WHAT TO DO AFTER A DEATH IN SOUTH AFRICA PRACTICAL ADVICE AND STEPS

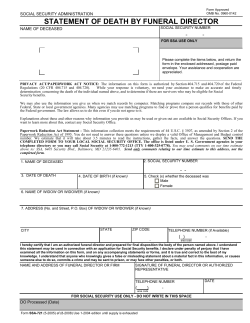

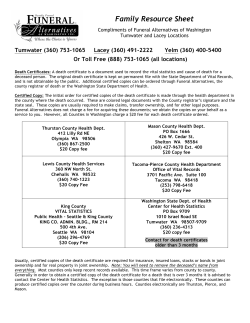

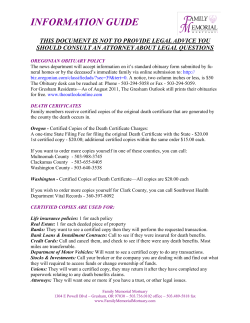

WHAT TO DO AFTER A DEATH IN SOUTH AFRICA PRACTICAL ADVICE AND STEPS IN TIMES OF BEREAVEMENT WHAT TO DO AFTER A DEATH IN SOUTH AFRICA 1 PRACTICAL ADVICE AND STEPS IN TIMES OF BEREAVEMENT Most people at some time in their lives find themselves responsible for making the arrangements after the death of a relative or friend. It is a difficult and emotional time and this booklet guides you through some of the steps you need to take. Personal Trust International has a team of professionals who have the qualifications and expertise to offer specialist advice for the administration of deceased estates. For more information, please contact Renette Hendriks in our Fiduciary Services Department on 021 689 8975. CONTENTS FROM THE TIME OF DEATH TO THE FUNERAL 1. First things to be done 2. Getting a medical certificate 3. How to register a death 4. Planning the funeral POSSESSIONS, PROPERTY AND CHILDREN 1. Is there a Will? 2. The executors 3. If the deceased has no Will WHAT TO DO AFTER A DEATH IN SOUTH AFRICA 2 FROM THE TIME OF DEATH TO THE FUNERAL 1. First things to be done If death occurs at home: Contact the family doctor. Contact the nearest relative if it is not you. Contact the police if the death was violent, accidental or if there were unusual circumstances or if the cause of death is not known for certain. Contact the relevant minister of religion. If death occurs at home, the majority of organs cannot be donated for transplant but the body can still be donated for medical research purposes. If it was the wish of the deceased or their nearest relative that the body or organs be donated for transplant or medical research purposes, please notify the doctor immediately. For more information on organ donation, visit odf.org.za. Alternatively call the Organ Donor Foundation Toll Free on 0800 22 66 11. . Contact a funeral director to collect the deceased from the place of death. Find out if there is a will, and if so, where it is and who is responsible for dealing with it (see relevant sections under Possessions, Property and Children). If death occurs in hospital: As the contact person/relative, in the event of a death, you will be notified by the hospital/police and given a convenient time to attend WHAT TO DO AFTER A DEATH IN SOUTH AFRICA 3 the hospital, when you will be asked to: • Identify the body, if the deceased was not a patient of the hospital • Obtain a death certificate • Give permission for a post mortem in cases where there is no legal requirement but clinicians wish to have one • Provide either confirmation of the estate or receipt as beneficiary to allow you to take away any personal possessions. If you know that the deceased wished to donate his or her organs after death, you should notify the hospital staff. You should also let the staff know if the body is to be donated to medical science. For more information on organ donation, visit odf.org.za. Alternatively call the Organ Donor Foundation Toll Free on 0800 22 66 11. . Contact a funeral director to collect the deceased from the place of death. Find out if there is a will, and if so, where it is and who is responsible for dealing with it (see relevant sections under Possessions, Property and Children). 2. Getting a medical certificate If death occurs at home Notify the doctor who will: Either issue a death certificate provided that there are no unusual circumstances; or, in cases where death is unexpected, violent, suspicious WHAT TO DO AFTER A DEATH IN SOUTH AFRICA 4 or not obviously explained, will report the death to the appropriate authorities. Arrangements will be made by them to transport the deceased to the nearest State Mortuary. The deceased will need to be formally identified at the mortuary prior to the release of the body to a funeral director. Anyone who knew the deceased may conduct the identification provided they are in possession of the deceased’s ID book as well as their own. If death occurs in hospital The hospital will: Either issue the death certificate provided the cause of death is quite clear; or, in cases where death is unexpected, violent, suspicious or not obviously explained, will report the death to the appropriate authorities and arrange for a post mortem if required. 