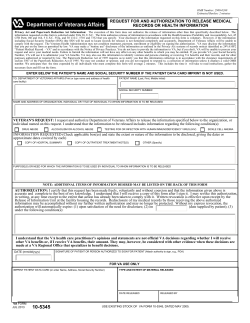

Department of Veterans Affairs May 2013 Travel Administration Volume XIV – Chapter 1