Amwal on outlook for 2015 (“The Peninsula”)

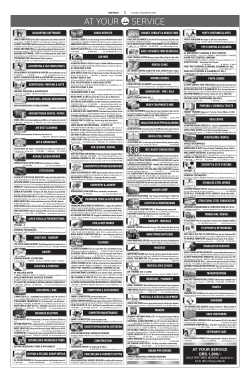

Tuesday 13 January 2015 22 Rabial I 1436 Volume 19 Number 6309 Price: QR2 www.thepeninsulaqatar.com [email protected] | [email protected] Editorial: 44557741 | Advertising: 44557837 / 44557780 Oil prices to stay low longer Lower prices to hit earnings of chemical and real estate companies, say experts BY SATISH KANADY DOHA: Global oil prices are most unlikely to rebound to $100 levels in near term. If the prices stay at current levels, Qatar may run a budget deficit in the current fiscal, though marginal, top market analysts said yesterday. Oil prices will stay low longer. The market will eventually balance settling $70-$75 a barrel in long term, In short term, the market could come down even to $40 levels a barrel before it makes a turnaround, Fahmi Alghussein CEO, Amwal and Afa Boran, Head of Asset Management, Amwal said. “If you ask us whether the benchmark oil prices will go down to $40 levels, I would say, yes. But if you ask me whether it will stay there for long… probably not”, Afa said. Incidentally, in line with Amwal’s expectations, the US bank Goldman Sachs slashed it oil forecasts yesterday saying fuel prices needed to stay low for much longer. The bank analysts said crude oil prices could come down much further in the short term, possibly into the high $30s a barrel before the market saw a rebound. If oil prices continue to stay at $50 levels, Qatar will face a marginal deficit in its budget ranging $5bn-$10bn. But Qatar’s Sovereign Wealth Fund (SWF) is healthy enough to meet its planned funding. The estimated savings of the government are more than $150bn. If you look at these figures, the projected capital spending for the next five years will not be a problem, Fahmi and Afa noted. On the possible funding gap, in the event of dropping oil prices, Fahmi said private sector is capable of filling the gap. “You could see more corporate debts and project financing coming soon into Qatari market”, Afa said. Fahmi said a $50 oil price will naturally affect future company profits and stock prices, but will depend on the country’s current budget surplus, accumulated savings and government willingness to continue with spending plans. Qatar’s stock price already reflects this outlook, as it is already down by 15 percent from their September peaks. On the impact of oil on corporate earnings, Fahmi noted chemical companies and real estate companies will be most affected. Chemical companies will be most directly affected as they get cheap feedstock, so a decline in selling prices would lower profits. Real estate prices and real estate stocks will be affected as well, as they reflect expectations of government spending which in turn reflect regional investor sentiment. Oil services will see a moderate impact, depending on the length and nature of contracts with clients. However, Amwal is bearish on new listings and IPOs in Qatar. “If you ask me today, I would say this is not the best time for listings”, Afa said. Amwal does not foresee any companies going public early this year. THE PENINSULA From Left: Mohammed Al Mulla, Vice President, Amwal; Fahmi Alghussein and Afa Boran at the press conference yesterday. KAMMUTTY VP Amwal’s equity funds top best market products DOHA: Two investment funds of Qatar-based Asset Management Company Amwal continued to emerge as leading products in the market in 2014. Amwal is Qatar’s first independent asset management firm, set up in 1998 and wholly owned by Sheikha Hanadi Nasser bin Khaled Al Thani. Amwal manages equities and balanced portfolios across GCC and Turkey. “Our product ‘Qatar Gate Fund’ is the only Qatar equity fund to have outperformed the Qatar Exchange Index every calendar year since its inception nine years ago. Our GCCfocused product ‘Al Hayer Fund’ generated outperformance of 3.7 percent in 2014, in volatile market conditions”, Amwal’s CEO Fahmi Alghussein and Afa Boran, head of Asset Management, said yesterday. Qatar Gate Fund, in partnership with Ahli Bank, is the best performing Qatari equity fund. Over the last five years our team has cumulatively delivered 110 percent returns vs average 95 percent of other funds and 102 percent of the closest competitor, outperforming the average fund by 15 percent and closest competing fund by 8 percent, he told reporters. Amwal’s Qatar Gate Fund has consistently delivered the lowest downside volatility versus peers, across different timeframes. This is particularly evident in the last year, when the downside volatility of the Fund’s portfolio was only 19 percent, while other funds exhibited downside volatility of around 25 percent, said Afa Boran. Afa said both Qatar and UAE have performed very well since MSCI’s initial announcement of planned upgrade to emerging market status. Since the decision was announced, Qatar is up around 45 percent, while UAE is up around 70 percent. It is important to note that UAE was a cheaper market to start with, he said. “Our investment philosophy is long-term value investing, similar to private equity investing, but with close monitoring of stock prices with an aim to take advantage of volatility…We aim to exploit risks that we understand, and avoid those that we cannot predict”, he said. THE PENINSULA Oil slumps 5pc to near 6-year lows NEW YORK: Oil slumped 5 percent to near six-year lows yesterday, accelerating its