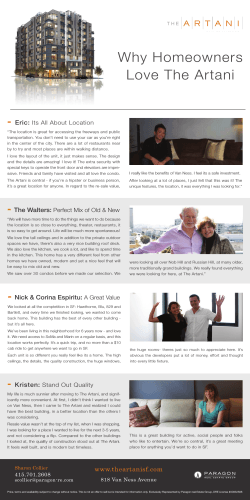

ICGI ANNUAL REPORT 2014