Tax Credit Advisor - National Housing & Rehabilitation Association

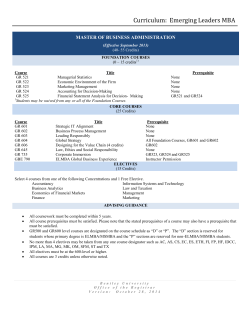

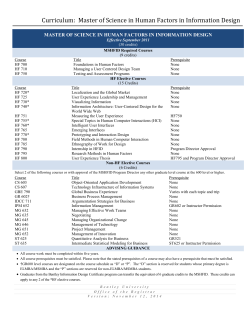

TaxCreditAdvisor 2014 MEDIA KIT TAX CREDIT ADVISOR About Us GROUND BREAKING. P ublished since 1990, Tax Credit Advisor magazine is the must-read publication for professionals in the affordable housing, historic preservation, and community/economic development fields. It’s the only national publication that provides readers – every month and in one convenient place – 1459 NEW AFFORDABLE APARTMENTS in-depth coverage of the federal Low-Income Housing, Historic Rehabilitation, and New Markets Tax Credits, plus federal multifamily housing programs administered by the U.S. Department of Housing and Urban Development and USDA Rural Development. Tax Credit Advisor has a paid readership (subscriptions cost $329/year) that includes the key decision-makers at companies and organizations throughout the U.S. Our readers include for-profit and nonprofit developers, general contractors, multifamily owners, property managers, housing finance agencies, government officials, nonprofits, and other professionals involved in tax credit transactions – syndicators, investors, lenders, attorneys, accountants, market analysts, consultants, etc. Tax Credit Advisor recognizes that in a time of rising costs and intense competition for tax credits and other subsidies, an informed understanding of the federal housing, historic, and new markets tax credits can mean the difference between a project that moves forward and one that doesn’t. Historic rehabilitation projects often combine the use of historic and low-income tax credits, helping finance affordable rental housing. Community it ) and economic development (cre a tiv new meaningful as to form traditional ide h new projects often pair new to transcend challenges wit n. 1. Ability problems and brings m ility to solve Ab Tea 2. tion ds erprise Syndica ideas or metho (e.g., The Ent gressiveness markets and historic credits, insights, pro t your needs.) ry deal to mee creativity to eve n Team rce... sou rise Syndicatio while mixed-use developYoforuaffr ord 3. The Enterp able housing es. vic ser . and tax credit up Enterprise ments may utilize as many as creativity, look looking for When you’re all three of these tax credits. And increasingly, renewable energy tax credits are being used in projects as well. With articles written by seasoned journalists and industry CPA er, CPA eller, Ke an Kell Bryyan Bry experts, Tax Credit Advisor provides a mix of breaking news, trend analysis, expert advice, and project case studies to help readers successfully develop, finance, manage, market, and invest in tax credit projects, and to keep up with new developments in the area of green building. R4 Capital is pleased to announce the closing of R4 Housing Partners LP, its $100-million inaugural multiinvestor LIHTC fund. National LIHTC syndication. New York | Boston | Santa Ana 0 ; @ ; 0 = 9 , ( * * , 0 , 5 LFUU 9 NBBSSLF EN , J[FFE OJ[ HO PH ? 7 SFDP JTBSFD QJTB VQ SPV (SP , O( FEFFO BSSSFE $ $BS 0 ; @ H JOH QMBDDJO EQMB OE BO , . 9 HB JOH UVSSJO USVDDUV 0 5 ; TTUSV O J JO S F E EFS B Y F MMFB B Marc D. Schnitzer, President 646 576 7659 | [email protected] Peter Dion, Executive Vice President 617 502 5943 | [email protected] U OHUBY VTJOH IPVTJ NFIP ODPNF XJODP MPXJ OMP UJPO FDUJP 44FD UI XJUI OUTXJ NFOUT FTUNF JOWFTU $ JOW )5$ -*)5 EJU-* XF SFEJU DDSF XF F D O ODF J 4 4J T S P PST FTU JOWFTU OBMJOW UJPOBM UJUVUJP OTUJUV $ JJOT -*)55$ JO-*) MJPOJO CJMMJPO CJM WFS EPWFS JTFEP FSBJTF BWFSB I IBW JO O OJO P J M M J JMMJP C C S PWFFS OHPW VEJJOH JODMMVE JUZJOD RVJUZ FFRV FS PWWFS EP BOE DUBO VDU EV PE QSP FEQS BODDFE IBO FOI JUFO EJU SFE DU DDSF VDU P EV UQSSPE SLFFUQ NBBSL BSZZN E EBS O P PO D F T TFD JO POJO JMMJJPO C CJMM INVES TMEN K T BAN .\HYH /&&)#% U[VY 3).#! JPHS MPUHU ,)&/2. )!!.$ . % 7 9 HK] /2+s */(. VUKHY % 2 &! 