û û û ` ` in the income tax appellate tribunal “b” bench

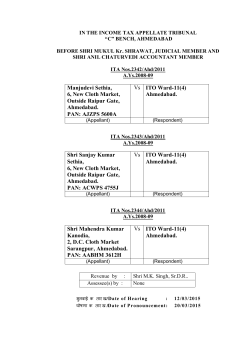

आयकर अपीलीय अिधकरण, बी’ अिधकरण, अहमदाबाद यायपीठ ‘बी बी अहमदाबाद । IN THE INCOME TAX APPELLATE TRIBUNAL “B” BENCH, AHMEDABAD BEFORE SHRI SHAILENDRA KUMAR YADAV, JUDICIAL MEMBER AND SHRI ANIL CHATURVEDI, ACCOUNTANT MEMBER आयकर अपील सं./ IT(SS)A No. 339/Ahd/2011 िनधारण वष/Assessment Year: Block Assessment 01.04.1990 to 24.01.2001 Shri Joshi Samir Pranubhai, C/o. Joshi Urology & Maternity Hospital, Nr. Hardik Complex, Viththal Wadi, Bhavnagar PAN : ABMPJ 5662 J Vs अपीलाथ/ अपीलाथ/ (Appellant) Assessee(s) by : Revenue by : ACIT, Circle-1, Bhavnagar ू यथ यथ/ थ/ (Respondent) Shri Tushar Hemani, AR Shri O.P. Vaishnav, DR सुनवाई क# तार%ख/ / Date of Hearing : घोषणा क# तार%ख /Date of Pronouncement: 26/02/2015 13/03/2015 आदे श/O R D E R PER SHRI ANIL CHATURVEDI, ACCOUNTANT MEMBER: This appeal filed by the Assessee is against the order of the Commissioner of Income Tax (Appeals)-XX, Ahmedabad dated 13.01.2011 for Block Assessment for the period from 01.04.1990 to 24.01.2001. 2. The brief facts of the case, as culled out from the records are as under:3. The assessee is an Uro Surgeon and stated to be operating his proprietary concern known as “Joshi Urology Hospital & Maternity Hospital”. In this case, a search u/s 132 of the Act was carried out on 24.01.2001. Thereafter, block return was filed on 19.11.2002 declaring total IT(SS)A No. 339/Ahd/2011 Shri Joshi Samir Pranubhai Vs. ACIT Block Asst: 01.04.90 to 24.01.01 -2income at Rs.6,43,631/- for the block period 01.04.1990 to 24.01.2001. Thereafter, an order u/s 158BC(c) of the Act was passed and the total undisclosed income was determined at Rs.22,40,505/- inter alia by estimating the professional receipts of Rs.14,33,468/-. Aggrieved by the order of the Assessing Officer, the matter was carried before the ld. CIT(A) who granted partial relief to the assessee. Against the said order of the ld. CIT(A), the Revenue preferred appeal before the Hon’ble Tribunal. The Hon’ble Tribunal vide order dated 13.11.2009 in IT(SS) No.101/Ahd/2004 partly allowed the appeal of the Revenue. In respect of addition of Rs.14,33,468/-, which was made by the Assessing Officer by estimating the professional receipts by making extrapolation by 20%, the Hon’ble ITAT, Ahmedabad Bench restored the addition of Rs.11,18,450/-. Thus, on the total un-disclosed income pursuant to the ITAT order and the disclosure made by the assessee; the difference of Rs.4,92,844/- was considered as undisclosed income and on the aforesaid undisclosed income, penalty of Rs.2,95,706/- was levied u/s 158BFA(2) of the Income-tax Act vide order dated 28.05.2010. 4. Aggrieved by the penalty order of the Assessing Officer, the assessee carried the matter before the ld. CIT(A) who vide order dated 13.01.2011 dismissed the appeal of the assessee. Aggrieved by the aforesaid order of the ld. CIT(A), the assessee is now in appeal before us, on the following grounds:1) The Learned Commissioner Of I. Tax (Appeals) - XX erred in law and on facts in confirming penalty order ignoring legal objections regarding validity of initiation of penalty proceedings. 2) The Learned Commissioner Of I. Tax (Appeals) - XX erred in law and on facts in confirming penalty order pursuant to penalty proceedings initiated without recording separate satisfaction by Assessing ACIT for initiation of penalty for each addition while passing assessment order. IT(SS)A No. 339/Ahd/2011 Shri Joshi Samir Pranubhai Vs. ACIT Block Asst: 01.04.90 to 24.01.01 -33) The Learned Commissioner Of I. Tax (Appeals) - XX erred in law and on facts in confirming penalty imposed u/s 158BFA(2) while penalty proceedings was initiated u/s 271(1) © r.w.s. 158BFA(2) of the Act. 4) The Learned Commissioner Of I. Tax (Appeals) - XX erred in law and on facts in confirming the penalty of Rs. 295706/- imposed without recording satisfaction by the ACIT that the case is fit to levy penalty. 5) The Learned Commissioner Of I. Tax (Appeals) - XX erred in law and on facts in confirming the penalty of Rs. 295706/- ignoring the facts that the addition made in the assessment order is disregarded and new formula has been arrived at by the honorable ITAT to ascertain total undisclosed income. 6) The Learned Commissioner Of I. Tax (Appeals) - XX erred in law and on facts in confirming the penalty of Rs. 295706/- instead of Rs. 78868/considering Concealed Income at Rs. 492844/- instead of Rs. 131447/7) The appellant crave and reserve his right to add, to modify, to alter and/or to withdraw any or all grounds of appeals. 