3. How to register a death The Births & Deaths Registration Act requires that a person’s death be reported to any of the following people: • Specific officer at the Department of Home Affairs • South African Police Service members, especially in areas where the Department of Home Affairs has no office • South African mission, embassy or consulate, if the death occurred abroad • Funeral undertakers who are appointed and recognized by the law. Form BI-1663 (Notification of deaths/still-birth) must be completed when reporting a death. The following people have to complete different sections of this form: • The person reporting the death WHAT TO DO AFTER A DEATH IN SOUTH AFRICA 5 • A medical practitioner • A Home Affairs official (where an official from the Department of Home Affairs is not available then a member of the SA Police Services may be approached to complete the form). The family must report the death to the Registrar of Births & Deaths as soon as the family gets a death certificate from the doctor. The funeral undertaker needs to complete certain sections on the form and the form must be submitted to the nearest Home Affairs office. The Registrar of Births & Deaths will give you: A Death Report (Form BI – 1680) which will be issued after a death has been registered, together with a burial order. No burial may take place unless authorised by way of a burial order (Form BI -14). If death occurs abroad: Deaths of South African citizens that occur outside South Africa must be reported to the nearest South African embassy or mission abroad. The country in which the death occurs must issue a death certificate and a certified copy of the death certificate must be submitted to the South African embassy or mission when reporting a death. If the deceased is to be buried in South Africa, the embassy or mission will assist with the paperwork and arrangements with regard to transportation of the body to South Africa. Obtaining a death certificate Obtaining a death certificate is essential in order to administer a deceased estate. The Department of Home Affairs will issue a Death Certificate on receipt of the notification of death and the Death Report. Applications for a Death Certificate must be lodged at any office of the Department of Home Affairs or at any South African embassy, mission or consulate if the death occurs abroad. An abridged death certificate will be issued free of charge on the same day of registration of death. An unabridged death certificate can be obtained by completing Form BI-132 and paying the required fee. This detail will usually be handled for you by your funeral parlour. WHAT TO DO AFTER A DEATH IN SOUTH AFRICA 6 The Executor needs to have several copies of the Death Certificate stamped and certified by a Commissioner of Oaths. Every instruction given and transaction done on behalf of the deceased, e.g. closing accounts, etc, will need to be accompanied by a certified copy of the death certificate. 4. Planning a funeral All decisions should be guided by the provisions contained in the deceased’s will, if any. Try to ascertain what kind of funeral the deceased would have preferred - burial or cremation. A funeral service to honour the life of the deceased is not a legal requirement in South Africa. However, it is customary to have a function or ceremony where family and friends can celebrate the life of the deceased, show their respect, and bid the deceased a loving farewell. The responsibility for funeral arrangements and determining the deceased's last resting place normally falls on the closest next of kin or persons named as heirs in the deceased’s will. If the deceased was religious, one should contact the deceased’s place of worship to see what funeral services they offer. A reputable funeral director will do everything from obtaining the death notice and certificate, supplying one with the original and the necessary certified copies, organising death notices in newspapers, to cemetery or crematorium arrangements, catering and florist arrangements, printing of hymn sheets, etc. What to take with you to a Funeral Parlour • A copy of the deceased’s Identity Document. • Next of kin’s Identity Document. • Funeral Policy and marriage certificate (these are required by the insurance company if the deceased had a policy). WHAT TO DO AFTER A DEATH IN SOUTH AFRICA 7 • A photo of the deceased for hymn sheets. • Clothes - for the deceased to be dressed in. Paying for a funeral Most funeral parlours require payment upfront. If the deceased had a funeral policy, the policy is to be handed over to the funeral director for him to verify. If the deceased did not have a funeral policy and you cannot afford the outlay, you can ask the funeral parlour if they can submit the invoice to the executor for payment out of the funds from the estate. However, many funeral services will not agree to this method of payment due to the length of time it can take for an estate to wind up and the possibility that the estate could be insolvent, in which case the funeral service might not receive payment. Some estate administrators will advance the money to pay for the funeral from the estate, depending on the financial status of the individual. It is, however, a legal requirement that the estate pay for the funeral. Kindly note that this only