5 , + . &! !.!'). `THY ' RL[HK / 2s $)2%#4 ]PZVY s% `Z[ - ! ) , * H KP[H [LJYL %$ & #!22 #/% . #/ www.R4cap.com ING SIPC NRA & ER FI MEMB ZLJ PZVY Ronne Thielen, Executive Vice President 714 727 3851 | [email protected] K]PZV & 8 $ " 3 3 8 8 8 t 8 Y` $0 % & / $0 . Creativity Loans | Public Congress. st threats in LIHTC again protect the Scan to help built an admired ices Group has Real Estate Serv estate industry, RubinBrown’s firm in the real For 30 years, ier accounting credits. nally as a prem tax natio n and ing tatio hous repu on affordable ely entir st t, tax, focused almo related to audi complexities ric tax help with the d experts can g for LIHTC, histo Our specialize deal structurin ing finance ding complex hous inclu state g, , ultin HUD and cons gy tax credits, renewable ener credits, NMTC, much more. agencies, and iseC www.Enterpr rge harrge -Cha r-In-C er-In tner Partn Part roup Grou ces G erviices Serv eS tatte Est Esta Real E Real wn.com inbro bryan.keller@rub 314.290.3300 n.com www.rubinbrow ing sors specializ CPAs and advi stry le housing indu s ui in the affordab Loui St.. Lo St t |S ity ity City as C nssas Kan er | Ka ver nve Denv Den For ad information/orders, contact Scott Oser at 301.279.0468 or [email protected] 2 ommunity.com Policy All rights reserved. Investment, Inc. sition ent & Acqui Predevelopm ves Financing | & Commercial ts | Green Initiati | Multifamily | Capital Marke Credit Equity Development Markets Tax t | Housing LIHTC & New Managemen nce | Asset Technical Assista Community © 2013 Enterprise ication Credit Synd President, Tax re, Sr. Vice unity.com Raoul Moo nterprisecomm 5 | rmoore@e 877.585.849 TAX CREDIT ADVISOR Readership Tax Credit Advisor reaches more than 400 of the most important decision makers involved in the use of housing, historic, and new markets tax credits. Key Statistics This broad spectrum of readers includes: Some of the characteristics of our readers include: • Developers and Owners • Builders and Property Managers • Housing Finance/Credit Agencies • Syndicators and Lenders • Corporate Investors • Attorneys, Accountants, Consultants • Nonprofits • Public Housing Authorities • Housing Bond Issuers • Appraisers and Market Analysts • Congressional, IRS, and HUD Staff • Federal, State & Local Officials • 73% notice the ads in the publication. • 67% have authority to purchase products and professional services, or to decide how to finance their deals. • 85% rate the Tax Credit Advisor a valuable business tool. • 63% spend over 31 minutes with each issue of the publication. • 66% have read 4 of the last 4 issues of the publication. • 75% report that two or more people besides themselves usually read their copy of the Tax Credit Advisor — more than 25% of readers say 5 or more. Composition of Subscribers 8% 28% 18% 28% 18% Developers / Builders / Property Managers Syndicators / Lenders / Investors • 83% keep each issue of the publication for future reference. Attorneys / Accountants / Consultants / Market Analysts Housing Agencies / Public Officials Other Tax Credit Advisor ’s Readers Are Involved In: Principal Activity of Firm/Organization LIHTC Rental Housing ........................................98% Other Affordable Rental Housing ......................71% Preservation of Existing Housing .......................68% Historic Rehabilitation .........................................63% Affordable Owner-Occupied Housing ..............46% Public Housing Redevelopment ........................44% New Markets Tax Credit Program .....................34% Economic Development .....................................27% For ad information/orders, contact Scott Oser at 301.279.0468 or [email protected] 3 TAX CREDIT ADVISOR’S Editorial Coverage Tax Credit Advisor is written to ensure that our readers get the most out of each and every issue. Each issue covers key subject areas based on our readers’ critical areas of need. These include coverage of federal low-income housing, historic rehabilitation, new markets, and renewable energy tax credits, and federal multi-family housing programs of HUD & USDA Rural Development. We also report on green building news and trends. Tax Credit Advisor provides at least one detailed case study per issue. Following are additional details on key subject areas of coverage: Historic Rehabilitation Tax Credits Low-Income Housing Tax Credits Green Building We report on the many dimensions of Low-Income Housing Tax Credits (LIHTCs), beginning with how Congress and the federal agencies (HUD, IRS) shape their use, and the award of LIHTCs under the qualified allocation plans of state housing agencies. We provide full details of how developers put LIHTCs to work in multi-layer financings that fund affordable housing, including the use of taxexempt bonds. Our coverage of LIHTC equity pricing includes the widely-followed Corporate Tax Credit Fund Watch, prepared by Ernst & Young, LLP, and Housing Tax Credit Monitor, prepared by CohnReznick, LLP. Both are exclusive to Tax Credit Advisor. We cover new occurrences in green building rating