ITIC Special Edition Bulletin: 11th Annual Asia

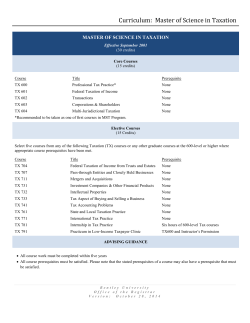

ITIC Bulletin International Tax and Investment Center February 2015 Special Edition 11th Annual Asia-Pacific Tax Forum 1-3 October 2014 Hanoi, Vietnam Summary Report by Hafiz Choudhury, Senior Advisor, ITIC Overview The 11th Asia-Pacific Tax Forum, hosted by the Ministry of Finance of Vietnam, was held in Hanoi on 1-3 October 2014. Over 80 delegates from the Asia-Pacific region, with senior government officials leading many of the delegations, participated. The Forum has been annually organized by ITIC since 2005 to bring together multiple stakeholders in the AsiaPacific region. While the initial focus was on excises, APTF has gradually taken on a more ambitious technical agenda, covering a range of indirect taxes, international direct tax issues (e.g., transfer pricing and the taxation of services) and natural resources taxation. The Hanoi meeting took this process further, and featured a technical program that covered extensive discussion on the Action Plan on Base Erosion and Profit Shifting (BEPS), VAT/GST on services, and coordination of tax regimes in regional economic groupings. Consequently, this report summarizes the Forum proceedings in a thematic approach, grouping subjects covered by the appropriate theme. The Hanoi program reflected the work of the APTF Steering Committee (comprising of government officials, academics and ITIC personnel), who work together during the year to determine an ongoing program of research topics. The annual meeting is used to report on ongoing projects, launch new research projects, and function as an international tax conference. As public sector officials take a more active involvement in the Forum, the technical focus has moved towards direct tax issues, fiscal policy in a more integrated global economy and VAT. We would like to thank our hosts at the Ministry of Finance of Vietnam, especially Mr. Nguyen Ba Toan (Deputy Director-General, International Cooperation Department) and Ms. Nguyen Thanh Huyen, along with other colleagues who played an enormous part in organizing the meeting. 2015 Asia-Pacific Tax Forum The 2015 Asia-Pacific Tax Forum will be held in New Delhi, India, on 5-7 May 2015. More information on the 2015 meeting is available on ITIC’s website. Registration for the 2015 APTF meeting will open on 20 February. Please contact Brian Mandel for further information. Formal Events and Peer Interaction The Forum is essentially driven by the needs of the member countries, and the annual meeting starts with a Public Sector Roundtable. This roundtable allows public sector participants to voice their areas of concern and provide inputs for future research. The roundtable is restricted to government representatives only, so that government officials can privately discuss their questions and concerns on tax policy and administration. It also provides a private forum for officials to interact with their peers from other countries and exchange experiences. ITIC Bulletin ♦ 11th Annual Asia-Pacific Tax Forum 2 Over 80 delegates attended the 11th annual Asia-Pacific Tax Forum in Hanoi. The roundtable session was chaired by Mr. Nguyen Ba Toan, Ministry of Finance of Vietnam, and featured a panel of speakers: (1) U Tet Htet Aung, Director Tax Analysis and Monitoring, Myanmar and (2) Mr. Rodelio Daschil, Director General, Senate Tax Study & Research Office, The Philippines. The session was facilitated by Mr. Hafiz Choudhury, ITIC Senior Advisor. This session helps ITIC/ APTF form an agreed list of technical issues and agenda for the coming year, which is then guided by the Steering Committee. The main formal event was the opening ceremony. The keynote speech was given by The Honorable Do Hoang Anh Tuan, Deputy Minister, Ministry of Finance, Vietnam. The Minister, in his remarks, highlighted the progress Vietnam has made in recent years, and welcomed open dialogue with taxpayers in managing the tax system. The Government wished to provide foreign investors a reasonable tax regime which had to be balanced with the need for revenues to meet the needs of a growing population. Mr. Daniel Witt, ITIC President, responded to the Minister’s welcome words, and thanked him for his hospitality. APTF was formed in response to the requests from many Ministries of Finance for a neutral table for dialogue, and ITIC will continue to perform this role as long as it is required. Representatives from the private sector were present not only to speak about the needs of their companies, but also as tax experts who experienced similar issues from around the world. They were