pertains to the actual account from the funeral parlour and not extra expenses such as flowers and catering costs pertaining to the memorial service. Cremation or Burial The decision whether to have a cremation or a burial will depend, in the absence of provisions in the deceased’s will, on the wishes of the next of kin and on costs. Cremation Cremation can only take place once the cause of death is definitely known and the death has been registered. The ashes Ashes can be scattered in a garden of remembrance or a favourite spot chosen by the deceased, or can be buried in a churchyard or cemetery or kept in an urn. WHAT TO DO AFTER A DEATH IN SOUTH AFRICA 8 Burial Find out if the deceased had already paid for a plot in a churchyard or cemetery by checking the will and looking through the papers for the necessary documents. You should give these to the funeral director. If no prior arrangement had been made, then a plot must be purchased. The funeral director will have the necessary information regarding purchase details. POSSESSIONS, PROPERTY AND CHILDREN 1. Is there a Will? A Will A will states what the person wants to happen to his or her money, property and possessions. It may state what the person wished to happen to his or her body; whether he or she wished to be cremated or buried or wished his or her body to be bequeathed to a hospital; whether any organs were to be donated; what sort of funeral was wanted etc. It may appoint one or more people as executors, to be responsible for paying debts and dealing with money, property and possessions. It may nominate a person to act as a guardian to any children. Finding the Will It is important to find the will as soon as possible. Whether or not the will is found, the next stage is the appointment of executors. If a will cannot be found among personal papers, enquiries should be made at the deceased’s lawyers, accountants, bank or insurance company. It may be in safe keeping with one of them. 2. The Executors What are executors? Executors are representatives of the deceased who pay off any debts or taxes and distribute the property and possessions to those entitled to them. WHAT TO DO AFTER A DEATH IN SOUTH AFRICA 9 Who becomes an executor? If the deceased had a will, he or she may have nominated an individual or a financial institution such as Personal Trust to perform the function of the executor. If no executor is nominated or the nominated executor is unable or refuses to accept the task, or if the person dies intestate, the Master of the High Court will appoint an executor, called an ‘Executor Dative’ on request from the deceased’s next of kin. Those who want to take on the role of the executor should apply to, and must convince, the Master of the High Court why they should be appointed. Duties of an executor Whether your executor is an individual or a financial institution such as Personal Trust, the following is a basic summary of the duties of the executor for straightforward cases. Possible complications and unique situations are not covered here. If your situation is unusual, please contact Personal Trust directly for more detailed advice. • The executor first needs to obtain the will and check on its validity, establish who the beneficiaries are and get an approximate idea of the assets and liabilities of the estate. Items such as bank accounts, title deeds to properties, insurance policy documents and any other documents that pertain to the financial affairs of the deceased need to be collected. • If a beneficiary is named in a life assurance policy, the proceeds can be paid directly to that beneficiary without having to go through the estate. This is an ideal vehicle for providing cash to dependants while the estate is being wound up. • An inventory of assets and property is an official form that can be obtained from the office of the Master of the High Court. The inventory should indicate whether total assets exceed R125 000. The surviving spouse or closest living blood relative residing in the district where the deceased lived must sign the inventory. If the assets total less than R125 000, the Master can shorten the procedure and allow the estate to be wound up in an informal, cost-saving manner. The procedure in this instance is much simpler, in that the executor does not have to advertise for creditors and does not have to draw and submit a Liquidation and Distribution Account. • An 'Acceptance of Trust' form is available at the Master’s office and must be completed and signed in duplicate. The Master’s office will forward a copy to the South African Revenue Service (SARS). In most cases the will in question would probably have exempted the executor from lodging security. Security is generally not required in cases where the executor is a parent, child or surviving spouse of the deceased. Where the Master requires security to