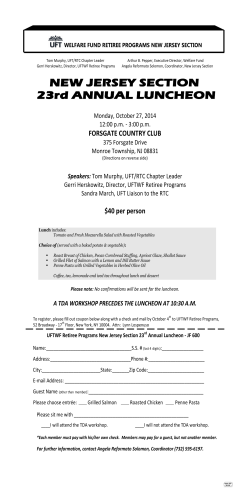

Table of Contents 1 - AT&T Ameritech /SBC Retirees

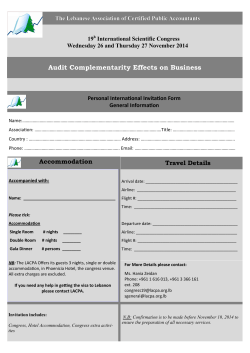

AT&T Ameritech /SBC Retirees Proudly working on behalf of retirees of the Bell System and successor companies of the New AT&T, Located worldwide AASBCR® Board of Directors Carole Lovell President – Director of Membership & Benefits Chet Przybyslawski Vice President - CFO Richard Runge Secretary Larry Smith Vice President—Legislation & Regulation Ron Widlewski Vice President—Communications Ben A. Goodin Attorney – Agent www.AASBCR.org AASBCR® State Representatives Florida, Louisiana Illinois Illinois Indiana Michigan Remaining States Pat Reichard Donna Cummings Ralph Kolderup Loretta McDowell Ron Rhodes Pamela Zitron Ohio Ohio Ohio Texas, Kansas, Missouri Wisconsin Wisconsin Lee Grimes Jim Martin Elaine Wolan Rene Miller Bob Ledvina Carol Linder Fourth Quarter Newsletter December, 2014 This Newsletter includes all the Bulletins, News Registers and the Legislative Ledger issued during the fourth quarter, October through September, 2014. What’s New in This Issue? Fro m th e Desk of Carole Lo vell - P resi den t Carole discusses the importance of managing your health care ® options and encouraging retirees to join AASBCR From the Desk of Larry Smith – VP Legislation Larry talks about the importance of giving our elected officials feedback. NRLN Action Alert - Congress Vote to Cut Pensions Previou sl y Pub lished The following News Registers, Blue Bulletins and Legislative Ledger have previously been sent electronically to AASBCR members with email. They are included here for those members without email capability. News Register, No 2, October, 2014 AASBCR ® Member Mailed Dues News Register, No 3, October, 2014 AT&T to Pay $80 million in Mobile Cramming Case Blue Bulletin, Vol 9, No 016,October 2014 Aon Retiree Health Exchange Blue Bulletin Vol 9, No 17, October 2014 Aon Retiree Health Exchange – Update and Reminders Legislative Ledger No 003, December 2014 AASBCR® Members Reply to this Action Alert All published documents are also available to Members on the website at http://aasbcr.org If you or another member experience any problems receiving or accessing Bulletins or Newsletters by email, please notify AASBCR® by calling 312 962- 2770. Fro m th e Desk of Carole Lo vell , President December 2014 My fellow retirees, We are at year end and those AT&T retirees along with their dependents who are eligible Medicare retirees and slated to be moved to the Aon Retiree Health Exchange should have chosen individual health insurance, a prescription plan and, if desired, dental as well as vision insurance. This is a huge change. Please do not ignore mail sent from AT&T or Aon. If you did not sign up for medical and prescription coverage and you are an eligible Medicare retiree, you will not have coverage in 2015. Please, do not let this happen to you. If you have any questions not already answered, remember that AASBCR® is continually in touch with AT&T HR and Aon Hewitt as we go through this change and AASBCR® will provide you with answers as quickly as possible. Those Medicare eligible retirees who have enrolled through Aon Hewitt should have the booklet titled HRA Guide for AT&T Retirees and Dependents. It explains how the Health Resources Account works, the reimbursement process, the catastrophic prescription drug benefit, and where to go for help. You can begin filing for reimbursements on or after January 1, 2015. AASBCR® needs you, our member to share your knowledge and experiences with AASBCR® with other retirees. This type of member involvement will make your retiree group, AASBCR® stronger. Please consider, as you attend lunches and other events with your friends and previous co-workers, telling them about our organization. These nonmembers may be working through benefit issues or the confusion about the Aon Retiree Health Exchange alone and with no ability to escalate issues to AT&T HR. They also may have no direct input to their Senators and Representatives to suggest effective legislation for retirees. Encourage your friends to join AASBCR®. Tell them all of the work that AASBCR® is doing interfacing with AT&T HR and asking questions about the Aon Retiree Health Exchange transition. Tell them about the good work being done with and for retirees in Washington DC through our partnership with the NRLN. You are the best person to accomplish that. Give them a copy of the AASBCR® brochure. It explains what AASBCR® is all about. Members can find the brochure by logging into the AASBCR® website at http://aasbcr.org/. On