complemented by the independent academic experts who brought insight on leading edge issues on global tax issues. APTF has always emphasized a strong social component, where delegates have an opportunity to establish new contacts and reinforce earlier ones among their peers. Such contacts at both a personal and a professional level facilitate sharing of ideas and a better understanding of common challenges and issues. The meeting also provides an opportunity for delegates to network and build personal relationships with peers from the public and private sectors. Participating delegates have repeatedly expressed their appreciation of the ways they can use the network and resources for their national tax policy needs. The meeting program in Hanoi also allowed other opportunities for delegates to meet privately or in small groups. Global Tax Policy Issues: Action Plan for BEPS, Corporate Income Tax Policy and Fiscal Sovereignty in the Asia-Pacific Region Three sessions from the meeting fell within this thematic group, which focused on initiatives and issues at the level of global tax policy. Purposefully, these issues did not cover a specific business or particular country. Instead, the aim was to highlight issues of global concern in tax policy and practice, and consider how countries in the region could address them. Professor Lee Burns of the University of Sydney, presented the keynote paper on the first day of the meeting, Current Issues in Corporate and International Tax in the AsiaPacific Region. Professor Burns first looked at corporate tax rate trends, the development of comprehensive capital allowance regimes, and corporate grouping rules in the ITIC Bulletin ♦ 11th Annual Asia-Pacific Tax Forum region, including a comparative survey of rates in the AsiaPacific region. He felt that while the globalization of the world economy (which started to take root in the 1980s) has changed the very structure of business worldwide, the tax infrastructure has remained largely the same. Tax, especially corporate income tax, has remained a key symbol of national sovereignty, while the competition to attract foreign investment has, in some cases, raised legitimate fears of a harmful “race to the bottom.” The keynote paper covered options for countries to consider in looking at group relief within the region, tax treatment of cross-border services and intangibles, measures to reduce the tax costs of corporate reorganizations, income characterization (particularly intangibles), and tax arbitrage within the region. Mr. Mayoon Boonyarat from Thailand’s Fiscal Policy Office and Mr. Dang Tuan Hiep, Deputy Director General of the Vietnam General Department of Taxation, provided insight in the approach being followed by their countries on corporate income taxation and their concerns for future changes. The corporate tax policy issues session was followed by a session on the Action Plan on BEPS – Issues and Challenges for Asia-Pacific Countries. Professor Burns again delivered the main presentation, which examined the actual impact in the Asia-Pacific region of the very specific issues addressed in the BEPS reports, and other global initiatives, including the Global Forum on Transparency /FATF and examples of national governments pursuing extraterritorial initiatives (e.g., US FATCA law and other similar legislation). Professor Burns outlined the key concern in many countries: a disconnect between the location of the economic activity and the location where profits are earned. This challenges the OECD inspired international norm that a source country has a right to tax business profits provided there is a sufficient economic presence in the country to support the taxing right. Professor Burns outlined trends in global FD, referring to his earlier comment that the global tax infrastructure now lags the needs of the globalized world economy, and compared this to national tax yields. He also presented trends in global business, and the impact of this in taxation structures. He considered the current measures available for 3 managing the growing risks of both harmful tax competition and weaknesses of national tax systems in coping with the challenge. He proposed policy approaches for Asia-Pacific nations to follow, and stressed the need for the interests of developing countries to be taken into account in developing responses to such global policy practices. Speaking as discussant, Mr. Dang Tuan Hiep (Vietnam) shared the perspective of his country. Vietnam had started engagement with OECD and some of the G20 nations, and was conscious of the need to keep these policy requirements in mind as the country