Kalyan Jewellers invests KD7 million in Kuwait

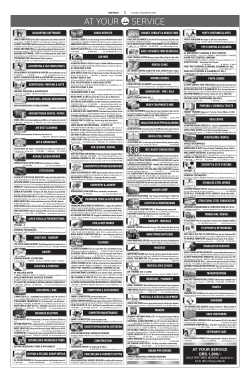

TUESDAY, DECEMBER 23, 2014 BUSINESS Kalyan Jewellers invests KD7 million in Kuwait Three signature showrooms to open on Friday l Mega Prize of KD75,000 for single winner Amitabh Bachchan, the Brand Ambassador of Kalyan Jewellers KUWAIT: Kalyan Jewellers, one of India’s most-trusted jewellery brands, has announced its foray into Kuwait with an investment of more than KD7 million. Kalyan Jewellers has offered a special consumer scheme to mark the launch. Consumers will be given a free gold coin on purchase of jewellery worth KD150 and will be eligible to participate in a lucky draw and win the mega prize of KD75,000. Amitabh Bachchan, the stalwart of Indian cinema and the Brand Ambassador of Kalyan Jewellers, who is on his first visit to Kuwait, will inaugurate the outlets on Friday (December 26, 2014) along with the other ambassadors Manju Warrier (Malayalam film actor), Nagarjuna Akkineni (Telegu film actor) and Prabhu Ganesan (Tamil film actor). The Chairman of the Group T S Kalyanaraman, the Executive Directors Rajesh Kalyanaraman and Ramesh Kalyanaraman will also be present for the inauguration. During the inauguration of the showrooms, the celebrities will jointly address the public from a specially erected stage. The timings for inauguration are as follows: December 26 : Al-Rai 11.15 am - 11.45am, Malia, Kuwait City) 2.45 pm 3.05 pm and Fahaheel 3.45 pm - 4.15 pm. T S Kalyanaraman, Chairman and Managing Director, Telugu film actor Nagarjuna Akkineni Tamil film actor Prabhu Ganesan Malayalam film actress Manju Warrier Kalyan Jewellers said, “The expansion in Kuwait is part of our growth strategy to consolidate our presence in GCC countries. The launch of three Kalyan stores in one day in Kuwait is a reiteration of our commitment to provide the best jewellery buying experience for connoisseurs of jewellery in Kuwait. The investment of KD7 million has been made to ensure that we can reach out to more customers through these three outlets. Our stores will offer an exquisite collection of contemporary and traditional designs that will fulfill distinct needs of the evolved Kuwait consumer.” Jewellers will have 77 outlets spread across West Asia and India including nine in the UAE. It will also add Qatar to its presence shortly. By the end of fiscal 2015, Kalyan Jewellers is targeting 100 showrooms. Kalyan Jewellers recently attracted a significant investment of $200 million from leading private equity investor Warburg Pincus. The investment is set to accelerate the growth plans of Kalyan Jewellers as it consolidates its leading position in the existing markets and enters global markets including Singapore and Malaysia. Since the investment from Warburg Pincus, Kalyan Jewellers has added over 15 showrooms to its network. Kalyan Jewellers is one of the most trusted brands in India and has developed a deep connect among its stakeholders with its brand promise of ‘Trust is Everything’. Kalyan Jewellers has developed a distinct image among consumers by smartly leveraging its brand ambassadors. Kalyan was the first jewellery brand in the country to have a male as a brand ambassador, successfully defying the convention in jewellery marketing. Kalyan Jewellers has also invested in educational campaigns for consumers to share their insights on buying jewellery. Amitabh Bachchan and Aishwarya Rai Bachchan are the brand ambassadors of Kalyan Jewellers. The brand also has regional icons like Prabhu Ganesan, Nagarjuna, Shivaraj Kumar and Manju Warrier associated with the brand. Kalyan Jewellers has been ranked among Top 10 Trend Setting Brands in India (Pitch, 2013). Target With the three showrooms opening in Kuwait, Kalyan Oil price fall puts squeeze on North Sea energy minnows LONDON: Plunging oil prices have increased the strain on the many small energy firms operating in the North Sea who were already facing diminishing returns from an area that once helped power the British economy. With fields more mature and oil harder to find, heavyweights such as BP and Shell turned their attention elsewhere long ago, leaving smaller independent firms to explore the more remote areas. As many as 133 companies are now active in the British part of the North Sea. However, a third of those companies are deemed by experts to be too small to finance big ticket projects and a fall of around 45 percent in oil prices since June has lessened the sector’s appeal to big investors. Efforts to find new oil and gas fields have slumped to the lowest level since exploration started in the 1970s because of reduced investment. That has sharply cut the amount of revenue the government can expect to take from the sector in taxation. “Nothing less than radical change will prevent the premature demise of the basin, let alone maximize economic recovery,” said Dave Blackwood, former head of BP’s North Sea business, adding his voice to industry calls for tax cuts. Britain’s finance ministry has said it is working on a reform of its oil and gas tax policy but its drive to reduce the budget deficit will limit its ability to cut rates. An election next May only adds to the political uncertainty. British oil companies pay a supplementary levy on top of production income tax, which will drop by 2 percentage points to 30 percent on Jan. 1. The oil industry is crying out for steeper cuts to help dampen the impact of surging costs. “You’ve got to get the tax change right. If you put it up too much, and arguably that has happened, then it strangles activity,” Mark Routh, chief executive at small North Sea player Independent Oil and Gas, told Reuters. Receipts fall During the early 1980s, annual tax receipts to Margaret Thatcher’s govern- ment peaked at 12 billion pounds ($18.8 billion) when booming North Sea oil output coincided with high oil prices, four times the 3 billion pounds predicted for 2014. Promised oil revenues were in part used to justify Scotland’s independence movement which banked on oil to underwrite a historic break for the rest of Britain, thwarted in a referendum in September. Instead, Brent crude prices fell as low as $58.5 a barrel last week and the major oil firms are shifting their focus to more