Document 4997

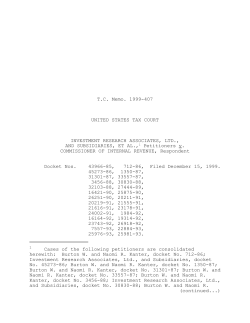

S a- Private

494 Foundation

Q990-PF

Treated as

" Return of Private Foundation OMBNQ 154f+0052

Form or ection 7(a)(1) Nonexempt Charitable Trust

Department ot the Treasury

iniemai Revenue semen Note: The foundation may be able to use a copy of this return to satisfy state reporting requirements

For calendar year 2009, or tax ear beginning O4 /01 , 2009, and ending 03/ 31 , 20 1 0

G Check all that apply Initial return I*-I lnttial return of a former public chan L-I Final return

return TI Address change Name change

Name ofAmended

foundation

A Employer identification number

Use the IRS

label. J. IRA & NICKI HARRIS FAMILY FOUNDATION, INC. 26-0818520

OUWIWISG- Number and street (or P O box number if mail is noi delivered to street address) Roomlsuite B Teienm-N numbeitm me io aim. it-mtiisiiit

P"" C/0 Boas Assoc1ATEs, LLC

orwpe 100 wALL STREET - 11TH FLOOR (212) 440-0800

See Specific

C If exemption application is

lnsuucuons City or town, state. and ZIP code

pending check here - - - --

1IH

D 1 Foreign organizations check here

NEW YORK, NY 10005

H Check type of organization Ill Section 501(c 3 exempt private foundation

I I Section 4947(a)(1) nonexempt chantable trust Other taxable rtvate foundation

I Fair market value of all assets at end Accounting method 1 XI Cash L-I Accrual

2 Foreign organizations meeting the

85% test. check here and attach

computation . . . . . .. .

.ffl

E ll private foundation status was terminated

under section 507(b)(t)(A) check here

. v Cl

of year (from Pan ll, co/ (c), /ine E Other (specify) -------------- - . - - .- - F If the foundation is in a 60-month termination

16) p $ 2 6, 83 1 , 93 8 I (Part I, column (d) must be on cash basis )

under section 507(b)(1)(B), check here

. rl-"I

i td) Disbursements

Analysis of Revenue and Expenses (The (a) Revenue and (M Net mvestme "I (C) Adjusted net for charitable

total of amounls in columns (b), (c), and (d) expenses per

income

IFICOITIS purposes

may

not necessanly equal the amounts in books

column (a) (see page 11 ofthe instructions) )

A/lg* (cash basis only)

Contnbutions itts, grants etc,received(attad*t schedule) ,

if the foundation is not required to

Chee* P li aiiaen sen B . . . . . . . .. .

Interest on savings and temporary cash investments

Dividends and interest from secunties , , ,

NCMQ

4,351.

39, 361.

4,

39,

5a Gross rents . . . . . . . . . . . . . . .. .

b Net rental income or (loss)

Gross

sales pnce

for all 1

assetsonline6a

1,732,152"

351. 0. ATC(-1

361. 0. ATCH 2

1

-220,629.

63 Net gain or (loss) from sale ot assets not on ltne 10

/Nk:AJf5

7 Capital gam net income (from Part IV, line 2) ,

B Net short-term capital gain . . . . . . ...

9

Income modifications - - - - - - - - - --

10 3 Gross sales less retums

and allowances - - - -

b Less Cost ot goods sold ,

c Gross profit or (loss) (attach schedule) . .

11 Other Income (attach schedule) , , , , ,, ,

12 Total Add lines 1 throuqh 11 . . . . . .. .

13 Compensation of officers. directors, tmstees, etc . .

14 Other employee salaries and wages . . . . .

Pension plans, employee benefits , , , ,, ,

16a Legal fees (attach schedule) .A.T,C,H, -4, I ,

c5Qt%lgFot5ssion -( a schedule) .*. .

%*b*

uie)

Interest

. . .avfpig

. . .. . U) 5,

. . . ,.

-5.

-176, 922.

100, 000.

43,

-5. O. ATCH

707.0

0.

0. 0.

26,000.

21,737.

13,

21,

0.7 0.

000.7

0.

737. 0.

42,519.

41,

778. 0.

208, 425.

76,

18, 169.

3

100,000

18, 169

13, O00

0

IIva

%eQ(3IIECh4dtgdmAnsee Q 4-oftho.instn1ctions)

221oepfrifsesausad

.L1. . . . ..gg I I I I I I

4

I Depreciation

(attach sch and depletion ,

0--Oeeu

1 22 Printing and publications , , . , , , , ,, ,

Other expenses (attach schedule) AIIIQH, Y ,

Total operating and administrative expenses.

Add lines 13 through 23 , , , , , . , ,, ,

Contnbutions, gifts, grants paid . . . . .. .

26 Total expenses and disbursements Add lines 24 and 25

3,262,975.

3,471,400.

V 27 Subtract line 26 from line 12

3 Excess of revenue over expenses and disbursements I I

515. O.

515. 0. f 3,

741

131,910

3. 262, 975

76,

394, 885

-3,648,322.

b Net investment income (if negative, enter -O-) ""0

Y c Adjusted net income (if negative, enter -0-). . -00. V

4 tzcarolggivacy Act and Paperwork Reduction Act Notice, see page 30 ofthe instructions * ATCH 6 JSA

QE1

Form 99 0-PF (2009)

1 637611" 526W 12/2/2010 11:30:37 AM V O9-8.6 PAGIEL

Ferm990PF (2009) 2 6- 0 8 1 8 5 2 O Page 2

Attached schedules and amounts in the Begmmng of year

Part Il BaIal1Ce Sheets description column should befor end-of-year

End of year

* I amounts only (See instnictions) (a) BOOK Value

1

Cash - non-interest-beanng I I , I I , I I I I I , , ,, I

2

Savings and temporary cash investments I I I I I , ,I I

3

627, 049

500, 000

500, 000

1,594,762

3,391, 388

3,238,375

15, 618,373

15, 315, 811

22,466,514

22, 982, 568

19, 834,248

26, 831, 938

0.

Less allowance for doubtful accounts V --------- -

Pledges receivable P -------------------- II

5

Grams reeerveble . . . . . . . . . . . . . . . . . .. .

* *K

0.

627, 049

403, 133.

5, 366, 300

Accounts receivable P 5 0 0 r 0 0 04

4

(b) Book Value (c) Fair Market Value

Q

Less allowance for doubtful accounts V --------- I

6

Receivables due from officers, directors, trustees, and other

disqualified persons (attach schedule) (see page 16 of the instn.ictio ns)

7

Other notes and loans receivable (attach schedule) V - II I

Less allowance for doubtful accounts V - - - - - - I - -I II

8

lnventones for sale or use I I I I I I I I I I I I I II I

Prepaid expenses and deferred charges , , , , , , , ,, ,

9

10 a lnvestments - U S and state govemment obligations (attach schedule)

b Investments - corporate stock (attach schedule) I8

11

12

13

14

c Investments - corporate bonds (attach schedule) I I I ,, I

Investments

- land, buildings,

and

equipment

basis 5. . . . . . . . . . . . . .- ..

Less accumulated depreciation 5

(attach schedule) - - - - - - - - - - - - - - --

Investments - mortgage loans , , , , , , , , , , , ,, I

Investments - other (attach schedule) I I I I I I I I II I

Land, buildings,

and

equipment

basis

. ., . . . . . . . . . , . .- .,

Less accumulated depreciation ,

(attach schedule) - - - - - - - - - - - - - - - --

15

Other assets (descnbe PII BLT-Q11 I Q ---------- - I -)

16

Total assets (to be completed by all filers - see the

instructions Also, see page 1, item l) I , , , , , , , ,, ,

11

Accounts payable and accrued expenses I I I I I I II I

is

Grerite Payable . . . . . . . . . . . . . . . . . . .. .

Deferred revenue . . . . . . . . . . . . . . . . . .. .

19

lf zo

Loans from officers, directors, trustees, and other disqualified persons

21

Mortgages and other notes payable (attach schedule) I I I

22

Other liabilities (describe P ---------------- - I Q3

23

Total llabllities (add lines 17 through 22) . . . . . . .. .

Foundations that foiiow sFAs 117, cheek here v I-I

and complete lines 24 throughI26 and lines 30 and 31

24

Unrestricted . . . . . . . . . . . . . . . . . . . . .. .

25

Temporarily restricted . . . . . . . . . . . . . . . .. .

Permanently restricted I , I , , , , , , , , , , , , ,, ,

26

Foundations that do not follow SFAS 117,

check here and complete lines 27 through 31. P

27

Capital stock, trust principal, or current funds I I I I II I

28

Paid-in or prtal surplus, or land, bldg , and equipment fund I I I

29

Retained eamings, accumulated income, endowment, or other funds

30

Total net assets or fund balances (see page 17 of the

rrielruetrerie) . . . . . . . . . . , . . . . . . . . . .. .

31

Total Ilabllities and net assetslfund balances (see page 17

of the instructions) . . . . . . . . . . . . . . . . . .. .

0. 0

22,982,568. 19,834,248

22,982,568. 19,834,248

22,982,568. 19,834,248

Analysis of Changes in Net Assets or Fund Balances

1 Total net assets or fund balances at beginning of year - Part ll, column (a), line 30 (must agree with

end-of-year figure reported on pnor years return) I I I I I

2 Enter amount from Part l, line 27a I I I I I I I I I I II I

3 Other increases not included in Iirie 2 (itemize) r- IAIIQAQHMIEQQTI I1IOI IIIIIIIIIIIIIIIII I I

4 1, 2, 3 u a a u n u n l n u a n Q a 1 n - u1 u

22, 982, 568

-3,648,322

500,002

19,834,248

O.