systems, the use of renewable energy, and incentives and funds to owners to make buildings more energy efficient and sustainable, and more. We report on the role of the National Park Service and state historic preservation offices in overseeing certification of these credits, as well as on changing deal structures, pending legislation, and IRS guidance. Case Studies Tax Credit Advisor identifies and dissects cuttingedge transactions that break new ground and serve as “case study” models. These detail funding sources, deal structures, and the challenges faced by the developers plus their solutions. Federal and State Update We provide readers a quick overview of the regulatory and legislative activity important to affordable housing and community development at the federal, state, and local levels. We also report on new state tax credits. NH&RA News We report on current news and future events of the National Housing & Rehabilitation Association and its councils. New Markets Tax Credits We cover the fast-paced regulatory developments affecting the use of these credits – from the CDFI Fund’s allocations and rulemaking, to the IRS’s clarification of tax structures. We describe the complex investment strategies involving NMTCs, including leveraged loan structures and the combination of NMTCs and historic credits. Exclusive Columns We carry exclusive columns by industry experts David A. Smith (The guru is In) and Timothy R. Leonhard (The Debt Corner). For ad information/orders, contact Scott Oser at 301.279.0468 or [email protected] 4 TAX CREDIT ADVISOR’S Editorial Calendar 2014 Editorial Calendar TCA Keeps You Up-To-Date ISSUE THEME January 2014* Senior Housing February 2014 Debt Financing Sources • Coverage of IRS, HUD, and CDFI Fund rules and federal/state legislation affecting housing, historic, new markets, and renewable energy tax credits March 2014* Green Building & Retrofits April 2014 Preservation Transactions & Opportunities May 2014* Tax Credit Equity Sources June 2014* Market Analysis July 2014 Effective Property Management August 2014* Resident Services September 2014 Public Housing Revitalization October 2014* Historic Rehabilitation November 2014 Niche Development Opportunities December 2014* New Markets Tax Credits • The latest market prices for housing credits, and current yields to investors • Corporate Tax Credit Fund Watch and Housing Tax Credit Monitor. These surveys of syndicators, prepared by Ernst & Young LLP and CohnReznick LLP exclusively for Tax Credit Advisor, provide information monthly on current LIHTC multi-investor funds, their yields, and current credit pricing. • News on “green” and sustainable building standards and practices and energy retrofits • Advice from industry experts on tax credit structuring and compliance • Information on new state qualified allocation plans for housing credits, state credit supply, and application deadlines • Incentives for making properties more energy-efficient • Coverage of key issues affecting projects, including property tax assessments, market studies, industry “best practices,” and other areas Bonus Distribution*(see months above) • How tax credits can be used to reposition older or underutilized properties Tax Credit Advisor is distributed year-round to attendees at a number of events attended by developers and other tax credit industry participants. • How to best manage tax credit properties and avoid compliance mistakes Among these are conferences of the: • Debt financing trends and sources • National Housing & Rehabilitation Association • New gap financing and subsidy sources • National Council of State Housing Agencies • Information on state tax credits • Affordable Housing Tax Credit Coalition • Council for Affordable and Rural Housing E D I T O R I A L C O N TA C T Glenn Petherick, Editor Phone: 202-939-1774 | Email: [email protected] • Select state housing credit agency events For ad information/orders, contact Scott Oser at 301.279.0468 or [email protected] 5 TAX CREDIT ADVISOR’S Advertising Rates & Specs 1x 3x 6x 12x $2,260 $2,130 $2,050 $1,695 Full Page 4-color (bleed or standard size) (Standard: 7.5”W X 9.75”H) (Bleed: 8.75”W x 11.25”H, trims at 8.5”W x 11”H) Jr. Page 4-color (4.875”W X 9.75”H) $1,790 $1,680 $1,630 $1,360 1/2 Page 4-color $1,315 $1,250 (Horizontal: 7.5”W X 4.625”H) (Vertical: 3.5”W X 9.75”H) $1,205 $1,025 1/4 Page 4-color (3.5”W X 4.625”H) $890 $770 $950 $915 * Black & White ads are available. Please contact Scott Oser for information, 