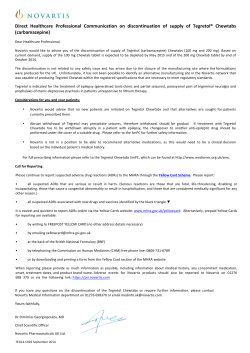

Novartis 20