S Form 990-PF (2009)

5 Decreases not included in line 2 (itemize) p -------- -

6 Total net assets or fund balances at end of year (line 4 minus7lme-5):l3art ll, column (Q), line 30 . . . . .

19,834,248

if Soo, ooo 264-,ervFl6LE (Due F2010( Sifc)

JSA

9E142U1000

637611* 526W 12/2/2010 11:30:37 AM V O9-8.6 PAGE 2

s

Farm

99oPF (zoos) 2 6 - 0 8 1 8 5 2 O Page 3

Pan IV Capital Gains and Losses for Tax on Investment Income

(a) List and descnbe the kind(s) of property sold (e g , real estate,

v 2-story bnck warehouse, or common stock, 200 shs MLC Co )

- SEE PART IV SCHEDULE

IEW" (qoaie

acquired

d) D316 $010

imilfqttiifidyfi 5" - dai- W

(g) Cost or other basis

plus expense of sale

(e) Gross sales price m Degfgifsxgbifwed

(h) Gain or (loss)

(e) plus (t) minus (g)

6

*Complete only) for assets showing -gain in column (Q) and owned by the foundation on 12/31/69

(I)F MV as of12/31/69 as ("12/31/69

lf

2 Capital gain net income or (net capital loss)

(I) Gains (Col (h) gain minus

COI (k), but not less than -0-) or

Losses (from col (h))

(k) Excess of col (i)

over col 0), if any

(1) Ad)usted basis

gain, also enter in Part I, line 7

lf(loss), enter -0- in Part I, line 7 y 2 -220, 629

3 Net short-terrn capital gain or (loss) as defined in sections 1222(5) and (6)

If gain,

also enter

in Part

I, line

8, column

If

(loss).

enter

4) in

Part

I. line(c)8(see

. . pages

. . . .13. .and

. .17. .of. the

. . instructions)

. . . . . . . .1 . . . . . . . . .. . 3 A/OA/E

(3) (d)

Qualification Under Section 49-10(3) for Reduced Tax on Net Investment Income

(For optional use by domestic private foundations subject to the section 4940(a) tax on net investment income )

If section 4940(d)(2) applies, leave this part blank

Was the foundation liable for the section 4942 tax on the distributable amount of any year in the base period? I - . E Yes N0

(CID t b I rat

Base nodIb)

years

If "Yes," the foundation does not qualify under section 4940(e) Do not complete this part

-1 Enter the appropriate amount in each column for each year, see page 18 of the instructions before making any entries

caienaaryear(n?e1ax year beginning in) Adjusted qualifying distnbutions Net value ol nonchantable-use assets (ml (blfglvxiggnby gl (6))

0.051868

2008

1,502,892

28, 975,473.

0.044730

2007 #F

1,721,576.

38,487, 905

0.059004

2006

2,243,393

38, 021, 177

0.048818

2005

1,858,158

38, 062, 902

0.064316

2004

1, 920,728

29,863,886.

3

Total of line 1, coiumn (a) ,

Average distribution ratio for the 5-year base period - divide the total on line 2 by 5, or by the

number of yea rs the foundation has been in existence if less than 5 years , , , , , , ,, ,

2 0.268736

3 0.053747

4

Enter the net value of nonchantable-use assets for 2009 from Part X, line 5 I I . - I .. l

4 26,388,515.

5

Multiply line 4 by line 3 U l

5 1,418,304.

6

Enter 1% of net investment income (1% of Part I, line 27b) I

6

7

Add lines 5 and 6 I I I II .

7 1,418,304.

Enter qualifying distnbutions from Part XII, line 4 . l . I

8

2

8

3, 394, 885.

If line 8 is equal to or greater than line 7, check the box in Part VI, line 1b, and complete that part using a 10/0 tax rate See the

ions onpage 18

Part VI instruct

Form 990-PF (2009)

:I2 ee

STM

9E1m1o69761T 526W 12/2/2010 11:30:37

AM

V O9-8.6 S PAGE 3

JSA

I I"

Form9eoPF(2oo9) 26-0818520

10

Page 4

Part VI Excise Tax Based on Investment Income (Section 4940(a), 4940(b), 4940(e), or 4948 - see page 18 of the instructions)

1a Exempt operalmg foundations described in section 4940(d)(2), check here * LI and enter "N/A" on line1 I I I

Dale of ruling or detennination letter , - - F - - - - - -- -(attach copy of ruling letter If necessary - see Instructions)

b Domestic foundations that meet the section 494O(e) requirements in Part V, check

here P and enier1% ofPari i. ine 21b . . . . . . . . . . . . . . . . . . . . . . . . . . . .. .

c All other domestic foundations enter 2% of line 27b Exempt foreign organizations enter 4%

of Partl, line 12, col (b)

Tax under section 511 (domestic section 4947(a)(1) trusts and taxable foundations only Others enter -0-) ,

Add "HBS 1 and 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. .

Subtitle A (income) tax (domestic section 4947(a)(1) trusts and taxable foundations only Others enter -0-) I I

Tax based on Investment Income Subtract line 4 from line 3 lf zero or less, enter -0

LDL

2...*-*QT

o

CreditsIPayments

a 2009 estimated tax payments and 2008 overpayment credited to 2009 I I 6a 1 O I 000

b Exempt foreign organizations-tax withheld at source I I I I I I I I I I II I m 0

c Tax paid with application for extension of time to file (Form 8868) I I I I II I E O

d Backup withholding erroneously withheld I I I I I I I I I I I I I I I II I E

10, 000.

7 Total credits and payments Add lines 6a through 6d . . . . . . . . . . . . . . . . . .. . . . . . . . .. . 7

8 Enter any penalty for underpayment of estimated tax Check here EI if Form 2220 is attached , , , , ,. ,

9 Tax due. If the total of lines 5 and 8 is more than line 7, enter amount owed I I , , , , , , , , , , I II I P ,lu

10, 000.

10 Overpayment. lfline 7 is more than the total of lines 5 and 8, enter the amount overpaid I I I I I I I I I I P 10

9,500.

11 Enter the amount of line 10 to be Credited to 2010 estimated tax b 500 . Refunded p 11

Part Vll-A Statements Regarding Activities

Yes No

1a Dunng the tax year, did the foundation attempt to influence any national, state, or local legislation or did it

PHFYICIPZIG Ofmfdfveneln any POIIUCSICSHIPHIQN7 . . . .. . . . . . . . . . . . . . . . . . . . . . . . .. . . . . .

1b X-I

b Did it spend more than $100 dunng the year (either directly or indirectly) for political purposes (see page 19

oftheinstructionsfvrdeinilionl? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. .

lf the answer is "Yes" to 1a or 1b, attach a detailed descnption of the activities and copies of any matenals

published or distnbuted by the foundation in connection with the activities

c Did the foundation tile Form1120-POL for this year? I I I I I I I I I I I I I I I I I I I I I I I I I I I I I I I I II I

d Enter the amount (if any) of tax on political expenditures (section 4955) imposed dunng the year

(1) on me foundation PS 0 - (2) On foundation manageis P $ 0

e Enter the reimbursement (if any) paid by the foundation during the year for political expenditure tax imposed

on foundation managers P $ 0

2 Has the foundation engaged in any activities that have not previously been reported to the IRS? I I I I I I I I I I I II I

lf "Yes," attach a detailed descnption of the activities

3 Has the foundation made any changes, not previously reported to the IRS, in its governing instrument, articles of

incorporation, or bylaws, or other similar instruments? Il "Yes, " attach a confomied copy of the changes , I I , I I , II I

I5

I1c X

it

2X

...-.Li

4a Did the foundation have unrelated business gross income of $1,000 or more during the year? , , , , , , , , , , , , ,, ,

b If "Yes," has it hled a tax return on Form 990-T for this year? I I I I I I I I I I I I I I I I I I I I I I I I I I I I II I

Was there a liquidation, termination, dissolution, or substantial contraction dunng the year? I I I I I I I I I I I I I I I II I l,i,.,-X*

l

If "Yes, " attach the statement required by General Instruction T

1 6 Are the requirements of section 508(e) (relating to sections 4941 through 4945) satished either

0 By language in the governing instrument, or

o By state legislation that effectively amends the governing instrument so that no mandatory directions that

conflict with the state law remain in the governing instrument? , , . , , , , , , , , , , , , , , , , , , , , , , , , ,, ,

7 Did the foundation have at least $5,000 in assets at any time dunng the year? lf "Yes,"complete Part ll, col (c), and Part XV

Ba Enter the states to which the foundation reports or with which it is registered (see page 19 of the

eX

..-6-.L,

instructions) P -FE*-I ----------------------------------------------------------- -

b lt the answer is "Yes" to line 7, has the foundation fumished a copy of Fom1 990-PF to the Attomey General

(or designate) of each state as required by General/nstruction G7lf "No, " attach explanation , , , , , , , , , , , , ,, , ,

l 9 ls the foundation claiming status as a private operating foundation within the meaning of section 4942())(3) or

l

4942(j)(5) for calendar year 2009 or the taxable year beginning in 2009 (see instructions for Part XIV on page

27)? If "Yes, "comp/die P-WX/V . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. .

10 Did any persons become substantial contributors during the tax yeaft If "Yes," attach a schedule listing their

frames and addresses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . . . . . . . . . . . . . . . . .. .

aux

9X

1o X

Form 990-PF (zoos)

W .isixseiuoiooo

63761T 526W 12/2/2010 11:30:37 AM V O9-8.6

PAGE 4

1P

Form"99cPF (2009) 2 6-O8 18520 Page 5

Part Vll-A Statements Regarding Activities (continued)

N 11 At any time dunng the year, did the foundation, directly or indirectly, own a controlled entity within the

meaning of section 512(b)(13)? lf "Yes," attach schedule (see page 20 of the instructions) . . . . . . . . . . . . . . . .. .

