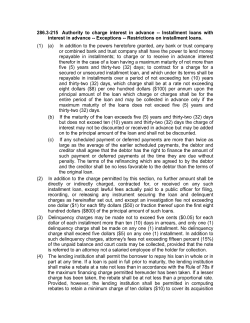

PARTICIPATION AND SERVICING AGREEMENT BY AND BETWEEN INDYMAC VENTURE, LLC