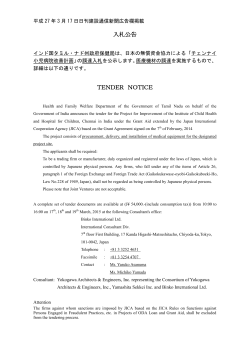

WorldECR issue 80