12 Did the foundation acquire a direct or indirect interest in any applicable insurance contract before

August 17, 2008? . . . . . . . . . . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. .

13 Did the foundation comply with the public inspection requirements for its annual retums and exemption application? . . . . .

Website address P- - - - , ------------------------------------------------------------------- -

14 The books are in care of PJQQBQ ,,A,S,S,O-QI,,A,T,,E.S.I, -------------- - - Telephone no P - , , , Q"-0-8-O-O ----- -

Located at vl99-l1lEEI:-E?13*E@"E-1-1115.EE0.Q1ilf.Ei"..Y.0.1i1Sf-.tDL ........... -- zip + 4 P 3.099? ....... - -

15 Section 4947(a)(1) nonexempl chantable trusts filing Form 990-PF in lieu of Form 1041 - Check here - - . - -- - - - - - - - - - -- - *E

and enter the amount of tax-exempt interest received or accrued dunng the year , . . . . . . . . . . . , . . .. , P I 15 I

Part Vll-B Statements Regarding Activities for Which Form 4720 May Be Required

File Form 4720 if any item is checked in the "Yes" column, unless an exception applies. 1 YES* N0

1a During the year did the foundation (either directly or indirectly) -,

(1) Engage in the sale or exchange, or leasing of property with a disqualified person? , , , , , ,, , EI V95 L N0

(2) Borrow money from, lend money to, or otherwise extend credit to (or accept it from) a 1

disqualified person? . . . . . . . . . . . . . . . . . . .. . . . . . . .. . . . . . . . .. . Yes .L N0

(3) Furnish goods, services, or facilities to (or accept them from) a disqualified person? . . . . .. . Yes .L N0

(4) Pay compensation to, or pay or reimburse the expenses of, a disqualified person? , , , , , ,, , Yes L N0

(5) Transfer any income or assets to a disqualified person (or make any of either available for ...

the benefit or use ofa disqualified person)? . . . . . . . . . . . . . . . . . . . . . . . . .. . EI Yes L N0

(6) Agree to pay money or property to a government official? ( Exception. Check "No" if

the foundation agreed to make a grant to or to employ the official for a period after 1

termination of government service, if terminating within 90 days ) . . . . . . . . . . . . . .. . Cl V95 -X.. N0

, b If any answer is "Yes" to 1a(1)-(6), did any of the acts fail to qualify under the exceptions descnbed in Regulations

section 53 4941(d)-3 or in a current notice regarding disaster assistance (see page 20 of the instructions)? - - - - .-.-. - - - 2.1.-L

Organizations relying on a current notice regarding disaster assistance check here . . . . . . . . . . .. . * 1 1

c Did the foundation engage in a prior year in any of the acts descnbed in 1a, other than excepted acts. that

were not corrected before the first day of the tax year beginning in 2009? , , , , , , , , , , , , , , , , , , , , , , , , ,, , 10 X

2 Taxes on failure to distnbute income (section 4942) (does not apply for years the foundation was a pnvate

operating foundation defined in section 4942())(3) or 49420)(5))

, a At the end of tax year 2009, did the foundation have any undistnbuted income (lines 6d and

No

6e, Pan Xlll) for tax year(s) beginning before 2009? . . . . . . . . . . . . . . .. . . . . . . .. . lj YES

lf"Yes," list the years 5 - - - - - - - - - - , - - - - - - -- Q , - - - - - -- - , - - - - - --

b Are there any years listed in 2a for which the foundation is not applying the provisions of section 4942(a)(2)

(relating to incorrect valuation of assets) to the year*s undistnbuted income? (lf applying section 4942(a)(2)

to all years listed, answer "No" and attach statement- see page 20 of the instnictions) . . . . . . . . . . . . . . . . . .. . H-.i.-XL

c Ifthe provisions of section 4942(a)(2) are being applied to any of the years listed in 2a, list the years here

V . . . . . . . . . . . . . . . . . .- - . . . . . . .- - . . . . . . .-

3a Did the foundation hold more than a 2% direct or indirect interest in any business

No

emefpflse SlaflYUme dUflfl9lhe Year? . . . . . . . . . .. . . . . . . . . . . . . . . . . . .. . E Yes

b lf "Yes," did it have excess business holdings in 2009 as a result of (1) any purchase by the foundation or

disqualified persons after May 26, 1969, (2) the lapse of the 5-year penod (or longer penod approved by the

Commissioner under section 4943(c)(7)) to dispose of holdings acquired by gift or bequest, or (3) the lapse

of the 10-, 15-, or 20-year first phase holding period? (Use Schedule C, Fomi 4720, to determine if the

. . . .viii

...li-X.

foundation had excess bus/ness holdings /n 2009) , , , , , . , . , , , , , , , , , , , , , , , , , , , , , ,, ,

l 4a Did the foundation invest dunng the year any amount in a manner that would jeopardize its chantable purposes?

b Did the foundation make any investment in a pnor year (but after December 31, 1969) that could jeopardize its

chantable purpose that had not been removed from ieopardy before the first day of the tax year beginning in 2009? . . . 4b X

Fam 990-PF (2009)

1 JSA

QE1-ssoiooo

637611" 526W 12/2/2010 11:30:37 AM V O9-8.6 PAGE 5

Fomi 99oPF (zoos) 2 6- O 8 1 8 5 2 0 Page (jr

Part Vll-B Statements Regarding Activities for Which Form 4720 May Be Required (cont/nued)

" 5a Dunng the year did the foundation pay or incur any amount to -,

(1) Carry on propaganda, or otherwise attempt to intiuence legislation

4945(e))?

... (section

... E:JYeS

.JiNo

(2) Influence the outcome of any specific public election (see section 4955), or to carry on,

directly or indirectly, any voter registration drive? I D I I I I - I . . I I . - . I1 I

(3)

(4)

. . . ... Yes I

No

. . . ... Yes :

No

. . . ... Yes -X No

Provide a grant to an organization other than a chantable. etc , organization described in

section 509(a)(1), (2), or (3), or section 4940(d)(2)? (see page 22 of the instructions) , . . . ... lilies (E No

Provide a grant to an individual for travel, study, or other similar purposes? , , , ,, ,

(5) Provide for any purpose other than religious, chantable, scientific, literary, or educational

purposes, or for the prevention of cruelty to children or animals? I , I I - . I , ., u

b lf any answer is "Yes" to 5a(1)-(5), did any of the transactions fail to qualify under the exceptions described in

Regulations section 53 4945 or in a current notice regarding disaster assistance (see page 22 ofthe instructions)2 . . . . . . . 5b X

Organizations relying on a current notice regarding disaster assistance check here , , , , , , , , , , , , ,, , P 1 t

c lf the answer is "Yes" to question 5a(4), does the foundation claim exemption from the tax *

because it maintained expenditure responsibility for the grant? , . . . . . . . . . . . . . . . .. . V95 1 N0

lf "Yes, " attach the statement required by Regulations section 53 4945-5(d)

6a Did the foundation, during the year, receive any funds, directly or indirectly, to pay premiums 2

on a personal benefit contract? . . . . . . . . . . .. . . . . . . . . . . . . .. . . . . . . .. . E) YES N0

b Did the foundation, during the year, pay premiums, directly or indirectly, on a personal benefit contract?

If "Yes" to 6b, file Form 8870

1a At any time dunng the tax year, was the foundation a party to a prohibited tax shelter transaction? , I W Yes X No

b If yes, did the foundation receive any proceeds or have any net income attnbutable to the transaction? . . . . . . . . . . .. . 1b X

Pan viii information About Officers, Directors, Trustees, Foundation Managers, Highly Paid Employees,

and Contractors

1 List all officers, directors, tnistees, foundation managers and their compensation (see page 22 of the instructions).

b Title, and avera e C) Compensation (d) co t b io i

(a) Name and address ( )hours per week g ((If not paid, enter employers ri)e::an?::i:ns (e2,(E,y:ear(f,igg?ginl"

devoted to position -0-) and deferred compensaiion

ATTACHMENT ll 100,000- 0- 0

2 Compensation of tive highest-paid employees (other than those included on line 1 - see page 23 of the instructions).

lf none, enter "NONE."

a c inn no i

lb) Title and ever"-*Q9 (Jn if eeumignio (e) E ense account.

devoted to position p o%s,,.TILnS:,,or,ge

(a) Name and address of each employee paid more than $50,000 howg per week (C) Compensation Ia P V d d fe d omg): allowances

(NONE

O. O. O.

Total number of other employees paid over $50,000 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . PI

Form 990-PF (2009)

JSA

9E)-160 1 000

63761T 526W 12/2/2010 11:3O:37.AM V O9-8.6 PAGE 6

Fami99oPF(2oo9) 26-0818520 Page?

-3 o.

I

NONE *

i Part VIII lnfonnation About Officers, Directors, Trustees, Foundation Managers, Highly Paid Employees, A

and Contractors (continued)

3 Five highest-paid independent contractors for professional services (see page 23 of the instructions). lf none, enter "NONE."

(a) Name and address of each person paid more than $50,000 (b) Type of service (c) Compensation

O.

