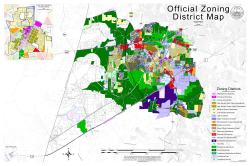

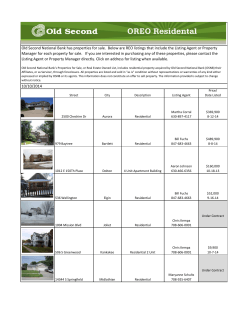

Residential