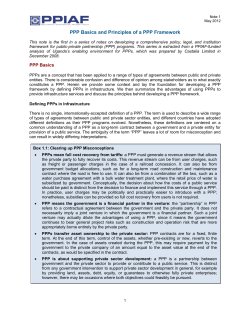

Paper - Brookings Institution