Alzheimer's Disease: An Epidemic Getting to Know Attorney Carrie E

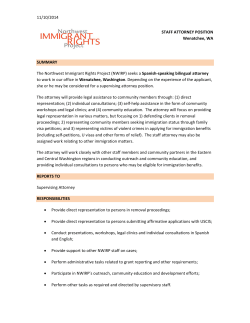

January-March 2015 Alzheimer’s Disease: An Epidemic Alzheimer’s disease is a progressive degeneration of brain tissue. Alzheimer’s is the most common cause of dementia, and affects intellectual functions such as memory, comprehension, and speech. Shortterm memory is typically affected first. As time goes on, long-term memory becomes cloudy, and then is gone. Ordinary daily activities grow increasingly difficult, reasoning skills diminish, and behavioral issues often surface (such as frustration, combativeness, paranoia, etc.) Often these behavioral issues worsen at night, and are often referred to as “sundowners”. Dramatic mood swings are not uncommon with many seniors diagnosed with Alzheimer’s. They may wander, or intentionally escape. The disease can cause combativeness, Attorney Jane M. McNamara Guiding families through the Complex Issues of Long-Term Care, Asset Protection and Elder Law. Contents: Alzheimer’s Disease: An Epidemic 1 Social Security Increase for 2015 1 Getting to Know Carrie E. Barnes 1 10 Signs that Families Need Help 2 Time to Make A Plan 2 The Cost Of Nursing Care3 Managing Unpredictable Behavior3 Essential Legal Documents 4 Press Release Upcoming Events 4 posing a danger to themselves or to those around them. They may become sexually aggressive, say inappropriate things to family and strangers, accuse spouses of affairs, believe everyone is stealing, urinate in public, and have other bizarre and unpredictable behaviors. Combinations of medications are required to ease the behaviors, which unfortunately, can become a “trial and error” process. As the disease progresses, the patient often cannot be cared for in the home. Finding an appropriate facility to meet the specific needs can be challenging and expensive. Eventually, the Alzheimer’s patient may become physically helpless, incontinent, and unable to communicate entirely. Alzheimer’s disease can run its course from onset to death in just a few years, or it may play out over a period as long as 20 years. More often, however, people suffer with Alzheimer’s disease for about nine years. It is the sixth leading cause of death in the U.S. One person out of eight, age 65 and over, has the disease. Women are more susceptible than men, and half of all nursing home residents suffer from Alzheimer’s or related disorders. Since there is no “cure”, and it is progressive and terminal, families must have the knowledge, education, and tools to cope with this disease. It is up to the families to seek out appropriate and correct information, create a plan, and make the best choices possible. Social Security Announces a 1.7 Percent Increase for 2015 Monthly Social Security and Supplemental Security Income (SSI) benefits for nearly 64 million Americans will increase 1.7 percent in 2015. This “COLA” adjustment will begin in January 2015 for Social Security beneficiaries. SSI beneficiaries will receive increases beginning on December 31, 2014. The Social Security Act ties the annual increase to the Consumer Price Index. For more information, please visit www.socialsecurity.gov/cola. For information about Medicare changes for 2015, please visit www. Medicare.gov. Getting to Know Attorney Carrie E. Barnes Carrie E. Barnes has been a lawyer for 25 years. She spent many years as a trial attorney litigating business, contract, personal injury and construction lawsuits. Carrie now uses her advocacy skills to assist our clients with the legal and financial issues involved in aging such as estate planning, asset protection, medical and long-term care options, Medicare and Medi-Cal benefits and insurance coverage (including long-term care insurance). Carrie is also a Veterans Administration accredited attorney, and assists our clients obtain and maintain VA benefits that help pay for long-term care. Page 2 10 Signs That Families Need Help Are you, your family members or friends struggling to meet the needs of an elderly loved one during a chronic illness, incapacity, or disability? If you see one of these signs of distress, the family may benefit from the LIFE CARE PLANNING and ELDER LAW services of the McNamara Law Firm: Legal Planning Advocacy Public Benefits Asset Protection Support and Information 1. The primary caregiver is suffering from burnout, ill health, frustration, guilt, or confusion. 2. Family members are confused about care options, what to do next or where to get help. 3. The elder was recently diagnosed with Alzheimer’s disease, dementia, Parkinson’s disease, or other chronic condition. 4. The elder is ill or disabled with children or family who live out of town. 5. The elder has experienced an event such as a fall, medication mistake, or accident. 6. Family members have discovered the elder wandering, malnourished, dehydrated, or unable to provide self care. 7. The elder suffered a medical event such as a stroke or heart attack. 8. There are worries about paying for long-term care in the future. 9. Adult children are voicing concerns about a parent’s debilitating diagnosis. 