Credit Application

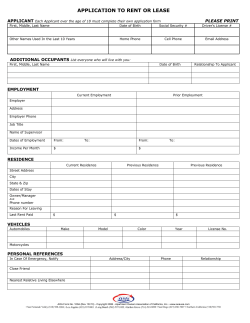

Store Reference No: Checklist: 1. Certified Copy of I.D. / Passport / Driver’s License 2. Proof of Residence e.g. Utility bill / letter from employer / lease agreement / affidavit from landlord / letter from school or university or college or government department or bank 3. Proof of Income e.g. Payslip / lease agreement for landlords / 3-month bank statement / proof of ownership of business or enterprise / guarantor _________________________ Customer Account No: _________________________ Checked and assisted by: ……………………………………………….. APPLICANT INFORMATION Middle Name I. First Name Surname Gender Date of Birth (DD/MM/YYYY) Male Female I.D. No.: Number of Dependents: Estimated Monthly Expenses (US$): Current Residential Address: Company Accommodation Staying with Parent Marital Status Married (Please Tick) Single Owned Rent Divorced Widowed Home Phone No.: Monthly Rental US$: Mobile Phone No.: No. of Years at current address: Alternative Mobile No.: Previous Address: No. of years at previous Personal E-mail Address: address: DETAILS OF SPOUSE (IF MARRIED) Full Name: Self-Employed Employment Employed Status Unemployed Telephone Number(s): E-mail Address: I.D. No.: Current Employer: Net Salary or Other Income (Specify): NEXT OF KIN (2 REQUIRED AND BOTH MUST NOT RESIDE WITH APPLICANT) II. Full Name (Kin 1): Relationship to Applicant: Residential Address: Telephone Number(s): Business Address: Business Telephone Number: Full Name (Kin 2): Relationship to Applicant: Residential Address: Telephone Number(s): Business Address: Business Telephone Number: APPLICANT’S INCOME / EMPLOYMENT INFORMATION III. Monthly Net Salary / Income (US$): (If not formally employed, please specify type of income) Business Phone Number: Current Employer Name and Address: Business E-mail Address: Previous Employer Name and Address: Trade / Occupation: Length of Time Employed: Type of Employment e.g. Full-time; contract (if contract, state length of contract): Business Phone Number: Length of Time Employed: TRADE REFERENCES IV. Are you currently paying off any other loans/credit? Store/Company: Store/Company: Yes Total Outstanding Debt (US$) Monthly Instalment (US$): Total Outstanding Debt (US$) Monthly Instalment (US$): No TERMS AND CONDITIONS V. I, the Applicant, hereby acknowledge and agree that I have read and fully understood the Terms and Conditions relating to this Credit Application Form, which are found overleaf. Where I had not fully understood any of the provisions of the Terms and Conditions, I hereby acknowledge and agree that such provisions were fully explained to me by an employee / agent of Leon Business Solutions (Private) Limited (“Leon”). I further acknowledge and agree, without limitation, to abide by all of the provisions of the Terms and Conditions. I hereby confirm that I have received a copy of this agreement and where I have not, I hereby agree and confirm that the onus lies solely with me to obtain such a copy. DATED ON THE ______________ DAY OF ____________________________ 20____. ______________________________ Applicant’s Signature ______________________________ Identity Number of Applicant OFFICIAL USE VI. Credit Application ___________________________________ Full name Approved Declined Item(s) Purchased: 1) 2) 3) 4) 5) Total Cash Price Deposit Paid BALANCE TOTAL INSTALMENT PER MONTH Term of Credit 6 Months 12 Months Other (Please Specify) Captured By (Full Name): US$ c Approved By: VII. Designation: TERMS AND CONDITIONS Date: Signature: PLEASE PRINT OR TICK WHERE APPLICABLE 1. PARTIES The undersigned acknowledges and agrees that, should any credit be extended in terms of this credit application, such credit will be extended to the Applicant by Leon Business Solutions (Private) Limited (“Leon”). 2. CESSION OR ASSIGNMENT OF RIGHTS The undersigned acknowledges and agrees that all rights and obligations of Leon in terms of this agreement may be ceded or assigned at any time and at the sole discretion of Leon to any third party. 3. 4. 5. 6. 7. 8. 