ITIC Bulletin - International Tax and Investment Center

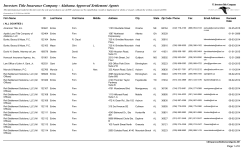

ITIC Bulletin December 2014 International Tax and Investment Center Contents Editor’s Note ITIC Participation in Worldwide Events Some articles throughout this Bulletin are linked to longer articles on ITIC’s website. These articles are specified in blue font and underlined for easy, “one click” access to the full article. Please note that some articles are limited for Sponsors only and are password protected. Please email Diana McKelvey to obtain the log-in information. Recent ITIC Publications News on Board Members, Advisors, and Staff Academy of Public Finance Regional Tax Forums Myanmar Update Middle East/North Africa Update Kazakhstan Update KMTA Update Ukraine Update Combatting Illicit Trade Iraq Update Libya Update Upcoming ITIC Events Due to the holiday period, the next issue of the ITIC Bulletin will be published in early February 2015. 21st Annual ITIC Board of Directors’ Meeting held in London Asia-Pacific Update Russia Update Season’s Greeting and Happy New Year from ITIC The International Tax and Investment Center (ITIC) held its 21st annual Board of Directors’ meeting in London on 30 October. In addition to the annual Board of Directors’ meeting, a briefing and dinner was organized at the House of Lords for ITIC’s Board, sponsors, and guests. The Board meeting marked the start of ITIC’s third decade of promoting tax, economic and investment reforms. To view the special edition Bulletin reporting on the meeting, click here. ITIC Issues Paper Available At the annual Board of Directors’ briefing on 29 October, ITIC released a new Issues Paper co-authored by Dave Hartnett (former Permanent Secretary of HMRC and ITIC Board member) and Hafiz Choudhury (ITIC Senior Advisor), titled, Tax Administration Priorities in Emerging and Frontier Countries. A copy of the paper is available on ITIC’s website here. ITIC Signs Cooperation Agreement with Brazilian Partner ITIC and the Grupo de Estudos Tributários Aplicados (GETAP) have agreed to cooperate on joint programs in Brazil to advance their common research and educational missions as non-governmental organizations (NGOs). The fundamental aim of the joint GETAP-ITIC programs is to foster mutual understanding and trust between the Brazilian Government and taxpayers. Continue reading ITIC Bulletin ♦ December 2014 2 In Memoriam: Bill Frenzel Our dear friend and colleague Bill Frenzel passed away on 17 November. As the founding Chairman of the Executive Committee of the Board of Directors, Bill provided leadership, guidance and wisdom to ITIC, and to me personally, for the past 22 years. As a strong advocate for pro-growth tax policies and free trade, he was a true champion for ITIC’s vision, mission and programs. Bill participated in our early missions (1992) to Kazakhstan and Russia that led to the creation of ITIC, and continued his active involvement on the Executive Committee until last month. Knowing of Bill’s illness, at our 30 October meeting, Dr. Miller and Mr. Witt paid tribute to Bill Frenzel’s service as a founding Director and Chairman of ITIC’s Executive Committee. By unanimous consent, the Board approved the following resolution: The Board of Directors of the International Tax and Investment Center is grateful for the services of Bill Frenzel as a founding Director and Chairman of the Executive Committee. His commitment to the founding principles of ITIC, particularly pro-growth tax policies and free trade have guided the organization for over 21 years. As a result of Bill’s leadership and tireless efforts, ITIC has grown from an idea to a well-respected international NGO working with over 85 countries. The Board has asked management to establish a living legacy to Bill Frenzel and establish a program in his name to continue his commitment to the promotion of pro-growth tax policy and free trade. U.S. House of Representatives Remembers Bill Frenzel On 19 November, the U.S. House of Representatives dedicated one hour of floor debate to the life of Bill Frenzel, and in particular, praised his great accomplishments in the areas of trade, tax, and U.S. budget policy. Continue reading Bill Frenzel: ITIC Chairman Emeritus Honored with Mexican Order of the Aztec Eagle for Promotion of Free Trade On 20 October, ITIC Chairman Emeritus of the Executive Committee, The Honorable William Frenzel, was honored by the Ambassador of Mexico to the United States, Eduardo Medina Mora, with the Mexican Order of the Aztec Eagle, the highest award Mexico confers on foreigners. This award, presented by Mexican Ambassador Mora on the 20th anniversary of the North