Total number of others receiving over $50,000 for professional services . . . . . . . . . . . . . . . . . . . . . . . . .. . PI NONE

Part IX-A Summary of Direct Charitable Activities

Lisl the foundation"s four largest direct chantable activities dunng the tax year Include relevant statistical information such as the number Expenses

of organizations and other beneicianes served, conferences convened, research papers produced, etc

1 - EIL-EA? E -NQQQL *Q1-itil -FLQ L1I1D-A-TuI-O-N- jj- PQI- EQIYQIJYIEP- -IN AN). -D-I-R.E-C-T ---------------- -

CE&B2?5EEE-5Q?1Y111E%LLHUiETE99B5.F9B?95P IS.?51?U3R9RTL.BX- - --

EONTRIEUTIONS, OTHER ORGANIZATIONS EXEMPT ENbER"ENEERNXL " - - " " - " - --

2-BEYENQE-QQQE-SEQ3E@iJ?@LGD-EU4 ....... -

4

Part IX-B Y Summary of Program-Related Investments (see E-:ge 23 of the instructions)

Desonbe the two largest program-related investments made by the foundation dunng the tax year on lines 1 and 2

Amount

1-915 ....................................................... -

O.

2 N/A

0.

All other program-related investments See page 24 of the instructions

3 N /A

O.

Total. Add lines 1 through 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . P 0 .

Form 990-PF (2009)

JSA

9E14651000 .

63761T 526W 12/2/2010 11:30:37 AM V O9-8.6 PAGE 7

I

Form 99dPF(2oo9) 26-0818520

s

Page 8

Minimum investment Return (All domestic foundations must complete this part Forei gn foundations,

see page 24 of the instructions.)

1 Fair market value of assets not used (or held for use) directly in carrying out charitable, etc ,

purposes

c Fair market value of all other assets (see page 24 of the instructions) I I I I I I I I I I I I I I I I II I

1a

1b

1c

e reel reed "nee re- e. and ei . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. .

1d

a Average monthly farr market value of securities I I I I I I I I I I I I I I I I I I I I I I I I I I I I II I

b Average ef meethlv eaeh balafieee . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. .

2,684,118

2, 954,129

21, 152, 124

26, 790, 371

e Reduction claimed for blockage or other factors reported on lines 1a and

1c (attach detailed explanation) I I I I I I I I I I I I I I I I I I II I I 1e I

SSM--neeffom--nerd """" ""

2 Acquisition indebtedness applicable to line 1 assets I I I I I I I I I I I I I II I

2

O

26, 790, 371

3

4 Cash deemed held for charitable activities Enter 1 1/2 % of line 3 (for greater amount, see page 25 I I 1

401,856

ofthe meffeet-enel . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. .

5 Net value of noncharitable-use assets. Subtract line 4 from line 3 Enter here and on Part V, line 4

6 Minimum investment return. Enter 5% ofeline 5 , , , , , , , , , , , , , , , , I , I , , , , , ,, ,

26, 388, 515

I6

1,319, 426

Part Xl Distributable Amount (see page 25 of the instructions) (Section 4942(j)(3) and (j)(5) pnvate operating

foundations and certain foreign organrzations check here P (-1 and do notcomplete this part)

1 Minlmum investment return from Part X, line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. .

1,319,426

1

2a Tax on investment income for 2009 from Part Vl, line 5 I I I I I II I 2a O

b Income tax for 2009 (This does not include the tax from Part Vl) I I I

C

I - u e u . Q - . n - . . - - . - n - - . - - . - - u n - - . - - . - . u - - I u . uI .

0

2c

1,319,426

Distributable amount before adjustments Subtract line 2c from line 1 I I I I I I I II I

Recoveries of amounts treated as qualifying distributions I I I I I I I I I I I I I I I I I I I I I I II I

1,319,426

3 4 - n . - . I - - . n u u u - - u . n . - - - u u a - - u . . . . - . u - n - - u . a u .u 1

Deductlon from distributable amount (see page 25 of the instructions) I I I I I I I I I I I I I I I II I

Distributable amount as adjusted Subtract line 6 from line 5 Enter here and on Part Xlll,

line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. .

7

1,319,426

1a

3,394,885

Part XII Qualifying Distributions(see page 25 of the instructions)

1 Amounts paid (including administrative expenses) to accomplish charitable, etc , purposes

a Expenses, contributions, gifts, etc - total from Part I, column (d), line 26 I I I I I I I I I I I I I I II I

b Program-related investments - total from Part IX-B I I I I I I I I I I I I I I I I I I I I I I I I I II I

2 Amounts paid to acquire assets used (or held for use) directly in carrying out charitable, etc , 1

1b

O

Purposes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . , 2

0

3 Amounts set aside for specific charitable projects that satisfy the

a Suitability test (prior IRS approval required) I I I I I I I I I I I I I I I I I I I I I I I I I I I I I II I

b Cash distribution test (attach the required schedule) I I I I I I I I I I I I I I I I I I I I I I I I II I

3a

3b

4 Qualifying distributions. Add lines 1a through 3b Enter here and on Part V, line 8, and Part Xlll, line 4 I I I II I

5 Foundations that qualify under section 4940(e) for the reduced rate of tax on net investment income

4

Enter 1% of Part I, lme 27b (see page 26 of the instructions) I I I I I I I I I I I I I I I I I I I I II I

5

0

O

3,394, 885

6 Adjusted qualifying distributions. Subtract line 5 from line 4 I I I I I I I I I I I I I I I I I I I I II I 6 3 , 394 , 885

Note: The amount on line 6 will be used in Part V, column (b), in subsequent years when calculating whether the foundation

qualifies for the section 494O(e) reduction of tax in those years

Form 990-PF (2009)

JSA

SEM701000

63761T 526W 12/2/2010 11:30:37 AM V 09-8.6 PAGE 8

(a) b

( ) (C) ld)

Form990PF(2009)

26-0818520 Page9

Part XIII Undistributed Income (see page 26 ofthe instructions) I

1

Distnbutable amount for 2009 from Part Xl,

2

Undistnbuted income, if any, as ol the end of 2009

Corpus Years pnor to 2008 2008 2009

1,319,426.

"ne 7 . . . . . . . . . . . . . . . . . . .. .

3

Enter amount for 2008 only I I I I I I, , , ,

b

Tolalforpnoryears 20 .20 I20

3

*I

1,191,812

From

2004 0

Fmm 2005 I I I II I 0

Excess distnbutions carryover, if any, to 2009

a

b

c

d

From 2000 I I I II I 0

From 2007 I I I II I 0

e

Fromzoos I I I III 36,613

I

Total of lines 3a through e I , I I I I I I II I

4

lme4 f S

36,613.

Qualifying distnbutions for 2009 from Part XII,

1, 191,812

I Applied to 2008, but not more than line 2a I I I

b Applied to undistnbuted income of pnor years (Election

required - see page 26 ol the instructions) I I I II I

Treated as distnbutions out ot corpus (Electron

required - see page 26 of the instructions) I I I I

d Applied to 2009 distributable amount I I I I

e Remaining amount distnbuted out of corpus I ,

5

Excess distributions carryover applied to 2009 I

(lf an amount appears in co/umn (d), the same

C

1,319,426.

883,647.

amount must be shown in column (a) )

Enter the net total of each column as

6

indicated below:

a Corpus Add lines 31, 4c. and 4e Subtract line 5

b

920,260.

Prior years" undistnbuted income Subtract

Iine4b from line 2b I I I I II I I I I I II I

C

Enter the amount of prior years" undistnbuted

income for which a notice of deficiency has been

issued, or on which the section 4942(a) tax has

been previously assessed . . . . . . . . . .. .

d

Subtract line Sc from line 6b Taxable

amount-see page 27 ol the instructions I I I I

e Undistnbuted income for 2008 Subtract line

4a from line 2a Taxable amount - see page

27 of the instnictions . . . . . . . . . . .. .

f

NON E

Undistnbuted income for 2009 Subtract lines

4d and 5 from line 1 This amount must be

distnbuled in 2010 I I I I I I I I I I I I II I

NONE

Amounts treated as distnbutions out of corpus

7

to satisfy requirements imposed by section

17o(b)(1)(F) or 4942(g)(3) (see page 27 of the

instructions) . . . . . . . . . . . . . . . .. .

O.

instructions) . . . . . . . . .. . . . . . .. .

0.

Excess distnbutions carryover from 2004 not

applied on line 5 or line 7 (see page 27 of the

Excess distributions carryover to 2010.

9

Subtract lines 7 and 8 from line Sa I I I I II I

920,260.

10

Analysis of line 9

a Excess from 2005

b Excess from 2006 I I

c

d

6

Excess from 2007 I I 0

Excessfrom 2008 I I 36, 613

Excessfrom2009 , , 883,647.

Fomi 990-PF (2009)

ak See STMT&

JSA

9514001000

637611" 526W 12/2/2010 11:30:37 AM V 09-8.6 PAGE 9

4I

Fom*199oPF (2009) 26-0818520 Page 10

Private Operating Foundations (see page 27 of the instructions and Part Vll-A, question 9) NOT APPLICABLE

t 1 a lf the foundation has received a ruling or determination letter that it is a private operating

foundation, and the ruling is effective for 2009, enter the date of the ruling . . I - U I . . - I .I . ) l

b Check box to indicate whether the foundation is a pnvate operating foundation described in section ( l 4942())(3) or l I 4942())(5)

Taxlesser

year Pnor

3 the

yearsad- (e) Total

23lusted

Enter

of

net incomethe

from Part

(a) 2009 (b)

2008

lor the minimum investment , (C) 2007 (d) 2006

retum from Part X for each

year listed . . I U Dl .

b 85%ofline2a , , , , ,

C Qualifying distributions from Part

Xll, line 4 for each year listed ,

d Amounts included in line 2c not

used directly for active conduct

of exemptacwitiea . . . . .

8 Qualifying distnbutions made

directly for active conduct of

exempt activities Subtract line

2d from line 2c , , , ,, .

3 Complete 3a, ta. or c for the

allemative test relied upon

8 *Assets* altemative test - enter

(1) Value ofall assets . . .