9. WARRANTY AS TO CORRECTNESS AND COMPLETENESS OF ANY INFORMATION SUPPLIED The undersigned hereby warrants that all information, whether given in writing or verbally, and which is (i) supplied by the Applicant prior to completing the Credit Application Form, and/or (ii) supplied by the Applicant in the actual Credit Application Form, and/or (iii) supplied by the Applicant subsequent to completing the Credit Application Form, is true and correct. The undersigned hereby agrees that Leon, its employees or designated agents may verify the veracity of any of the information supplied by the Applicant, with such verification including but not limited to, contacting the undersigned’s employer, tenant or landlord. Should Leon, its employees or designated agents reject the undersigned’s application for credit, neither them nor their affiliates shall be under any obligation whatsoever to provide reasons and / or justifications for their decision to the undersigned or to any other person. USE OF PERSONAL INFORMATION The undersigned acknowledges and agrees that personal information in this credit application or provided subsequently, and personal information obtained from a credit/consumer reporting agency and/or financial institution, may be used by, collected by and/or disclosed to Leon (including Zimbabwean subsidiaries, affiliates, agents and contractors of Leon as well as any authorised agent(s) designated by Leon) for the following purposes: (i) evaluating the credit application and the undersigned’s eligibility for credit, (ii) entering into a conditional sales agreement, (iii) contract management and administration, including for credit, billing, collection, cessionary disposition, lien registration, insurance tracking and service and warranty purposes. The undersigned acknowledges and agrees that personal information may be transferred to a third party or parties to be used for the same purposes described herein if this agreement entered into by the undersigned is ceded or assigned to such third party or parties, or to an organisation in connection with the due diligence for, and completion of, a business transaction, including, without limitation, a securitisation or financing involving Leon or its subsidiaries or affiliates. The undersigned further acknowledges and agrees, in connection with Leon making a determination in respect of this credit application, that (a) all information provided in this application is for the purpose of securing credit and warrants that it is true, correct and complete, (b) a credit/consumer report and other credit information containing personal information may be requested from a credit/consumer reporting agency and financial institution, (c) Leon is authorised to exchange with any credit/consumer reporting agency and financial institution credit information covering this application and details of any credit granted (including, without limitation, payment history relating to the credit granted) for the purposes of Leon determining creditworthiness and for the purposes of permitting other credit grantors to do the same. Should any of the information provided by the undersigned change at any time either prior or subsequent to this credit application being approved, the undersigned hereby acknowledges and agrees that they will immediately, or failing which, as soon as reasonably possible, inform Leon of any such change. The undersigned hereby acknowledges that, where any information differs from the representations made by the undersigned in terms of this credit application, Leon may, at its sole discretion and without reference to the undersigned, amend or cancel the agreement between the parties. LANGUAGE AND GOVERNING LAW 10. It is the express wish of the parties that this form and any related documents be drawn up and executed in English. It is further agreed by the parties that the laws which shall govern this agreement are the laws of the Republic of Zimbabwe. COSTS AND CHARGES 11. The Applicant hereby acknowledges and agrees to pay, without deduction, all charges and/or fees which may be levied by Leon from time-to-time. Such charges and/or fees shall include interest, insurance, penalty costs, early settlement fees, transaction fees, monthly management fees and any other account-management related costs. 12. Furthermore, where the Applicant wishes to pay any amount herein in terms of a payroll deduction by their employer and such employer levies an administrative fee for such a service, the undersigned hereby acknowledges that they shall be solely liable to pay any such amount. 13. The Applicant hereby acknowledges that all of the aforementioned charges, fees and costs have been fully explained to the Applicant with such explanation including, but not limited to, the limit of credit extended to the Applicant, the monthly instalments to be paid by the Applicant, the composition of such monthly instalments and the penalty fees to be paid by the Applicant where they have defaulted on any payment that is due and payable. 