NOT TO BE PUBLISHED WITHOUT THE APPROVAL CENTURY STAR FUEL CORP.,

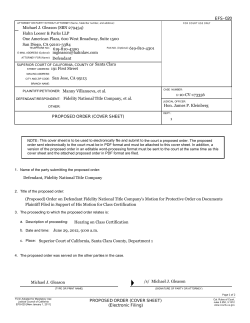

NOT TO BE PUBLISHED WITHOUT THE APPROVAL OF THE COMMITTEE ON OPINIONS CENTURY STAR FUEL CORP., SUPERIOR COURT OF NEW JERSEY Plaintiff, LAW DIVISION vs. BERGEN COUNTY MICHAEL JAFFE, DOCKET No. BER-L-6045-13 Defendant. CIVIL ACTION OPINION Argued: Decided: November 21, 2014 November 21, 2014 Honorable Robert C. Wilson, J.S.C. Philip I. Levitan, Esq., on behalf of Plaintiff, Century Star Fuel Corp. (Fein, Such, Kahn & Shepard, P.C.). Gerald R. Salerno, Esq., on behalf of Defendant, Michael Jaffe (Aronsohn, Weiner Salerno & Bremer, P.C.). INTRODUCTION Before the Court is a motion for summary judgment brought by Philip I. Levitan, Esq., of Fein, Such, Kahn & Shepard, P.C., on behalf of Plaintiff Century Star Fuel Corp., and a crossmotion for summary judgment brought by Gerald R. Salerno, Esq., of Aronsohn, Weiner Salerno & Bremer, P.C., on behalf of the Defendant, Michael Jaffe. Oral argument was requested and heard on November 21, 2014. FACTUAL BACKGROUND THIS MATTER arises out of a purported personal guaranty placed within a contract for the purchase of heating oil and fuel (hereinafter “the Contract”). The Plaintiff, Century Star Fuel Corp., (hereinafter “Century Star”) is a New York corporation primarily engaged in the sale of petroleum fuels. On April 30, 2002, Defendant, Michael Jaffe (hereinafter “Jaffe”), then President of University Residence, Inc. (hereinafter “the Corporation”) obtained a line of credit from Century Star for the purchase of heating oil. Jaffe executed a single-page form (hereinafter “the Contract”), prepared by Century Star, in which the Corporation applied for the credit line to purchase heating oil and fuel, on behalf of the Company. Century Star now asserts that Jaffe, pursuant to nine words within that contract, became personally bound to repay the outstanding line of credit. Century Star, through the certification of its President, Perry Garber, asserts that it is its standard business practice to only extend credit to corporate entities when such a personal guarantee is obtained from an officer of the corporate entity seeking credit. Century Star never contemplated, drafted, or sent written authorization to Jaffe releasing him of his purported obligations under the Contract. There remains a balance due and owing under the Contract for fuel deliveries and maintenance service provided to University Residence, Inc., which Plaintiff now seeks Jaffe to pay personally. The signed writing in this matter contained but a single signature line for Jaffe to sign on behalf of University Residence, Inc. There was no separate and distinct line for him to execute for him to be bound personally. The pertinent language within the “boilerplate” provisions of the Contract upon which Plaintiff rests its case against Jaffe reads as follows: Applicant … agrees and acknowledges that the person who signs this Application has the Authority to do so; and Personally Guarantees all present and future extensions of credit.1 The Applicant was listed as “University Residence Inc.” next to the signature line. Plaintiff contends that this clause is unambiguous and that Jaffe, having signed the single signature line on 1 Exhibit P-1 affixed to this Opinion. 2 the Contract, is bound by its terms. Jaffe, however, contends that the Contract does not and cannot require him to personally guarantee the Corporation’s debts, and that he never intended to do so by executing the Contract. Both parties have moved for summary judgment. RULES OF LAW The New Jersey procedural rules state that a court shall grant summary judgment “if the pleadings, depositions, answers to interrogatories and admissions on file, together with the affidavits, if any, show that there is no genuine issue as to any material fact challenged and that the moving party is entitled to a judgment or order as a matter of law.” N.J.S.A. § 4:46-2(c). In Brill v. Guardian Life Insurance Co., 142 N.J. 520 (1995), the Supreme Court set forth a standard for courts to apply when determining whether a genuine issue of material fact exists that requires a case to proceed to trial. The New Jersey procedural rules state that a court shall grant summary judgment “if the pleadings, depositions, answers to interrogatories and admissions on file, together with the affidavits, if any, show that there is no genuine issue as to any material fact challenged