Lazard Retirement Emerging Markets Equity Portfolio 4Q 2014

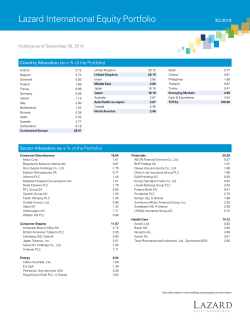

Lazard Retirement Emerging Markets Equity Portfolio 4Q 2014 Holdings as of December 31, 2014 Country Allocation (as a % of the Portfolio) China Hong Kong India Indonesia Malaysia Pakistan Philippines South Korea Taiwan Thailand South/East Asia 12.08 3.68 8.47 6.52 0.75 1.30 1.70 13.71 4.82 2.45 55.48 Egypt Hungary Russia South Africa Turkey Europe/Middle East/Africa 1.16 0.96 6.80 8.77 5.09 22.78 Argentina Brazil Colombia Mexico Latin America Cash & Equivalents TOTAL 0.99 14.03 1.00 1.42 17.45 4.29 100.00 Sector Allocation (as a % of the Portfolio) Consumer Discretionary Bajaj Auto, Ltd. Coway Co., Ltd. Hero MotoCorp, Ltd. Hyundai Mobis Co., Ltd. Imperial Holdings, Ltd. PT Astra International Tbk Via Varejo SA Woolworths Holdings, Ltd. Wynn Macau, Ltd. 7.63 0.41 0.78 0.45 1.42 0.82 1.04 0.72 0.88 1.12 Consumer Staples Ambev SA ADR British American Tobacco Malaysia Berhad CP All Public Co. Ltd. Kimberly-Clark de Mexico SAB de CV, Series A KT&G Corp. Magnit OJSC Sponsored GDR Natura Cosmeticos SA Oriflame Cosmetics SA SDR Shoprite Holdings, Ltd. Souza Cruz SA Tiger Brands, Ltd. 9.45 1.40 0.75 0.93 0.73 1.04 0.63 0.66 0.23 1.57 0.80 0.72 Energy China Shenhua Energy Co., Ltd., Class H CNOOC, Ltd. Eurasia Drilling Co., Ltd. GDR Gazprom OAO Sponsored ADR Lukoil OAO Sponsored ADR Oil & Gas Development Co., Ltd. Pacific Rubiales Energy Corp. Pakistan Petroleum, Ltd. PTT Exploration & Production Public Co. Ltd. YPF Sociedad Anonima Sponsored ADR 8.43 0.92 1.21 0.51 1.32 0.59 0.56 1.00 0.74 0.59 0.99 Financials Akbank TAS Axis Bank, Ltd. Banco do Brasil SA Bank of India BB Seguridade Participacoes SA China Construction Bank Corp., Class H Commercial International Bank Egypt SAE GDR Hanwha Life Insurance Co., Ltd. KB Financial Group, Inc. Nedbank Group, Ltd. OTP Bank PLC PT Bank Mandiri (Persero) Tbk Punjab National Bank Sanlam, Ltd. Sberbank of Russia Shinhan Financial Group Co., Ltd. Standard Bank Group, Ltd. Turkiye Is Bankasi AS, C Shares Industrials Bharat Heavy Electricals, Ltd. Bidvest Group, Ltd. CCR SA Koc Holding AS Localiza Rent a Car SA PT United Tractors Tbk Weichai Power Co., Ltd., Class H 28.04 0.97 1.88 3.13 0.07 2.11 3.61 1.16 1.50 1.64 0.89 0.96 1.63 1.73 0.76 1.37 2.27 0.85 1.51 6.19 0.87 0.87 0.88 1.37 0.71 0.75 0.75 See other side for more holdings and prospectus information Lazard Retirement Emerging Markets Equity Portfolio 4Q 2014 Holdings as of December 31, 2014 Sector Allocation (as a % of the Portfolio) – Continued Information Technology Baidu, Inc. Sponsored ADR Cielo SA HCL Technologies, Ltd. Hon Hai Precision Industry Co., Ltd. NetEase, Inc. Sponsored ADR Samsung Electronics Co., Ltd. SK Hynix, Inc. Taiwan Semiconductor Manufacturing Co., Ltd. Tata Consultancy Services, Ltd. Materials Alrosa AO Grupo Mexico SAB de CV, Series B Huabao International Holdings, Ltd. Jindal Steel & Power, Ltd. PPC, Ltd. PT Semen Indonesia (Persero) Tbk The Siam Cement Public Co. Ltd. Vale SA Sponsored ADR 19.58 2.04 2.26 0.73 0.92 2.42 3.40 1.66 3.90 2.25 5.60 0.78 0.69 0.99 0.09 0.66 0.79 0.94 0.65 Telecom Services China Mobile, Ltd. Sponsored ADR MegaFon OAO GDR Mobile TeleSystems OJSC Sponsored ADR Philippine Long Distance Telephone Co. Sponsored ADR PT Telekomunikasi Indonesia (Persero) Tbk Sponsored ADR Turkcell Iletisim Hizmetleri AS Vodacom Group, Ltd. 10.06 2.69 0.54 0.83 1.70 2.31 1.24 0.75 Utilities CEMIG SA Sponsored ADR 0.73 0.73 Cash & Equivalents 4.29 TOTAL 100.00 Published on January 21, 2015. Equity securities will fluctuate in price; the value of your investment will thus fluctuate, and this may result in a loss. Securities in certain non-domestic countries may be less liquid, more volatile, and less subject to governmental supervision than in one’s home market. The values of these securities may be affected by changes in currency rates, application of a country’s specific tax laws, changes in government administration, and economic and monetary policy. Emerging-market securities carry special risks, such as less developed or less efficient trading markets, a lack of company information, and differing auditing and legal standards. The securities markets of emerging-market countries can be extremely volatile; performance can also be influenced by political, social, and economic factors affecting companies in emerging-market countries. The Portfolio invests in stocks believed by Lazard to be undervalued, but that may not realize their perceived value for extended periods of time or may never realize their perceived value. The stocks in which the Portfolio invests may respond differently to market and other developments than other types of stocks. The securities mentioned are not necessarily held by Lazard for all client portfolios, and their mention should not be considered a recommendation or solicitation to purchase or sell these securities. It should not be assumed that any investment in these securities was, or will prove to be, profitable, or that the investment decisions we make in the future will be profitable or equal to the investment performance of securities referenced herein. There is no assurance that any securities referenced herein are currently held in the portfolio or that securities sold have not been repurchased. The securities mentioned may not represent the entire portfolio. Not a deposit. May lose value. Not guaranteed by any bank. Not FDIC insured. Not insured by any government agency. Please consider a fund’s investment objectives, risks, charges and expenses carefully before investing. For more complete information about the Lazard Retirement Series, Inc. and current performance, you may obtain a prospectus or summary prospectus by calling 800-823-6300 or going to www.LazardNet.com. Read the prospectus or summary prospectus carefully before you invest. The prospectus and summary prospectus contain investment objectives, risks, charges, expenses and other information about the Portfolio and Lazard Retirement Series that may not be detailed in this document. Lazard Retirement Series is distributed by Lazard Asset Management Securities LLC. Lazard Asset Management LLC • 30 Rockefeller Plaza • New York, NY 10112 • www.lazardnet.com MF12394

© Copyright 2026