2HELP1 POLICY TERMS AND CONDITIONS Below

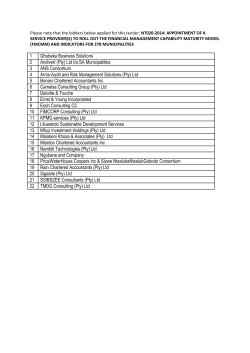

2HELP1 POLICY TERMS AND CONDITIONS Below mentioned is a schedule of the more important terms and conditions applicable to the 2Help1 Underwriting Managers Policy as entered into between 2Help1 Underwriting Managers (Pty) Ltd, hereinafter the "Company" and the “Client". 1. The 2Help1 Underwriting Managers Policy between the Company and the Client is automatically renewed monthly with an annual review of the 2Help1 Underwriting Managers Policy and provided that the premium payable by the Client to the Company is received on policy’s due debit date for the month in question. The Client will not be covered for any month in which the premium for that month has not been received by the Company. 2. The Company acts as an agent for the Service Provider. Accordingly, any reference to the service provided by the Company at all times refers to the Company acting as an agent for the Service Providers and at all times only the Service Provider and not the Company, shall be liable for the particular service to the client and it is an express term of the agreement that under no circumstances whatsoever will the Company accepts any liability of whatsoever nature for the non-delivery or delay in delivery of poor or bad service in respect of the particular service provided by the Service Provider. 3. The Company in its own discretion is entitled to substitute one Service provider for another upon giving the client 30 days written notice to such effect. 4. The Client shall be entitled to cancel the 2Help1 Policy by giving 2Help1Underwriting Managers (Pty) Ltd one calendar month written notice by sms of such intention. 5. An annual administration fee will be debited against your account on the anniversary of the policy. 6. 2Help1 hereby confirms that we will flag all your personal information with all the relevant credit institution. 7. 2Help1 will not be liable, if and when incorrect and or false information is provided by the client The following definitions will assist you in understanding the policy terms and conditions. “Annual Period Aggregate Limit” Annual Period Aggregate limit shall mean the total maximum amount that we will pay for all the claims that have or may arise in anyone annual12 month period of insurance regardless of the number of claims.SeeClause23 for example. “Underwriter” The Underwriter shall mean the organization that will provide the policy and claims services in the event of a claim or eventfor which you require advice or legal expense. “Insured Person” The Insured is you as named in the Policy Application Form/Schedule/Voice Recording. “Legal practitioner” A Legal Advisor shall also mean a legal practitioner or other qualified person, firm or company appointed by us to act on your behalf or any other person appointed by us who has the qualifications required to manage your matter/case or proceedings. “One Event Limit of Indemnity” This One Event Limit of Indemnity stated in the Policy Schedule shall mean the maximum amount that we will pay for one event or claim and we will not pay more than the Annual Period Aggregate Limit in any one annual 12 month Period of Insurance .See clause23.3. “Proceedings” Proceedings shall mean the pursuit or defence of a civil related action from an Insured Event arising within the Republic of South Africa. “Forum” Forum shall mean a Court of Law Magistrate’s Court or High Court or any other Forum approved by us in writing. “Third Party” Third Party shall mean the opposing party in the Proceedings. “Period of Insurance” The Period of Insurance shall mean the period starting from the Inception Date for periods of one month for each month that the premium is paid. The Premium is payable monthly or annually as setout inClause5. “Claim” Claimshallmeananeventwhichaffectsyouintermsofthispolicyandforwhichyouhavearighttobecompensatedas clause3. per “Inception Date” Inception Date shall mean the date on which the insurance starts which is 90 days after the date of 1stsuccessful premiumcollection. “Condition” Condition is a specific term, statement or expression contained in this policy which you must comply with at all times during the Period of Insurance. “Exclusion” Exclusion shall mean an event, circumstance or condition which is not insured and for which no cover is provided in terms of this policy as set out in clause22. “ExcessAmount” The Excess Amount payable shall mean the amount stated in the Policy Schedule which you must pay for each and everyClaim that you refer to us for Legal Expense or Legal Advice and or disbursement amount requested as per clause22. “Insured Event” The Insured Event shall mean the first circumstance or first situation which gives rise to a Matter, Case or Proceeding that Originates specifically from someone obtaining your name, address, credit card number or other personal information and Utilizes this to open accounts, chargepurchasesorrunupbillsbypretendingtheyareyou.Theydon’tpaythebills, leaving you with the unpaid amounts and with collection agencies calling you, resulting in a ruined credit rating. “Current Matter/Case or Proceedings” The matter case or proceedings shall mean the dispute which you have referred to us for legal advice and assistance. “New Matter” An occurrence that originated after the 90 day waiting period. “Policy Schedule” The Policy Schedule shall mean the document that sets out the premium payable, the limits of indemnity and other details of the Policy of which you must be aware. It is an important document and must be kept in a safe place. “Waiting Period” The Waiting Period shall mean 90 days from the Inception Date excluding all telephonic legal advice. “We/Our/Us” We/Our/Us shall mean GENRIC Insurance Company Limited registration no94/03920/06, the Insurer. “You/Your” You / Your shall mean the Insured person named in the Policy Schedule. 