promising new areas in south-east Asia, Africa and shale oil plays in North America. While Britain’s growing pool of small-scale firms, such as Parkmead, Hurricane Energy and Infrastrata , can be more nimble when it comes to adopting new technologies, many of the areas remaining to be explored are remote and therefore costly. “If they don’t have the money they can’t fund activity,” said Brian Nottage, general manager at oil and gas advisory Hannon Westwood. An example is Atlantic Petroleum, which produces oil in the UK North Sea and has cut its exploration spending for 2015 by 75 percent, arguing it needed to save cash to fund its operating fields in the current oil price environment. An increasing number of firms looking to enter new fields are now offering “farmouts”, allowing investors including rival companies, to take a stake in the new project. “(But) not that many are successful, hence the problem that we see in exploration activity,” Nottage said. Of the 133 companies in the UK North Sea, more than a third have not developed reserves in the basin, meaning they cannot bank on any revenue from production in the short term. In the longer term, the large number of small-scale players accessing the North Sea exploration market could lead to merger activity to create more robust businesses. “The UK North Sea is definitely at an inflection point. That inflection point will either send it down or have the potential to make sure it remains as a basin for another 10-15 years,” said Alison Baker, head of PwC’s UK oil and gas practice. —Reuters Russia’s new grain export duty sows confusion MOSCOW: Russia stiffened its bid to curb grain exports yesterday with plans for a duty on shipments, to defend domestic bread supply against a crumbling ruble. Russia, one of the world’s top wheat exporters to North Africa and the Middle East, has been exporting record volumes of grain this year as the ruble fall attracted buyers. It brought in a large grain crop of 104 million tons but after the surge in exports Moscow needed to hang on to its remaining stocks, Prime Minister Dmitry Medvedev told a meeting with officials. “(We will) prepare a proposal for a decision on export duty. It will be done within 24 hours,” Deputy Prime Minister Arkady Dvorkovich told the meeting. Medvedev told Dvorkovich to submit the proposal for his signature. Turkey and Egypt are the largest buyers of Russian wheat. Neither man said when, at what level or for which type of grains the duty was to be imposed. Russia used a protective duty on wheat exports in 2008. Officials are discussing a prohibitive duty and may impose it earlier than exporters are able to fulfil already-signed contracts, an industry source familiar with the discussions told Reuters. Dmitry Rylko, the head of IKAR consultancy, said he expected the duty to be at a prohibitive level. Traders have forward contracts for Russian grain until April. Last week, Russia cut railway loadings of grain for export, industry sources said. State-controlled Russian Railways, which has a monopoly on rail shipment, declined to comment. —Reuters Airbus CEO Fabrice Bregier (left) and Qatar Airways CEO Akbar Al Baker pose with a replica of an Airbus A350 during a ceremony in Toulouse, southwestern France, yesterday. —AP Airbus delivers a350-900 plane to Qatar Airways TOULOUSE, France: Airbus delivered its first next-generation A350900 plane to Qatar Airways yesterday in a formal ceremony that kickstarts its bid to erode rival Boeing’s dominance in the lucrative long-haul market. The Dohabased company, owned by the energy-rich Gulf state, has ordered 80 of the planes, making it not only the launch customer but also the largest single customer of the fuel-efficient A350 so far. Qatar Airways’s first A350 had been due to be delivered on December 13 in the southwestern French city of Toulouse where Airbus is based, but the airline postponed the handover at the last moment, citing equipment in the cabin that did not correspond to its requirements. “My dear Akbar, you are a demanding customer, particularly demanding and sometimes even a little too demanding, but you are also one of the architects of the A350,” Airbus chief Fabrice Bregier told Qatar Airways head Akbar Al-Baker at the ceremony. “We owe you a lot for this program.” Fuel savings crucial Airlines are in a major push to modernize their fleets to reap the energy savings that the latest generation of planes offer, especially as competition in the sector is fierce But Airbus hopes to catch up with its A350, whose wings and fuselage are made of carbon fibre and which will save up to 25 percent in fuel consumption. Airbus invested 10-12 billion euros ($12-$15 billion) in its strat- TOULOUSE: A Qatar Airways A350 takes off from the Airbus headquarters in Toulouse yesterday. —AFP and fuel is one of biggest costs. For the moment, Boeing dominates the lucrative market for long-haul, midsized planes with its B777 and nextgeneration 787 Dreamliner outweighing the European firm’s A330. egy to position the A350 between the popular B777 and the Dreamliner, hoping to eat away at both planes’ markets. So far, the plane has been a success with 778 orders already regis- tered by the end of November. Boeing, meanwhile, has accumulated 1,055 orders for the Dreamliner, which was launched several years ago. The first commercial flight of Qatar Airways’s brand new plane will take place on January 15 on the Doha to Frankfurt route, and the second A350-900 should come into operation in February. The airline is one of a trio of fastgrowing Gulf carriers seeking to further muscle into European markets, as energy-rich states in the region seek to develop new sources of income to reduce their dependence on oil. Baker has described the delivery of the A350 as the “second significant fleet milestone” for the carrier after recently receiving three of 14 A380 superjumbo planes bought from Airbus. The airline has also purchased Boeing’s 787 Dreamliner. The A350 program was launched in 2007, and the first test flight for the plane took place in June last year. Bregier told reporters in Toulouse that Airbus planned to ramp up production of its newest plane from two to 10 aircraft a month within four years. —AFP

© Copyright 2026