the left side, click on PRINTABLE DOCUMENTS, and then click on AASBCR® Members Brochure. If you need more copies of the brochure, just send an email to [email protected] or call the virtual office number at (312) 962-2770. Also, please do not share the newsletters and bulletins with the same nonmember friends over time. AASBCR® volunteers work hard to research and provide valuable information to AASBCR® paying members. Members’ dues support all of the publications as well as the website. I leave you with a final thought from Mitch Albom, author, playwright, and screenwriter who has written several books, including Tuesdays with Morrie, the bestselling memoir of all time. “If you're always battling against getting older, you're always going to be unhappy, because it's going to happen anyhow.” Happy Holidays. Have a happy, healthy and safe New Year. Carole Lovell Office / Fax Number (312) 962-2770 P.O. Box 7477, Buffalo Grove, IL 60089-7477 http://aasbcr.org/ Fro m th e d esk o f L arry S mi th – VP L egi sl ati on and Regul ation One of the lesser understood benefits of being a member of AASBCR® is our membership in the NRLN (National Retiree Legislative Network). The NRLN is an "association of associations" like AASBCR® and represents over two million American households just like your own. Working with the NRLN we have direct contact with members of the Senate and the House of Representatives and their staffs. Our contacts and meetings with them enable us to make comments on retiree issues and to provide input and opinions on emerging legislation that directly affects the lives of current and future retirees. Here’s where we need your help. In order to increase the influence we all can have on our elected officials and the issues they vote on while representing us we need to let them know what we think. On occasion, sometimes for good reason and sometimes for not so good reasons, very important issues will be added to Bills late in the process. On those occasions we will make every effort to make you aware of the legislation, the issue, why it's important and how you can help. Your elected officials do listen to you. Their staffs record and report on calls on every issue. You will make a difference either by contacting them or not contacting them. On the next page is the latest NRLN Action Alert which describes the issue, why it's important and how you can find and contact your elected officials to let them know that it's not okay to fund the Pension Benefit Guarantee Corporation (PBGC) by reducing pensions to current and future retirees. If you have questions, comments or concerns about the process or this issue please feel free to contact Larry Smith at 815-498-3508. NRLN Action Alert Congress Vote to Cut Pensions Outrageous Despite the opposition from some unions and retiree advocate groups, including the National Retiree Legislative Network (NRLN), Congress has passed a $1.1 trillion dollar omnibus spending bill that includes giving trustees of multi-employer pension plans the ability to cut pensions earned by 1.5 million workers and retirees up to 50 percent. These are about 1,400 pooled pension plans -- called multi-employer plans -- of mostly union workers across a bunch of companies, where it looks like the plans won’t be able to cover full benefits in coming decades. A retiree with a pension of $24,000 per year and 25 years of service could see his or her annual pension benefit cut in half, according a statement in a news report by our friends at the Pension Rights Center. The Pension Benefit Corporation (PBGC) has said it's about $42.4 billion short of the money it would need to pay out on these pensions for multi-employer plans if they failed. Further, Congress did not stipulate that this change applied to multi-employer plans only. It enacted the law in a way that it changed the Employee Retirement Income Security Act (ERISA) to permit the change to some underfunded multiemployer plans but did not add “only”. Therefore, Congress did not preclude that underfunded single-employer plans couldn’t be de-risked by allowing plan sponsors to cut pension benefits in the future! This was either an inexcusable oversight or a purposeful omission of protection of single-employer pension plan retiree participants. I urge you to send the NRLN’s sample letter to your members of Congress to express your outrage on giving trustees of multi-employer pension plans the ability to cut the pensions workers and retirees have earned while at the same time exposing all single-employer plan participants to the same risk. This goes against the protections in ERISA