Communication campaign - Personnel costs and Other

Communication campaign Most common issues identified: Personnel costs & Other direct costs Antonio Requena Fernández FCH JU Financial Officer Personnel costs Personnel costs Hours dedicated to the project Hourly rate 2 Hourly rate Salary Social security Pension contribution Health insurance Other statutary costs… Hourly rate of an employee Totalannual annualcosts costs Total Totalannual annualcosts costs Total Total annual costs Annual productive hours 3 Hourly rate: Productive hours Standard (ALL employees) Actual (individual) Total days in a year 365 Weekends -104 Subtotal 261 Annual holidays -21 Statutory holidays -15 Illness & others -15 Productive days per year 210 You compute the actual individual number of productive hours for each employee The time recording system must allow keeping track of this number of actual individual productive hours If actual productive hours exceeds standard use actual!!! Don’t use billable hours!!! Working hours per day Productive hours per year 8 1 680 4 Overtime Overtime may be accepted If actually paid according to beneficiary’s policy AND If there is a system that allows the identification of normal / overtime hours worked for the project The hourly rate applicable to these «overtime» hours has to be calculated separately from the hourly rate applicable to the normal working hours In any other case: either overtime not paid or there is not clear distinction between normal and overtime hours The hourly rate is calculated: • Adding in the numerator: normal costs + «overtime» costs (if any) • Adding in the denominator: normal hours + «overtime» hours 5 Hourly rate: Productive hours Activities included Normal working activities of the personnel, including: Sales and Marketing Preparation of proposals Administrative time Non-project related, general research activities Teaching, training and similar hours (in the case of universities/similar bodies) Activities excluded General training (if not project related) General internal meetings (if not project related) 6 Hours dedicated to the project The golden rule: Claim ONLY actual hours worked on the project Timesheets Alternative evidence Whole duration of the project Must give the same level of assurance as the timesheets Full name of beneficiary Name and signature of employee To be assessed by the auditors Title of the project Daily, weekly or monthly basis Amount of hours claimed for the project Name and signature of a supervisor Reconcilable with the absences register 7 Example of timesheet Project Reference Name of Beneficiary Name of staff member Calendar Year Calendar Month Calendar Day Hours worked on this project * Hours worked on other projects** Hours worked on other projects** Hours worked on other projects** Hours worked on other projects** Hours worked on other projects** Other activities Total hours 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 Total 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 * In case of absence, indicate one of the reason codes below ** Indicate project reference Summary for this month Absences Weekend Sick leave Public holidays Annual holidays Other absence WE SL PH AH OA Reference to the WP Brief description of tasks Other activities 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Total hours 0.0 Hours worked on this project Hours worked on other projects* Hours worked on other projects* Hours worked on other projects* Hours worked on other projects* Hours worked on other projects* Date and signature of staff member Date and signature of Project Manager/ Coordinator/Responsible 8 Actual personnel costs. Some errors Personnel Personnel costs costs Hours Hours Annual costs Productive hours Timesheets not reliable Claim of more hours than dedicated to the project Claim of more hours than substantiated by timesheets 9 Actual personnel costs. Some errors Personnel Personnel costscosts Annual costs Hours Hours Productive hours Timesheets not reliable Claim of less hours than dedicated to the project Claim of less hours than substantiated by timesheets 10 Actual personnel costs. Some errors Personnel Personnel costs costs Annual costs Hours Productive hours Productive hours Use of standard hours instead of actual when the latter are higher Use of billable hours instead of productive hours 11 Average personnel costs Acceptability criteria for average personnel costs Based on the usual cost accounting practice of the beneficiary and consistently applied to their participations in the Framework Programme Based on the actual personnel costs of the beneficiary as registered in its statutory accounts, without estimated or budgeted elements They exclude any ineligible cost item and any cost claimed under other costs categories in order to avoid double funding Number of productive hours shall correspond to usual management practice of the beneficiary and reflects its actual working standards 12 SME owners SME owners and other natural person who do not receive a salary Hourly rate Annual living allowance corresponding to the appropriate research category published in the ‘People’ Work Programme of the year of the publication of the call to which the proposal has been submitted Country correction factor published in the same document 1 575 100 13 SME owners Example: SME owner without salary from Austria with 5 years of experience at the time of deadline of submission of a proposal 2011 Use the tool available at CORDIS 39.71 €/h 58 500 €/year 106.9 1 575 100 14 Other direct costs The golden rule: Costs attributed directly to the project which can be identified as such according to the accounting principls of the beneficiary Travel costs • Only for staff taking part in the project • In case of conferences/seminars: copy of the presentations to show direct link to the project • Expenses related to daily commute to work are not considered travel costs. Consumables and supplies • If they are necessary for the implementation of the project • Subject to the accounting principles of the beneficiary, the following consumables/supplies can be considered either direct or indirect costs: • Water, heating, electricity, maintenance, insurance • Communication expenses, postal charges, office supplies • Costs related to general administration and management • Miscellaneous recurring consumables 15 Other direct costs The golden rule: Costs attributed directly to the project which can be identified as such according to the accounting principls of the beneficiary Minor tasks • Minor services not identifed in Annex I but needed for the implementation of the project • Examples: • Organisation of the rooms and catering for a meeting (logistic support) • Printing of material, leaflets, etc. • Services related to setting up and maintenance of a project website • To be reported under type of activity “Management”, category of costs “Subcontracting” 16 Other direct costs The golden rule: Costs attributed directly to the project which can be identified as such according to the accounting principls of the beneficiary Equipment • If necessary for the implementation of the project • Costs to be determined according to the beneficiary’s usual accounting practice • Possibility of charge 100% equipment acquisition price in 1 reporting period if national legislation allows it • Otherwise, depreciation to be charged in each relevant periodic report • Consider percentage of use in the project • Depreciation costs for equipment bought before the start of the project • Yes, if the equipment has not yet been fully depreciated , then the remaining depreciation can be eligible under the project • Subject to the accounting principles of the beneficiary, computers and office software can be considered either direct or indirect costs 17

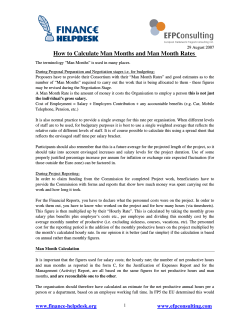

© Copyright 2026