(2) Value of assets qualifying

under semen

4942(.l)(3)(B)(l)- - - -

b "Endowment" altemative lest

enter 2/3 of minimum invest

ment retum shown in Part X,

linetifor eachyearlisted I .

C "Support" eltemalive test - enter

(1) Total support other than

gross investment income

(interest, dividends rents.

payments on secuntias

loans (section 5t2(a)(5)),

*""*Y*"***) . . . .. .

(2) Support from general

public and 5 or more

exempt organizations as

provided in section 4942

(l)(3)(5)("l) . . . .- .

(3) Largest amount of sup

port from an exempt

organization , , , , ,

(4) Gross investment income ,

Pan XV Supplementary information (Complete this part only if the foundation had $5,000 or more in assets

at any time during the year -see page 28 of the instructions.)

1 lnfonnation Regarding Foundation Managers:

l a List any managers of the foundation who have contributed more than 2% of the total contributions received by the foundation

before the close of any tax year (but only if they have contributed more than $5,000) (See section 507(d)(2) )

NONE

b List any managers of the foundation who own 10% or more of the stock of a corporation (or an equally large portion of the

ownership of a partnership or other entity) of which the foundation has a 10% or greater interest

NONE

2 lnfonnation Regarding Contribution, Grant, Gift, Loan, Scholarship, etc., Programs:

Check hereh if the foundation only makes contributions to preselected charitable organizations and does not accept

unsolicited requests for funds lf the foundation makes gifts, grants, etc (see page 28 of the instructions) to individuals or

organizations under other conditions, complete items 2a, b, c, and d

a The name, address, and telephone number of the person to whom applications should be addressed

1 b The fom1 in which applications should be submitted and information and materials they should include

c Any submission deadlines

d Any restrictions or limitations on awards, such as by geographical areas, charitable fields, kinds of institutions, or other

factors

951551000

Form

990-PF

(2009)

63761T 526W 12/2/2010

11:30:37

AM V O9-8.6

PAGE 10

Form saopr (zoos)

i.

Part XV Supplementary Information (continued)

3 Grants and Contributions

During

e

" " " " Paid

h Year

or tApproved

26-0818520

Page 11

for Future Payment

Re*"P*e"* Fszsissii" P""1.zzf,aLi21,"* of

Namean d address (home or business) 0, ,.,,,,.,,,,.,,, ,,.,,,,,.,,,,,,,,

a Paid dunng the year

SEE LIST ATTACHED

recipient

3, 262, 975.

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . . . . . . . . . ...P3a

3,262, 975.

b Approved for future payment

0.

NONE

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. .

3214911000 ,

63761T 526W 12/2/2010 11:30:37 AM V O9-8.6

P3b

O.

Farm 990-PF (2009)

PAGE 11

Fomi990-PF(2oo9) 26-0818520 Page12

* Part XVI-A Analysis of Income-Producing Activities

Enter gross amounts unless otherwise indicated Unrelated business income Excluded by section 512, 513, or 514

(el

Related or exempt

function income

(3) (b) (C) (d) See page 28 of

1 Program service revenue Business code Amount Exctusion code Amount he Instructions )

b

c

d

e

f

g Fees and contracts from govemment agencies

2 Membership dues and assessments , , l , ,

4,351.

3 interest on savings and temporary cash investments

39, 361

4 Dividends and interest from secunties l I ,

5 Net rental income or (loss) from real estate

a Debt-financed property , , , I , ,l l ,

b Not debt-financed property , , , , ,, ,

6 Net rental income or (loss) from personal property ,

7 Otherinvestment income , , I , , , , ,, ,

-220, 629

8 Gain or (loss) from sales ot assets other than inventory i

9 Net income or (loss) from special events , , ,

10 Gross profit or (loss) from sales of inventory . .

11 Other revenue a

ii ATTACHMENT 12 1

-5

c

d

e

iz subtotal Ada wiumnsibi, (ai, amiiei , , , -176, 922

13 Tote-i.Addiine12.coiumnsibi.idi.ar-die) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . 11 -176/ 922

(See worksheet in line 13 instructions on page 28 to verify calculations )

Part xvl.B Relationship of Activities to the Accomplishment of Exempt Purposes

Line N0, Explain below how each activity for which income is reported in column (e) of Part XVI-A contributed importantly to

v the accomplishment

of the foundation"s exempt purposes (other than by providing funds for such purposes) (See

page 29 of the instructions)

NOT APPL I CABLE

Form 990-PF (2009)

JSA

6376lT 526W 12/2/2010 11:30:37.AM V O9-8.6 PAGE 12

9El492 1 000

Faint 99oPF(2oo9) 26-0818520 Page13

Information Regarding Transfers To and Transactions and Relationships With Noncharitable

" Exempt Organizations

1 Did the organization directly or indirectly engage in any of the following vinth any other organization descnbed Yes No

in section 501(c) of the Code (other than section 501(c)(3) organizations) or in section 527, relating to political

t?

a Tlrg?1rsIfe?*sI?i(gm the reporting foundation to a nonchantable exempt organization of

i1i Cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . latll..-.lk

(2) Otherassets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . QQL*-.JL

b Other transactions

(1) Sales of assets to a nonchantable exempt organization I I . I I I I D I - . I . I . I I I , I , , I , , , , , , , , ,, , 1b(1)

(2) Purchases of assets from a nonchantable exempt organization , . I , , , . I I - . . . - I I , . - - I . . , I . I ,, , 1b(2)

(3) Rental offacilities, equipment, or other assets , , , , , , , , , , I . . . I , . I , . Q I , , I . , , , , I . I I I I, , 1b(3)

(4) Reimbursement arrangements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . 1bl4)

(5) LOHHS Of 103" Quafafllees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . 15(5)

(6) Performance olservicesor membership or fundraising solicitations . D , , , , , , , , , , , , . , . , , , . , , I . .I , 1b(6l

c Sharingoffacilities, equipment, mailing lists, otherassets, orpaid employees , , , , , , . , , . . , . . . . , , , , , , ,, , 1c

d If the answer to any of the above is "Yes," complete the following schedule Column (b) should always show the fair market

value of the goods, other assets, or services given by the reporting foundation If the foundation received less than fair market

value in any transaction or shanng arrangement, show in column (d) the value of the goods. other assets, or services received

N /A N /A

(a) Line no (b) Amount involved (C) Name ol nonchantable exempt organization (d) Description of transfers, transactions, and shanng arrangements

2a ls the foundation directly or indirectly affiliated with, or related to, one or more tax-exempt organizations described in

section 501(c) of the Code (other than section 501(c)(3)) or in section 527? , , , , , , , , , , , , , , , , , , , , , , ,, , lj Yes No

b If "Yes," complete the following schedule

(a) Name of organization (b) Type of organization (c) Description of relationship

N/A

Under - allies of perjury. I declare that l have xamined this retum, including accompanying schedules and statements. and to the best of my knowledge and

belief, it i - e, correct lete Decl . io of preparer (other than laxp er or fiduciary) is based on all information of which preparer has any knowledge

* xx. . * s I-I-ZH7* lb , PRESIDENT/DIRECTOR

Signature of Date

Title identifying

page Preparer"s

Check if C, number (See Signature on

30 oi ihe in iructions)

"" ,. repare,-S

gnature, KV1 self-employed

V 1 113 W7 page

Q-15L,C(LJ5&

mfs name (of

yours

if , i1s*Ass0c1AfrEs,

self-employed),

address,

1 O WALL

STREET - 1 1TH FL

LLC EIN p 1 3-4 07 9 1 4 7

a"dZlPC0d@ New YORK, NY 10005 Pnoneno 212-440-0800

Y Form 990-PF (2009)

JSA

9E1-1931000

63761T 526W 12/2/.2010 11:30:37 AM V 09-8.6 PAGE 13

JJ IRA & NICKI HARRIS FAMILY FOUNDATION INC. 26-0818520

CAPITAL GA

Krnd of Property

Gross sale Deprecratron

pnceless ahowedl

expenses of sale a-llggghle

FORM 990-PFC PART rv

NS AND LOSSES FOR TAX ON INVESTMENT

INCOME

Date Date

sold

Descnphon

Cost

or as

FMV

basrs

Excess

of

other

of Ad)

as of

FMV

over

mm

I 12131159 1231169 I adr basrs

SEE REALIZED G(L) REPORT I ATTACHED

PROPERTY TYPE: SECURITIES

23,810.

14,692

242,785

305,039

VAR

VAR

VAR

VAR

VAR

-46,311.

SEE REALIZED G(L) REPORT II ATTACHED

PROPERTY TYPE: SECURITIES

1,184,631.

VAR

-31,652.

SEE REALIZED G(L) REPORT II ATTACHED

PROPERTY TYPE: SECURITIES

258,728.

Gam

or

Goss)

9,118.

SEE REALIZED G(L) REPORT I ATTACHED

PROPERTY TYPE: SECURITIES

211,133.

amwwd

1,179,860

VAR

VAR

4,771.

LTCG THRU SUMMIT VENTURES VI-B LP

10,778.

10,778.

LTCL THRU WILLIAM BLAIR MEZZ CAP FD II

40,179

LTCG THRU

40,179.

SCF-IV LP

16,451.

16,451.

LTCG THRU OCM OPPORTUNITIES FUND LP

5,849.

5,849.

STCG THRU OCM/GFI POWER OPPS FD II

1,019.

1,019.

LTCG THRU OCM/GFI POWER OPPS FD II

4,413.

4,413.

STCG THRU LONE CASCADE LP

15,340.

15,340.

LTCL THRU LONE CASCADE LP

170,226.

-1 70,226.

TOTAL GAIN(LOSS) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ... -220,629.