that have protected workers’ and retirees’ pensions for the past 40 years. We need you to help us help you by responding each time you get an Action Alert. Bill Kadereit, President National Retiree Legislative Network Here are the easy steps to follow on this Action Alert: Click here to access the NRLN’s sample letters. . The NRLN Action Network system will present the letters to be emailed to your U.S. Representative and U.S. Senators. If you have a problem with this link, go to www.nrln.org and click on the “Take Action Now!” near the top of the NRLN website home page. When you have accessed the NRLN sample letters, to the left of the letters are windows to type in your contact information, required by members of Congress so they know they are receiving an email from a constituent. If you have sent previous NRLN emails to your members of Congress your contact information may be automatically displayed. Personalize the letters by editing in your own comments. Click on the "Preview" button and the letters addressed to your Representative and two Senators from you will appear. Check to make sure the letters to your members of Congress are correct and then click "Send". Here are other features of our Congress web service that are useful: 1,After you have emailed your letter to your members of Congress, you will have the option to select a number of publications from a news media list to send a message to the editor. With regard to the present Action Alert, the composed message has been provided. 2.You have the option, if you have a Facebook page, to click on a Facebook icon to post a link to the NRLN's Action Alert on your Facebook page. After you click on the Facebook icon the link to the Action Alert will appear and the option to "Write Something". You may want to type in something like Email the NRLN's sample letter to your members of Congress. Click the "Share" icon to post your comment and the Action Alert link. 3.You also have the option, if you have a Facebook account, to post the NRLN’s message on your Representative’s or Senator’s Facebook page. Most members of Congress have a Facebook page. Click on the attachment to this email for the steps to follow to post on your legislator’s Facebook page. 4.Also, after emailing your letter there is an option to post to your Twitter account if you have one. Scroll down the NRLN webpage to "Send a Tweet" and click on the "Submit" buttons to send the short message to each of your members of Congress. 5.Scroll down further on the NRLN webpage to "Tell a Friend" and you will have the option to quickly email a message to your friends to ask them to access the NRLN Action Alert. Simply type or paste in their email addresses into a window. 6.Further down the webpage is "Share on your Web Site" that is only for the use of Webmaster. The News Register October 2014 No 002 ® Reminder to AASBCR retiree members - Bulletins and the website are paid for by ® AASBCR members. Please do not share with non-members. Remember, there is more to ® AASBCR than information. We work with AT&T HR and with the NRLN and Congress in support of retirees. Our dues pay for all of this. Encourage retiree friends to join and ® support AASBCR in our fight. “Intra-organization Communication is the Life-Blood of our organization.” AASBCR® Member Mailed Dues AASBCR®, your retiree group, has a reminder for all our members. AASBCR® certainly appreciates the timely payment of dues that most of its members provide. However, the member info sheet also should be enclosed if you are mailing your check. That sheet was either part of the email that you received, or it was an enclosure that was mailed to you. AASBCR® needs to know that your telephone number, email address, and physical address are correct. That insures ongoing communication with you. If you do online banking and all that is sent is a check, it would be helpful to request a memo line noting AASBCR® dues and the member name. The Vice President of Finance and Chief Financial Officer cannot always determine who the member is with only a bank check. Your attention to this matter is greatly appreciated. The News Register October 2014 No 003 AT&T to Pay $80 Million for Consumer Refunds in Mobile Cramming Case AASBCR® is making our retiree members aware of this Federal decision. Consumers who believe that third party charges were unfairly added to their AT&T cell phone bill by AT&T without their authorization can visit www.ftc.gov/att to submit a refund claim and find out more about the FTC’s refund program under the settlement. If consumers are unsure about whether they are eligible for