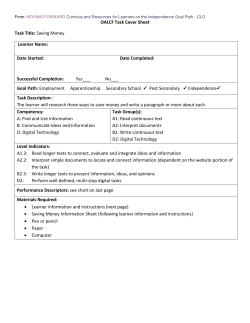

The 2014 Festivus Airing of Grievances

The Econtrarian December 23, 2014 Legacy’s Senior Economic and Investment Advisor Paul L. Kasriel The 2014 Festivus* Airing of Grievances Well, it’s that time of the year again for the airing of grievances. And I’ve got a lot of problems with you people! First of which are those of you (PK, NYT?) who insist that the Fed’s QE did not result in any inflation. It all depends on your definition of inflation. If your definition is restricted to the prices of goods and services, you are right. No matter how you slice it or dice it, there has been no discernible upward trend in the price changes of consumer goods and services since the start late 2012 start of QE III, as shown in Chart 1. If, however, you expand the definition of inflation to include the prices of assets, then there has been a discernible pick-up in inflation since late 2012. For households, their holding gains on assets (stocks, bonds, houses, e.g.,) scaled against the market value of their total assets have moved up noticeably since the onset of QE III in late 2012, as shown in Chart 2. In fact, asset inflation in 2013, according to this measure, was approaching the housing-bubble highs of 2005-06. You don’t think that QE had anything to do with asset inflation starting in late 2012? Check out Chart 3, which shows the behavior of credit granted for the purchase and carrying of securities and thin-air credit, i.e., the sum of credit created by depository institutions and credit created by the Fed in the form of depository institution reserves held at the Fed and their vault cash. Perhaps asset-price inflation will moderate in 2015 as growth in thin-air credit does. My next grievance with you people is your dark-cloud reaction to the recent decline in petroleum prices. When these prices rise, the talking heads warn of dire economic consequences. When they fall, the talking heads also warn of dire consequences. My approach to ascertaining whether the recent decline in energy prices is a “good” economic development for the U.S. economy, in particular, and the global economy, in general, is to keep in mind that more is better than less. That is, if more energy is available, then more of the final goods and services we consume can be produced. Think of an agriculturally-based economy. Which will contribute to higher standard of living for the residents of this economy – a bumper crop or a lost crop? The bumper crop, obviously. Similarly, more energy production is better than less energy production with regard to our standard of living. Chart 4 shows that U.S. energy production has been CHART 1 CPI-U: All Items % change, year-to-year NSA, 1982-84=100 FRB Cleveland 16% Trimmed-Mean CPI SA, 12 Month % change 3.5 3.5 3.0 3.0 2.5 2.5 2.0 2.0 1.5 1.5 1.0 1.0 0.5 2012 2013 Sources: BLS, Haver Analytics 0.5 2014 CHART 2 Households: Holding Gains on Assets as a % of Total Assets 4-quarter moving average 4 4 2 2 0 0 -2 -2 -4 05 06 07 Source: Haver Analytics 08 09 10 11 12 13 14 -4 CHART 3 Security Credit % change, year-to-year NSA, Bil. $ Depository Inst.: Loans, Securities, Reserves @ Fed. & Vault Cash % change, year-to-year NSA, Bil. $ 16 12 8 4 0 -4 -8 16 12 8 4 0 -4 -8 2012 2013 Sources: Federal Reserve Board, Haver Analytics 2014 Continued next page * Festivus is a fictitious holiday popularized on an episode of the Seinfeld sitcom. Festivus is “celebrated” with an evening meal on December 23. One of the Festivus traditions is the airing of grievances in which celebrants recount the accumulated disappointments they have with each other during the year. Another tradition is the feats of strength in which one of the celebrants, usually the youngest family member, attempts to pin the head of household in a wrestling match. The Econtrarian December 23, 2014 The 2014 Festivus Airing of Grievances Continued and services in the economy does not decline. Rather your decrease in current spending on goods and services is offset by an increase in spending by the entity that ultimately received the funds with which you purchased the stocks or bonds. So, if rich people are earning relatively more income than less rich people, total spending in the economy need not go down if the rich people save relatively more of their income. Rich people’s increased saving enables other entities to increase their current spending. The saved income does not vanish from the spending stream, as today’s Keynesian talking heads would have you believe. Rather, it gets transferred to others who are eager to increase their current spending. As an aside, if the increased saving by rich people funds spending on capital goods, all else the same, the economy’s future potential to produce goods and services is enhanced. In sum, increased saving is not a “bad” economic thing in the short run and is potentially a “good” economic thing in the long run. soaring in recent years. That’s a “good” thing, economically speaking. CHART 4 IP: Energy, Total 12-month moving average SA, 2007=100 120 120 115 115 110 110 105 105 100 100 95 95 90 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 90 Source: Federal Reserve Board, Haver Analytics Another grievance I have with you people is your Keynesian (probably not Keynes, himself, rather his subsequent interpreters) view of saving. How many times have you heard that if extra income goes to the rich, they will just save it, which won’t stimulate total spending in the economy? But if income goes to the less rich, they will spend it, which will stimulate total spending in the economy. This popular view is that when people save, funds somehow disappear from the total spending stream of the economy. This popular view of saving is often advanced as an economic argument to buttress a moral argument for government-mandated income redistribution. But except in one case, this popular view of saving is fallacious. Income redistribution generally will not stimulate total spending in the economy. If income is taken from the rich and given to the less rich, the rich will react by either cutting back on their current spending and/or cutting back on their saving, which implies less spending by some other entity. Either way, the increased spending by the less rich will be offset by the decreased spending and/or saving by the rich. Thus, income redistribution will not result in a net increase in total spending in the economy. Again, there may be a moral argument for income redistribution, but there is not a macroeconomic reason for it. What does it mean to increase your saving? It means you cut back on your current spending on goods and services relative to your income. When you cut back on your