Brazos County

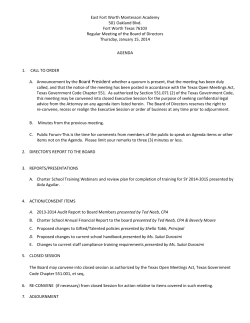

DELINQUENT TAX SALE THE COUNTY OF BRAZOS, TEXAS BRAZOS COUNTY, TEXAS March 3, 2015 at 10:00 AM Atrium of the Administration Building GENERAL INFORMATION REGARDING THE TAX SALE You must READ THE FOLLOWING IMPORTANT INFORMATION regarding the property to be offered for sale. 1. Prior to the beginning of the tax sale, a person intending to bid is required to register with the person conducting the sale and present a valid Driver’s License or identification card issued by a State agency or the United States government. 2. The property will be sold at public auction and will be sold for cash to the highest bidder, based on oral bids. Successful bidders must pay for their property with cash or a cashier’s check payable to _________________________________. Any bidder who fails to make payment shall be held liable for twenty percent of the value of the property plus costs incurred as a result of the bidder’s default pursuant to Rule 652 of the Texas Rules of Civil Procedure. 3. The amount of the opening bid is set out below each tract, and the bidding must start at that figure or higher, and sums less than the given figure cannot be accepted. The minimum bid amount includes taxes which were delinquent at the date of judgment. This does not include the current tax year. Purchasers will be required to pay all taxes which accrued subsequent to the date of judgment. 4. Purchasers at this tax foreclosure sale will receive an ordinary type of Sheriff’s Deed which is without warranty, express or implied. Title to property is NOT guaranteed. A policy of title insurance may be difficult to obtain. 5. All property purchased at this sale is subject to a statutory right of redemption. This redemption period commences to run from the date the purchaser’s deed is filed for record in the County Clerk’s office. Purchasers have the right of possession during the redemption period. There is a two year right of redemption for homestead property and property appraised as agricultural land. There is a 180 day right of redemption for all other property. 6. Anyone having an ownership interest in the property at the time of the sale may redeem the property from the purchaser during the redemption period. The redemption price is set by the Texas Tax Code as follows: purchase amount, deed recording fee, taxes paid by purchaser after the tax sale, and costs expended on the property, plus a redemption premium of 25 percent of the aggregate total during the first year or 50 percent of the aggregate total during the second year. “Costs” are defined as the amount reasonably spent by the purchaser for the maintenance, preservation and safekeeping of the property as provided by Section 34.21 (g) of the TEXAS TAX CODE. 7. Property is sold by legal description. Bidders must satisfy themselves concerning the location and condition of the property on the ground, including the existence of improvements on the property, prior to this tax sale. Property is sold “AS IS” with all faults. All sales are final. There are no refunds. Deeds, maps and plats of the properties are in the County Clerk’s office or the Appraisal District. Lawsuit files on which this sale is based are in the office of the District Clerk. The approximate property address reflected on the bid sheet is the address on the tax records and may not be accurate. 8. Property purchased at this tax sale may be subject to liens for demolition, mowing, or maintenance fees due to the City or Property Owners Association in which the property is located. If you have any questions, please contact our office in Bryan at (979) 775-1888. PROPERTIES TO BE SOLD ON MARCH 3, 2015: TRACT SUIT # STYLE 1. 