a refund, they can visit the claims website or contact the settlement administrator at 1-877-819-9692 for more information. Please read the Time article below. More Than 350,000 Customers Have Asked AT&T for a Refund After Bogus Charges By Victor Luckerson; TIME Oct 15, 2014 Hundreds of thousands of AT&T customers have requested refunds for bogus cell phone charges since the Telco reached a settlement with the Federal Trade Commission last week to reimburse consumers, an FTC official told TIME Wednesday. In total, 359,000 individuals have sent in claims to the FTC seeking refunds for unauthorized charges that appeared on their cell phone bills in a practice known as “cramming.” Through cramming, third parties are able to issue unwanted, recurring charges for things like love tips and horoscopes to cell phone users. Jessica Rich, the director of the FTC’s bureau of consumer protection, said the response from consumers was one of the largest the agency has ever seen. The only case with a larger number of claims that she could recall was a 2012 settlement with Skechers over deceptive marketing for one of its shoe lines, which garnered close to half a million consumer complaints. “We expect this to be a lot higher,” Rich said. In total, AT&T has agreed to pay $80 million in refunds to customers for cramming charges. The Telco giant will also pay $20 million in penalties and fees to the 50 states and Washington, D.C., and a $5 million penalty to the FTC. At the time of the settlement, an AT&T spokesman noted that the company was the first in the Telco industry to stop charging customers for premium SMS messages in late 2013. The FTC is currently suing T-Mobile over the same issue. It’s not guaranteed that all the people who have issued claims will actually receive refunds. An independent claims administrator will review the refund requests to determine if they are valid. “I’m expecting that most of the claims are going to be valid, but if they’re not valid, there will be a way to determine that,” Rich said. Customers who think they were victims of cramming can file to claim refunds until May 1. 2015. AT&T Ameritech /SBC Retirees - We are AASBCR® Blue Bulletin Vol. 9 No. 016 October, 2014 ® ® Reminder to AASBCR retiree members - Bulletins and the website are paid for by AASBCR ® members. Please do not share with non-members. Remember, there is more to AASBCR than information. We work with AT&T HR and with the NRLN and Congress in support of retirees. Our ® dues pay for all of this. Encourage retiree friends to join and support AASBCR in our fight. Aon Retiree Health Exchange The AASBCR® Benefit Directors recently learned about discrepancies in the guaranteed issue claim made by the Aon Retiree Health Exchange. Guaranteed issue means that during this Medicare enrollment period, retirees will be automatically accepted into a Medicare Supplement/Medigap plan regardless of any preexisting conditions. Upon verifying the information, the AASBCR® Benefit Directors were informed by Aon that: “You have guaranteed acceptance into many Medicare Supplement Plans. There are generally 4 types of Medigap lettered plans that can vary by state and carrier (D, G, M & N) as to whether guaranteed issue is offered. The Aon Benefit Advisors know which plans this applies to and will discuss this with retirees during the appointment. Note that UHC AARP is one of our national carriers that offers guaranteed issue for ALL of their plans in situations where there is a loss of an employer sponsored group health plan." This means that on some Medigap lettered policies, D, G, M, and N, certain insurers can and will ask about pre existing conditions and may delay coverage of those conditions, charge more for the policy, or deny coverage entirely. AASBCR® is sharing this information as it differs from what was originally stated. When discussing plans with the Aon Benefit Advisor, keep in mind that Medigap lettered plans A, B, C, F, K, and L are guaranteed issue for eligible AT&T Medicare retirees during this Medicare enrollment period. If you are interested in any of the other lettered plans, ask the advisor about whether guaranteed issue applies. As added resources, retirees may also wish to check the official Medicare website - Medicare.gov. and/or an independent Medicare insurance broker or agent in your state that offers a variety of plans. These independent PO Box 7477 Buffalo Grove IL 60089-‐7477 Phone/FAX (312) 962-‐2770 http://aasbcr.org/ This communication is Private and Confidential. It is intended only for viewing by AASBCR ® Members. Copying or forwarding of this communication