Brookfield Place 181 Bay Street, Suite 1800 Toronto, Ontario, Canada M5J 2T9 T 416.863.1500 F 416.863.1515 www.airdberlis.com Newsletter Editor: Derek J. McCallum This Real Estate Law newsletter offers general comments on legal developments of concern to municipalities, businesses, organizations and individuals, and is not intended to provide legal opinions. Readers should seek professional legal advice on the particular issues that concern them. © 2010 Aird & Berlis LLP. Real Estate Law may be reproduced with acknowledgment. PAGE 8 MARCH 2010

© Copyright 2026