restructured the economy. Mr. Rajiva Ranjan Singh (India) stressed the need for capacity building, and the development of cooperation between developing countries in addressing the challenges in BEPS. Both discussants agreed that a long-term commitment and strategy was needed in Asia-Pacific countries to respond to these global policy initiatives. The final session on this theme was held on 3 October, titled Tax Coordination and Fiscal Sovereignty. This session considered the challenges facing policymakers in maintaining fiscal sovereignty and the ability to determine their own domestic policy. The session looked at a wider set of challenges to national fiscal sovereignty, such as (1) recommendations on use of the tax system for nonfiscal policy goals; (2) regional trade obligations; and (3) pressures from special interests and civil society groups. The goal was to present the mix of choices and trade-offs faced by policymakers. Mr. Oliver Salmon from Oxford Economics made a presentation on the impact of WHO FCTC Price and Tax Measures Recommendation, which could be seen as specific tax policy recommendations made to advance non-fiscal goals. Mr. Salmon presented the work of the study and made policy recommendations, drawing on studies and analysis conducted by ITIC, such as the Asia-11 Illicit Tobacco Indicator 2012, which focused on the need for nations to maintain control over their own fiscal policy, designed to meet their own needs and not to be driven by external goals. Mr. Hafiz Choudhury then provided a short report on a new study by ITIC on the impact of “global” tax proposals (e.g., the so-called “Tobin” tax or for taxing international transportation, carbon emissions or the arms trade). The study identified more than 150 “global” tax proposals, which could be loosely categorized into four areas: 1. Financial sector taxes 2. Digital economy taxes ITIC Bulletin ♦ 11th Annual Asia-Pacific Tax Forum 3. Environmental levies 4. Miscellaneous taxes on activities (trade, natural resources, migrants, etc.) The study concluded that global taxes were still some way away from implementation, given both the absence of political will and a global enforcement mechanism. There was, however, food for thought in some specific areas, such as taxation of exploitation of the seabed in international waters and in environmental levies. 4 Tax policy is influenced by a much wider group of stakeholders rather than a narrow group of tax professionals. Indeed, almost by definition, final policy decisions are rarely made by policy professionals. Such decisions are often affected by considerations outside purely technical considerations. A panel discussion on Wider Stakeholder Community in Tax Reforms, moderated by Mr. Daniel Witt, brought together a wide range of stakeholders in the tax policy process from outside Ministries of Finance to give their perspective on how tax policy is viewed. National Tax Policy: Policy Design, Stakeholder Engagement and Drafting into Tax Law The next thematic group of sessions focused on how national tax policy could be designed, gain acceptance in a wider stakeholder community, and then be implemented in law through drafting. While the global context was very important, countries need to also balance these with national revenue raising requirements; broader goals of economic development; and other national policy goals in industrial growth, trade policy, healthcare, economic liberalization, etc. The policy aspect was covered in the session, Tax Gap Analysis and the Impact of Policy Measures led by Mr. Oliver Salmon. Mr. Salmon examined the use of tax gap studies to measure revenue potential with actual revenues raised, and the impact of specific policy approaches, such as earmarking. The paper reviewed the “revenue gap” in excise taxes and methods of measurement of such gaps, with a view to closing them. It also utilized data from the new ITIC/Oxford Economics report on illicit trade in Asia. The presentation showed how measurement could help identify the performance of specific policies, and whether or not specific taxes were achieving their stated purpose. These policy goals could then be evaluated against both achievement of stated goals and their actual revenue raising performance. Speaking as discussants, Mr. Benjamin Diokno, Professor of Economics, University of the Philippines (and a former Secretary of Budget and Management) and Dato’ Khalid Yusuf, former Director General of Royal Malaysian Customs, shared their experiences with policy design, revenue estimation, and actual revenue achieved. The panel provided an approach to identify effective tax policies, measure