is not authorized by AASBCR . ® agents usually do not charge the retiree a fee for a consultation since the insurance carrier compensates them. The retiree can also call the insurer directly for rates and even go to the website of the insurer to see plan details. AASBCR® is always working for our retiree members and wants to be certain that ALL eligible AT&T Medicare retirees choose their own medical health insurance and prescription drug plans for 2015. Retirees should also decide on dental and vision if they wish to add that coverage. Remember, if you are an eligible AT&T Medicare retiree, there is NO DEFAULT PLAN. You must select a plan for yourself. To "unlock" the Health Resources Account (HRA) you must purchase a Medicare Prescription Drug plan, a Medicare Supplemental policy or a Medicare Advantage policy through the Aon Retiree Health Exchange. After unlocking the HRA, retirees may also use the remaining HRA money to pay for any eligible medical expenses until the money is totally spent. Proudly working on behalf of retirees of the Bell System and successor companies of the New AT&T, located worldwide PO Box 7477 Buffalo Grove IL 60089-‐7477 Phone/FAX (312) 962-‐2770 http://aasbcr.org/ This communication is Private and Confidential. It is intended only for viewing by AASBCR ® Members. Copying or forwarding of this communication is not authorized by AASBCR . ® AT&T Ameritech /SBC Retirees - We are AASBCR® Blue Bulletin Vol. 9 No. 017 December, 2014 ® ® Reminder to AASBCR retiree members - Bulletins and the website are paid for by AASBCR ® members. Please do not share with non-members. Remember, there is more to AASBCR than information. We work with AT&T HR and with the NRLN and Congress in support of retirees. Our ® dues pay for all of this. Encourage retiree friends to join and support AASBCR in our fight. Aon Retiree Health Exchange – Update and Reminders Below is a chart taken from the Aon Retiree Health Exchange website. For those of you turning 65 in 2015, it explains when the AT&T group health care coverage ends, when your Medicare coverage begins and when you should enroll in individual health care coverage through the Aon Retiree Health Exchange in order to avoid a gap in coverage. PO Box 7477 Buffalo Grove IL 60089-‐7477 Phone/FAX (312) 962-‐2770 http://aasbcr.org/ This communication is Private and Confidential. It is intended only for viewing by AASBCR ® Members. Copying or forwarding of this communication is not authorized by AASBCR . ® * You must enroll in Medicare Parts A and B during the three months leading up to your 65th birthday to make sure that coverage is effective on the first of the month in which you turn age 65. Reminder For those of you already eligible to move to the Aon Retiree Health Exchange, please remember you must take action to "unlock" the Health Resources Account (HRA). To do this, you need to purchase a Medicare Prescription Drug plan, a Medicare Supplemental policy or a Medicare Advantage policy through the Aon Retiree Health Exchange. After unlocking the HRA, you may also use any remaining HRA money to pay for eligible medical expenses until the money is totally spent. If you have not signed up yet or need to talk to a Benefits Advisor, remember that Mondays are always very busy and often have very long wait times. If possible try to call later in the week. Most retirees have until December 31st to enroll. Retirees who previously left the AT&T group plan to enroll in an Individual Medicare Plan need to enroll by December 7th. If you have already enrolled, your new insurance carrier will send you plan materials along with your new insurance cards. The Health Reimbursement Account Guide is now posted on the Aon Retiree Health Exchange site at http://myretireehealthexchange.com/pdf/ATT_HRA_Guide.pdf Reminder; you cannot file for reimbursements until January 1, 2015. Answers to basic questions regarding the Health Exchange may be available at the website. Proudly working on behalf of retirees of the Bell System and successor companies of the New AT&T, located worldwide PO Box 7477 Buffalo Grove IL 60089-‐7477 Phone/FAX (312) 962-‐2770 http://aasbcr.org/ This communication is Private and Confidential. It is intended only for viewing by AASBCR ® Members. Copying or forwarding of this communication is not authorized by AASBCR . ® AT&T Ameritech /SBC Retirees – We are AASBCR® Proudly working on behalf of the Bell System and successor companies of the New AT&T, located throughout the World Legislative Ledger December 2014, No 003 ® ® Reminder to AASBCR retiree members - Bulletins and the website are paid