301-279-0468. Advertising Closing Dates: January-December 2014 Edition Space Reservation Deadline Materials Due January 2014 December 9 December 13 February 2014 January 13 January 17 March 2014 February 12 February 17 April 2014 March 14 March 19 May 2014 April 14 April 18 June 2014 May 14 May 19 July 2014 June 13 June 18 August 2014 July 14 July 18 August 11 August 15 September 15 September 19 November 2014 October 13 October 17 December 2014 November 7 November 13 September 2014 October 2014 Please note: The publisher reserves the right to place the word “Advertisement” next to advertising copy that resembles editorial material. Proofs A color proof is required for all color ads. We are not responsible for color inconsistency if a color proof is not provided. Advertising Submission Specifications Tax Credit Advisor accepts ads in black-and-white (grayscale) or full color (CMYK). Advertisers should supply one of the following: (1) press-ready PDF file with fonts embedded; (2) Illustrator eps with fonts outlined; (3) high res jpeg, min. 300 dpi; or (4) Quark file with fonts + links. Please submit all artwork/proofs to: Glenn Petherick [email protected] Tax Credit Advisor 1400 16th St., NW, Suite 420 • Washington, DC 20036 202-939-1774 (tel.) 6 TAX CREDIT ADVISOR Advertising Insertion Order Company Name: _____________________________________________________________________________________________________ Contact Name: ______________________________________________________________________________________________________ Phone: _______________________________________________ SIZE Full Page 4-color (bleed or standard size) Jr. Page 4-color 1/2 Page 4-color 1/4 Page 4-color Email: _____________________________________________________ 1x 3x 6x 12x $2,260 $1,790 $1,315 $950 $2,130 $1,680 $1,250 $915 $2,050 $1,630 $1,205 $890 $1,695 $1,360 $1,025 $770 * Black and White ads available. Contact Scott Oser, [email protected], 301-279-0468 O R D E R I N F O R M AT I O N : ISSUES: ❑ Jan 14 ❑ Sep 14 ❑ Feb 14 ❑ Oct 14 ❑ Mar 14 ❑ Nov 14 F R E Q U E N C Y: ❑ 1X ❑ 2X AD SIZES: ❑ Full page (Bleed: 8.75”w x 11.25”h, trims at 8.5”w x 11”h) ❑ 3X ❑ Apr 14 ❑ Dec 14 ❑ May 14 ❑ Jan 15 ❑ 4X ❑ 5X ❑ Jun 14 ❑ Feb 15 ❑ Jul 14 ❑ Mar 15 ❑ 6X ❑ 12X ❑ Aug 14 ❑ Full page (Standard: 7.5”w x 9.75”h) TOTAL COST OF AD(S) ❑ Jr. page (4.875”w x 9.75” h) ❑ Half page Horizontal (7.5”w x 4.625”h) $______________________ ❑ Half page Vertical (3.5”w x 9.75”h) ❑ Quarter page (3.5”w x 4.625”h) Your signature on this ad insertion order will reserve your company’s advertising program in the Tax Credit Advisor. Please fax a signed copy to Glenn Petherick at 202-265-4435. (Problem faxing? Contact: Glenn Petherick, tel. 202-939-1774, [email protected]). Accepted By: __________________________________________________ Date: ______________________________________________ B I L L I N G I N F O R M AT I O N : Name: ________________________________________________________ Title:_______________________________________________ Firm: ________________________________________________________________________________________________________________ Address: ____________________________________________________________________________________________________________ City: ______________________________________________________ State: ________________ Phone: ________________________________________________________ Zip: ___________________________ Fax: _______________________________________________ Email: _______________________________________________________________________________________________________________ If you wish to pay in advance, please complete the information below: ❑ Please charge my credit card: ❑ Visa ❑ Mastercard ❑ American Express Credit Card Number: ____________________________________________ Exp. Date:_________________________________________ Security Code:___________________________________________________ [3- or 4-digit code on back of card or front (AmEx)] Name as it appears on card: ______________________________________ Signature: _________________________________________ CARDHOLDER BILLING ADDRESS: ❑ Check here if same as billing address above. Address: ____________________________________________________________________________________________________________ City: ______________________________________________________ State: ________________ Zip: ___________________________ For ad information/orders, contact Scott Oser at 301.279.0468 or [email protected] 7

© Copyright 2026