and that the moving party is entitled to a judgment or order as a matter of law.” N.J.S.A. § 4:462(c). In Brill v. Guardian Life Insurance Co., 142 N.J. 520 (1995), the Supreme Court set forth a standard for courts to apply when determining whether a genuine issue of material fact exists that requires a case to proceed to trial. Justice Coleman, writing for the Court, explained that a motion for summary judgment under N.J.S.A. § 4:46-2 requires essentially the same analysis as in the case of a directed verdict based on N.J.S.A. § 4:37-2(b) or N.J.S.A. § 4:40-1, or a judgment notwithstanding the verdict under N.J.S.A. § 4:40-2. Id. at 535-536. If, after analyzing the evidence in the light most favorable to the non-moving party, the motion court determines that “there exists a single unavoidable resolution of the alleged dispute of fact, that issue should be 3 considered insufficient to constitute a ‘genuine’ issue of material fact for purposes of N.J.S.A. § 4:46-2.” Id. at 540. DECISION In the instant matter, the Court is presented with the question of whether the Defendant, Michael Jaffe’s, single signature at the end of a private corporation’s Contract is sufficient to bind Jaffe personally, as a guarantor or secondary obligor of the corporate Contract, while simultaneously binding the Corporation as the primary obligor. There being no dispute that the Contract bound the Corporation to its terms, the Court considers only whether the personal guaranty provision at issue is binding individually upon Mr. Jaffe. “A guaranty is the promise to be liable for the obligation of another person.” Magna Fabrics, Inc. v. New York Art & Shipping, LLC, 2013 N.J. Super. Unpub. LEXIS 2016, *6 (App. Div. 2013). “Essentially, under a guaranty contract, the guarantor, in a separate contract with the obligee, promises to answer for the primary obligor’s debt on the default of the primary obligor.” Id., at *6-*7 (emphasis added); see also, Feigenbaum v. Guaracini, 402 N.J. Super. 7, 18 (App. Div. 2008) (“a contract of guaranty is a secondary and not a primary obligation, and can exist only where there is some principle or substantive liability to which it is collateral.”) “A guaranty is a separate and independent contract. The guarantor is not a party to the contract between the principal obligor and the guarantee, and the principal obligor is not a necessary party to the contract of guaranty.” Great Falls Bank v. Pardo, 263 N.J. Super. 388, 398 n.5 (Ch. Div. 1993); see also, Daimler Trucks N. AM., LLC v. Preziosi, 2011 N.J. Super. Unpub. LEXIS 2188, *11 (App. Div. 2011); Herkimer Inv., LLC v. Goldstein, 2012 N.J. Super. Unpub. LEXIS 1734, *19-*20 (App. Div. 2012). “Generally, a guarantor is a different person from the maker or, if the same person, signs in different capacities when signing as maker and guarantor (e.g., an 4 individual may sign as an officer of a corporate maker and also sign individually as a guarantor of the corporate obligation).” Ligran, Inc. v. Medlawtel, 86 N.J. 583, 589 (1981); see also, Daimler Trucks N. Am., LLC v. Preziosi, 2011 N.J. Super. Unpub. LEXIS 2188, *11 (App. Div. 2011). In the present circumstance, where one party is alleged to have simultaneously signed a contract in two different capacities, the Court must begin its analysis with the premise that “a corporation is an entity separate from its … corporate principals.” Lyon v. Barrett, 89 N.J. 294, 300 (1982). “Ordinarily, officers of corporations are insulated from personal liability for the conduct of the corporation.” Macysyn v. Hensler, 329 N.J. Super. 476, 486 (App. Div. 2000). Other jurisdictions follow the same rationale: “officers or agents of a corporation are not liable on its contracts if they do not purport to bind themselves individually,” and an officer-guarantor may be bound when “the terms of the … Guaranty constitute a deliberately stated, unambiguous and separate expression personally obligating” the officer-guarantor for the corporate debt. PNC Capital Recovery v. Mech. Parking Sys., 283 A.D.2d 268, 270 (N.Y. App. Div. 1st Dep’t 2001). Plaintiff, Century Star, alleges that Defendant Jaffe personally bound himself to be liable for the debts of the Corporation, and as such the Court is mindful that “[t]he requisites of contract formation [and interpretation] apply generally to formation of a contract creating a secondary obligation.” Restat. 