for by AASBCR ® members. Please do not share with non-members. Remember, there is more to AASBCR than information. We work with AT&T HR and with the NRLN and Congress in support of retirees. Our ® dues pay for all of this. Encourage retiree friends to join and support AASBCR in our fight. AASBCR® Members Reply To This Action Alert Retirees need to work with the National Retiree Legislative Network to assist their Congress in reintroducing important legislation that will otherwise die when the 113th Congress is completed and the 114th Congress begins their work in January. If retirees want change, they must act to accomplish that. The issues the NRLN is asking Congress to reintroduce are: Pension Asset Protection* Company Pension De-Risking* Disclosure Improvements To Pension Annual Funding Notices* PBGC Reform* Bankruptcy Reform* Protect Retirees In Mergers, Acquisitions & Spin-Offs* Increase Funding For Social Security And Medicare* Reduce The Cost Of Prescription Drugs* Eliminate Medicare's 3-Day Inpatient Requirement Eliminate Pre-Existing Condition Exclusion For Americans Age 65 And Older Protect Medicare From Becoming Voucher Program. *Issues with an asterisk are supported by NRLN whitepapers. Below is a request from Bill Kadereit, president of the NRLN, our partner on Capitol Hill. Please help all retirees by following the suggested links and sending an email letter to your U.S. Representative and Senators. Bills the 114th Congress Should Introduce and Pass The 113th Congress will be back in session for a short time in December before it adjourns for the holidays. With adjournment, bills in the current Congress will die in committees. When Congress reconvenes in January, it will be the 114th Congress with Republicans being the majority party in the House and Senate. All unpassed bills we supported in the 113th Congress will need to be introduced as new bills in order to be considered. Representatives and Senators who will be members of a new Congress normally ask their staff members in December to begin thinking about and proposing bills to be introduced in the New Year. I am requesting that you email to your members of PO Box 7477 Buffalo Grove IL 60089-7477 Phone/FAX (312) 962-2770 http://aasbcr.org/ ® This communication is Private and Confidential. It is intended only for viewing by AASBCR ® Members. Copying or forwarding of this communication is not authorized by AASBCR . AT&T Ameritech /SBC Retirees – We are AASBCR® Proudly working on behalf of the Bell System and successor companies of the New AT&T, located throughout the World Congress the NRLN’s sample letter recommending bills beneficial to retirees that should be re-introduced or introduced and passed early during the 114th Congress. We believe our sample letter will give the NRLN a jump start on advocating a significant part of our 2015 Legislative Agenda. Your Representative and/or Senator may not be a member of the 114th Congress due to retirement or not being reelected. When that is the case, you can remove him or her from the letter by unchecking the box by his or her name. Or, go ahead and send the letter. Maybe your letter will turn up in the office of the new Representative or Senator. Here are the steps to follow on this Action Alert: 1. Click here to access the NRLN’s sample letters. The NRLN Action Network system will present the letters to be emailed to your U.S. Representative and U.S. Senators. If you have a problem with this link, go to www.nrln.org and click on the “Take Action Now!” near the top of the NRLN website home page. 2. When you have accessed the NRLN sample letters, to the left of the letters are windows to type in your contact information required by members of Congress so they know they are receiving an email from a constituent. If you have sent previous NRLN emails to your members of Congress your contact information may be automatically displayed. 3. Personalize the letters by editing in your own comments. 4. Click on the "Preview" button and the letters addressed to your Representative and two Senators from you will appear. Review the letters to your members of Congress and then click "Send". Wise Words from Seniors Every strike brings me closer to the next homerun………. Babe Ruth The most common way people give up their power is by thinking they don’t have any…………..Alice Walker PO Box 7477 Buffalo Grove IL 60089-7477 Phone/FAX (312) 962-2770 http://aasbcr.org/ ® This communication is Private and Confidential. It is intended only for viewing by AASBCR ® Members. Copying or forwarding of this communication is not authorized by AASBCR .

© Copyright 2026