American Free Trade Agreement (NAFTA), recognizes the work done by Mr. Frenzel in helping to move the NAFTA Bill through the U.S. House and Senate. Continue reading Obituaries About Mr. Frenzel • Bill Frenzel, Key Voice on Economics in House, Dies at 86 – The New York Times • Bill Frenzel, Minnesota Republican and fiscal authority in the U.S. House, dies at 86 – The Washington Post • Obituary: Republican Bill Frenzel; represented west metro in Congress - Star Tribune ITIC Expands Senior Management Team At the Board of Directors’ meeting, ITIC President Daniel Witt introduced Blake Marshall, who joined ITIC as a new Vice President. Blake has extensive experience working in developing and emerging markets as Executive Vice President of the US-Russia Business Council and as Senior Vice President of Hill+Knowlton Strategies. Witt added, “Blake brings extensive program management and communications experience to help ITIC further strengthen and expand our programs. Blake is a seasoned internationalist with hands-on experience developing and implementing programs.” Blake’s hiring was recently featured in the International Tax Review. To view the full article, click here. Blake joins current ITIC Vice President Irene Savitsky, who oversees ITIC’s finance and administration. 2015 ITIC Calendar of Events Released To view the calendar, click here. ITIC Bulletin ♦ December 2014 Second Annual International Conference on Shadow Economy and Taxation The second annual International Conference on Shadow Economy and Taxation Conference will be held on 2224 April 2015 in Bucharest, Romania. ITIC Program Advisor, Liz Allen, will co-chair the event. First Annual Conference The first annual International Conference on Shadow Economy and Taxation was held in April 2013 in Vilnuis, Lithuania. A special edition ITIC Bulletin reporting on the conference is available here. ITIC Participation in Worldwide Events ITIC Participates at 2nd Kazakhstan-US Convention On 10 December, ITIC President Daniel Witt made a presentation on the panel session titled, “KazakhstanGateway to Central Asia,” at The 2nd Kazakhstan-US Convention in Washington, DC. 3 South Caucasus Project – Progress Report As previously advised, we have been cooperating with The European Geopolitical Forum with the South Caucasus Project, which is examining a possible role for economic cooperation in attenuating the conflict in Nagorno-Karabakh and the associated territories. Upcoming MEC International / Windsor Energy Group Events in London MEC International Ltd is a global advisory and business development firm focused principally on the Middle East. Other regions where they are active include Sub-Saharan Africa and Central Asia. ITIC and MEC have cooperated on joint programs over the years, including an event in London to launch ITIC’s second Iraq taxation booklet, a roundtable to discuss the Taxation of Islamic Financial products study, as well as many educational programs for officials from Central Asia. Recent ITIC Publications The following publications have been released by ITIC and are available on ITICnet.org (click the links below): ITIC Special Study – Global Taxes and International Taxation: Mirage and Reality by Professor Richard Bird ITIC Participates in IMF Fiscal Affairs Department 50th Anniversary Conference ITIC President Daniel Witt participated at the Fiscal Affairs Department’s 50th Anniversary Conference: Fiscal Affairs, Past and Future on 5 December at the IMF Headquarters in Washington, DC. ITIC Senior Advisor Participates at Annual International Fiscal Association ITIC Senior Advisor Hafiz Choudhury recently participated at the 68th annual International Fiscal Association (IFA) on 12-17 October in Mumbai, India. Mr. Choudhury participated as a speaker on the panel on “Taxation and Non-Tax Treaties.” ITIC Participates at IMF/World Bank Panel on Promoting Natural Resource Transparency On 6 October, Mr. Karl Schmalz, ITIC Senior Advisor, participated on a panel at a Joint IMF-World Bank Seminar on The New Fiscal Transparency Code and PEFA (Public Expenditure and Financial Accountability) Framework on “Promoting Natural Resource Transparency.” ITIC Issues Paper – Tax Administration Priorities in Emerging and Frontier Markets by Messrs. Dave Hartnett and Hafiz Choudhury ITIC Issues Paper – The Brisbane G20 and Cairns Communiqué and Recent Developments in the Forum on Tax Administration: Implications for Business by Dr. Jeffrey Owens [Dr. Owens’ paper was also featured in the International Tax Review. Viewed additional information here]. ITIC Issues Paper – Extending the G20 Tax Mandate by Dr. Jeffrey Owens [Further information can be viewed