10. The elder is hospitalized and the family has been told that returning home is not an option. A LIFE CARE PLAN is a written “roadmap” prepared by The McNamara Law Firm, PC, which sets forth a customized and detailed action plan for the elder. The LIFE CARE PLAN details the process to meet the unique care needs, pay for care, receive appropriate monetary benefits to help pay for care (Medi-Cal, Veterans Administration benefits, etc.), and meet other important goals. The LIFE CARE PLAN helps the family clearly understand what needs to be done to meet these goals (proper care, dignity, asset protection, relief for the well spouse or family members, etc.). Our team at the McNamara Law Firm assists every step of the way. Time to Make a Plan Once a diagnosis of dementia, Alzheimer’s, Parkinson’s, or other progressive illness has been made, it is extremely important to map out a plan to manage the disease and its devastating financial aftermath. It is essential to have professional assistance to help with this plan. The McNamara Law Firm, PC provides these essentials for the elderly and their families dealing with Alzheimer’s, dementia, stroke, and illnesses related to aging. Please visit our Web Site for our updated Calendar of Events and information. www.theMcNamaraLawFirm.com Developing a Plan: Plan as soon as possible. Many families use the services of an elder law attorney, who is well-versed in the complexities of Medi-Cal eligibility and asset protection, care options, and VA Aid and Attendance benefits for care. The plan should consider legal and estate planning, long-term care options, insurance issues, Medicare and Medi-Cal, and planning for the best quality of life possible for the elder. Legal and Estate Planning: There will come a time when the ill elder can no longer sign legal documents. The person will be deemed “incapacitated”, and it will be unlawful for them to sign documents. This will create great difficulty and frustration for the family member trying to conduct financial transactions, make medical decisions, or engage in asset protection measures to protect the home and life savings. Legal documents should be completed BEFORE the disease renders the person incompetent. Page 3 The Cost of Nursing Home Care Seniors are living longer with chronic diseases, dementia, diabetes, and the effects of stroke. Unfortunately, many are unable to pay for their needed care on a long-term basis. If nursing home care is required, many seniors simply do not know their options. They use all of their savings to pay for that care – at a cost of over $7,500.00 per month. Many do not understand the California benefit for long-term care called Medi-Cal. Medi-Cal can provide assistance, if the senior is eligible. However, Medi-Cal can later seek “recovery” against the senior’s home for this nursing home financial assistance. A lifetime of savings and frugal living is lost, because the senior had an illness or condition that required nursing home care. The senior or the family never considered or were aware that there were other options and asset protection possibilities. Alternatively, many seniors live in assisted living facilities, board and care homes, or have private in-home caregivers. Again, the senior’s savings is the primary source of payment, and often the senior outlives their funds. Families are looking for tools, information, and advice on how to afford care for elderly loved ones, without using all of their life savings, and possibly losing the senior’s home. They need information on Medi-Cal, VA benefits, community resources, and other alternatives. Many seniors wrongly believe that their insurance, such as Medicare, will cover their care needs. Not so. Medicare, SCAN, Kaiser, Secure Horizons, Blue Shield, HealthNet, and all the other insurance companies do not pay for long-term care. They only cover short-term nursing home care for older and disabled patients, after hospitalization. After this initial period expires, the patient must privately pay for the expensive care. However, Medi-Cal covers long-term nursing home care for seniors who are eligible. Additionally, many eligible veterans and their spouses receive VA Aid and Attendance benefits, which provide monthly monetary assistance for care expenses, such as in-home caregivers and assisted living facilities. Making wise decisions is very important when faced with these challenges. Having all the information, and understanding the options is critical in making wise decisions. Elder Care Coordinator Corner Managing Unpredictable Behavior in Dementia Patients Behavior management in Alzheimer’s and dementia patients is often challenging for the caregiver and family members as the disease progresses. Lisa Krzyzewski, Elder Care Coordinator The Law Firm’s Elder Care Coordinators: Advocate on behalf of the client Regularly visit to ensure proper care Support family members through the decisionmaking process Assist with VA and Medi-Cal applications Provide information, resources, and guidance. The changes in the brain often lead to unusual and unpredictable thinking and aggressive/paranoid behavior. For example, your loved one may become anxious around family members, neighbors, or friends whom he or she may no longer recognize. The dementia victim may lash out. Sleep patterns are often disrupted. He or she may become withdrawn, wander, become aggressive, and/or become angry and irritable. Although medications are often successful in managing outbursts, they do not “cure” the situation. Here are some tips to help you manage the behavior changes that often accompany Alzheimer’s disease: Be calming. If your loved one becomes agitated or aggressive, redirect their attention. Some methods to do this include changing the subject or environment, playing music or a video that they used to enjoy, or reminisce about the family, or activities once enjoyed. Routines often work. Try to minimize any changes in the surroundings or to your loved one’s daily routine. Avoid situations that require the person with Alzheimer’s to make decisions, which can be very frustrating and cause anxiety for them. Gently remind. Help your loved one maintain his or her orientation and dignity. Provide the names of the people around them. Remind them of the day of the week, and what the schedule is for that day. Reassure. Use a quiet