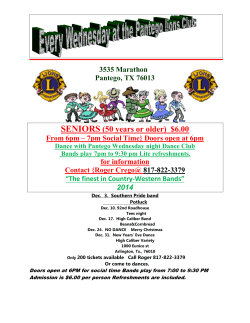

December 2014