here]. ITIC Bulletin ♦ December 2014 News on Board Members, Advisors, and Staff 4 Professor Sijbren Cnossen Delivers Keynote Presentation in Moscow Welcome New ITIC Directors • Ms. Omleen Ajimal, Squire Patton Boggs • Mr. Alan Butler, Diageo • Mr. Donato Del Vecchio, BAT • Mr. Richard Inch, Tullow Oil • Ms. Myrtle Jones, Halliburton • Mr. Alexander Kryvosheyev, JTI • Mr. James Schreiter, ExxonMobil New Senior Advisors Elected Mr. Allen Bruford Former Deputy Director, Compliance and Facilitation Directorate, World Customs Organization Dr. Benjamin Diokno Professor of the School of Economics at the University of the Philippines Mr. Sumit Dutt Majumder Former Chairman of the Central Board of Excise and Customs of the Government of India Mr. Karl Schmalz Former Assistant General Tax Counsel, ExxonMobil Corporation Dr. Suthad Setboonsarng Former Deputy Secretary General, ASEAN ITIC Senior Economic Advisor, Professor Sijbren Cnossen, visited Moscow on 27 November 2014 to give a presentation to the Russian Chamber of Commerce on Coordinating Indirect Taxes in the Eurasian Economic Union and Tax Policy Issues in Russia. ITIC Senior Economic Advisor Publishes Paper on African VAT In the wake of various Africa Tax Dialogues in Pretoria (Centurion), Cape Town, Kampala, Accra, Abuja and Arusha, as well as the recently launched Academy of Public Finance for African Tax Officials (which held its first course on VAT in Pretoria in March 2014), ITIC Senior Economic Advisor Professor Sijbren Cnossen published a paper on Mobilizing VAT Revenues in African Countries. Avoiding and Resolving Tax Disputes in India ITIC Distinguished Fellow, Dr. Jeffrey Owens, was recently featured in the 13 October edition of Tax Notes International, with his paper, titled, “Avoiding and Resolving Tax Disputes in India.” His paper compares the experience of India with that of the other BRICS and selected OECD countries with a particular focus on the issue of mandatory arbitration. To download a copy of the full paper, click here. Blake Marshall Featured in New Publication: Costs of a New Cold War ITIC Vice President Blake Marshall contributed to a new book, titled, Costs of a New Cold War: The U.S.-Russia Confrontation over Ukraine, edited by Paul J. Saunders. Blake’s chapter, “Russia, Ukraine, and U.S. Economic Policy,” is available here. The full book can be viewed here. ITIC Bulletin ♦ December 2014 Comments by ITIC Honorary Co-Chairman Donald Johnston to the Conference of the Top 500 Chinese Enterprises 5 Africa Tax Dialogue Held in Arusha ITIC Honorary Co-Chairman Donald Johnston spoke at the Conference of the Top 500 Chinese Enterprises in Chongqing, China on 3 September 2014. To view his remarks, click here. Academy of Public Finance The Academy of Public Finance is a public/private initiative between the International Tax and Investment Center (ITIC), the Institute for Austrian and International Tax Law at the Vienna University of Business and Economics (WU), EY, the International Finance Corporation of the World Bank, and the African Tax Institute. Recent Courses Held • VAT Workshop -- Moscow, Russia • Excises Workshop -- Astana, Kazakhstan • Transfer Pricing -- Addis Ababa, Ethiopia Upcoming Advisory Board Meeting On 21 January 2015 in Vienna, the Academy of Public Finance Advisory Board will meet in Vienna at the Institute for Austrian and International Tax Law, Vienna University of Economics and Business. The 2014 Africa Tax Dialogue, hosted by the Tanzania Revenue Authority, was held on 15-17 July in Arusha. Over 115 participants from 15 African countries attended the meeting. Presentations from the meeting are available in the Africa Tax Dialogue library on ITIC’s website. Special Edition Bulletin Published The special edition Bulletin reporting on the meeting was published in September. The report can be viewed here. 2015 Africa Tax Dialogue The next Africa Tax Dialogue is planned for 17-19 November 2015 in Maputo, hosted by the Mozambique Revenue Authority. Asia-Pacific Tax Forum Held in Hanoi Regional Tax Forums Eurasia Tax Forum Held in Vienna The 11th annual Asia-Pacific Tax Forum was held on 1-3 October in Hanoi, hosted by the Ministry of Finance of Vietnam. Presentations from the meeting are available in the Asia-Pacific Tax Forum library on ITIC’s website. APTF featured in Vietnamese Media The tenth annual Eurasia Fiscal Experts’ Seminar was held on 8-10 July on the campus of the Vienna University of Economics and Business. Presentations from the meeting are available in the Eurasia Tax Forum library on ITIC’s website. Special Edition Bulletin Published The special edition Bulletin reporting on the Seminar was published in September. The report can be viewed here. 2015 Eurasia Tax Forum The 11th annual Eurasia Tax Forum will be held on 30 June - 2 July in Brussels, at the headquarters of the World Customs Organizations. • Vietnam TV-1 • Nhan Dan Online Forthcoming Bulletin A special edition Bulletin reporting on the meeting will be published in early January 2015. 