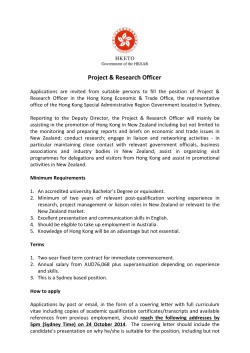

Funds Menu