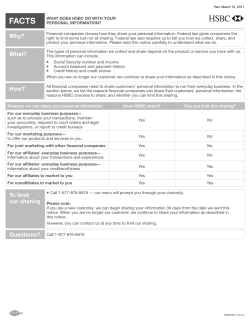

HSBC Advance Bank Account Terms and Conditions