JSA

BE1730 1 D00

63761T 526W 12/2/2010 11:30:37 AM V 09-8.6 PAGE 14

j. IRA AND NICKI HARRIS FAMILY FOUNDATION INC. EIN: 26-0818520

SUPPLEMENTARY STATEMENTS

PART: XV LINE: 2 SUPPLEMENTAL INFORMATION

THE ORGANIZATIONS PRIMARY ACTIVITY IS TO SUPPORT, BY CONTRIBUTIONS,

OTHER ORGANIZATIONS QUALIFYING FOR EXEMPTION UNDER SECTION 501(c)(3)

OF THE INTERNAL REVENUE CODE. THE TRUSTEES CHOOSE THESE ORGANI

ZATIONS BASED UPON THEIR KNOWLEDGE OF THE ORGANIZATIONS" ACTIVITIES

NO CONTRIBUTIONS, GRANTS, GIFTS, LOANS OR SCHOLARSHIPS ARE MADE TO

INDIVIDUALS. THE ORGANIZATION DOES NOT PRESENTLY RECEIVE APPLICA

TIONS OR CONDUCT PROGRAMS FOR DONATIONS IN ITS ACTIVITIES.

I ATTACHMENT 10

J. IRA & NICKI HARRIS FAMILY FOUNDATION, INC. 26-0818520

FORM 990PF, PART III - OTHER INCREASES IN NET WORTH OR FUND BALANCES

DESCRIPTION AMOUNT

ROUNDING 2.

PRIOR PERIOD ADJUSTMENT 500,000.

TOTAL 500,002.

, ATTACHMENT 10

63761T 526W 12/2/2010 11:30:37 AM V O9-8.6 PAGE 24

1

SCHEDULE D I I OMB No 1545-0092

*(rofm1o411 Capital Gains and Losses

Depanmem of me Treamy P Attach to Form 1041, Form 5227, or Fom1 990-T. See the instructions for 9

lnlemal Revenue semee Schedule D (Form 1041) (also for Form 5227 or Form 990-T, if applicable).

Name of estate or trust Employer Identification number

J. IRA & NICKI HARRIS FAMILY FOUNDATION, INC. 26-0818520

Note: Form 5227 filers need to complete onlyParts I and I/ I

Short-Term Capital Gains and Losses - Assets Held One Year or Less

(a) Descnptlon ol property (b) Date acquired (c) Date sold (9) Cost or 0213313515 m gam or (mu) for

(Example 100 shares 7% preferred of *Z* Co ) (mo , day, yr) (mo , day, yr) (d) Sales pnce (selfuqilgglons) e Subifagnzgehfnizd)

1a

1b I

b Enter the short-tenn gam or (loss), if any, from Schedule D-1, line 1b , , , , , , , , , , , , , , ,y I -20 834 .

2 Short-term capital gam or (loss) from Forms 4684, 6252, 6781, and 8824 I I I . I , I , , , . , I , . I ,, , 2

3 Net short-term gam or (loss) from partnerships, S oorporations, and other estates or trusts , , . . . . . .. , 3

4 Short-tenn capital loss carryover Enter the amount, if any, from line 9 of the 2008 Capital Loss

Carrvovefwvfksheet . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ... 4 ( )

5 Net short-term gain or (loss). Combme lines 1a through 4 In column (f) Enter here and on line 13,

column(-lyontheback . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . P 5 -20,334

Part ll K Long-Term Capital Gains and Losses - Assets Held More Than One Year K

(a) Descnptron ol properly (b) Date acquired (c) Date sold ) Sales noe (egsggslgreotrgg 311515 mggI2nc::,rgcg?rfor

(Example 100 shares 7% preferred of "Z" Co ) (mo , day, yr) (mo , day, yr) (d P Ingnfcuons) Summa (6) from (d)

6a

. . . . . . . . ...

b Enter the long-temw gam or (loss), If any, from Schedule D-1, line 6b I , I , . , , , , I, , - 1 9 9 7 95.

7 Long-teml capital gam or (loss) from Forms 2439, 4684, 6252, 6781, and B824 , , I , I I I I ,I I

8 Net long-term gain or (loss) from partnerships, S corporations, and other estates or trusts , , I , , I , I ,, I

9 Capital gam dlsrnbuvons . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. .

10 Gam from Form 4191. Peru . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. .

11 Long-term capital loss carryover Enter the amount, if any, from line 14 of the 2008 Capital Loss

C2ffy0Vef Wvfksheel . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. .

12 Net long-tenn gain or (loss). Combme lines 6a through 11 in column (f) Enter here and on line 14a,

JL..-1#

.Lis

11( )

10

column@)ontheback . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . D 12 -199,795.

9F1210 2 000 1

For Paperwork Reduction Act Notice, see the Instructions for Form 1041. Schedule D (Form 1041) 2009

JSA

637611" 526W 12/2/2010 11:30:37 AM V 09-8.6 PAGE 28

schedule o (Form 1041) zoos page 2

a

$UmmaW of Pans 1 and " (1) Beneficiaries* (2) Estate*s

Caution: Read the instructions beforecomp/eting this part. (see page 5) or trusts (3) Total

13 Net short-term gain or (loss) I I I I I I I I I , , , , , , , , I II I 13 -20, 834 .

14 Net long-term gain or (loss):

3 T0f3lf0fV@af . . . . . . . . . . . . . . . . . . . . . . . . . . . ... 146 -199,795

b Unrecaptured section 1250 gain (see line 18 of the wrksht) I I I I I 14b

C 23% fate 921" . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . 140 0

15 Total net gain or(loss). Combine lines 13 and 14a I I I I II I P 15 -220, 629.

N0le: If/ine 15, column (3), is a netgain, enter the gain on Form 1041, line 4 (orFom1 990-T, Part I, line 4a) lflines 14a and 15, column (2), are net gains, go

to Part V, and do notcomplete Part /V lf line 15, column (3), is a net loss, complete Part /V and the Capital Loss Carryover Worksheets necessary

Part IV Capital Loss Limitation I

Thehere

lossandonenter

lineas15,

column

(3)1041,

or bline

$3,000

I I I 990-T,

I I I I Pan

I I i,I Iline

I I4c,

I IifaI Itrust)

I I I, the

I I smaller

I I I I IofI tI

16aEnter

a (loss)

on Form

4 (or Form

II I 16 3, OOO.

Note: lf the loss on line 15, column (3), is more than $3,000, or if Form 1041, page 1, line 22 (or Form 990-T, line 34), is a loss, complete the CapitalLoss

Carryoverworksheeton page 7 of the instructions to figure your capital /oss carryover

Tax Computation Using Maximum Capital Gains Rates

Form 1041 tilers. Complete this part only if both lines 14a and 15 in column (2) are gains, or an amount is entered in Part I or Part ll and

there is an entry on Form 1041, line 2b(2), and Fom1 1041, line 22, is more than zero

Caution: Skip this part and complete the worksheet on page 8 of the instructions if

0 Either line 14b, col (2) or line 14c, col (2) is more than zero, or

0 Both Fomi 1041, line 2b( 1), and Form 4952, line 4g are more than zero

Fomi 990-T trusts. Complete this part only if both lines 14a and 15 are gains, or qualified dividends are included in income in Part I

of Form 990-T, and Form 990-T, line 34, is more than zero Skip this part and complete the worksheet on page 8 of the instructions if

either line 14b, col (2) or line 14c, col (2) is more than zero

17 Enter taxable income from Form 1041, line 22 (or Fonn 990-T, line 34) I I 17

18 Enter the smaller of line 14a or 15 in column (2) 1

but not less than zero I I I I , I I I , I I , , II I 18

19 Enter the estate"s or trusts qualified dividends

from Form 1041, line 2b(2) (or enter the qualilied

dividends included in income in Partlof Form 990-T) I I

wmmwww . . . . . . . . . . . . . .HEI

21 lf amount

the estate

or line

trust4g,

is tiling

Fonrienter

4952,

from

otherwise,

-0-enter

, , P the B

22 Subtract line 21 from line 20 lf zero or less, enter -0

23 Subtract line 22 from line 17 lf zero or less, enter -0

. . . . . . . . . . .,.22

. . . . . . . . . . ...23

24 Enter the smaller of the amount on line 17 or $2,300 I I I I I I I I I I II I 24

25 ls the amount on line 23 equal to or more than the amount on line 247

E Yes.

Skip

linesthe

25 amount

and 26, go

to line

andI Icheck

No.

Enter

from

line2723

I I I the

I I I"No"

I I I box

I I I I I I I II I 25

26 Subtract line 25 ff0m line 24 . . . . . . . . . . . . . . . . . . . . . . . . .. . * 26 l

27 Are the amounts on lines 22 and 26 the same?

EI YES. Skip lines 27 thru 30, go to line 31 E N0. Enlsr the smaller ol line 17 or line 22 27

28 Enter the amount from line 26 (lf line 26 is blank, enter -O-) , , , , , , , ,, , 28

29 Subtract line 28 from line 27 I I I I I I I I I I I I I I I I I I I I I I I II I 29

30 Nlvltiplyline 29 by15%(15l . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . 30

31 Figure the tax on the amount on line 23 Use the 2009 Tax Rate Schedule for Estates and Trusts

(see the Schedule G instructions in the instructions for Form 1041) I I I I I I I I I I I I I I I I I I II I 31

32Mmwmw . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .:L

33 Figure the tax on the amount on line 17 Use the 2009 Tax Rate Schedule for Estates and Trusts

(see the Schedule Ginstructions in the instructions for Fonn 1041) I I I I I I I I I I I I I I I I I I II I 33

34 Tax on all taxable income. Enter the smaller of line 32 or line 33 here and on Form 1041, Schedule

G, line 1aI(or Form 990-T, line 36) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . 34

Schedule D (Form 1041) 2009

JSA

9F122o2ooo

63761T 526W 12/2/2010 11:30:37 AM V O9-8.6 PAGE 29

*iFofm1041i (Form 1041) I

sciieoute o-1 Continuation Sheet for Schedule D OMBND 15450092 1.

