Qatar Re grows its January renewals portfolio by 25% to US$ 432

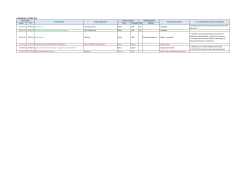

Press Release Qatar Re grows its January renewals portfolio by 25% to US$ 432 million Expected profitability remains largely unchanged Doha, 29 January 2015 – Qatar Re today announced that it expects to write approximately US$ 432 million of property, casualty and specialty lines premiums from the January 1 renewals. On a constant foreign exchange basis, this volume represents an increase of 25% from the 2014 expiring renewable base of business of US$ 344 million. For the full year 2015, Qatar Re expects to maintain momentum for further growth on the back of improved geographical and product diversification. Qatar Re renews roughly 55% of its total portfolio in January. Gunther Saacke, Qatar Re’s Chief Executive Officer, commented: “We are pleased with the January renewals. Qatar Re remains on track to building a strong global reinsurance franchise. To the largest possible extent, we have weathered the severe headwinds from a rapidly deteriorating global reinsurance market environment. Our active cycle management, in combination with in-depth technical know-how and specialty lines expertise, has enabled us to grow the book without compromising on overall technical profitability.” During the year-end renewals Qatar Re continued to build its portfolio in a global reinsurance market which is still characterized by declining rates and weakening terms and conditions. The Company successfully grew existing client relationships and established new ones, further expanding in still attractive segments such as US catastrophe reinsurance, while cancelling the most rapidly deteriorating pieces of business (about 15% of the total renewal base). Qatar Re’s renewed portfolio displays an almost unchanged technical ratio and even a marginally positive price change year-over-year, owing to active portfolio rebalancing. The Company’s 2014 year-end portfolio consists of 32% casualty including motor pro rata and excess of loss business, 31% specialty, 21% property (incl. engineering, energy and catastrophe) and 16% Lloyd’s quota share business. The main change in the renewed portfolio affects the Lloyd’s segment which was cut back by about one third to US$ 65 million due to declining return expectations. This reduction was more than offset by strong growth in more attractive catastrophe and specialty lines of business. The motor segment, on average, displayed unchanged price levels and grew to US$ 132 million. The property business, where rating pressures were most pronounced, expanded only marginally. Qatar Re also recorded strong renewal results in its important agriculture line of business which accounts for more than a fifth of the renewed book (US$ 95 million). The portfolio grew by more than 40%, driven by US crop covers including lead participations on tailormade programmes. The marine & aviation business saw typical rate reductions of 0-5% over all sub-lines (including offshore energy and aerospace), making it one of the more stable specialist classes. The renewed marine & aviation portfolio amounts to US$ 49 million. Going forward, Gunther Saacke explained: “We expect to generate further profitable growth over the remainder of the year. Particular momentum is arising from project based opportunities and structured solutions, from our improved access to and traction in the European markets and from our expanded, globally operating facultative practice.” The following chart summarises the dynamics of Qatar Re’s January 1 renewals (in US$ million): 500,00 450,00 400,00 350,00 300,00 250,00 200,00 150,00 100,00 50,00 - * Excludes capacity underwriting of selected Lloyd's Syndicates -2- About Qatar Re Established in 2009, Qatar Reinsurance Company LLC (Qatar Re) is the reinsurance arm of Qatar Insurance Company (QIC), the largest composite insurer in the Middle East region. QIC is the ultimate parent company of Qatar Re and is headquartered in Doha, Qatar. Qatar Re is also headquartered in Doha, with branch offices in Zurich and Bermuda as well as a representative office in London. The company is authorized and regulated by the Qatar Financial Centre Regulatory Authority (QFCRA). Qatar Re is backed by a full parental guarantee by QIC, which was capitalized at US$ 1.6 billion as of September 30, 2014, with a market capitalization of US$ 4.0 billion as of December 31, 2014. Qatar Re is rated “A/Stable” by Standard and Poor’s and A (Excellent) by A. M. Best and benefits from QIC’s strong and growing capital base. Qatar Re writes all major property, casualty and specialty lines of business. For further information on Qatar Re please visit www.qatarreinsurance.com. About Qatar Insurance Company Qatar Insurance Company (QIC) is a publicly listed composite insurer with a consistent performance history of 50 years and an underwriting footprint across the Middle East, Africa and Asia. Founded in 1964, QIC was the first domestic insurance company in the State of Qatar. Today, QIC is the market leader in Qatar and a dominant insurer in the GCC and MENA region. QIC is one of the highest rated insurers in the Gulf region with a rating of “A/Stable” from Standard & Poor’s and “A/Excellent” by A.M. Best. In terms of profitability and market capitalization, QIC is also the largest insurance company in the MENA region. It is listed on the Qatar Exchange, with a market capitalization of US$ 4.0 billion as of December 31, 2014. For further information on QIC, please visit www.qatarinsurance.com. Contact Dr. Schanz, Alms & Company AG Henner Alms, P: +41 44 256 1082, E: [email protected] Kai-Uwe Schanz, P: +41 44 256 1081, E: [email protected] -3-

© Copyright 2026