1. Who are the Parties to this agreement? The parties are: 1.1 The Insurer, who is GENRIC Insurance Company Limited registration number 2005/037828/06 are glistered insurance company incorporated in South Africa and an Authorised FinancialServicesProviderlicencenumber43638. Postal Address: P.O. Box 1115, Bromhof, 2154. 1.2 The Underwriting Managing Agent(UMA),whoisCommunityLegalClinic(Pty)Ltdregistrationnumber2002/004018/07aregistered company incorporate in South Africa and an Authorised Financial Services Provider license number 39887. Postal Address: P.O. Box 6040, Tygervalley, 7536, has writtenauthorization from Genric to: 1.2.1 issue your Policy, 1.2.2 offerlegal advice and mediation services, and to 1.2.3 Appointa legal advisor who will manage your claim on your behalf and who will assist you with legal assistance as required. 1.3 ThemandatedIntermediaryis………………………………….(Pty)Ltdregistrationnumber…………………………………….aregisteredcompanyincorporatedin Africa and an Authorised Financial Services Provider license number………………………. Postal Address:…………………………………………………………. 1.4 You, the Insured. 3. What Insured Events do we cover? The insured events covered by us are: South 3.1 Legal Advice and Mediation for new matters. 3.2 Claims in respect of Legal Expenses only for matters as perclause3.3 that incurred after the 90 day waiting period. 3.3 Yourlegalexpenseswhicharisefromanyofthesituationsorcircumstanceslistedbelowandwhichleadstoadispute.Thelegalexpensesarethereasonable costs you have incurred read in conjunction with clause 22 for: 3.3.1 Instituting or defending a civil matter to claim damages from a third party as a result of unlawful usage of your personal details; 3.3.2 Defending a civil matter wherein a collection Agency institutes action against you for unpaid bills wherein your identity was used to make purchases or to run up bills and incur debt; 3.3.3 Legal Costs involved in restoring or repairing of your ruined Credit Rating(CR)as a result of Identity Theft; 3.3.4 Legal Costs related to a Rescission of Judgment. 23. What is the meaning of “Limit of Indemnity?” 23.1 We will not be liable to pay more than the Limit of Indemnity as specified in the Schedule of Insurance in respect of any insured one event giving rise to a claim. 23.2 However the aggregate amount of claims in one period of insurance (one year from inception of the cover), cannot exceed R100,000 e.g. Should you have 6 claims in anyone year of insurance and this equates to or be equal to the annual aggregate amount of R100,000,the limit of liability will be reached, whereby the overall annual aggregate limit will be depleted and no more claims can be instituted for that same year of insurance. 23.3 For the primary insured the One Event Limit of Indemnity means that for any one case of representation, attorney fees to the maximum amount of R20,000or any lesser amount as per panel attorneys’ statement of account is payable. 24. Claims Notification Every claim should be delivered to Community Legal Clinic (Pty) Ltd at the following address: P.O. Box 6040, Tygervalley, 7536 Tel:086-1101-622 The Insurer will at all times have the right to inspect all documentation relating to the policy and will communicate to the Insured any problems regarding the documentation 25. How to report a claim and when to do so; A claim with regards to an Identity Theft occurrence shall be deemed to have occurred after it came to the policyholder’s attention that his identity has been violated by means of monetary loss. On the happening of this event ,which may result in a claim in terms of this policy the Insured shall, at his/her own expense: 25.1 Submit to Community Legal Clinic (Pty)Ltd at its physical address full details in writing of any claim, as soon as reasonably possible up to a maximum of 24 hours of the event giving rise to a claim; 25.2 Furnish the Insurer with such proof, information, sworn declarations/affidavits, and/or documentation of whatsoever nature, which the Insurer may require to process the claim; 25.3 Please note that only original documentation will be accepted, copies of documentation need to be certified and fax copies are not acceptable. At any stage, the Insurer may require additional information to process the claim. 