14. The Applicant hereby acknowledges and agrees that, where the due date of any payment falls on a weekend, Zimbabwean public holiday or any other non-business day, the Applicant shall pay any due amount on the next business day. 15. The undersigned acknowledges and agrees that, should they fail to timeously pay any amount when such amount becomes due and payable, the entire outstanding amount, including any penalty fees, shall become immediately due and payable. 16. In terms of this agreement and notwithstanding anything to the contrary contained herein or elsewhere, the Applicant hereby irrevocably agrees to pay the following charges, costs and fees where applicable: 16.1. Interest on the principal amount of 8% per month; 16.2. Insurance on the principal amount of 1% per month; and 16.3. Account administration fee of US$4.25 (incl. VAT) per month; 17. In addition to the above charges, costs and fees, and where the Applicant has failed to timeously pay any amount due to Leon, the Applicant hereby irrevocably agrees to pay the following charges, costs and fees where applicable: 17.1. Late penalty fee of US$5.00 per month; 17.2. Late penalty interest of 8% per month of any outstanding amount; 17.3. Collection commission of 10% on any outstanding amount. WHOLE AGREEMENT 18. The terms and conditions contained in this credit application form shall constitute the entire agreement between Leon and the Applicant and no variation, amendment, consensual cancellation or otherwise shall be of any force or effect unless agreed to by both the Applicant and Leon in writing and signed by both parties. CERTIFICATE OF INDEBTEDNESS 19. The undersigned hereby acknowledges and agrees that a certificate signed by the Credit Manager or any competent member of Leon showing the amount owing by the Applicant to Leon shall be sufficient proof that the said amount is due, owing and unpaid and shall be satisfactory proof of what is contained therein for the purpose of any action (whether by way of provisional sentence, summary judgment or otherwise) proof of the debt on insolvency or for any purpose whatsoever. Where the quantum of Leon’s claim is thereafter disputed by the Applicant, the Applicant shall bear the onus of proving that such amount is not owing and/or due and/or payable. NO PREJUDICE 20. No indulgences, latitude, extension of time or the like granted by Leon to the Applicant shall in any way whatsoever constitute a novation or waiver of any rights which Leon may have against the Applicant nor may it operate as an estoppel against Leon. DOMICILIUM CITANDI ET EXECUTANDI 21. The undersigned hereby chooses as their domicilium citandi et executandi the Current Residential Address as it appears in the Credit Application Form. RECOVERY OF OUTSTANDING AMOUNTS, REPOSSESSION OF GOOD(S) AND PROHIBITION AGAINST DISPOSING OF PURCHASED GOOD(S) 22. The Applicant hereby consents to the jurisdiction of the Magistrates’ Court for the determination of any action or proceedings irrespective of whether or not such action or proceedings are beyond the jurisdiction of the said Court. It is hereby expressly understood that Leon shall be entitled and not obliged to bring any action in any other competent Court, which has jurisdiction over the Applicant. In the event of any such action being instituted by Leon against the Applicant for any reason or for any amount due in terms hereof, the Applicant hereby agrees to pay all legal costs incurred by Leon in recovering any outstanding amounts, including but not limited to legal fees on an attorney and client scale, collection commission, tracing fees and the like. 23. Without limiting any other right and / or remedy available either herein or in law generally, Leon shall have the right to immediately repossess any good(s) purchased by the Applicant where the Applicant has breached any term of this Agreement and sell same in order to recover any outstanding amounts. 24. Where any goods have been repossessed and sold in terms of this Agreement, the Applicant hereby acknowledges that they will be liable for any amounts still outstanding to Leon, where the price received for the sold repossessed goods is insufficient to fully settle the debt owed by the Applicant. 25. Furthermore and notwithstanding anything to the contrary contained herein or elsewhere, where the Applicant has breached any term of this Agreement, they shall in no way whatsoever dispose of the purchased good(s) until Leon is satisfied that the Applicant has rectified such breach(es). Leon’s satisfaction shall be made by Leon in writing and signed by an authorized employee thereof.

© Copyright 2026