Life Claims Service Center P.O. Box 105448 Atlanta, GA 30348-5448 Phone: 800-813-5682

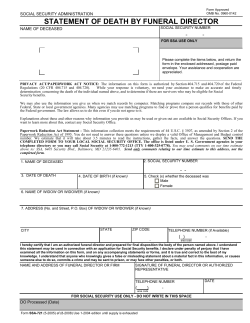

Life Claims Service Center P.O. Box 105448 Atlanta, GA 30348-5448 Phone: 800-813-5682 Fax: 877-305-3901 Email: [email protected] Please accept our condolences on your recent loss. We realize that this is a difficult time for you, and we will do our best to make sure that all of your dealings with us are handled in a professional, caring and timely manner. We know that during a confusing time like this, even simple decisions can seem huge. And no matter how well you may have prepared, you may feel that you are forgetting something important. So we have provided you with some information that may be of help: “Losing a Loved One: A List of Reminders” is a list of things that may need to be taken care of in the coming months, from dealing with pets to canceling credit cards. We hope you’ll find this checklist useful. To help us process your claim quickly, please complete the enclosed Beneficiary Claim Form and mail it to us as soon as possible. For your convenience, we have also enclosed an instruction sheet called “A Guide to Help You Complete Your Beneficiary Claim Form” to help answer any questions you may have. If needed, feel free to call our Life Claims Service Center at 800-813-5682, Monday through Friday, 8:30 am – 8:00 pm Eastern Time. Our Access Advantage account is a checkbook program that is provided to you without cost as an additional benefit. As soon as your claim is received and approved, we will send you an Access Advantage account kit that will include your checkbook and more detailed information on how to access your funds. Life insurance proceeds of $10,000 and more are paid through our Access Advantage account program. The funds will be available immediately, and you may withdraw the total amount, or leave a full or partial balance in the account where it will earn competitive money market interest rates. The Access Advantage Account program is set up for your convenience and is provided at no cost to you. If you have a question specifically related to this program, please call the Access Advantage account Service Center at 800-551-7564. Anthem Life Insurance Company is a strong, stable industry leader, and we take our responsibility very seriously. We are committed to serving you in a caring and compassionate manner. Sincerely, Anthem Life Insurance Company Life and Disability products underwritten by Anthem Life Insurance Company, an independent licensee of the Blue Cross and Blue Shield Association. ®ANTHEM is a registered trademark of Anthem Insurance Companies, Inc. The Blue Cross and Blue Shield names and symbols are registered marks of the Blue Cross and Blue Shield Association. 13007MUMEN 3/10 Losing a loved one: A list of reminders Losing a loved one has a way of making anyone feel unprepared. Suddenly, there are a hundred things to do and remember. We hope you’ll find this checklist useful. Immediately Discuss medical issues with doctors. Should there be an autopsy? Was the deceased an organ/tissue donor? Determine whether the deceased wrote a letter of intent or made pre-arrangements for funeral, cremation or burial, including whether any services were pre-paid. Contact funeral home or provider about disposition of the body. Notify family and close friends. Don’t be shy about asking for help with phone calls. (The contact chart on the back of this sheet may help.) Preparing for funeral or memorial service Make planning decisions for a funeral or memorial service, including who will be billed. Gather the deceased’s information for the funeral home — including ID numbers and personal history — so they can issue a death certificate. You can also use this information for an obituary or paid death notice. Ask friends and family to handle notifying people of the service, and to provide travel assistance. Send obituary or paid death notice to local papers and any other appropriate publications. Decide how many death certificates you’ll need. Family and household issues Provide for the immediate care of deceased’s dependents and other urgent matters. If the deceased had any pets, arrange for their feeding and care, and decide whether a new living situation is necessary. See to outstanding property matters, such as the deceased’s mortgage, rent and utilities. If the house is empty, arrange for a house sitter or put timers on the lights and TV. Plan for mail pickup and cancel newspaper delivery. Remove any valuables such as jewelry, small antiques and wallets. Locate the deceased’s calendar and cancel scheduled appointments. Cancel services such as meal deliveries, home health aides or volunteers. 12913CAMEN 3/10 Personal and financial matters Other benefits Find important documents, including: − will or living trust − deeds − titles − licenses − insurance policies − financial records − tax returns − identification papers − disability claims − military certificates Check all insurance policies for death-related benefits. Ask frequent flyer programs about transferring mileage. Contact the attorney and/or executor named in the will to handle probate court and estate matters. Transfer assets and property titles if you are a surviving spouse, partner or dependent. Open individual bank accounts if you are a surviving spouse or partner. Locate any safe deposit box(es). Notify Social Security of death and file for any death or survivor benefits that may apply: 800-772-1213. Contact U.S. Department of Veterans Affairs for benefits if the deceased was a veteran: 800-827-1000 or www.va.gov. If the deceased was an active peace officer or in the military, contact local representatives. Employment issues Contact accountant or tax advisor about filing taxes, preparing a budget and valuing assets. Investigate possible benefits through social or fraternal organizations, unions, mortgage companies and credit cards. Contact the deceased’s employer about benefits, unpaid compensation and retirement/investment accounts. Ask about any unused vacation or personal time, unpaid commissions or bonuses, etc. Contact insurance agents to change your policies and beneficiaries, if necessary. Cancel the deceased’s individual credit cards; but don’t remove the name from joint accounts for six months. Change all home utilities to your name if you shared a household with the deceased. Update your will and consider preparing your own funeral or memorial pre-arrangements. People to contact Name Phone number Name Life and Disability products underwritten by Anthem Life Insurance Company, an independent licensee of the Blue Cross and Blue Shield Association. ® ANTHEM is a registered trademark of Anthem Insurance Companies, Inc. The Blue Cross and Blue Shield names and symbols are registered marks of the Blue Cross and Blue Shield Association. Phone number A Guide to Help You Complete Your Beneficiary Claim Form Anthem Life Insurance Company has begun preparing your claim. To complete the claim process, please send us the following: 1. A completed Beneficiary Claim Form from each beneficiary. (You may photocopy the attached form if necessary.) Claims by an Estate or Assignee For claims by an estate or assignee, the executor or administrator filing the claim must sign the Claim Form and submit certified copies of the appointment papers. Please remember to include the estate’s Identification Number. 