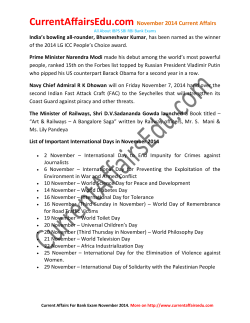

Interview Digest for IBPS PO and Clerk