months-long rout after Goldman Sachs slashed its short-term price forecasts and Gulf producers showed no signs of curbing output. Brent was down $2.34 to $47.78 a barrel by 11:47am EST (1637 GMT), after dropping as low as $47.18 to its lowest since April 2009. US crude oil was down $1.98 at $46.38 after earlier hitting a low of $45.90, also near six-year low. Analysts at Goldman Sachs cut their three-month forecasts for Brent to $42 a barrel from $80 and for the US West Texas Intermediate contract to $41 from $70 a barrel. The bank cut its 2015 Brent forecast to $50.40 a barrel from $83.75 and US crude to $47.15 a barrel from $73.75. Despite declining investments in US shale oil, the main driver in the current supply glut, production will take longer to come down, Goldman said in a report. Tariq Zahir of Tyche Capital Advisors said a bottom was hard to predict as prices varied so quickly. “I figured we’d see $40 in the near term, but everything seems to be happening quicker than expected,” Zahir said. “You’re going to get some more margin call selling in here, there will be a bounceback that will be sharp and violent.” Walter Zimmerman of United-ICAP said the market’s sharp changes in the last few months make it impossible to predict an average price for the year. “In today’s markets, that are so widely volatile, an average price is completely useless,” Zimmerman said. “There’s a million barrels a day of excess production,” he said. “That is what is driving the price.” REUTERS Doha Bank committed to supporting SMEs ‘Delicious’ Ford GT DOHA: Doha Bank organised a SME customer meet related to the projects financed under Al Dhameen guarantee programme of Qatar Development Bank (QDB). Addressing the event, the bank’s CEO Dr R Seetharaman said SMEs are expected to play an important role in supporting Qatar’s economic diversification. Doha Bank will participate in Qatar’s diversification story by encouraging the SME sector. “Doha Bank already enjoys a sizeable SME customer base & a strong corporate and retail business franchise with branch presence across the country to meet customers growing requirements. At Doha Bank, we know that doing business in today’s economic climate is challenging - and that situations and business needs can change overnight’, is what he reiterated. SME sector in Qatar is promising, and is expected to grow rapidly and will play an important role in Qatar’s overall growth,” Dr Seetharaman noted. By providing financial guarantees for projects, QDB seeks to promote the entrepreneurial spirit of the private sector and offer services that will facilitate the development, growth and diversity of the national economy,” said Jawaher Al Noaimi, Al Dhameen Manager at Qatar supercar wows Detroit DETROIT: Ford attempted to land a knock-out blow to its rivals at the Detroit auto show in revealing a dazzling new GT supercar yesterday. The glitzy presentation at the cavernous arena named after the boxer Joe Louis was an attempt to grab the headlines at the United States’ premier auto show, where power and luxury have roared back to the fore. Ford had given very little away in the lead-up to the first major international auto show of the year, but speculation had been rife that it had something special in mind. And it did not disappoint, unveiling a GT for next year that immediately won glowing approval from car enthusiasts who flooded social Officials pose for a group picture. Development Bank. “Al Dhameen has helped SMEs in Qatar overcome the challenges they face when seeking commercial financing. The programme has also helped banks overcome reservations about financing small and medium-sized companies due to the high-risk ratio of some in the sector. In 2014 alone, Al Dhameen guaranteed over 69 clients with a total value of QR174m,” she said. Doha Bank is committed to continue meeting financial requirements of SME sector in Qatar and also through its offices in Dubai, Abu Dhabi, Sharjah and Kuwait. Doha Bank has started its operations in India which will help businesses coming from India to start in Qatar as well as corporates who want to do business with corporates in India. Doha Bank has already demonstrated its long term commitment to the success of SMEs by supporting Al Dhameen guarantee programme of Qatar Development bank. The bank has recently financed five new projects under this programme such as setting up a state of the art auto battery factory, establishing a dental clinic employing the most advanced equipment, welding electrodes, bitumen unit, and tourism project. The projects are equipped with most advanced equipment & machines. The total outlay on these projects will exceed QR50m. THE PENINSULA media to proclaim what one called on Twitter “delicious”. The new GT, an update to the legendary sports car last produced a decade ago, boasts 600 horsepower and twin-turbocharged V6 eco-boost engines. Mark Fields, Ford’s chief executive said the Ford GT will go into production in 2016. The GT will be available late 2016, Fields said, marking the 50th anniversary of the company’s original high-performance racer, the GT40. Ford had already been in the spotlight in Detroit, snapping up the award for best truck, for the new aluminum F-150, while the Volkswagen Golf was named North American car of the year. AFP The Ford GT on display at the North American International Auto Show in Detroit yesterday.

© Copyright 2026