2015 Asia-Pacific Tax Forum The 12th annual Asia-Pacific Tax Forum will be held on 5-7 May 2015 in Delhi, hosted by the Indian Council for Research on International Economic Relations. ITIC Bulletin ♦ December 2014 Middle East/North Africa Held in Riyadh The fifth annual Middle East/North Africa Tax Forum was held on 11-13 November in Riyadh, hosted by the Department of Zakat and Income Tax of Saudi Arabia. Presentations from the Forum are available in the Middle East/North Africa Tax Forum library. Forthcoming Bulletin A special edition Bulletin reporting on the meeting will be published in January 2015. Forum Featured on DZIT Website To view the Department of Zakat and Income Tax’s coverage of the meeting, click here. 2015 MENA Tax Forum The sixth annual MENA Tax Forum is scheduled for 10-12 November 2015 in Qatar, Doha, hosted by the Ministry of Finance. Asia-Pacific Update ITIC Meets with Lao PDR Ministry of Finance On 7 October, ITIC President Daniel Witt met with The Honorable Bounnam Chounlaboudy, Deputy Director General of the Tax Department of the Lao PDR Ministry of Finance, to discuss Lao PDR’s continued participation with the Asia-Pacific Tax Forum (APTF). India: Tax Administration Reform Commission (TARC) Reports Over the past few months, the Tax Administration Reform Commission (TARC) of the Government of India, chaired by long-time ITIC friend and former Distinguished Fellow Dr. Partho Shome, released their second and third reports (all reports are available for download here). 6 ASEAN Excise Tax Study Group Meets in Hanoi On 30 September, before the start of the 11th annual AsiaPacific Tax Forum, the ASEAN Excise Tax Study Group met in Hanoi. Ministry of Finance representatives from Cambodia, Malaysia, Myanmar, Thailand, and Vietnam attended along with APTF and ITIC Program Advisors Rob Preece, Leigh Obradovic, and Oliver Salmon (also a Senior Economist at Oxford Economics based in Singapore). ITIC President Daniel Witt also participated. The main purpose of the meeting was to review and discuss the final draft of the Excise Tax in ASEAN: A guide to reform ahead of AEC 2015 that will be published in January 2015. Excise Tax in ASEAN: A guide to reform ahead of AEC 2015 The final product of the Study Group, “Excise Tax in ASEAN: A guide to reform ahead of AEC 2015,” will be published in early 2015. This resource manual is a result of over two years of active engagement between key Ministry of Finance policymakers and excise tax administrators from all 10 member states and the APTF expert team. The project commenced at the ninth annual APTF meeting held in 2012 in Manila. Myanmar Update Third Meeting of the Myanmar Natural Resources Taxation Working Group Held The second report covers Customs Administration reform and Inter- and Intra-Agency exchange of information. The third report covers the following topics: impact assessment, tax base and taxpayer base expansion, and risk or compliance management. ITIC organized the third meeting of the Myanmar Natural Resources Taxation Working Group in Nay Pyi Taw on 9-10 October 2014. ITIC Bulletin ♦ December 2014 ITIC Senior Advisor Meets with Myanmar Internal Revenue Department ITIC Senior Advisor Hafiz Choudhury recently travelled to Myanmar to visit with officials from the Internal Revenue Department (IRD). More information on Hafiz’s meetings has been shared directly with project sponsors. Hafiz Choudhury and Director General of the Internal Revenue Department, U Min Htut (far left), discuss the key policy choices made regarding the SCT Law. Middle East/North Africa Update Taxation of Islamic Finance Project Update By Hafiz Choudhury, Senior Advisor, ITIC ITIC is delighted to announce the completion of Phase II of the research project on cross-border tax implications of Islamic Finance (IF) transactions. The project started in 2011, soon after the initial MENA Tax Forum in Doha, with an initial paper on the subject. The discussants on the topic and other participants raised a number of questions that highlighted differential treatment across jurisdictions and the need for a thorough examination of the challenges and options faced. Conference participants repeatedly mentioned in other feedback sessions that this topic merited much further, in-depth analysis. Also, given the problems