3d of Suretyship & Guaranty, §§ 7, 14. As such, “a contract arises from offer and acceptance, and must be sufficiently definite that the performance to be rendered by each party can be ascertained with reasonable certainty.” Weichert Co. Realtors v. Ryan, 128 N.J. 427, 435 (1992) (internal citations omitted) (emphasis added). The parties herein do not dispute the fact that Plaintiff drafted the Contract which Jaffe executed. Therefore, this Court will interpret any ambiguities or inconsistencies against the 5 Plaintiff drafter and in favor of the non-drafting party. Karl’s Sales & Serv. v. Gimbel Bros., 249 N.J. Super. 487, 493 (App. Div. 1991). Here, there was only one Contract, and only one place for Defendant to sign as officer of the Applicant Corporation. The concluding provision of the Contract contains the provision herein at issue: Applicant acknowledges receiving an exact copy of this Agreement, and in consideration of the granting of credit: (1) Agrees and acknowledges that it contains Limited Warranties and Disclaimers, (2) Agrees to be bound by the terms and conditions set forth in this Agreement both front and back, (3) Agrees that the person who signs this Application and Agreement has the authority of Applicant’s Business entity to do so, and Personally Guarantees all present and future extensions of credit, and (4) Agrees and acknowledges that this Application contains an Agreement which secures all of the obligations of the Applicant. Moreover, the Contract concludes with a line for “Applicant (Print Complete Business Name),” wherein Defendant wrote “University Residence Inc.” There is a line requiring the signing party to “(Print Name),” one asking for a “Signature,” and finally one for the date of execution.2 Upon a plain reading of the Contract’s language, it is abundantly clear that the purported guaranty clause is wholly insufficient to bind Defendant as a guarantor of the corporate debts in this matter. The provision cited above throughout refers to the “Applicant” as the party agreeing to be bound by the Contract. The executory portion of the Contract includes the phrase “Applicant (Print Complete Business Name),” leading to the only reasonable conclusion that the Applicant in this matter was University Residence, Inc. The language in subpart 3 of the concluding provision of this agreement is inconsistent and altogether unclear. The subpart begins by noting that the aforementioned Applicant “[a]grees that the person who signs this Application and Agreement has the authority of the Applicant’s Business entity to do so, and Personally Guarantees all present and future extensions of credit.” This compound phrasing is inarticulate at best, and is buried within a provision having nothing to do in any regard with Jaffe individually. 2 Exhibit P-1, affixed to this Opinion. 6 Plaintiff, solely upon this innocuous language, argues that this single subpart binds Jaffe personally. Considering the evidence before the Court in a light most favorable to the Plaintiff, and drawing every reasonable inference in favor of the Plaintiff, the Court finds as a matter of law that there is no genuine factual dispute as to the legal sufficiency of the purported personal guaranty clause in this matter. When a corporate entity is obliged by contract to pay another person or entity any compensation, certain formalities must be met in order for the obligee to hold the corporate representative who executed the contract liable as a personal guarantor in the case of the primary obligor’s default. A corporate entity’s outstanding account or debt may not be imposed as a liability on an officer, director, or shareholder of the corporate entity unless there is a separate and distinct guaranty, which is executed by the officer, director, or shareholder independently of any other clauses or provisions of the agreement. That is, a separate and distinct provision, with a separate and distinct signature, must exist to bind the individual officer, director, or shareholder. A buried clause in a corporate credit agreement is wholly insufficient as a matter of law to bind the signatory corporate representative or agent. Clearly, Century Star Fuel Corp.’s instant Contract fails to accomplish this. Although brevity may have been a stated goal, confusion and ultimately a legally unenforceable contract is the result. For the foregoing reasons, Plaintiff’s motion for summary judgment is DENIED, and Defendant’s cross-motion for summary judgment is GRANTED. It is so ordered. 7

© Copyright 2026