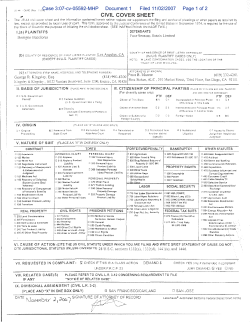

Case: 1:14-cv-02783 Document #: 30 Filed: 09/18/14 Page 1 of... IN THE UNITED STATES DISTRICT COURT EASTERN DIVISION