caused by, there was much greater need for coordination and sharing of experience by administrators and policymakers. Phase I of the project looked at four of the most common Islamic Finance transactions, and reviewed the relevant domestic legislation in several MENA jurisdictions, as well as in the UK and in Malaysia. The work of Phase II was to extend the analysis to cross border transactions, and also to consider the indirect tax, mainly VAT, treatment of IF transactions. Phase II work was conducted by the same combined team of Mohamed Amin, Salah Gueydi and Hafiz Choudhury, who worked mainly through desk research, supplemented by a remote team that carried out the detailed survey of tax treaties. Tax Treatment and International Standards Part I of the Phase II report focused on the international direct tax treatment of Islamic Finance (IF) cross border transactions. The focus was on the tax laws and tax 7 treaties of selected MENA and Muslim majority countries mostly covered by the Phase I report. The tax regimes of IF transactions in Turkey, Saudi Arabia and Qatar were considered in detail along with a very detailed survey of the tax treaties concluded by Malaysia, Turkey and Saudi Arabia to determine whether or not such treaties have dealt with IF, and if so, in what way. In addition, the approaches taken by the UN and OECD Model Conventions in dealing with IF were analyzed to assess the approaches taken in dealing with IF, to identify the policy issues and challenges they raise and to make proposals to address them. This report shows that neutral tax treatment of IF transactions, as compared to their conventional equivalents, is the international standard. This principle was adopted in the countries where IF is practiced and where an IF specific tax regime exists such as Malaysia, Turkey, Saudi Arabia and Qatar as well as in the UN model convention. The study noted that the OECD model did not address tax issues of IF arrangements, even though a number of OECD members have introduced, or are in the process of introducing, tax regimes for IF transactions. The conclusion drawn is that tax issues of cross border IF transactions still need to be studied in a more comprehensive way taking into account the approach followed (legal or economic), the policy objective to be pursued (tax neutrality) and the list of typical IF arrangements. Phase III of the IF study project should look more closely to a more comprehensive set of IF transactions (i.e. includes Musharaka and Mudaraba) and deal in more details with the issues such as treaty access for IF arrangements (taking into account the work of OECD on partnerships), permanent establishment and IF arrangements and characterization of the income from IF transactions, especially with regard to treatment dividends or interest income. VAT/GST Issues Part II of the report covered the VAT/GST issues involved in IF transactions. The analysis looked the core principles relevant to VAT and Islamic Finance by creating an outline of common conventional finance transactions which approximate the economic effect of the four transactions examined in Phase I. Each “pair” of similar transactions were then contrasted with one another to show the way a typical EU style VAT would impact such transactions. The study then examined the choices made by a few jurisdictions and how VAT would apply to Islamic finance transactions that have similar economic consequences to the conventional transactions. The goal was to make recommendations regarding best practice for indirect tax systems that wish to accommodate Islamic finance. The conclusions were that IF transactions could be divided into those that were very similar to conventional finance transactions, peripheral transactions associated with an ITIC Bulletin ♦ December 2014 IF structure and IF transactions that had a very different structure to a conventional transaction. Depending on the nature of the transaction different VAT considerations were needed to achieve neutrality. Further work is necessary to establish guidelines at transaction level. Both parts of the Phase II report were presented at the fifth annual MENA Tax Forum, in Riyadh on 10-13 November. Forum participants agreed that work on Phase III should commence immediately. 