KGAL sells office building in Chicago at 30 % above market value

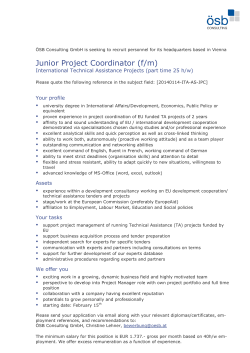

PRESS RELEASE KGAL sells office building in Chicago at 30 % above market value Grünwald, 05.02.2015 – An office building in Chicago’s central business district was sold to an American investor in mid-January 2015. Ahead of schedule, KGAL and UBS Real Estate GmbH succeed in selling an office building in Chicago´s central business district to an American investor. KGAL’s retail fund KAMAU GmbH & Co. KG held 44.9 % of the property. The realised selling price included a 30 % premium on the most recent market valuation. KGAL and UBS Real Estate GmbH were able to take advantage of the favourable market conditions for the sale of the office building at 515 North State Street in Chicago, which had been acquired in 2004. The agreed selling price of just under USD 140 million exceeded the most recent market valuation (determined in 2014) by 30 %. Both companies, the KGAL Group and UBS Real Estate GmbH, each held 44.9 % of the property through funds. 2 Constructed in 1990, the building consists of around 58,000 m of office space. As a result of continuous modernisation efforts on the building and its technology, the property was awarded the Gold LEED certificate in 2012. “We are delighted that we, together with our partner UBS Real Estate, have been able to benefit from the current positive market environment for the sale of this property,” said André Zücker, Head of Real Estate at KGAL. Initial estimations indicate that this successful sale will result in overall distributions of approx. 150 % (with regards to invested capital) to the investors of the KAMAU KG retail fund. Approx. 1,570 characters (including spaces) Enclosed please find digital photo material for this press release. Please add “KGAL/Steinkamp/Bellog Photography, Chicago” as the image source when used. KGAL GmbH & Co. KG, a German based asset- and investment manager, with registered offices in Grünwald near Munich (Germany) has been initiating and managing long-term real capital investments with sustainable and stable yields for more than 47 years. The company's portfolio of services comprises the design and management of funds for institutional investors. The quality of KGAL products in the main asset categories of real estate, aviation and infrastructure is based on the experience of its in-house experts. As of December 31st 2014, the KGAL Group manages an investment volume of EUR 22.3 billion. KGAL currently manages capital for 102,000 investors (incl. multiple subscriptions) with equity investments in a total of 129 active limited partnership funds. Investors have entrusted EUR 6.8 billion in equity capital to KGAL for these funds. The KGAL Group has 322 employees (as of 31.12.2014). KGAL GMBH & Co. KG Andrea Fusenig Head of Marketing & Communications Tölzer Str. 15 82031 Grünwald Germany T 089 64143-533 F 089 64143-150 [email protected] www.kgal.de www.kgal-group.com

© Copyright 2026