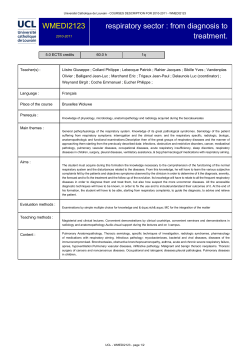

Document 5717