8 Bill on Deoffshorization On 11 November 2014, Deputies approved the first reading of the bill on deoffshorization. Note: Additional memos regarding the deoffshorization can be viewed here and here. bill on Tax Maneuver Update The following articles are password protected and only available to ITIC Sponsors. “Rosneft” has suggested to refuse carrying out the proposed tax maneuver in the Oil Branch which was approved by the State Duma in the first reading. It was planned that the reform would bring 500 billion rubles to the 2016-2017 budget; however, it would reduce profitability of oil processing. Russian Federation - President Address to the Nation on 4 December Category Euro-5 Fuel Excises Discussed in State Duma Russia Update On 4 December, Russian Federation President Vladimir Putin delivered the annual Presidential Address to the Federal Assembly. Sponsors’ attention is invited to the text of President Putin’s speech, in particular, the treatment of the locus of responsibility in regulatory policy, the tax freeze 2015-2019, and the further tax amnesty. We shall monitor implementation in the light of the Government’s follow-up meeting this week. Maneuver in Price On 2 December, Mr. Alexander Khloponin, Vice-Premier of the Russian Federation, declared that retail networks charge commissions not from the price of manufactured products but from the price of manufactured product plus excise tax (i.e. from the state payments which have nothing in common with the price of manufactured products). New Tax to Petroleum Industry Workers Khanty-Mansiysk autonomous district can introduce into State Duma a draft bill on experiment in the petroleum industry consisting in the change of MET (Mineral Extraction Tax) to Tax on Financial Result (TFR) for pilot fields. This draft bill is likely to be introduced via the Committee on Budget and Taxes by the end of the year. Amendments to Tax Code Relating to Foreign Companies On Tuesday, 25 November, President of the Russian Federation, Vladimir Putin, signed a bill into law that requires controllers to inform tax authorities of membership in foreign companies. The news was posted on the President’s official web page. On 5 November, the bill on Category Euro-5 Fuel Excises being lifted for 1 ruble per liter was discussed by the State Duma Budget and Taxes Committee. If the bill passes, the cost of gasoline is expected to grow by 14-15%. The bill proposes to amend the bill on tax maneuvers, which is in currently in its second reading. Draft Budget Approved for 2015-2017 The Government of the Russian Federation has managed to avoid the introduction of a sales tax. According to the Minister of Finance, Anton Siluanov, the Government did not view it as a tool that would increase tax proceeds. Government has abandoned the idea of returning the sales tax On 18 September in Moscow, Minister of Finance Anton Siluanov announced the Government has abandoned the idea of returning to utilizing a sales tax. Minister of Finance announces tobacco excise tax increase The Russian Federation Finance Ministry’s proposal for a sharp increase in tobacco excise taxation for the years 2015-2017 has been revised to a more gradual approach and reducing the risk of a “tax shock” that would risk destabilizing the legal market. ITIC Bulletin ♦ December 2014 Kazakhstan Update The following articles are password protected and only available to ITIC Sponsors. Kazakhstan Tax System - Risk Management and Enforcement As earlier advised, ITIC, in cooperation with HMRC and the British-Kazakh Law Association, organized a program of consultations on comparative practice at the request of the Kazakhstan State Revenues Committee (SRC) and the Supreme Court in London 1-4 December. The issues involved are of the highest importance to investors and officials as Kazakhstan introduces a new fiscal risks management system, to be rolled out during 2015-2016. Energy Charter Conference held on 26-27 November in Astana, Kazakhstan The Statutory Session of the Conference adopted the Astana Declaration of the Energy Charter Process for Global Energy Architecture 2015-2019 which seeks full implementation of the Energy Charter Treaty and global expansion of the Energy Charter Process. New Head of State Revenues Department Mr. Madi Takiev has been appointed as Head of the State Revenues Department of Atyrau Oblast. Note: More information on the State Revenues Department structure is available here. Consultative Program in London held for Kazakh Officials On 29 November – 4 December, ITIC arranged a Taxation Compliance and Enforcement: Policy, Law and Administration consultative program for the State Revenues Committee of the Ministry of Finance and Supreme Court of the Republic of Kazakhstan in London. State Revenues Committee Priority Issues Based on ITIC’s 21 years of cooperation under the Memorandum of Understanding and Cooperation that was jointly signed by ITIC and the Ministry of Finance of the Republic of Kazakhstan, ITIC’s Almaty office received the official letter from the State Revenues Committee listing the priority administration issues for 2015. 