performance, and determine policy changes to meet current realities. The panel consisted of: • Mr. Rodelio Daschil, who spoke from the perspective of the legislature; • Mr. Geerten Michielse, from the IMF, who spoke about his experience as a external stakeholder advising on tax reforms; • Dato’ Khalid Yusuf, speaking as a former head of Malaysia’s tax administration; and • Mr. Benjamin Diokno, to speak from the experience of a cabinet minister with responsibility for implementing tax policy. The discussion covered why stakeholder community engagement was necessary, how such engagement might take place, and thoughts on how to establish the right group with whom to engage. Panelists stressed the importance of communication and the need to establish a framework for the discussion. It was thought that stakeholder consultation and the use of fact-based dialogue gave a sound basis to lasting tax reform. Policy approaches ultimately need to be translated into workable legislation to have effect. Good tax systems depend on accurate and effective tax laws, which need to be regularly amended to meet changing policy priorities and economic circumstances. The breakout technical session, Drafting Tax Legislation, addressed the issue. Mr. Graham Tubb (New Zealand Inland Revenue Department) and ITIC Bulletin ♦ 11th Annual Asia-Pacific Tax Forum Mr. Geerten Michielse jointly led the session; Mr. Tubb focused on indirect taxation and Mr. Michielse discussed drafting direct taxation laws. Mr. Tubb outlined the process for the New Zealand GST Law (recognized as having the widest tax base in the OECD), from the White Paper and draft legislation, public consultation, dealing with opposition to the law, on-going policy development, engagement with the legislative drafting team through to enactment. He outlined some principles of clear drafting and demonstrated how these could be applied in practice in other countries. Mr. Michielse gave a brief overview of the fiscal work of IMF, and then outlined the process of drafting a corporate income tax. He addressed the issues of accounting treatment, areas of deviation from general law, specific areas (tax incentives), special provisions for corporations (intragroup dividends), reorganizations, limited group taxation and core areas of concern (base protection, transfer pricing and international taxation issues). Issues in Indirect Tax Policy – Indirect Taxation of Cross-Border Services, Technical Issues in Valuation, Regional Coordination of Excise Policies, and VAT/GST Given the origins of APTF as an indirect tax meeting, there is a strong expectation from the member countries that the annual meeting will cover “leading edge” issues in indirect taxation. This year’s meeting featured four sessions that considered issues of interest to the APTF membership, especially the 10 ASEAN countries. Global trade in services is growing at a much faster pace than trade in goods, and the Asia-Pacific region is no exception. In particular, it is considered that cross-border provision of services within ASEAN will most likely grow with further integration of the ASEAN Economic Community. The breakout technical session, Cross-Border Services and Potential Issues in AEC was led by Mr. Graham Tubb, and the panel featured Professor Lee Burns, Mr. Rob Preece, ITIC Program Advisor and Mr. Sumit DuttMajumder, former Chairman of CBEC, India. 5 Mr. Tubb outlined the key challenge in cross-border services – they are often intangible and lead to mismatches and mixed use of the Origin Principle and Destination Principle by different jurisdiction. This causes inconsistencies/ distortions and can also result in complex zero rating issues for exported services. E-commerce creates additional opportunities for fraud and double non-taxation, and issues like carousel fraud give rise to further challenges. He outlined the principles in the OECD VAT Guidelines 2014, and issues from the BEPS report. The panel discussed various options coming out of the current international thinking that would apply to services within an ASEAN internal market. However, the approach to tax services in the jurisdiction of consumption, or residence, of the consumer regardless of any fixed or permanent establishment of the company in the country of consumption will require suppliers to register in multiple foreign jurisdictions. This will significantly increase compliance costs, and ultimately increase costs of services to the countries concerned. APTF should consider ways of enhancing cooperation in looking at indirect taxes for international services, including digital services, thus reducing costs and improving compliance. A separate breakout technical session addressed Common Valuation Issues and Techniques in Transfer Pricing and Indirect Taxation. Led by Mr. Hafiz Choudhury, this panel included Mr. Sumit DuttMajumder and Mr. Johari Alifiah, Royal Malaysian Customs, and looked at how the work of direct tax departments in application of transfer pricing rules and indirect tax authorities in application of the Customs Valuation Agreement can better coordinate transactions between related parties. The discussion started with the context of the global business models of multinational enterprises and growth of services in global trade. A globalized supply chain with centralization of certain functions, assets and risks in principal entities now leads to estimates that 80% of global trade is linked to the international production networks of MNEs. In this context, it is important to understand the aims of transfer pricing rules versus customs valuation rules. However, as many developing nations need to quickly develop expertise in transfer pricing, it is useful to leverage the experience of Customs in valuation, and also meet concerns from business about “double obligation” of having to satisfy both Customs and Tax authorities on the same issue. The panel outlined areas where the differences ITIC Bulletin ♦ 11th Annual Asia-Pacific Tax Forum in approach could be dealt with and how “circumstances surrounding the sale” under Article 1.2 (a) in relation to the use of transfer pricing studies under TCCV Commentary 23.1 could be used. 6 Subject-Specific Taxation: Tourism, Automobiles and Extractive Sector ITIC has organized a detailed study of tax coordination in the ASEAN countries within the context of the AEC 2015, and has produced the ASEAN Excise Tax Resource Manual that comprises best practice excise rules within AEC. This landmark document is a key resource for countries in the region as they move towards greater economic integration. APTF has seen increased requests for taxation issues on a single topic to be covered in a holistic way, so that all tax issues relevant to the subject area could be considered simultaneously. This would allow participants to see the interplay of tax issues between one another, and consider these in the context of other policy drivers (e.g., industrial development policy, environmental policy, etc.). Three sessions were designed based on industry-specific subjects for this meeting. The plenary session, Report on ASEAN Excise Tax Study Group, featured the Phase III Report of the Group presentation and explored how to coordinate the findings of Phase III as part of the AEC commitment to create a single production base and single market. Messrs. Rob Preece, and Leigh Obradovic, and Oliver Salmon and representatives from ASEAN governments presented the key recommendations from the Manual, and ways in which it could be applied in implementation of excise rules in a coordinated manner within the AEC. Breakout Technical Session E focused on Automotive and Environmental Taxation. Taxation of automobiles is an increasingly complex subject in the Asia-Pacific region. Special taxes on automobiles have a history of being revenue raising instruments on “luxury goods” in the region. However, priorities are moving towards use of special taxes, registration taxes and circulation taxes to reflect the desire of governments to reduce CO2 emissions through improved technologies. These new technologies would improve fuel efficiency and reduce emissions, and also encourage greater use of alternate cleaner burning fuels and cleaner alternate energy sources. Tax policy in the automotive sector also impacts industrial policy and technology policy, in addition to environmental policy. Within the goal of creating a single automotive sector in the ASEAN region, it also affects trade policy for ASEAN countries. One of the key benefits for governments in participating in APTF is the opportunity to share experience on technical issues with peers. With the continuing importance of VAT as the leading indirect tax worldwide, a panel discussion on GST/VAT Developments in the Asia-Pacific Region was organized to share country experiences and contrast various solutions. The session was moderated by Mr. Wayne Barford, formerly of the Australian Taxation Office, and included the following panelists: U Soe Naing (Myanmar), Mr. Sumit Dutt Majumder (India) and Mr. Graham Tubb (New Zealand). The panel members were asked to respond to questions from a prepared list of issues to be considered in introducing a VAT system. The contrast was between New Zealand (which has a mature and advanced GST system), India (which after many long years of discussion, seems ready to implement a GST) and Myanmar (which is at the very start of that journey). The discussion showed a contrast of ongoing challenges and possible solutions; delegates from the floor added further experiences from a range of other countries, including Australia, Pakistan and Thailand. The automotive sector taxation panel, moderated by Mr. Rob Preece, featured Mr. Paul Sumner, Head of the Asia-Pacific Automotive Practice, PWC, and Mr. Warwick Ryan, KPMG/APTF Program Advisor, along with representatives from Thailand and Vietnam. The panel examined the tax base and variations that exist (CIF, exfactory, resale selling price, Open Market Value etc.), and the application of rates on ad valorem or specific rates or unit/quantity. Nominal rates versus effective rates of tax, and possible reforms in excise and special taxes, and other taxes, in a manner which reflects new priorities, were all considered by the speakers. They also discussed options for coordination and/or standardization of tax systems within ASEAN in a manner that meets the principles of good tax policy (e.g., equity, efficiency, simplicity and transparency). ITIC Bulletin ♦ 11th Annual Asia-Pacific Tax Forum Breakout Technical Session F focused on Transfers of Interests in Extractive Sector Projects. Mr. Geerten Michielse considered both the direct and indirect tax issues relevant to indirect transfers of interest in extractive sector projects. While indirect transfers are a wider issue than just in the extractive sector, there are particular challenges in the oil/gas and mining sectors that merit special attention. Mr. Michielse started from the premise that the license to exploit resources was a business asset, and if the direct sale of business assets is a taxable event, indirect sale of the same business asset must also be a taxable event to avoid arbitrage. In the case of sales of shares, the challenge lay in that international tax principles allocated taxing rights to the residence state. He explained the explicit “source” rule usually utilized to solve this problem, and various alternative approaches to implementing and enforcing the rule. The discussion then covered the application of the rule in actual legislation and administration, including ensuring consistency with the double taxation agreement network of the country. Breakout Technical Session C considered the Design and Impact of Tourism Related Taxes and Fees. The APTF Steering Committee considered that it was important to look at the full spectrum on taxes and fees that affect tourism, a significant component of economic activity in many Asia-Pacific countries. The discussion, led by Mr. Leigh Obradovic considered the impact of such taxes on tourism and how an efficient regime could be designed to maximize revenue potential while not creating disincentives for investment in tourism. The taxes considered covered: • Direct taxes on tourism relating to business, • Tax incentive regimes covering both direct and indirect taxes • VAT on tourism-related activities • Excise taxes • The impact of duty free shops. The discussion also covered other taxes on tourism, such as room taxes, specific use fees for tourist attractions, general tourist levies and environmental levies. It was clear that this was a growing and important area for countries in the region, and should be examined further in future work of APTF. 7 Conclusion The closing session started with a discussion of the “Hanoi Agenda” for research work over the next year, led by Mr. Hafiz Choudhury. The final discussions agreed to include: (1) regular Steering Committee calls and (2) outreach to other countries in the region, including both past participants like China and administrations like Hong Kong and Japan. “Hanoi Agenda” The “Hanoi Agenda” agreed to at the end of the meeting stated: • Continue the work of ASEAN Excise Tax Study Group, to start on Phase IV of the work. • ASEAN Excise Tax Reform Manual: utilization through workshops and training. • Consider the urgent needs for capacity-building and coordination in the Asia-Pacific region, to meet the requirements coming out of the Action Plan for BEPS. • Conduct further research in the interaction of global tax rules with trade and investment arrangements. • Develop an action plan on how the work of direct tax departments on transfer pricing rules can be utilized at the regional level in application of the Customs Valuation Agreement through TCCV 4.1. and 23.1. • Continue APTF work in the area of GST, especially in the treatment of cross-border services, including banking and financial