26. Complaints Procedure for the Insured’s Benefit; We undertake to settle all valid claims as quickly as possible. However, it is in the public’s interest to verify the validity of any claims and to investigate the appropriate aspects thereof. As such there may be instances where a delay could occur .If you have any complaints about this policy or you are In any way unhappy with the service you have received, please ask to speak to the manager of that particular department. If the matter cannot be resolved this way, then please contact:The Compliance Officer–Policies Moonstone Tel: 021-883-8000 DISCLOSURE NOTICETOSHORT-TERMPERSONALLINESINSURANCEPOLICYHOLDERSIMPORTANT–PLEASE READCAREFULLY DISCLOSUREANDOTHERLEGALREQUIREMENTS (Thisnoticedoesnotformpartof theinsurancecontract or anyotherdocument) Asa short-termcommercial insurance policyholder,orprospectivepolicyholder,youhavetheright to thefollowinginformation: DISCLOSURENOTICE INFORMATI0N 1. ABOUTYOURFINANCIALSERVICEPROVIDER (BROKER) a) Name,company registrationno.,FSPlicenseno.address,contact detailsof yourbroker b) Detailsof thelegal/ contractualstatus of yourbroker,tomake it clear toyouaboutwhoacceptsresponsibility for the actionsof your broker inthe renderingoffinancial service. c) Confirmation thatyour broker hasa standardagency contractwith theProductSupplierfreefromanyimposed restrictions,and confirmationofwhether yourbrokerhassuch contractswithany otherProductSuppliers d) Confirmationaboutwhether your broker ispermittedto receive /handlepremiums onbehalf oftheProductSupplier e) Where applicable,whether yourbroker holdsmore than10% ofthe ProductSupplier’sshares or equivalent financial interest in the ProductSupplier,ormorethan30% of your broker’stotal remunerationwas receivedfromthe ProductSupplierover the previoustwelvemonths f) Randamount of feesand commissionpayable orthe basisof calculation e.g. 12.5%on Motor and20% on Non-motor g) Detailsof yourbroker’s compliancedepartment h) Detailsof thefinancial serviceswhichyour broker isauthorised to provide interms oftheirFAISlicence i) Whether your broker has professional indemnity insurance j) Whethera representative ofyour broker isrenderingservices under supervisionas definedin theDeterminationofFit&Proper Requirements. k) Whether your brokeris exempt fromanymatter coveredby theAct ………………………………………………………………………………..(PTY)LTD Address………………………………………………………………………………………………….. Company Registration No: elephone: Fax: Fax Number: E-mail: FSPNo: ………………………………………………..T …………………………………………….. ……………………………………………… ……………………………………………….. …………………………………… ………………………………………………… (Pty)Ltd isan authorisedfinancial services providerandmay render intermediary servicesandprovide advice. ……………………………… (Pty) Ltdacceptsresponsibility forthe professional activitiesof their representativesinsofar as theyactwithin thescopeof their contracts. We havea writtenmandatewithan insurer andwillonlypresentterms toyou wherewe have suchan agreement interms ofShortTermPersonal and Commercial Lines. The Brokerisnot permittedto receive/handle premiums onbehalfof the ProductSupplier. No sharesareheld inthe product supplier. More than30% of thebrokers’ remunerationwas receivedfromthe Product supplier overthe previous12 months. The broker earns………………………..% commission of the total premium. Compliance Officer:………………………………………………………………………………… Address:…………………………………………………………………………………………………. Telephone:……………………………………………………………………………………………… E-mail:………………………………………………..…………………………………………………… For our complaintsprocedure callouroffice formoredetails. Categories ofInsurance: Short TermCommercial andPersonalLines …………………………………………… (Pty) LtdhasProfessionalIndemnity insurance of R1mandnoFidelity Guarantee insurance due tono collection ofpremiums. …………………………………………………………… rendersservicesunder supervision. 2Help1 Underwriting Managers (PTY) LTD 2. ABOUTTHEPRODUCTSUPPLIER(UMA) (a) (b) (c) (d) (e) 99 Jip de Jager Street, The Vineyards office Estate,1st Floor Pinotage House ,Bellville,7530 P.O. Box 7304,Welgemoed,7536 Name,address,contact details Detailsof thelegal/ contractualstatus of theUMA Detailsof theCompliancedepartment of theUMA/ Insurer Type of policy involved TheUMA hasprofessionalindemnityinsurance Company Registration No: Telephone: Fax: Fax Number: E-mail: FSPNo: 1970/001776/07 086-1243-571 086-6275-213 [email protected] 44850 2help1Underwriting Managers (Pty) Ltd is an authorised financial services provider. 2help1 Underwriting Managers (Pty) Ltd has a Binder Agreement with GENRIC Insurance Company Ltd to perform binder functions on their behalf and is paid a binder fee of 50% of the total premium. Compliance Officer: MoonstoneCompliance Mrs A Daneel Telephone: 021-883-8000 E-mai: [email protected] For our claimsprocedure contactsouroffice. Categories ofInsurance: Short TermCommercial andPersonalLines 2help1 Underwriting Managers (Pty) Ltd has Professional Indemnity insurance ofR1m and no Fidelity Guarantee insurance due to no collection of premiums. The function of the Compliance Officer is to ensure that legislative requirements are met, in particular those related to disclosure as described in the Policy Holder Protection Rules, and to facilitate the resolution of disputes arising between the parties involved in the insurance contract. Service complaints will be forwarded to senior management for further attention. If your enquiry or your dispute is not satisfactory resolved, you may contact: The Ombudsman for Short Terms Insurance The Financial Services Board PO Box 35655 PO Box 35655 BRAAMFONTEIN MENLOPARK 2017 0102 Tel:(011) 726 8900 Fax(011) 726 5501 Fax No.(012) 347 0221

© Copyright 2026