9 Mme. Galiya Makazhanova Presentation Featured in Petroleum Magazine We are pleased to share with you an article featuring Mme. Galiya Makazhanova’s presentation, “On Legal Precedents in the Consideration of Tax Disputes involving Subsurface Users” that was published in the Kazakhstan monthly magazine “Petroleum,” a popular weekly magazine among oil and gas companies. President Nazarbayev State of the Nation Address On 11 November, President Nazarbayev delivered his “State of the Nation” Address, Nurly Zhol (Bright Path), somewhat ahead of time and to the ruling Party rather than the Parliament. Draft Package of Changes and Amendments to the Tax Code The Draft Package of Changes and Amendments to the Tax Code was passed on 6 November by Majilis of the Parliament of the Republic of Kazakhstan. WTO - Accession of Kazakhstan Following Kazakhstan’s agreement with the EU on 9 October, prospects seem brighter for a successful conclusion of the Accession process by the end of 2014, subject to the current round of bilateral negotiations with the USA (and no subsequent “spoiling” by the Russian Federation). Chairman Yergozhin Interview Mr. Daulet Yergozhin gave an interview to Tengrinews Agency where he spoke about the newly created State Revenue Committee of the Ministry of Finance of the Republic of Kazakhstan incorporating ExTax and Ex-Customs Committees, as well as some of the responsibilities of the abolished Financial Police Agency and its operation. ITIC Bulletin ♦ December 2014 Pre-Court Settlement of Tax Disputes Discussed At the joint meeting of the National Chamber of Entrepreneurs (NCE) of Kazakhstan, headed by Mr. Timur Kulebayev (Head of NCE and the State Revenues Committee (SRC) of the Ministry of Finance of Kazakhstan) and Mr. Daulet Yergozhin (Chairman of the SRC MF), the issue of pre-court settlement of tax disputes was discussed. Foreign Minister Idrissov urges ‘Great Gain’ Philosophy Shortly after official meetings with Mr. John Kerry, U.S. State Secretary, on further strengthening the USKazakhstan strategic partnership relationship and having received the full support from the U.S. State for Kazakhstan WTO accession, Kazakh Foreign Minister Mr. Erlan Idrissov participated at the Expanding Economic Connectivity in Greater Central Asia Conference in New York City on 23 September 2014. 10 E-Audit Program As advised on 29 October, ITIC conducted a program of consultations and workshops in Astana and Atyrau with the State Revenues Committee HQ and Atyrau Regional Office during the period 4-7 November 2014. Ukraine Update Financial Times Article of Interest: Ukraine Anders Aslund, a longtime friend and noted expert on the Russian and Ukraine economies, had an op-ed featured in the Financial Times titled, “Marshall’s postwar logic holds true in Ukraine today.” To view a copy of the article, click here. Combatting Illicit Trade Illicit Trade Discussed at Mexico SAT Event in Veracruz KMTA Update Kazakhstan State Revenues Committee Professional Development 2015 Sponsors will be aware of the restructuring of the Kazakhstan fiscal agencies initiated on 6 August 2014, and the subsequent establishment of the State Revenues Committee (SRC), which combines the functions of Tax, Customs and Investigation/Enforcement. Kazakhstan Tax System Development The First Regional Forum on Illicit Trade held by the Mexico Servicio de Administración Tributaria (SAT), in conjunction with the OECD, provided an excellent opportunity for officials from all areas of enforcement from Mexico, the United States, and Canada. Excise Products Illicit Trade and Revenue Loss Presented by ITIC at Interpol Conference At Interpol’s 2014 International Law Enforcement IP Crime Conference in Hanoi, Vietnam, ITIC President Daniel Witt presented recent ITIC studies on the illicit trade of excisable products and revenue loss. In the framework of the 2014 Kazakhstan Minerals Taxation Academy (KMTA) e-audit workshop in Astana and Atyrau on 4-7 November, a short consultation was held with Mr. Daulet Yergozhin, Chairman, State Revenues Committee (SRC), Ministry of Finance of the Republic of Kazakhstan. At the meeting, Mr. Yergozhin outlined some planned tax administration issues that are of interest. WCO announces the results of its first global operation against illicit trade in tobacco To view the WCO results, click here. ITIC Bulletin ♦ December 2014 Iraq Update Iraq Taxation Working Groups Meet in Riyadh 11 Documents Available in Libya Library All documents relating to the Libya working group documents have been posted in the Libya Library (projectspecific password required) on