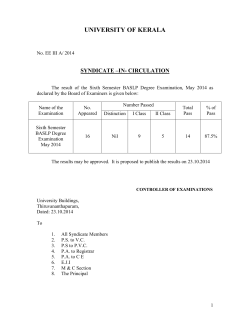

Caution: