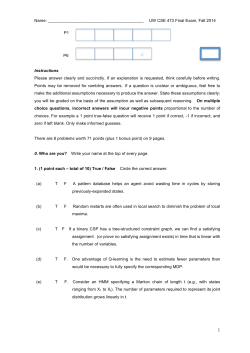

Lecture 6-Financial Functions and Excel Charts

Computer Science & Engineering 2111 Lecture 6 Financial Functions CSE 2111 Lecture 6-Financial Functions 1 Financial Functions • Functions that can be used to calculate values based on compounded interest – Taking a loan – Investing in a savings account CSE 2111 Lecture 6-Financial Functions 2 Simple Interest vs. Compound Interest • Simple interest always calculates interest based on the original amount. So $1,000 at 4% per year for 2 years • Year 1: $1000 * 4% $40 in interest for the 1st year. • Year 2: $1000 * 4% $40 in interest for the 2nd year. After 2 years you would have: $1,000 * 4% = $80 interest For a total of $1,080 CSE 2111 Lecture 6-Financial Functions 3 Simple Interest vs. Compound Interest • Compound interest always calculates interest based on the “latest amount”. So $1,000 at 4% per year for 2 years compounded Yearly • Year 1: $1,000 * 4% $40 in interest for the 1st year. • Year 2: $1,040 * 4% $41.60 in interest for the 2nd year. After 2 years you would have: $1,000 * 4% = $81.60 interest For a total of $1,081.60 Simple Vs. Compound Interest $1,000 after 2 Years at 4% $82.00 $81.50 $81.00 $80.50 $80.00 $79.50 $79.00 Simple Interest Compound Interest CSE 2111 Lecture 6-Financial Functions 4 Compounding Periods • • • • Compounded Yearly Compounded Quarterly Compounded Semi-Annually Compounded Monthly • The total amount of your financial transaction will be different based on when the interest is compounded. CSE 2111 Lecture 6-Financial Functions 5 Compounding Interest Quarterly What if we compound our 4% interest quarterly for the $1,000. This would be four separate calculations Quarter 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Principal $1,000 * 1% $1,010 * 1% $1,020.10 * 1% $1,030.301 * 1% Interest = $10.00 = $10.10 = $10.201 ≈ $10.30 CSE 2111 Lecture 6-Financial Functions 6 CSE 2111 Lecture 6-Financial Functions 7 Financial Functions • Present Value (PV) – What you get/pay at the beginning of the financial transaction • Future Value (FV) – What you are going to get OR what you will have to pay at the end of the financial transaction • Payment (PMT) – Payment made each period. It remains constant over life of annuity • RATE – Interest rate per period • NPER – Number of payment periods CSE 2111 Lecture 6-Financial Functions 8 Financial Functions-Syntax =PV(rate, nper, pmt, [fv], [type]) =FV(rate, nper, pmt, [pv], [type]) =PMT(rate, nper, pv, [fv], [type]) =RATE(nper, pmt, pv, [fv], [type], [guess])*Compounding Periods =NPER(rate, pmt, pv, [fv], [type]) / Compounding Periods CSE 2111 Lecture 6-Financial Functions 9 Arguments in Financial Functions Argument Description Argument Rules rate Interest rate per compounding period Always divide the rate by the number of compounding periods Rate/ # of compounding periods nper Number of compounding periods Always multiply the number of years by the compounding period # of compounding periods * # of years pmt Periodic payments to the initial sum Payment amount cannot vary pv Original value of financial transaction fv Value at the end of the financial transaction type Designates when payments are made 0: Payments are made at the end of the period 1: Payments are made at the beginning of the period (0 is the default and is implied) CSE 2111 Lecture 6-Financial Functions 10 Using Financial Functions Arguments • Use consistent signs – Outgoing cash ( - ) – Incoming cash ( + ) • For arguments that are zero, at least a comma must be put in the function to maintain the argument order, unless no other non-zero arguments follow. =PV(.03, 2, 0, 5000, 0) same as =PV(.03, 2, , 5000) CSE 2111 Lecture 6-Financial Functions 11 Write an excel formula in cell D2 to calculate the payment for a loan amount of $15,000 at 9% interest rate for a period of 5 years. Assume the loan is compounded monthly. =PMT(rate, nper, pv, [fv], [type]) ----Returns periodic payment =PMT(.09/12,5*12,15000,0,0) OR =PMT(.09/12,5*12,15000) CSE 2111 Lecture 6-Financial Functions 12 Write an excel formula in cell B2 to determine how many years it will take to save $12,000 if you put $10,000 into a savings account paying 4% annual interest compounded quarterly. =NPER(rate, pmt, pv, [fv], [type]) ----Returns # of Payment periods =NPER(.04/4,0,-10000,12000,0) /4 OR =NPER(.04/4,,-10000,12000)/4 Note: Divide the function by the number of compounding periods to calculate the number of years for the annuity CSE 2111 Lecture 6-Financial Functions 13 Write an excel formula in cell A2 to calculate the annual interest rate of a new Chevy Cruz. The cost of the car is $18,999, and you will put down $2,000. You will pay $350 per month for five years. The annual interest rate is compounded monthly. =RATE(nper, pmt, pv, [fv], [type]) ----Returns the rate per period =RATE(5*12,-350,16999,0,0)*12 OR =RATE(5*12,-350,16999)*12 Note: Multiply the function by the number of compounding periods to calculate the annual interest rate CSE 2111 Lecture 6-Financial Functions 14 Write an excel formula in cell E2 to determine how much money you would have to put into a CD now to have a $5,000 down payment on a car when you graduate in 2 years. The CD pays 3% annual interest rate compounded yearly. =PV(rate, nper, pmt, [fv], [type]) - Returns the present value of an investment =PV(.03,2,0,5000,0) OR =PV(.03,2,,5000) CSE 2111 Lecture 6-Financial Functions 15 Write an excel formula in cell F2 to determine the value of a CD in 2 years. You plan on an initial investment of $5,000 and you will add an additional $50 per month. The CD pays an annual interest rate of 3% compounded monthly. =FV(rate, nper, pmt, [pv], [type]) - Returns the future value of an investment =FV(.03/12,2*12,-50,-5000,0) OR =FV(.03/12,2*12,-50,-5000) CSE 2111 Lecture 6-Financial Functions 16 Write an Excel formula in cell G2 to calculate the monthly mortgage payment for a $100,000 home with a balloon payment of $10,000. The annual interest rate is 4% compounded monthly with a loan duration of 30 years. Note: A balloon payment is an amount due at the end of the loan and is indicated in the fv argument as a negative value . CSE 2111 Lecture 6-Financial Functions 17 Five years ago you won $75,000 on the game show, “I Wanna Win A lot of Money”! At that time, you invested the money in a CD that paid 6% per year compounded monthly. Write a formula in cell C9, to determine T/F if you have enough money to purchase a $100,000 house without financing. CSE 2111 Lecture 6-Financial Functions 18

© Copyright 2026