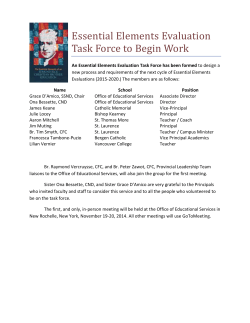

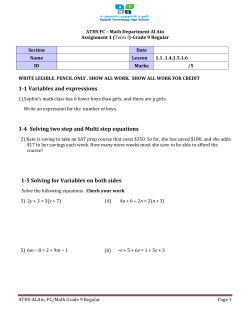

Document 441575