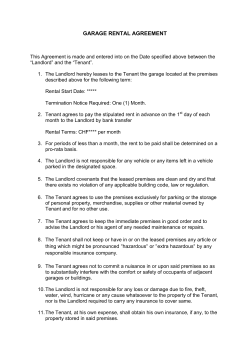

Landlord and Tenant Law February 10, 2012