Depanmen,

ofthe Treasury P See instructions for Schedule D (Form 1041). 9

imemai Revenue service P Attach to Schedule D to list additional transactions for lines 1a and 6a.

Employer identification number

Name of estate or trust

J. IRA a NICKI HARRIS FAMILY FOUNDATION, INC. 26-0818520 .

Short-Term Capital Gains and Losses - Assets Held One Year or Less 1

(B) Descnpuon of pmpeny (Example (b) Dale (C) Date sold (d) Sales pnce (e) Cost or other basis

(1) Ga n r I 1

100 sh 7% preferred 01.2. co ) acquired (mo I day- ) (see page 4 ol the (see page 4 of lhe I 0 (oss)

i

1aS EE REALIZED G(L) REPORT I

(mo , day xr ) yr instructions) instructions) Summa (9) from (d)

23,810. 14,692. 9,118. 1

ATTACHED

S EE

REALIZED G(L) REPORT

II ATTACHED

258,728. 305,039. -46,311.

1,019. 1,019.

S TCG THRU OCM/GFI POWER

OPPS FD II

15,340. 15,340.

STCG THRU LONE CASCADE LP

1b Total. Combine the amounts in column (Q Enter here and on Schedule D, line 1b . . . . . . . . . . . . . . . .. . -20, 834 .

For Pap erwork Reduction Act Notice, see the Instructions for Form 1041

JsA

9F12214 000

6 PAGE 30

. Schedule D-1 (Form 1041) 2009

63761T 526W 12/2/2010 11:30:37 AM V 09-8.

I

smeaule D-1 (Form 1041) zoos Page 2

.

Name of estate or trust as shown on Form 1041 Do not enter name and employer rdentrlicatron number 11 shown on the other srde Employer identification number

Part ll Long-Term Capital Gains and Losses - Assets Held More Than One Year

ta) Descnptnon ol property (Example

100 sn 7% preferned ot "Z" Co )

Ga SEE REALIZED G(L) REPORT I

(b) Dale D Q ld (d) Sales pnce

acquired

(see page 4 oi the

(mo

I dal((3)

lr)Ziyi()

* " instructions)

ATTACHED

SEE REALIZED G(L) REPORT

II ATTACHED

(e) Cost or other basis 1 m Gam or 00")

(ser?1s,1?ugc?1r5nosf)me Summa (8) (mm (6)

i 211,133

242,785. -31,652

1,184,631

1,179,960. 4,771

10,778

10,778

LTCG THRU SUMMIT VENTURES

VI-B LP

LTCL THRU WILLIAM BLAIR

40,179. -40,179

MEZZ CAP FD II

LTCG THRU SCF-IV LP

16,451

16,451

LTCG THRU OCM OPPORTUNITIE

S FUND LP

5,849.

5,849.

4,413

4,413

LTCG THRU OCM/GFI POWER

OPPS FD II

170,226. -170,226

LTCL THRU LONE CASCADE LP

6b Total. Combine the amounts rn column (f) Enter here and on Schedule D, lme 6b . . . . . . . . . . . . . . . .. . - 1 99, 795

scneaure D-1 (Form 1041) zoos

JSA

QF1222 3 000

63761T 526W 12/2/2010 11:30:37 AM V 09-8.6 PAGE 31

.

JV9

Q

J. Ira di Nicki Harris Family Foundation, Inc.

Charitable Contributions

FYE1 March 31, 2010

EIN: 26-0818520

Date Organization City/State Amount

04/07/09

04/07/09

04/08/09

04/08/09

04/08/09

04/08/09

04/08/09

04/08/09

04/08/09

04/08/09

04/09/09

04/17/09

AISH Center New York

New York, NY

New York, NY

New York, NY

New York, NY

New York, NY

Boys" Town of Italy

ProJect HOPE at NYU Child Study Center

NYU Child Study Center

Museum at Eldridge Street

The Kennedy Center

Washington, DC

Chicago, IL

Boston, MA

Big Shoulders Fund

Brigham and Women"s Hospital

University of Michigan - Locker Room Renovation

Kravis Center

The American Hospital of Paris Foundation

Palm Beach Community Chest - United Way

06/26/09

06/30/09

07/10/09

Jewish Board of Family and Children"s Services

Jewish Federation of Palm Beach County

Collegiate School

Hope at NYU School of Medicine

Baycrest Foundation

The UCLA Foundation, Inc

Central Synagogue

American Friends of the Israel Museum

The Bronx Museum of the Arts

National Museum of American Jewish History

Palm Beach Civic Association

Chicago Youth Center

Hope at NYU School of Medicine

National Museum of American Jewish History

Ross School of Business - University of Michigan

University of Michigan

The Jewish Museum

Columbus Citizens Foundation

Hospital for Special Surgery

Norton Museum of Art

Hospice Foundation of Palm Beach County

Planned Parenthood of South Florida and the Treasure Coast, Inc

Historical Society of Palm Beach County

Preservation Foundation of Palm Beach

The National MS Society

Wilsonville Youth Sports, Inc

The Fresh Air Fund

Society of the Four Arts, The

Dana Farber Cancer Institute

Jonathan M Harris Foundation, Inc.

Hope at NYU School of Medicine

10/20/O9

10/20/09

10/22/09

10/22/09

10/22/09

10/22/09

10/22/09

10/22/09

10/22/09

10/27/09

11/05/09

11/20/09

12/08/09

12/10/09

12/10/09

10,000 O0

50,000 00

20,000 00

60,000 00

West Palm Beach, FL 100,000 00

92nd Street Y

O7/12/09

1,000 00

300,000 00

50,000 00

Ann Arbor, MI 360,000 00

05/11/09

05/11/09

O6/26/O9

07/23/09

07/23/09

09/10/09

09/10/09

09/10/09

09/10/09

09/16/09

09/18/09

09/18/09

09/18/09

09/18/09

09/18/09

09/21/09

2,500 00

PMC (Pan Mass Challenge)

Amherst College

Town of Palm Beach

l/5

New York, NY

Palm Beach, FL

New York, NY

Needham, MA

Amherst, MA

New York, NY

West Palm Beac h, FL

New York, NY

1,000 00

25,000 00

20,000 00

250 00

10,000.00

22,500 00

50,000 00

17,500 00

New York, NY 350,000 OO

Toronto, ON 1,000 00

Los Angeles, CA 1,000 OO

New York, NY 50,000 00

New York, NY 1,000 00

Bronx, NY 12,500 00

Philadelphia, PA

Palm Beach, FL

Chicago, IL

New York, NY

Philadelphia, PA

Ann Arbor, MI

Ann Arbor, MI

New York, NY

New York, NY

New York, NY

West Palm Beac h, FL

Palm Beach, FL

West Palm Beac h, FL

West Palm Beac h, FL

Palm Beach, FL

New York, NY

Wilsonville, OR

New York, NY

Palm Beach, FL

Boston, MA

New York, NY

New York, NY

Palm Beach, FL

5,000 00

5,000 00

1,000 00

250,000 00

125,000 00

140,000 00

250,000 00

2,500 00

10,000 00

10,000 00

10,000 00

2,000 00

3,000 00

1,000 O0

2,500 00

1,000 00

1,000 00

1,000 00

5,000 00

10,000 00

50,000 00

500,000.00

1,500 O0

II

N

n

J. Ira & Nicki Harris Family Foundation, Inc.

Charitable Contributions

FYE: March 31, 2010

EIN: 26-0818520

Date

Organization City/State

12/IO/09 Preservation Foundation of Palm Beach

12/10/09 Brigham and Women"s Hospital

12/10/09 Albert Einstein College of Medicine

12/11/09 Dystonia Medical Research Foundation

12/18/09 Boys and Girls Club of Broward County

Palm Beach, FL

Boston, MA

New York, NY

Chicago, IL

12/21/09 Teach for America

New York, NY

New York, NY

New York, NY

Aventura, FL

New York, NY

New York, NY

Palm Beach, FL

Philadelphia, PA

New York, NY

Chicago, IL

Chicago, IL

Fort Lauderdale, FL

12/21/O9 Solomon R Guggenheim Museum

01/26/10 Anti-Defamation League

02/02/10 The Christopher Ricardo Cystic Fibrosis Foundation, Inc

02/02/10 American Friends of the Israel Museum

02/02/10 92nd Street Y Nursery School

02/04/10 Bruce and Marsha Moskowitz Foundation

l

O2/04/10 National Museum of American Jewish History

02/O4/10 American Jewish Committee

O2/04/10 The Ryan Licht Sang Bipolar Foundation

O2/16/10 Northwestern University Feinberg School of Medicine

02/17/10 Friendship Circle of MetroWest

O2/18/10 Brigham and Women"s Hospital

02/19/10 The Kennedy Center

03/03/10 UJA-Federation of New York

03/O4/10 Town of Palm Beach United Way

03/10/10 Nicklaus Children"s Health Care Foundation

O3/11/IO Hope for Depression Research Foundation

03/19/10 The American Ireland Fund

Livingston, NJ

Boston, MA

Washington, DC

New York, NY

Palm Beach, FL

North Palm Beach, FL

New York, NY

Boston, MA

Amount

500 00

2,000 00

425 00

2,500 00

2 5,000 00

12,500 00

100,000 00

10,000 00

1,000 00

2,500.00

1,000 00

1,000 00

1,000 00

10,000 00

1,000 00

1,000 00

2,500.00

60,000 O0

50,000 00

10,000 00

2 5,000 00

2 5,000 O0

2,500 00

10,000 00

Subtotal I $ 3,258,175.00

1/5

1I

W

H

u

J. Ira & Nicki Harris Family Foundation, Inc.

Charitable Contributions (Non-Cash)

FYE: March 31, 2010

EIN: 26-0818520

DATE

DONEE / DESCRIPTION OF GIFT CITY, STATE

10/ 22/2009

NORTON MUSEUM OF ART WEST PALM BEACH, FL $

FMV

1,700.00

JEFF CHIEN-HSINE LIAO, "YANKEE .5 TADIUM5", 40x 64" EDITION 2/I2

10/ 22/ 2009

UNIVERSITY OF MICHIGAN BUSINESS SCHOOL ANN ARBOR, MI

1,700.00

JEFF CHIEN-HSING LIAO, "YANKEE 5 TADIUM5", 40 X 64", EDI 7TON 3/I2

10/22/2009

NEW YORK CITY DEPARTMENT OF EDUCATION NEW YORK, NY

JEFF CHIEN-HSINE LIAO, "YANKEE 5 TADIUM5", 20 x 32", EDI UON I/12

700.00

10/ 22/ 2009

CENTRAL SYNAGOGUE NEW YORK, NY

700.00

T-T?

