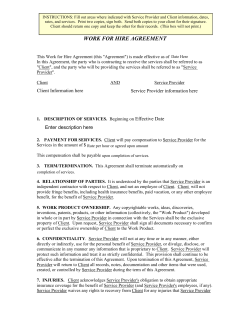

Document 44401