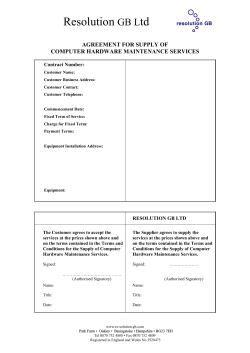

Contract Management Guide