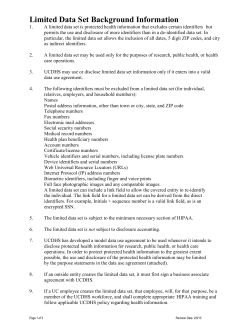

Nonprofit Strategic Partnerships: Building Successful Ones and Avoiding the Legal Traps