Export-Import Bank of the United States Presentation

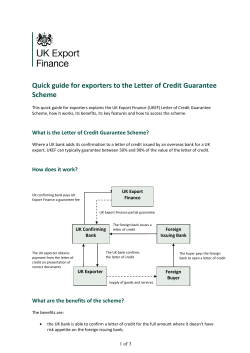

Orange County Business Council Economic Development Committee Meeting: What is Ex-Im Bank? The official Export Credit Agency (ECA) of the Government U.S. Self-sustaining and independent Established in 1934 Headquarters in D.C. Eleven regional offices with Export Finance Managers Mission: To create and sustain jobs by increasing U.S. export sales Export-Import Bank of the United States No Cost to Taxpayers $1.1 Billion returned to U.S. Treasury in 2013 Export-Import Bank of the United States Ex-Im Bank and the other Trade Agencies Work Together Commerce assists businesses in developing foreign contacts, market strategies, and customer solicitation SBA assists small businesses in developing the capacity to export and the business strategies SBA is the lead for financing working capital for small business exporters, particularly at the entry level. Ex-Im target for working capital finance: exporters with at least 3 years of experience and a year of exporting Ex-Im is the lead for insuring foreign receivables and financing foreign buyers for companies of all sizes Export-Import Bank of the United States 4 Ex-Im Bank Supports Small Business! 85% plus of Ex-Im transactions are for small businesses USA. Authorized $6B in 2012 to support U.S. small businesses. Record year in working capital guarantees, at $2.0 Billion for small business Authorized $3.2 B in trade credit insurance for small business Authorized $813 million loan guarantees and insurance to foreign buyers of capital goods and services from U.S. small business exporters. Export-Import Bank of the United States 5 Global Access: Public/Private Export Campaign Number of Small Business Exporters ▪ 27 million small businesses in the US ▪ 260,000 export (less than1%) ▪ 60% of these export to only one country National Export Initiative ▪ Double Exports from the US in five years (2009-2014) ▪ Exports: Smartest, best way to get the economy into high gear Ex-Im Bank’s Small Business Global Access Initiative ▪ $9.0B in authorizations and 5,000 customers per year by 2014 ▪ Up from $3.0B and 2,000 customers in 2008 ▪ Budget neutral: no increase in budget Export-Import Bank of the United States Support in Over 150 Countries 1. Brazil 2. Colombia 3. India 4. Indonesia 5. Mexico 6. Nigeria 7. South Africa 8. Turkey 9. Vietnam Export-Import Bank of the United States Ex-Im Bank bridges a gap with transactional finance ▪ Minimize risk ▪ Level the playing field ▪ Supplement commercial financing Export-Import Bank of the United States We Support a Variety of Industries ▪ Manufacturing ▪ Services ▪ Construction Equipment ▪ Renewable Energy ▪ Medical Equipment ▪ Agribusiness ▪ Mining ▪ Wholesale/Retail ▪ Power-generation ▪ Oil ▪ Aircraft and Avionics ▪ Mining Export-Import Bank of the United States Ex-Im Bank Financing Covers the Spectrum Pre-Export Financing Post-Export Financing Working Capital Guarantee Insurance Guarantees Direct Loans Export-Import Bank of the United States How Can Export Import Bank Products Assist You? NEED SOLUTION Funds to Fulfill Orders Working Capital Guarantee Extension of Credit Receivables Insurance Buyer Financing Medium- and Long-Term Insurance & Loan Guarantee Export-Import Bank of the United States Working Capital Guarantee ▪ Funds to pay for raw materials, labor, supplies, etc. ▪ 90% guarantee to lenders for export-related working capital lender loans ▪ Transaction specific or revolving loans ▪ No minimum or maximum amount rd ▪3 source of collateral to lender behind assets & A/R Export-Import Bank of the United States Working Capital Guarantee (cont.) Export-Import Bank of the United States Short-Term, Accounts Receivable Insurance Protects U.S. exporters against nonpayment by foreign buyers due to: – Commercial Risks – Political Risks Allows exporters to offer competitive credit terms to foreign buyers – Generally up to 180 days, some 360 day terms Provides additional financing Export-Import Bank of the United States Short-Term, Accounts Receivable Insurance (cont.) Single or Multi-buyer Policies Small Business Policy Export-Import Bank of the United States Foreign Buyer Financing (Customer Finance for U.S. Exporters) Used to finance foreign buyers purchasing U.S. capital equipment: ▪ 85% financed, 15% cash down payment ▪ Repayment up to 5 years, exceptionally 7 years Export-Import Bank of the United States Buyer Financing (cont.) Financing can be accomplished through the following Ex-Im products: ▪ Loan Guarantees ▪ Export Credit Insurance ▪ Direct Loans Export-Import Bank of the United States Public Policy (Charter) Restrictions ▪ Military Exports (exceptions apply) ▪ Foreign Content ▪ Restricted Countries (CLS) ▪ Economic Impact ▪ Shipping ▪ Additionality Export-Import Bank of the United States Military Policy No Defense Articles or Services, or Military buyers Three Exceptions ▪ Humanitarian purposes ▪ Drug interdiction ▪ Dual use items Export-Import Bank of the United States U.S. Content Policy—ST products ▪ For Short-Term products, the product must have at least 50.1% US content to support the entire transaction ▪ Products must be manufactured in and shipped from the U.S., if exporter is a large business. ▪ Products may be started in another country, if exporter is a small business, and adds 50.1% value to the final cost, and ships from U.S.A. Export-Import Bank of the United States Foreign Content Policy for MT and LT Financing Ex-Im Bank will support the following amounts: ▪ If contract has no more than 15% foreign content, we will support 85% of the contract price ▪ Otherwise, we will limit our support to the U.S. content ▪ Note: the contract value and foreign content must exclude amounts not shipped from the U.S. Export-Import Bank of the United States Restricted Countries ▪ We are open in all continents, with the exception of some countries ▪ Country restrictions for political or economic conditions and Default Issues ▪ Refer to the Country Limitation Schedule (CLS) www.exim.gov, under Country/Fee info Export-Import Bank of the United States Call Ex-Im, If You... …have a foreign buyer that wants credit terms… ….export routinely but your growth in foreign sales is limited because of risks of non-payment? …are losing export opportunities because you will only accept a L/C or cash pre-pay? ….can’t find a lender to finance your overseas purchase orders? … are encountering cash flow problems due to increased foreign sales? …couldn’t get your lender to confirm a L/C from your buyer’s bank? …have a buyer that needs several years to pay for capital equipment? Export-Import Bank of the United States Ex-Im Bank Partners Additional resources and assistance in applying for Ex-Im Bank products are available from: ▪ Insurance Brokers (see list on www.exim.gov) ▪ City / State Partners (see list on www.exim.gov) ▪ Delegated Lenders (see list on www.exim.gov) ▪ US Export Assistance Centers (USDOC and SBA) Export-Import Bank of the United States For Information and Assistance to Apply: CITY CONTACT TELEPHONE Atlanta Susan Kintanar 404-897-6082 Chicago Michael Howard 312-353-8081 Dallas Kelly Kemp 214-551-4959 Detroit John Toles 313-309-4158 Houston Patrick Crilley 281-721-0470 Southern California David Josephson 949-660-0726 Miami Sharyn Koenig 305-526-7436 x.17 Minneapolis Denis Griffin 612-348-1213 New York Tom Cummings 212-809-2652 San Francisco Jim Lucchesi 415-705-2285 Seattle John Brislin 206-728-2264 Export-Import Bank of the United States

© Copyright 2026