voice, and be protective and affectionate. If they are delusional, be reassuring rather than defensive. Watch medications and health. Be sure your loved one gets the right medications at the right time. Watch for reactions and possible side effects of medicines, such as depression or agitation. Consult with the doctor about giving any over-the-counter medicines (even “PM” medications), because they may react with prescription medications and cause side effects. Changes in behavior may also be caused by urinary tract infections and dehydration, which are all too common in senior citizens, but not always diagnosed. Identify triggers. Try to identify any actions, words, or situations that may “trigger” inappropriate or dangerous behavior. Be honest. Recognize when the person’s behavior is more than you can handle. Your own, as well as your loved one’s safety, must be considered at all times. Page 4 Essential Legal Documents If you or a loved one has been diagnosed with a progressive disease, it is necessary to consider legal and financial matters. Even those without such a diagnosis need proper legal documents in place, as even the healthiest individuals unexpectedly may have a health crises. People with Alzheimer’s, dementia, and other illnesses may have the capacity to manage their own legal and financial affairs right now, but as the disease progresses, they will need to rely on others to act in their best interest. This transition is never easy. However, advance planning allows people with progressive brain illnesses, and their families, to make decisions together for what may come. Legal Documents Clearly written legal documents that outline your loved one’s wishes and decisions are essential. These documents authorize another person to make health care and financial decisions, including plans for long-term care. Obtain legal advice and services from an elder law attorney - one who is well versed in the maze of issues you are or will be facing. As you plan for the future, ask the attorney about the following documents: • Power of Attorney. This gives a person an opportunity to authorize an agent -- usually a trusted family member or friend -- to make legal decisions when he or she is no longer competent. Estate Planning, when done properly, can be invaluable. • Power of Attorney for Health Care (Advance Healthcare Directive). This gives the person an opportunity to authorize an agent to make all decisions regarding healthcare, including choices regarding medical providers, medical treatment, and, in the later stages of the disease, end-of-life decisions. • Trust. Enables an appointed Trustee to manage Trust assets during the grantor’s cognitive impairment. However, a Revocable Living Trust does not offer protection from Medi-Cal recovery. For asset protection planning, an Elder Law attorney should be consulted to determine if specialized Irrevocable Asset Protection Trusts are appropriate. Without comprehensive legal documents, court intervention (“Conservatorship proceedings”) may be needed, giving the “conservator” legal authority to make decisions and carry out financial transactions. Unfortunately, the affected person’s wishes may ultimately not be carried out, as all court rules and procedures must be strictly adhered to; and after death, the Probate Court may be required to handle estate assets. Typically “pre-planning” is the wiser choice for most individuals. CALENDAR OF EVENTS February 7, 2015, Saturday, 10:00 am—3:00 pm Golden Year Expo—Hyatt Hotel, Valencia Keynote Speaker March 20, 2015, Friday, 11:30 am—1:00 pm Hosted by Avan All-Valley Aging Network Pacifica Senior Living, Santa Clarita Panel Speaker May 9, 2015, Saturday Caregiver Resource Day, Senior Center, Newhall Keynote Speaker Please visit our Web Site for our updated Calendar of Events and information. www.theMcNamaraLawFirm.com PRESS RELEASE Attorney Jane M. McNamara Elected To LCPLFA Board Principal Attorney of McNamara Law Firm Will Serve On National Law Board To Advise On Elder and Life Care Planning Law St. Louis, MO – National attorney association LCPLFA (Life Care Planning Law Firms Association) elected Attorney Jane M. McNamara of Valencia, CA to the Board of Directors at the organization’s annual meeting earlier this month in St. Louis. Attorney McNamara has been serving the unique needs of the elderly in law practice since 1991. The McNamara Law Firm specializes in assisting seniors, the elderly, and the disabled obtain services, care, and appropriate public benefits so they can enjoy the highest quality of life possible. Attorney McNamara’s practice focuses on guiding seniors and their families through the maze of legal issues dealing with dementia, illness, long term care, and asset protection. Attorney McNamara is also accredited with the Veterans Administration, and assists clients obtain VA benefits to help pay for long term care. The firm offers guidance for clients during a difficult and overwhelming stage of life, and takes pride in effectively advocating on behalf of clients to ensure they receive proper and appropriate care for their unique circumstances. The Life Care Planning Law Firms Association Annual Meeting took place earlier this month in St. Louis, where Attorney McNamara was elected to the Board. LCPLFA is a national attorney organization dedicated to dealing with the unique needs of elderly clients. Attorney McNamara’s extensive experience in the field will certainly lend itself to the benefit of the organization. To learn more about the LCPLFA, visit www.lcplfa.org. www.theMcNamaraLawFirm.com www.VAbenefits4seniors.com 28212 Kelly Johnson Parkway • Suite 110 Valencia, CA 91355 www.theMcnamaraLawFirm.com • www.vabenefits4seniors. com

© Copyright 2026