ensure WHAT TO DO AFTER A DEATH IN SOUTH AFRICA 10 the honesty of the executor it is usually a bond which can be obtained from an insurance company. The amount of security required is at the discretion of the Master, who generally insists on security covering the value of the assets disclosed in the inventory. • The executor needs to apply to the Master of the High Court to be formally appointed and granted the necessary powers to administer the estate. This can take up to six weeks, depending on which of the nine Masters' Offices in South Africa is involved. It is best to go in the morning, and take the following documents with you: – The original will, (it is advisable to get a receipt when you hand it over) – The death notice – An inventory – A certified copy of the death certificate – An acceptance of trust form, in duplicate – A next of kin affidavit – An affidavit that the estate has not been reported to another Master's office (required by some) – A list of creditors. Different Masters’ offices have slightly different requirements, so it is advisable to enquire as to exactly what they require. Aside from the will, all of the above documents are available from the Masters’ offices. • The Master of the High Court will grant 'Letters of Executorship' to those persons who have been authorised to deal with the estate and who have agreed to accept the responsibility of winding up the estate. Copies of the ‘Letters of Executorship’ will be needed by banks and insurance companies that may hold assets pertaining to the deceased as proof that the assets they hold will be passed on to the properly authorised representative of the deceased’s estate. What the executor must do once appointed Once appointed, the executor must: • Advertise the estate so that any creditors can become aware of the need to register their claims against the estate. Advertisements must be placed in the Government Gazette and a local newspaper where the deceased resided in the 12 months preceding death. Creditors have 30 days from the date of publication of the advertisement to lodge any claims against the estate. WHAT TO DO AFTER A DEATH IN SOUTH AFRICA 11 • Check the deceased’s bank account or post, in order to find what monthly payments are being made. You will need to pay up and close these accounts, e.g. credit cards, petrol card, telephone accounts, DSTV, gym membership, clothing accounts, etc. • Close the deceased’s bank accounts and open up a cheque/current account called ‘Estate Late’ followed by the deceased’s name, as soon as more than R100 has been received. All investments will be paid into this account and all creditors and beneficiaries will be paid from this account. • Assets such as the deceased’s house may be sold, depending on what the beneficiaries want. The proceeds from the sale will go into the ‘Estate Account'. Such proceeds will later be paid out to beneficiaries from the ‘Estate Account'. • Give notice on shares, investments, annuities, policies, etc, that monies owing to the deceased are to be paid into the ‘Estate Account'. If beneficiaries have been nominated in policies, the benefice will bypass the estate and be transferred directly to the nominated beneficiary. • The executor then needs to prepare the 'Liquidation and Distribution Account' (L&D account). This can take from six weeks to six months or even longer depending on the degree of difficulty of the estate. The L&D account includes all the assets and liabilities in the estate at the date of death. It also includes the income and expenditure incurred by the estate since the date of death. The net value of the estate is then the inheritance due to the beneficiaries. When a person dies, the death can trigger a Capital Gains Tax payment depending on the size of the estate; expert tax knowledge is required to perform the calculation. The executor then submits the L&D account together with supporting documents to the Master of the High Court. If the Master has queries, the executor is to respond within a certain time period. The executor submits the deceased’s final tax return to SARS at the same time. • Once the Master of the High Court has given his approval, the account must be advertised in the Government Gazette and in a local newspaper and made available for inspection for 21 days at the Master’s office and at the Magistrates office in the district where the deceased lived. The heirs should have the opportunity to review the account before it is finally submitted to the Master. If no objections are lodged against the Liquidation & Distribution account, the Master will confirm that the executor may distribute the assets to the beneficiaries. WHAT TO DO AFTER A DEATH IN SOUTH AFRICA 12 • Before distributing the estate the executor must obtain a release from SARS. This will only be granted by SARS once they are satisfied that all outstanding