5. Before us, ld. Authorized Representative submitted that though various grounds have been raised but the issue is only with respect to penalty u/s 158BFA(2) of the Act. 6. Before us, the Authorized Representative submitted that on the basis of certain seized material found at the time of search, the Assessing Officer concluded that the assessee had suppressed the professional receipts. The suppression rate was determined at 20% and the suppressed professional receipts were estimated at Rs.14,33,468/- by resorting to extrapolation. When the matter carried before the Tribunal, the addition to the extent of Rs.11,18,450/- was confirmed, but; however, the basis of addition was altered by the Tribunal. The ld. AR also pointed out that the Tribunal has categorically mentioned that it does not accept the working done by the Assessing Officer in estimating the professional receipts by extrapolating it by 20% since 20% was found only in one month. Thereafter, Hon’ble ITAT IT(SS)A No. 339/Ahd/2011 Shri Joshi Samir Pranubhai Vs. ACIT Block Asst: 01.04.90 to 24.01.01 -4resorted an altogether different method, and after considering the actual deposits found in the bank, confirmed the addition to the extent of Rs.11,18,450/-. Before us, ld. AR submitted that when the original basis of initiation of penalty proceedings is altered or modified by the Appellate Authority, the authority initiating the penalty proceedings has no jurisdiction thereafter to proceed on the basis of findings of the Appellate Authority and for this proposition, reliance was placed on the decisions in the cases of CIT vs. Ananda Bazar Patrika P. Ltd. - 116 ITR 416 (Cal), CIT vs. Dwarka Prasad Subhah Chandra - 94 ITR 154 (All), CIT vs. Shadiram Balmukand – 84 ITR 183 (All) and the decision of Hon’ble Gujarat High Court in the case of CIT vs. Lakhdhir Lalji-85 ITR 77 (Guj.). The ld. AR further submitted that even the total deposits in the bank accounts were estimated to be the income of the assessee and it is a settled law that no penalty can be levied on addition which has been made on estimated basis. The AR further submitted that the order of the Hon’ble ITAT, qua the concerned addition, has been challenged before the Hon’ble Gujarat High Court and substantial question of law in respect of the same has been admitted and the admission of the Hon’ble Gujarat High Court shows that the issue is debatable and therefore also no penalty is leviable being the debatable issue. The ld. AR, thus, submitted that the penalty levied in the present case be deleted. Ld. Departmental Representative, on the other hand, supported the order of the Assessing Officer and the CIT(A). 7. We have heard the rival submissions and perused the material on record. We find that the addition on account of professional receipts of Rs.14,33,468/- was estimated by the Assessing Officer by making extrapolation by 20%. When the matter was challenged before the Tribunal, we find that the Hon’ble Tribunal rejected the claim of peak and did not accept the working done by the Assessing Officer in estimating the IT(SS)A No. 339/Ahd/2011 Shri Joshi Samir Pranubhai Vs. ACIT Block Asst: 01.04.90 to 24.01.01 -5overall professional receipts by extrapolating it by 20% because 20% was only found by the Assessing Officer in one month. We further find that the Hon’ble Tribunal, after considering the actual receipts found in the bank account, worked out the total undisclosed receipts and confirmed the addition to the extent of Rs.11,18,450/-. It is, thus, seen that the addition was confirmed by referring to an altogether different method than that adopted by the Assessing Officer. In the present case, we find that the penalty u/s 158BFA(2) has been levied by the Assessing Officer on the amount of un-disclosed income finally determined by the Hon’ble Tribunal. We find that in the case of CIT vs. Ananda Bazar Patrika P. Ltd. (supra), the Hon’ble Kolkata High Court, after referring to the decisions of CIT vs. Dwarka Prasad Subhah Chandra (supra), CIT vs. Shadiram Balmukand (supra) and CIT vs. Lakhdhir Lalji (supra), has held that when the original basis of initiation of penalty proceedings is altered or modified by the Appellate Authority, the Authority initiating the penalty proceedings has no jurisdiction thereafter to proceed on the basis of the findings of the Appellate Authority. Before us, the Revenue has not brought any contrary binding decisions nor could point out any distinguishable features of the decisions cited by ld. AR. Considering the aforesaid facts, we are of the view that in the present case no penalty is leviable. We hold accordingly. 8. In the result, the appeal of the assessee is allowed. Order pronounced in the Court on 13th March, 2015 at Ahmedabad. Sd/(SHAILENDRA KUMAR YADAV) JUDICIAL MEMBER Ahmedabad; Dated 13/03/2015 *Biju T, PS Sd/(ANIL CHATURVEDI) ACCOUNTANT MEMBER IT(SS)A No. 339/Ahd/2011 Shri Joshi Samir Pranubhai Vs. ACIT Block Asst: 01.04.90 to 24.01.01 -6आदे श क# ूितिल+प अमे+षत/Copy of the Order forwarded to : षत 1. अपीलाथ / The Appellant 2. ू यथ / The Respondent. 3. संबंिधत आयकर आयु- / Concerned CIT 4. आयकर आयु-(अपील) / The CIT(A)-XX, Ahmedabad 5. +वभागीय ूितिनिध, आयकर अपीलीय अिधकरण, अहमदाबाद / DR, ITAT, Ahmedabad 6. गाड फाईल / Guard file. आदे शानुसार/ BY ORDER, //TRUE COPY// उप/ उप/सहायक पंजीकार (Dy./Asstt.Registrar) आयकर अपीलीय अिधकरण, अिधकरण, अहमदाबाद / ITAT, Ahmedabad

© Copyright 2026