goods/ services spending, what do you do with that saved income? You typically, directly or indirectly, purchase equities or bonds. In other words, you transfer some of your income, which you have voluntarily chosen currently not to spend on goods and services, to another entity, perhaps a business, a government or even another household, that currently wants to increase its spending relative to its income. So, in this case of increased saving by you, total spending on goods Now, there is one case in which an increase in saving can lead to a decrease in total spending in the economy. If you increase your saving and choose to use your extra unspent income to increase your balances at depository institutions, total spending in the economy will decline, all else the same. But wait, doesn’t the bank lend the increase in funds it received from you? Probably. But the income you received but chose not to spend now came to you from the bank of Continued next page Paul His L. Kasriel, insights have helped shape The economic Econtrarian and financial policies a global scale.Economic and Investment Advisor and former Senior Vice President Paul is on Legacy’s Senior and Chief at The NowEconomist you can find himNorthern at Legacy.Trust Company. Paul works across Legacy’s wealth management initiatives, consulting on investment strategies with his innovative research. Considered one of the bestAdvisor economic forecasters as measured by long term accuracy, Paul is a highly regarded, Paul L. Kasriel is Senior Economic and Investment for Legacy Private Trust Company and former Chief Economist at The Northern Trust Company. Paul is a highly innovative economic researcher whose work has helped form economic policy at national and global levels. regarded economic researcher whose forecasts and Econtrarian perspectives have helped form economic policy at national and global levels. He and the Legacy wealth management team focus on providing innovative investment solutions that can help you reach your financial and retirement goals. Visit www.lptrust.com to read Paul’s commentaries and out-of-the-box perspectives on the economy and financial markets. To learn more about Legacy’s suite of wealth management and investment services, please contact Michael B. Mahlik, 920.967.5040. 2 Two Neenah Center, Fifth Floor Neenah, WI 54956 920.967.5020 The Econtrarian December 23, 2014 The 2014 Festivus Airing of Grievances Continued some other entity. That bank has lost funds and, thus, has to reduce its loans. So, the result of you using increased saving to build up your deposits is net decline in goods/services spending in the economy. In the 1930s, when Keynes was advancing Keynesianism, this type of saving was referred to as hoarding “money”. Back in the Great Depression, when many businesses and depository institutions were failing, people preferred to save in the form of currency and/or in deposits at super-liquid banks because of the safety of principal of these types of assets. This saving in the form of cash, or hoarding, is what motivated Keynes to have a dim view of saving in his Keynesian macroeconomic theory. Although I suspect that Keynes understood the different implications regarding total spending in the economy between an increase in saving that took the form of stocks and bonds and an increase in saving that took the form of currency and deposits, it is not clear that current adherents to Keynesian macroeconomic theory understand this difference. For whatever reason, the term “hoarding” has gone out of fashion. We now refer to saving in the form of cash (either currency or bank deposits) as a decrease in the “velocity” of money. If a decrease in the velocity of currency and deposits is not countered with an increase in the supply of currency and deposits, then nominal spending in the economy will decrease. I have one last grievance to air. This one, however, is not with you people. Rather it is with me, people! Throughout 2014, I had been telling you people to steer clear of bonds, especially investment-grade bonds, because I had thought that bond yields would rise. The reason I had thought bond yields would rise is that I also thought that 2014 growth in domestic nominal spending on goods and services would be stronger than the Fed and the consensus expected as a result of increased growth in thin-air credit. I figured that the Fed would be reluctant to pre-emptively raise the federal funds rate in 2014, but that market participants would anticipate more aggressive funds rate increases in 2015, which would result in higher bond yields in 2014. Well, growth in domestic nominal demand did turn out to be relatively robust in 2014, save for a weather-depressed first quarter. And the Fed did not raise its policy interest rates in 2014 nor even seriously threaten to do so. But Treasury bond yields did not rise during 2014. As Chart 5 shows, Treasury bond yields actually fell. The yields that did rise were those on shorter maturity Treasury coupon securities, as represented by the yield on the 2-year Treasury security in Chart 5. Perhaps market participants believe that the Fed will raise its policy interest rates in 2015 sufficiently to slow growth in economic activity in 2015 and 2016 such that goods/services price inflation will stay in check. And given the pronounced slowdown in the growth of thin-air credit in the closing months of 2014, this market “bet” might be right. CHART 5 3.2 10-Year Treasury Note Yield at Constant Maturity EOP % 2-Year Treasury Note Yield at Constant Maturity EOP % 0.675 3.0 0.600 2.8 0.525 2.6 0.450 2.4 .0375 2.2 0.300 2.0 Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 0.225 2014 Sources: U.S. Treasury, Haver Analytics But I was dead wrong on the direction of bond yields in 2014. So, I’ve been pinned. That means that the airing of grievances is over for 2014 and the Festivus celebrations can now begin in earnest. Gather around your Festivus poles, preferably made of aluminum because of its high strengthto-weight ratio, and join me in singing the Festivus Carol. n A Festivus Carol (Lyrics by Katy Kasriel to the melody of O’ Tannenbaum) O’ Festivus, O’ Festivus, This one’s for all the rest of us. The worst of us, the best of us, The shabby and well-dressed of us. We gather ‘round the ‘luminum pole, Air grievances that bare the soul. No slights too small to be expressed, It’s good to get things off our chest. It’s time now for the wrestling tests, Feel free to pin both kin and guests, Festivus, O’ Festivus, The holiday for the rest of us. Two Neenah Center | Fifth Floor | Neenah, WI 54956 | 920-967-5020 | www.lptrust.com © 2014 Legacy Private Trust Company®. All rights reserved.

© Copyright 2026