taxes have been paid. • Creditors must be paid before the residue of the estate can be distributed among heirs. • After the account has been advertised, the executor prepares a cash statement and distributes the assets to the heirs. It takes an average of eight months to three years to finalise an estate. The executor will also arrange for transfer of fixed property, e.g. a house that was in the deceased’s name into the name of the person who inherited it. There will be no transfer duty, but the estate will pay conveyancing costs regardless of who inherits the property. • Once the executor has provided the Master of the High Court with proof that the creditors have been paid and that the assets have been distributed, the Master signs off the estate and the executor’s task is complete. If the deceased has no Will/dies intestate The Master of the High Court may appoint an ‘Executor Dative’ since no-one would have been nominated in a will. If a valid will cannot be traced, even though relatives may be positive that one exists, the estate must be administered as if no will had been drawn up. If a person dies without a will, or if the will is found to be invalid, the estate is to be administered in terms of the Intestate Succession Act, Act 81 of 1987. These rules only apply if the deceased was domiciled in South Africa at the time of death. If the deceased was domiciled in another country, the laws of that country will apply. About Intestate Succession Intestate succession is based primarily on blood relationship. Illegitimacy shall not affect the capacity of a blood relation to inherit. An adopted child is considered a descendant of his adoptive parents. The following is an outline of how an intestate estate devolves: • If the deceased is survived by a spouse or spouses, and has no living descendants, the spouse inherits the estate. If the deceased was a husband in a polygamous marriage the surviving spouses will inherit in equal shares. WHAT TO DO AFTER A DEATH IN SOUTH AFRICA 13 • If the deceased is survived by a descendant, but not by a spouse, the descendant shall inherit the estate. • Where there is a living spouse or spouses and descendant/s, each spouse will inherit R125 000 or a child’s share, whichever is greater (this amount is fixed from time to time by the Minister of Justice). The children will get the balance of the estate and, if a child is deceased and has descendants, that child’s portion will go to his/her surviving spouse and dependants. • If the deceased leaves no spouse or descendants, but both parents are alive, the parents shall inherit the estate in equal shares. • If the deceased has no surviving spouse or dependants but has only one surviving parent, the parent inherits half the estate and the descendants of the deceased parent the other half. If there are no such descendants, the surviving parent shall inherit the estate. • If the deceased is not survived by spouse, descendant or parent but is survived by descendants of the deceased’s mother or father who are related to the deceased through the parents, one half of the estate is divided equally among the mother’s descendants and one half of the estate is divided equally among the father’s descendants. • If the deceased is not survived by a spouse, descendant, parent or descendant of a parent, the other blood relations of the deceased who are related to him nearest in degree shall inherit the intestate estate in equal shares. • Where there are no relatives, and the assets have not been claimed by a legitimate heir after 30 years, the estate is forfeited to the state. Minors If the deceased dies intestate and a minor inherits, such portion will be held by the Guardians’ Fund at the Master of the High Court until the child reaches majority at 18 years of age. Marriage in Community of Property Where Intestate Succession applies in a case of marriage in community of property, one half of the estate belongs to the surviving spouse/s and will not devolve according to the rules of intestate succession. PERSONAL TRUST INTERNATIONAL LIMITED RONDEBOSCH OFFICE Personal Trust House Belmont Park Belmont Road Rondebosch 7700 P O Box 476 Rondebosch Cape Town 7701 RSA Tel: 021 689 8975 · Fax: 021 686 9093 · e-mail: [email protected] website: www.personaltrust.co.za SOMERSET WEST OFFICE G03 Parc du Links Niblick Way The Interchange Somerset West 7130 Postnet Suite Number 126 Private Bag X15 Somerset West 7129 RSA Tel: 021 852 2265 · Fax: 021 852 9298 KNYSNA OFFICE Thesen House 6 Long Street Knysna 6570 P O Box 2320 Knysna 6570 RSA Tel: 044 382 2100 · Fax: 044 382 7427 INTERNATIONAL OFFICE LONDON 14/15 Mount Havelock Douglas Isle of Man IM1 2QG P O Box 909 Beaconsfield Buckinghamshire HP9 1JH U.K. Tel: 0044 7973 255 259 · Fax: 0044 1494 400 313 FSP Licence No. 707 Personal Trust International Limited Reg No 1951/002859/06

© Copyright 2026