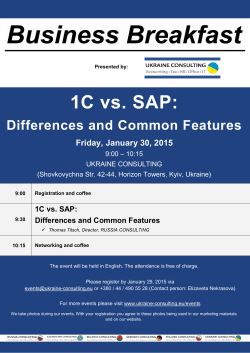

PDF Version - Business New Europe