services. • Develop a research program on taxation issues in the hospitality and tourism sector. • Enhance the capacity of APTF to support tax administration reforms and dispute resolution processes. • Initiate a program for private sector participation in capacity development in tax administration across the region. It was also announced that the 12th annual APTF meeting would be held in New Delhi on 5-7 May 2015. Mr. Rajiva Ranjan Singh extended an invitation to all delegates to attend the next APTF meeting in New Delhi. Mr. Daniel Witt summarized the Hanoi meeting, and again extended ITIC’s thanks to the Ministry of Finance of Vietnam for hosting the event. ITIC Bulletin ♦ 11th Annual Asia-Pacific Tax Forum 8 Delegates Enjoy Opportunities for Fellowship, Informal Discussions, and Local Entertainment Asia-Pacific Tax Forum Featured in Local Media The 11th annual Asia-Pacific Tax Forum was featured in multiple media outlets across Vietnam. Countries Represented AustraliaPakistan CambodiaPhilippines Hong Kong Singapore IndiaTaiwan IndonesiaTaipei MalaysiaThailand MyanmarUnited Kingdom • Vietnam TV-1 interviewed Daniel Witt and Professor Lee Burns. The television coverage (including a video interview with Mr. Witt and Professor Burns) can be viewed on ITIC’s Facebook page here. Online coverage is available here (English translation). • Nhan Dan Online featured a news article on the APTF meeting. To view this article, click here. • Vietnam Investment Review interviewed ITIC President Daniel Witt during his visit in Hanoi. To read the interview, click here. New Zealand Vietnam United States ITIC Bulletin ♦ 11th Annual Asia-Pacific Tax Forum Documents Available on ITICnet.org The following documents can be downloaded here: 9 • 11th APTF Annual Meeting by Mr. Hafiz Choudhury • Common Valuation Issues and Techniques in Transfer Pricing and Indirect Taxation by Mr. Johari Alifiah • OECD/G20 Action Plan on BEPS: Issues and Challenges for Asia-Pacific Countries by Professor Lee Burns • Public Sector Roundtable Presentation by Mr. Hafiz Choudhury • Current Issues in Corporate and International Tax in the Asia Pacific Region by Professor Lee Burns • Tax Gap Analysis and the Impact of Policy Measures • ASEAN Economic Community 2015: Tax Design Principles and the Excise Tax Base by Mr. Leigh Obradovic • ASEAN Auto Excise Regime by Mr. Paul Sumner • Drafting Tax Legislation: A Strategy Built on Four Pillars by Mr. Warwick Ryan • Corporate and International Tax in the Asia Pacific Region by Mr. Mayoon Boonyarat • Closing Session by Mr. Hafiz Choudhury • Policy Considerations in Excise Tax Design by Mr. Oliver Salmon • Structure of Tourism-Related Taxation and Incentives in the Philippines by Mr. Norberto Villanueva • ASEAN Economic Community 2015: Resource Manual-Phase III by Mr. Rob Preece • Wider Stakeholder Community in Tax Reforms by Mr. Rodelio Dascil • The Design and Impact of Tourism Related Taxes and Fees by Mr. Leigh Obradovic • Wider Stakeholder Community in Tax Reforms: Comments by Dr. Benjamin Diokno • Drafting Tax Legislation by Mr. Geerten Michielse • • Indirect Sale of Licenses by Non-Residents by Mr. Geerten Michielse Australia GST-Zero Rated and Exempt Supplies by Professor Lee Burns • • Drafting and Implementing the GST: New Zealand’s Experience by Mr. Graham Tubb Automotive and Environmental Taxation by Mr. Warwick Ryan • • Some Aspects of GST on Cross-Border Services: New Zealand’s Experience by Mr. Graham Tubb Automobile Taxation Meeting by The Royal Thai Excise Department • GST in India Present Status by Sumit Dutt Majumder • Common Valuation Issues in Transfer Pricing and Customs by Mr. Hafiz Choudhury • Related Party Transactions in Customs and Transfer Pricing in Income Tax Need for Convergence by Sumit Dutt Majumder Edited by: Diana McKelvey, ITIC Washington About ITIC Vision: ITIC aims to be recognized globally as a fiscally-focused network organization with a respected sponsor base and presence across key non-OECD jurisdictions that promotes education and programs for the benefit of all its stakeholders. Mission: ITIC’s mission is to encourage pro-growth tax, trade and investment policies in non-OECD countries by facilitating mutual understanding and trust between business and government through the ITIC neutral table, based on high quality analyses, policy studies and capacity building programs. 1800 K Street, NW, Suite 718, Washington, D.C. 20006 Tel: (1) (202) 530 97 99 / Fax: (1) (202) 530 79 87 [email protected] / www.ITICnet.org Almaty • Astana • Baghdad • Baku • Bangkok • Dubai • Kiev • London • Manila • Moscow • Nay Pyi Taw • São Paulo • Washington, DC

© Copyright 2026