ITIC’s website. International Organizations Update EBRD 2014 Transition Report: Innovation in Transition - The Role of the Firm The 26th meeting of the Iraq Taxation Working Groups was held in Riyadh, Saudi Arabia, ahead of the fifth annual Middle East/North Africa Tax Forum. Iraq Working Groups Meet in Dubai On 14 October, ITIC convened a meeting of the Iraq Petroleum, Oil Service and Customs working groups in Dubai. ITIC President Daniel Witt chaired the meeting and ITIC Senior Advisor Reggie Mezu lead the discussion on the progress of the 2014 work plans and the initial plans for 2015. Upcoming Iraq Working Group Meetings in Dubai Meetings with senior officials from the PCLD of the Ministry of Oil, Ministry of Finance, General Commission of Taxation, and General Commission of Customs, are being planned on 21-23 January in Dubai: • 22 January - Iraq Customs Working Group • 23 January - Iraq Taxation Working Groups More information on the meetings, including the draft agenda and presentations, will be sent directly to working group members and posted in the Iraq Library (password protected) on ITIC’s website. Documents Available in Iraq Library All documents relating to the Iraq working groups have been posted in the Iraq Library (project-specific password required) on ITIC’s website. Libya Update Next Working Group Meeting The next meeting of the Libya Petroleum Taxation Working Group will be held on 26 January in Paris, hosted by Total. More information on the meeting will be sent directly to working group members. The Transition Report 2014, launched on 18 November at the European Bank for Reconstruction and Development (EBRD) headquarters in London, focuses particularly on how individual companies across the transition region innovate. Guidelines for Multinational Enterprises in the Minerals Sector At an OECD-supported event in Beijing on 24 October, the Chinese Chamber of Commerce of Metal Minerals, in cooperation with GIZ and Global Witness, launched a set of guidelines intended to provide a roadmap for responsible business conduct of Chinese multinational enterprises (MNEs) operating overseas in the minerals sector. OECD News • Revised calendar for stakeholder consultation • OECD bolsters relationship with Ukraine • OECD/G20 Releases Base Erosion and Profit Shifting Project Explanatory Statement Macro-Economic Policy: The Role of Infrastructure in the Caucasus and Central Asia Countries Recently we drew sponsors’ attention to the 11 November address, Path to the Future,by Kazakhstan President Nazarbayev and the significant role assigned to infrastructure investment and development (as well as to innovation). ITIC Bulletin ♦ December 2014 12 Upcoming ITIC Events 22 January - Iraq Customs Working Group Meeting, Dubai 23 January - Iraq Taxation Working Groups Meeting, Dubai 26 January - Libya Petroleum Tax Working Group Meeting, Paris 10 March - Diplomatic Dialogue Luncheon for Africa, House of Lords, London 12 March - Diplomatic Dialogue Luncheon for Asia, House of Lords, London March (TBC) - Brazil Tax Workshop with GETAP, Brasilia, Brazil 17 April - Inaugural Global Tax and Trade Lecture and reception (on eve of spring meetings of IMF and World Bank), Washington, DC 22-24 April - Second Annual International Conference on the Shadow Economy and Taxation, Bucharest, Romania 5-7 May - 12th Annual Asia-Pacific Tax Forum, Delhi, India 30 June - Annual Board of Directors’ Luncheon, House of Lords, London 30 June - 2 July - 11th Annual Eurasia Tax Forum, Brussels 2 November - Board of Directors’ Briefing, Reception and Dinner, London 3 November - Board of Directors’ Meeting, London Offices of Statoil 10-12 November - Sixth Annual Middle East/North Africa Tax Forum, Doha, Qatar 17-19 November - Africa Tax Dialogue, Maputo, Mozambique ITIC Vision ITIC Mission ITIC aims to be recognized globally as a fiscally-focused network organization with a respected sponsor base and presence across key non-OECD jurisdictions that promotes education and programs for the benefit of all its stakeholders. ITIC’s mission is to encourage pro-growth tax, trade and investment policies in non-OECD countries by facilitating mutual understanding and trust between business and government through the ITIC neutral table, based on high quality analyses, policy studies and capacity building programs. Edited by: Diana McKelvey, ITIC Washington 1800 K Street, NW, Suite 718, Washington, D.C. 20006 Tel: (1) (202) 530 97 99 / Fax: (1) (202) 530 79 87 [email protected] / www.ITICnet.org Almaty • Astana • Baghdad • Baku • Bangkok • Dubai • Kiev • London • Manila • Moscow • Nay Pyi Taw • São Paulo • Washington, DC

© Copyright 2026