2. A certified copy of the death certificate. 3. A copy of the Enrollment Form or Beneficiary Designation Form on which the insured named his or her beneficiaries. Section 1 Information About the Beneficiary Please be sure to complete this entire section. It’s also important to include your telephone number as we may need to call you if we need more information. Social Security or Identification Number In most cases, Life benefits are not subject to income tax. However, because you may be earning taxable interest under our Access Advantage account, the federal government requires us to obtain your Social Security Number or Taxpayer Identification Number. If you do not provide us with your Social Security Number or Taxpayer Identification Number, the federal government requires us to withhold a portion of any interest that we would otherwise pay you as a deposit against the taxes that may be due. Important: If you have been notified by the Internal Revenue Service that you are subject to backup withholding tax, please check the “Yes” box after the question on the Claim Form. We may call you for more information if you are not a United States citizen and/or you reside in a foreign country. Assignment of Benefits If you have assigned any or all of the claim proceeds for funeral/burial expenses, please include a copy of that assignment along with the itemized bill. If the policy proceeds have been assigned to a bank or financial institution, the Claim Form must be signed by an authorized representative of that institution. Section 2 Information About the Insured (the Deceased) Please complete this section for identification purposes. If Life coverage was issued within two years of the insured’s date of death, or if the insured’s death was due to an accident and the policy provided for accidental death benefits, we may ask you for additional information. Section 3 Signature and Certification Please sign the Beneficiary Claim Form in the same manner that you sign your checks. This is important as your signature may be used to verify your Access Advantage account checks. Please note that you will also be certifying, under penalty of perjury, that your Social Security Number or Taxpayer Identification Number and backup withholding status are correct. If you have additional questions about the Access Advantage account, please call our Access Advantage account Service Center at 800-551-7564, Monday through Friday, 8:30 am – 5:00 pm Eastern Time. Life and Disability products underwritten by Anthem Life Insurance Company, an independent licensee of the Blue Cross and Blue Shield Association. ®ANTHEM is a registered trademark of Anthem Insurance Companies, Inc. The Blue Cross and Blue Shield names and symbols are registered marks of the Blue Cross and Blue Shield Association. 12909MUMEN 3/10 Beneficiary Claim Form Please return this beneficiary claim form together with an official certified copy of the death certificate. Please type or print your name and address exactly as you Section 1: Information About the Beneficiary would like them to appear on your checks. q q Name Sex Male Female First Middle Initial Last Address Home Phone ( ) Street Apt. No. Daytime Phone ( ) City State ZIP Date of Birth Beneficiary’s Social Security or Taxpayer Identification Number Month Day Year Have you been notified by the Internal Revenue Service that you are subject to backup withholding tax as a result of failure to report all interest or dividends? Are you exempt from backup withholding tax? Are you a United States citizen? (If No…) Do you reside in a foreign country? In what capacity are you making this claim? Beneficiary’s Relationship to the Insured q Yes q Yes q Yes q Yes q Beneficiary q Trustee q Spouse q Parent q No q No q No q No q Executor/Administrator (for claims by an estate or assignee) q Other ______________________________ q Child q Other ______________________________ Section 2: Information About the Insured (the Deceased) Name ____________________________________________________________________ Social Security Number ______________ First Middle Initial Last Date of Birth __________________________ Month Day Year Date of Death __________________________ Month Day Year Anthem Life Insurance Policy Number _________________________________________________________ Section 3: Signature and Certification I certify, under penalty of perjury, that the Social Security Number or Taxpayer Identification Number and Beneficiary’s backup withholding status information in Section 1 is complete and correct. I understand that my signature may be used for signature verification for certain purposes, including for my Access Advantage account. Signature _______________________________________________________________________________________________ (Sign as you would a check. Your signature may be used for check verification.) It is a crime to knowingly, with intent to defraud, file a statement of claim containing materially false or misleading information, or to conceal any material fact. Untrue or misleading statements may subject persons to criminal prosecution and civil penalties. For Use by Anthem Life Only Examiner Claim Number Date Approved/ Denied Branch Total Benefit and Interest Return this completed form to: Anthem Life Insurance Company Life Claims Service Center P.O. Box 105448 Atlanta, GA 30348-5448 800-813-5682 Fax: 877-305-3901 Email: [email protected] This claim form may have been sent before Anthem Life Insurance Company has determined whether any Life coverage was in force at the time of death; whether any proceeds are payable; and to whom any proceeds are payable. Anthem Life Insurance Company retains its rights to make these determinations. Life and Disability products underwritten by Anthem Life Insurance Company, an independent licensee of the Blue Cross and Blue Shield Association. ® ANTHEM is a registered trademark of Anthem Insurance Companies, Inc. The Blue Cross and Blue Shield names and symbols are registered marks of the Blue Cross and Blue Shield Association. Si usted necesita ayuda en Español para entender este documento, puede solicitarlo sin ningun costo adicional llamando al número de servicio al cliente que se encuentra en este documento. 12902MUMEN 3/10

© Copyright 2026