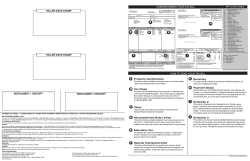

Maximum Levy Worksheet - School District General Fund

MAXIMUM LEVY WORKSHEET - For Tax Year 2014 SCHOOL DISTRICT GENERAL FUND OFFICE OF STATE TAX COMMISSIONER Complete all calculations that apply. School District: Tax Year: Calculation 1 (N.D.C.C. § 57-15-14.2 School district levies) 1. Taxes levied last year 2. Current year taxable value 3. Levy at 70 mills (No. 2 times 0.070) 4. 12 percent increase (No. 1 times 1.12) 5. Levy with 12% increase, maximum 70 mills (No. 3 or No. 4, whichever is less) Calculation 2 (N.D.C.C..Sec. 57-15-01.1 Protection of Taxpayers and Taxing Districts) 6. Taxes levied last year 7. Taxes levied two years ago 8. Taxes levied three years ago 9 . Base year (Largest of 6, 7, or 8) 10. Expired temporary levies (See Instructions) 11. Base year taxes (No. 9 minus No. 10) 12. Base year taxable value of taxable & exempt* property 13. Calculated mill rate for taxes levied in the base year (No.11 ÷ No. 12) 14. Taxable value of taxable & exempt* property 15. Adjustment for property no longer in the removed since the base year. taxing district (No. 13 times No. 14) 16. Taxable value of taxable & exempt* property 17. Adjustment for property added to the taxing district (No. 13 times No. 16) added since the base year. 18. New or increased mills authorized by the legislature or electors (xxx.xx) 20. Base year mill rate 21. Base year mill rate minus 60 mills, ONLY IF 2013 IS NOT THE BASE YEAR 22. Amount of state aid under ch. 15.1‐27. (Multiply the budget year taxable value of the school district by the lesser of (1) the base year mill rate of the school district minus 60 mills; or (2) 50 mills, ONLY IF 2013 IS NOT THE BASE YEAR) 23. Adjusted base year taxes (No. 11 minus No. 15 plus No. 17 plus No. 19 minus No. 22) 19. New mills increase (No. 2 times No. 18) MAXIMUM LEVY WORKSHEET - For Tax Year 2014 SCHOOL DISTRICT GENERAL FUND Page 2 OFFICE OF STATE TAX COMMISSIONER Calculation 3 (N.D.C.C. § 57-15-14 Voter approval of excess levies in school districts.) Mill Rate Levy Amount 24. Specified mill rate approved for a period including a taxable year before 2009 25. Required mill rate reduction 115.00 26. Adjusted specified levy ( No. 24 minus No. 25) 27. Specified mill rate approved for a period including taxable years 2009 through 2012 28. Required mill rate reduction 40.00 29. Adjusted specified levy ( No. 27 minus No.28) 30.Specified mill rate approved for a period after taxable year 2012 Calculation 4 Unlimited levy approved before taxable year 2009 Levy Amount 31. Approved levy. Enter dollars. Date 32. Effective date of specified (or unlimited) levy authority 33. Expiration date of specified (or unlimited) levy authority 34. Maximum General Fund Levy Authority (greatest of Nos. 5, 23, 26, 29, 30, or 31) Levy Amount Maximum levy calculation (N.D.C.C. § 57-15-01.1) 35. Max Levy (No. 34) 36.Amount of levy certified by district 37. Final levy (lesser of 35 or 36) 38. General fund mill rate (No. 37÷ No. 2) * Property exempt by local discretion or charitable status. See section 57‐15‐01.1(2)(d). SDGF Max Levy Worksheet 2014 fill by hand.xlsx

© Copyright 2026