JEFF CHIEN-HSIN6 LIAO, "YANKEE 5 TADIUM5", 20X 32", EDI 7TON 2/12

Subtotal II

Subtotal I

Subtotal II

4,B00 00

3,258,175.00

4,800 00

TOTAL CONTRIBUTIONS PAID * $ 3,262,975.00

* ALL CONTRIBL/7TON$ WERE MADE T0 THE 6ENERAL PURPOSE

FUND OF PUBLIC CHARI TABLE ORGANIZA 710/NLS THAT WERE

CLASSIFIED UNDER $EC7TON 501(c)(3) OF THE INTERNAL REVENUE

CODE.

3/3

Q

Chieftain Capital Management, Inc.

REALIZED GAINS AND LOSSES

.I IRA AND NICKI HARRIS FAMILY

F OUNDA TI ON INC

C/0 J I HARRIS & ASSOC INC

From 04-01-09 Through 03-31- I0

Open

Close Cost

Date Date Quantity Security Basis Proceeds Short Term Long Term

Gain Or Loss

10-29-02

04-16-09

10-29-02

04-17-09

10-29-02

04-20-09

IO-29-02

04-21-09

05-21-09

05-26-09

01-08-07

05-26-09

01-05-07

05-26-09

01-05-07

05 -27-09

02-01-07

05-27-09

01-22-07

05-27-09

01-22-07

05-28-09

02-08-08

02-I 1-08

01-22-07

05-29-09

05-29-09

05-29-09

375 00 Laboratory Corp America

Holdings

425.00 Laboratory Corp America

Holdings

275.00 Laboratory Corp America

Holdings

225 00 Laboratory Corp America

Holdings

5,825.00 Dell lnc

550.00 Ryanair Iloldings PLC Sp

ADR

300.00 Rynnmr Holdings PLC Sp

ADR

250.00 Ryanair Holdings PLC Sp

ADR

200.00 Ryanair Holdings PLC Sp

ADR

350.00 Ryanair Holdings P1.C Sp

ADR

50.00 Ryanair Holdings PLC Sp

ADR

125.00 Ryanair Holdings PLC Sp

ADR

1,250.00 Dell Inc

1,350.00 Dell Inc

225.00 Ryanair Holdings PLC Sp

275.00 Precision Castparts Corp

7,476 19

23,125.99

15,649.80

8,473 01

26,363.98

17,890 97

5,482.54

17,029.29

1 1,546.75

4,485.71

14,134.74

9,649.03

75,659.65

24,277.14

40,925.68

15,702.92

-34,733.97

-8,574.22

13,209.81

8,565.23

-4,644 ss

10,936.04

7,137.69

-3,193.35

8,748 83

5,842.59

-2,906 24

15,303.75

10,224.52

-s,o-/9.23

2,163.42

1,4 60.65

-102.11

5,408 55

3,642.90

-1,765 65

24,725.38

26,699.63

9,735 39

14,620.50

-to,1o4.as

1 5,790. I3

-10,909.50

-3,168.69

14,692.40

23,810.45

6,566.70

ADR

1 1-19-03

06-02-09

TOTAL GAINS

TOTAL LOSSES

257,477.43

TOTAL REALIZED GAIN/LOSS -22,533.47

I/1

zenuzeo QIL I

234,943.96

9,118.05

9.118 05

0.00

9,118.05

54,73 6.55

-86,388.07

--31,651.52

. J. IRA AND NICKI HARRIS FAMILY FOUNDATION, INC.

ACTION BY MEMBER WITHOUT A MEETING

The undersigned, being the sole member of J. Im and Nicki Harris Family Foundation, Inc. (the

"Foundation"), consents that a meeting of the members of the Foundation be dispensed with and

takes the following action by written consent pursuant to Section 617.070l(4) of the Florida Not

for Profit Corporation Act:

RESOLVED, that the following persons be, a.nd they hereby are, elected to serve as

directors of the Foundation until the next annual meeting ofthe Member and until their

successors have been elected and qualified:

J. Ira Harris

Nicki Harris

Jacqueline Harris Hochberg

Jonathan M Harris

David Moore

Bruce Moskowitz

Craig Shadur

1, 5 V , T

Harris

, .vii 1 1* -.t hui

,I ,1rt1

.J-5:.

.gi-,--,-,.

4,2 1-51112

1-.-"1.*.e-fi

045475/DOOOI Business l6962J6v3

l *I hi 0: I , I

July 8, 2009

NOTICE OF RESIGNATION

3

i

I

To: Secretary

J. Ira and Nicki Harris Family Foundation, Inc.

I hereby resign as a director of the J. Ira and Nicki Hairis Family Foundation,

Inc., effective as of February 2, 2009.

l

1

1,

(9-X....Q4w/L9""x..,./

ii

Daniel Tisch

it

,I

ii

l

J

1

1

.il

41

1,

i

l

J. IRA AND NICKI HARRIS FOUNDATION, INC.

EIN: 26-0818520

FYE 3/31/2010

ATTACHMENT TO FORM 990-PF, PART V

IN FYE 3/31/08, THERE WAS A Q507(b)(2) TRANSFER FROM THE J. IRA AND NICKI HARRIS FOUNDATION, INC.

(EIN 65-0805468). WE ARE MAKING AN ADMINISTRATIVE ADJUSTMENT TO FORM 990-PF, PART V, LINE 1,

COLUMNS (b), (C) AND (d) FOR TAX YEAR 2007 IN ORDER TO COMPLETE THE TRANSFER OF TAX

ATTRIBUTES WITH RESPECT TO THE S507(b)(2) TRANSFER,

STMT A

J. IRA & NICKI HARRIS FAMILY FOUNDATION, INC.

EIN: 26-0818520

FYE 3/31/2010

Attachment to Form 990-PF

Part VII-B, Question 5c

EXPENDITURE RESPONSIBILITY STATEMENT

Pursuant to IRC Regulation S 53.4945-5(d)(3), The J. Ira di Nicki Harris Family Foundation, Inc. provides

the following information:

(11 Grantee J onathan M Harris Foundation, Inc.

c/o BCRS Associates, LLC

100 Wall Street - 11 Floor, NY, NY 10005

(21 Amount of Grant $ 50,000.00

December 8, 2009

(31 Purpose of Grant Funds were paid to The Jonathan M Harris Foundation, Inc. as part of

the core endowment from which distributions will be made to primary,

secondary, post-secondary and graduate educational institutions.

(41 di (61 The Jonathan M Harris Foundation, Inc. has furnished The J. Ira & Nicki

Harris Family Foundation, Inc. with its Annual Report. The Trustees of The

J. Ira di Nicki Harris Family Foundation, Inc. have been assured by The

J onathan M Harris Foundation, Inc. that the funds have been used according

to the terms of the contract.

5 Diversions To the knowledge of the Grantor, no funds have been or will be

1

diverted to any activity other than the activity for which the

grant was originally made.

(71 Verification The grantor has no reason to doubt the accuracy or reliability of

the report from the grantee, therefore, no independent

verification of the reports was made.

J. IRA AND NICKI HARRIS FAMILY FOUNDATION, INC.

EIN: 26-0818520

FYE 3/31/2010

ATTACHMENT TO FORM 990-PF, PART XIII

IN FYE 3/31/08, THERE WAS A ($507(b)(2) TRANSFER FROM THE J. IRA AND NICKI HARRIS FOUNDATION, INC

(EIN" 65-0805468). WE ARE MAKING AN ADMINISTRATIVE ADJUSTMENT TO FORM 990-PF, PART V, LINE 3e

(EXCESS DISTRIBUTIONS CARRYOVER FROM2008) IN ORDER TO COMPLETE THE TRANSFER OF TAX

ATTRIBUTES WITH RESPECT TO THE 5507(b)(2) TRANSFER.

AS A RESULT, FOR FYE 3/31/10 WE ARE REDUCING THE PRIOR YEAR MINIMUM DISTRIBUTION REQUIREMENT

FROM $1,228,425 TO $1,191,812.

STMT B"

Folrm Application for Extension of Time To File an

iRev.Aim2009) Exempt Organization Return OMB N, ,5.,5-,,0g

gfgigffglgufglgguw P File a separate application for each retum.

c If you are filing for an Automatic 3-Month Extension, complete only Part I and check this box . . . . . . . . P IZ N

0 lf you are filing for an Additional (Not Automatic)-3-Month Extension, cdmplete only Part ll (on page 2 of this form).

Do not complete Part Il unless you have already been granted an" automatic 3-month extension on a previously filed Form 8868.

Automatic 3-Month Extension of Time. Only submit original (no copies needed).

PartlonIy......................................PQ