11-000130-CV272 County of Brazos v Ashby Road Investments, Incorporated FKA Rutherford Partners, Incorporated 2. 12-003333-CV-85 The County of Brazos, Texas v James A. Curry et al 3. 13-002875-CV272 The County of Brazos, Texas v Leslie James Denton 4. 14-000032-CV272 The County of Brazos, Texas v Mary Frances Owen Phelps et al 5. 14-000286-CV-85 The County of Brazos, Texas v James Brunson et al 6. 14-000798-CV272 The County of Brazos, Texas v Curtis W. Webb, Sr. 7. 14-000908-CV-85 The County of Brazos, Texas v Ronnie Watson et al 8. 14-001024-CV361 The County of Brazos, Texas v Teresa Mechelle Schubert Mikulec 9. 14-001062-CV272 The County of Brazos, Texas v Bobby Washington et al 10. 14-001850-CV272 The County of Brazos, Texas v Johnie L. Gooden et al 11. 14-001967-CV361 The County of Brazos, Texas v Saul Perez et al 12. 14-002135-CV272 The County of Brazos, Texas v Blue Marlin Texas 1, LLC et al PROPERTY DESCRIPTION, APPROXIMATE ADDRESS, ACCT # Lot 2, Block 1, Sims Addition to the City of Bryan, Brazos County, Texas (Volume 304, Page 659 of the Deed Records, Brazos County, Texas), 308 Emmett St. Account #000000041574 Judgment Through Tax Year: 2013 Lot 18, Block 9, Castle Heights Addition, City of Bryan, Brazos County, Texas and a manufactured home, Serial # F-42C10DRH (Volume 491, Page 699, Deed Records, Brazos County, Texas), Tisdale Street Account #000000021423 Judgment Through Tax Year: 2013 Lot 3, Christy Addition, City of College Station, Brazos County, Texas (Volume 7869, Page 189, Deed Records, Brazos County, Texas), 701 Gilchrist Ave Account #000000021971 Judgment Through Tax Year: 2013 13.45 acres, more or less, being part of Lot 1, Block 1, Tabor Meadows Subdivision, Brazos County, Texas (Volume 3385, Page 210, Deed Records, Brazos County, Texas), Wheelock Hall Road, Account #000000300827 Richard Carter Survey, Tract 5.6, Abstract 8 aka Lot 23, Block 1, City of Bryan, Brazos County, Texas (Volume 1236, Page 635, Deed Records, Brazos County, Texas), 3508 East 29th Street, Bryan, Texas Account #000000038988 Judgment Through Tax Year: 2013 Lot 24, Legion Addition, City of Bryan, Brazos County, Texas (Volume 995, Page 768, Deed Records, Brazos County, Texas), 306 Waco Street Account #000000031394 Judgment Through Tax Year: 2013 3.1' of Lot 8 and Lot 9, less 1.1', Block C, College Vista Addition, City of College Station, Brazos County, Texas (Volume 9323, Page 213, Deed Records, Brazos County, Texas), 307 Live Oak Account #000000024217 Judgment Through Tax Year: 2013 1.185 acre, more or less, being Lot 10, Willow Bend, Brazos County, Texas and a manufactured home Serial # 1PTX8648ATX, Label #NTA0983029 (Volume 10597, Page 196, Deed Records, Brazos County, Texas), 6044 Serenity Circle Account #000000101987 Judgment Through Tax Year: 2013 Lot 8, Block 8, Lopez Addition to the City of Bryan, Brazos County, Texas (Volume 3552, Page 197, Deed Records, Brazos County, Texas), 1505 Fig Street Account #000000031742 Judgment Through Tax Year: 2013 All of Lots 14 & 15, Brogdon Sub of House, City of Bryan, Brazos County, Texas (Volume 6570, Page 65, Deed Records, Brazos County, Texas), 1121 Rollins Avenue Account #000000019965 Judgment Through Tax Year: 2013 A manufactured home only, Serial #TXFL784A23057RC31, Label #PFS1009600, Brazos County, Texas, 2102 Stone View (PVT) Court Account #000000350112 Judgment Through Tax Year: 2013 Lot 10R, Bittle Addition, City of Bryan, Brazos County, Texas (Volume 6554, Page 34, Deed Records, Brazos County, Texas), 1809 Groesbeck Street Account #000000109960 Judgment Through Tax Year: 2013 MIN BID $5,100 $3,400 $14,000 $6,700 $11,400 $3,850 WITHDRAWN $4,700 $3,000 $3,200 WITHDRAWN $12,400

© Copyright 2026