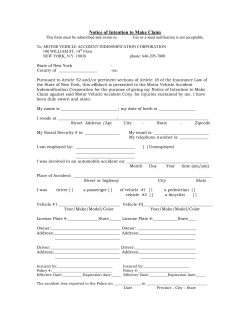

Guide to Questions Autopac